Large-Growth Funds That Flip-Flopped in the Value Rally

Valuation-conscious growth approaches have seen their fortunes turn for the better this year.

As the stock market pendulum has swung away from growth stocks to value names, a number of mutual funds sporting portfolios that were loaded up with big-company stocks with the highest earnings growth potential have gone from “first to worst” since October.

At the same time, large-growth strategies with more valuation-conscious approaches have seen their fortunes turn significantly for the better.

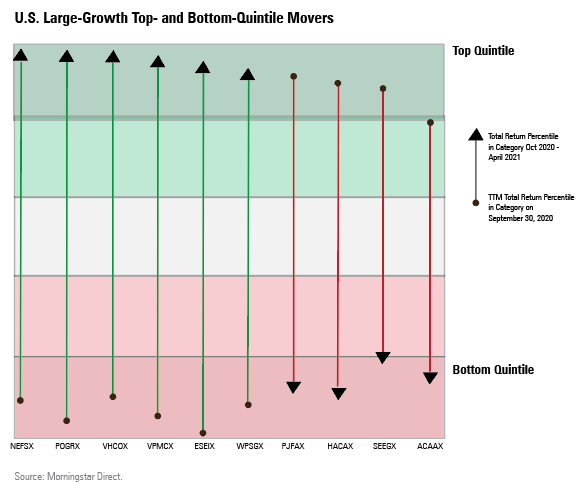

We dug into the large-growth Morningstar Category to look for funds that had significant swings higher or lower in their category rankings. To do so, we compared funds' one-year return as of Sept. 30, 2020, with their ranking from Oct. 1 through month-end April 30, 2021. (A longer version of this article is available for Morningstar Direct and Office clients here.)

These time frames featured two distinct periods in the dynamic between value and growth stocks. From Oct. 1, 2019, through Sept. 30, 2020, the Morningstar US Large Value Index declined 7.1% while the Morningstar US Large Growth Index returned 40.5%.

The tides changed starting in October. From October 2020 through April 2021, the Morningstar US Morningstar US Large Value Index returned 35.6% and the Morningstar US Large Growth Index returned 22.4%.

In this context, we found six large-growth funds that carry Morningstar Analyst Ratings of Bronze, Silver, or Gold that moved up four quintiles in terms of their category rankings and four analyst-covered funds that moved down four quintiles.

Performance flip-flops on their own are not a surprise given the variety of strategies imposed even in a single category. Morningstar analysts evaluate funds over a full market cycle, and despite short-term ranking swings, long-term rankings often remain intact and Analyst Ratings remain unchanged. However, tracking how funds react to different market events and conditions can provide valuable information about fund biases and how funds can fit into a portfolio.

Within the large-growth category, funds sport strategies ranging from high growth strategies, with a lesser emphasis on valuation and a greater focus on companies with high earnings potential, to valuation-sensitive growth strategies. In the market’s recovery from the coronavirus pandemic, high growth strategies excelled, with mega-cap names driving performance. The tides shifted with values' resurgence in October, as core growth and valuation-sensitive strategies outperformed their high growth counterparts.

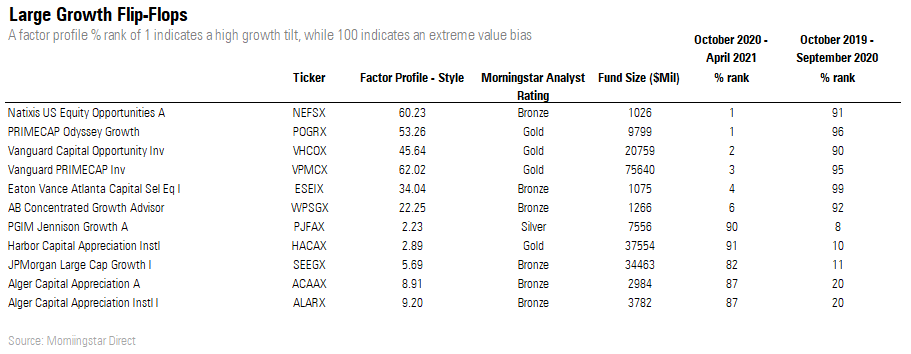

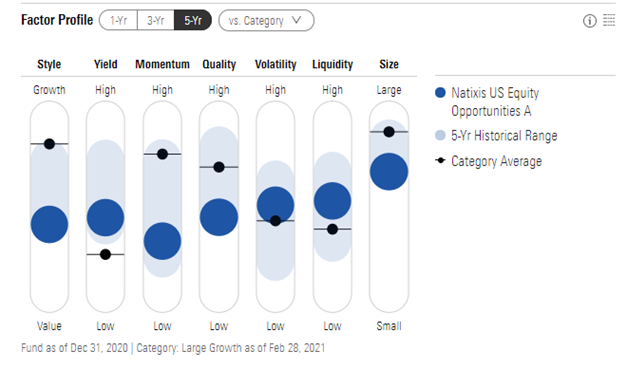

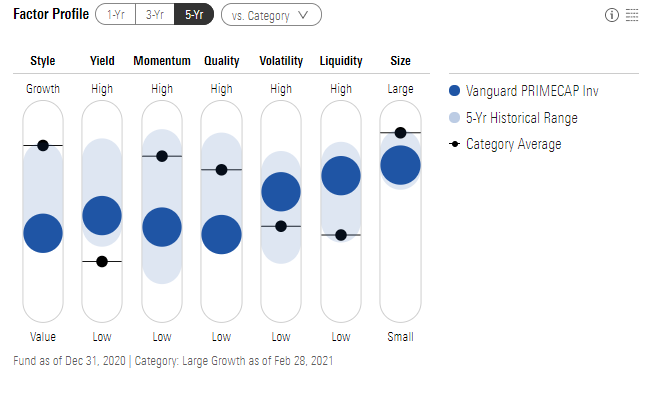

The following table looks at the performance of funds along with how that rank on Morningstar's Factor Profile style metric. Funds with a low style score have portfolios that are filled with high growth stocks, while a higher style score reflect funds that sport more valuation-conscious approaches.

Growth Funds That Slipped

Of the four funds that flopped lower, three of them were high growth strategies. These strategies' funds tended to hold larger positions in most of the so-called FAANG stocks: Facebook FB, Amazon.com AMZN, Apple AAPL, Netflix NFLX, and Google GOOGL. These stocks were some of the strongest performers coming out of the recession in March.

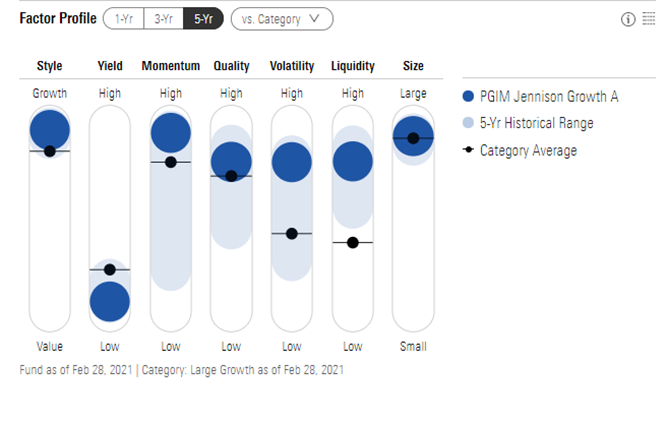

PGIM Jennison Growth PJFAX and Harbor Capital Appreciation HACAX, which both employ the same subadvisor, Jennison Associates, had percentile ranks of eight and 10, respectively, for the period ended September 2020. However, since October, the funds have ranked 90th and 91st, respectively, in the category. Morningstar strategist Robby Greengold describes the portfolio as being “dominated by fast-growing giant caps trading at relatively high price multiples.”

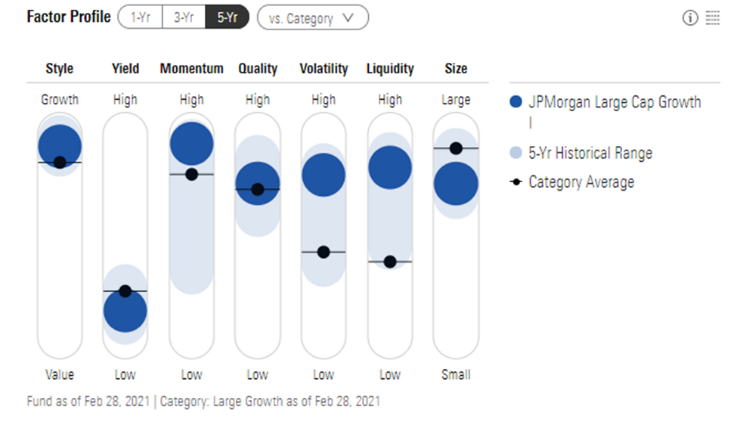

Bronze-rated JPMorgan Large Cap Growth posted a category percentile rank of 11 for the period ended September 2020. Since then, the fund ranked at the 82nd percentile. Similar to the Jennison-subadvised funds, the fund looks for competitive advantages aiming to invest in big winners, says analyst Claire Butz in her Analyst Report. She continues, adding that manager Giri Devulapally “believes the biggest winners are often expensive.”

Another fund that has slumped over the past seven months is Bronze-rated Alger Capital Appreciation ACAAX. The fund placed in the 20th percentile for the period ended September 2020. Since then, the fund dropped to the 87th percentile. Back in March 2020, Alger Capital Appreciation’s performance was buoyed by a portfolio that counted four out of the five FAANG stocks among its top seven holdings.

Growth Funds That Swung Higher

At the end of September 2020, Bronze-rated Natixis U.S. Equity Opportunities NEFSX was languishing at the 90th percentile for its 12-month returns. But since then, the fund’s performance has catapulted it to the number-two spot among all large-growth funds in the top 1 percentile. The portfolio is composed of one growth sleeve, subadvised by Loomis, and one value sleeve, subadvised by Harris Associates.

Vanguard Primecap VPMAX, Vanguard Capital Opportunity VHCOX, and Primecap Odyssey Growth POGRX--each carrying a Gold Analyst Rating--are managed by the same team and employ similar strategies. In the period ended April 2021, they carry a percentile rank of 1, 2, and 3, respectively. For the prior period, they finish 96th, 90th, and 95th. Vanguard Primecap’s style score is significantly below the category average, acting as a headwind in the period ended in September but propelling the fund to the top since October.

The fund is willing to ride out periods of extreme volatility, allowing it to stick with its picks as long as it believes they are still solid long-term investments, says strategist Alec Lucas. This has burned it over shorter time periods in the past, most recently by holding a top-20 position in Southwest Airlines LUV through the first quarter of 2020 as COVID-19 all but eliminated air travel.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)