Sustainable Model Portfolios Don't Have to Cost More Green

Going all-in on ESG investments doesn’t mean you have to pay high fees.

As sustainable investing continues to grow in popularity, so does the scrutiny around those strategies. Intentionally sustainable funds have been plagued by claims of greenwashing and price gouging. In 2020, Morningstar launched the Morningstar ESG Commitment Level to assess how firms and managers incorporate environmental, social, and governance criteria into their process (and identify those that say they do, but don’t in practice). In this article we’ll focus on the price tags of sustainable multi-asset portfolios.

Fees are a crucial part of any investment decision. Choosing cheaper funds over more expensive ones is a reliable way to tilt the odds of better outcomes in your favor. That's true whether you're considering the costs of a single fund or thinking about the costs of a whole portfolio. For investors looking to go green with some or all of their portfolio, there's good news. Sustainable multi-asset portfolios can be very low-cost.

To see how much a green portfolio could cost, we’ll look at moderate-risk model portfolios from BlackRock and Dimensional Fund Advisors. We’ll also use Vanguard’s standard four-index core model portfolio as a framework for swapping its market-cap-weighted equity exposure for the firm’s ESG equity exchange-traded funds (Vanguard ESG U.S. Stock ETF ESGV and Vanguard ESG International Stock ETF VSGX). We’ll compare the fees of these firms’ ESG model portfolios against those of the non-ESG model portfolios and examine how they are building their ESG portfolios.

These model portfolios are not directly investable, but they are illustrative of how investment professionals could build a fully ESG portfolio and what it would cost (or in the Vanguard example, how swapping in ESG equity ETFs within an already established asset-allocation framework would affect fees). These examples are illustrative only and are not investment advice.

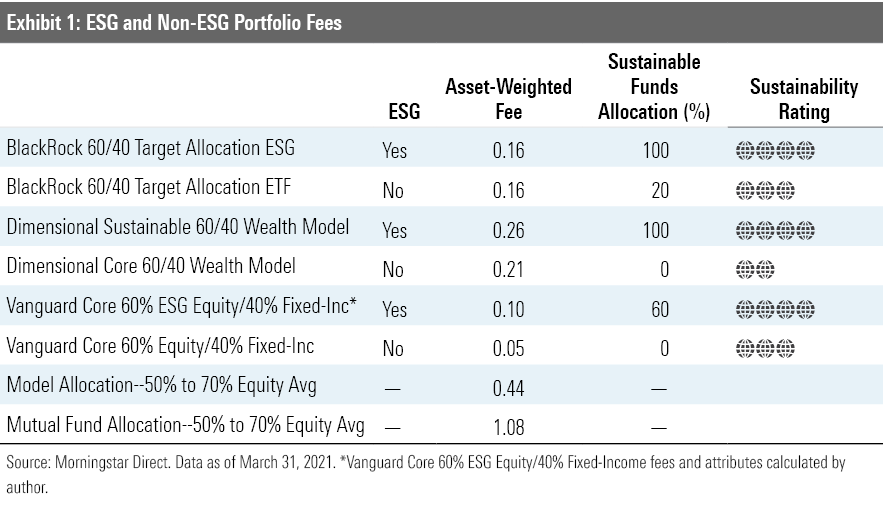

Exhibit 1 shows the asset-weighted fee for each firm’s non-ESG model and the ESG model. It also shows the average fee for all model portfolios and allocation mutual funds in the allocation--50% to 70% equity Morningstar Category. This includes models and funds that use only passive funds, only active funds, or a mix of both for their underlying investments.

It’s a small sample size, but it’s clear that building a multi-asset portfolio with mostly intentional ESG strategies doesn’t have to come with high investment fees. All three of the sample ESG portfolios come in well below the average asset-weighted fee of moderate-allocation model portfolios; compared with similar asset-allocation mutual funds, it’s not close.

The underlying funds in these portfolios are passively implemented, which is the main reason the costs are so low in general. Don’t mistake passive implementation for a lack of active risk-taking, though. The passive ESG funds are actively owning more ESG-friendly companies and fewer companies with ESG risks than a market-cap-weighted index would. My colleague Lan Ahn Tran has an excellent deep dive on how ESG ETFs differ from market-cap-weighted ETFs.

It is worth noting that the DFA sustainable model and our homebrewed Vanguard ESG model do have slightly higher fees than the non-ESG versions with the same top-down asset allocation. The good news is both are only 0.05% higher, or $5 for every $10,000 invested. That shouldn’t have a meaningful impact on the returns over the long term. The Vanguard ESG ETFs will also likely see their already low costs (0.12% for ESGV and 0.15% for VSGX) come down if those funds’ assets continue to grow; the firm’s ownership structure demands it.

Now let’s look at look at the underlying funds that make up these portfolios.

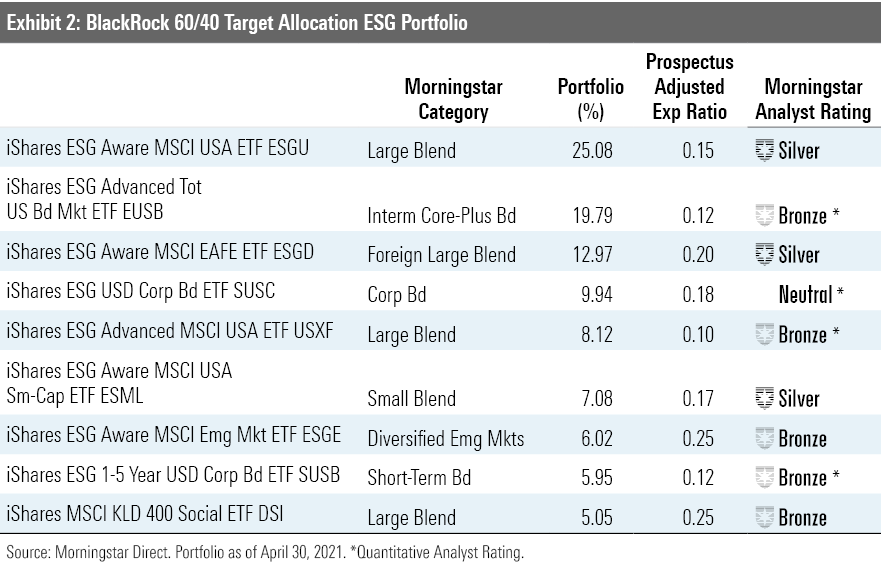

BlackRock 60/40 Target Allocation ESG

BlackRock’s model portfolio team uses its broad range of iShares ESG ETFs to construct this globally diversified portfolio. It uses three ETFs for its U.S. large-cap exposure. The iShares ESG Aware suite of ETFs makes modest tilts toward companies with favorable ESG characteristics within their respective starting indexes, like the MSCI USA Index. IShares ESG Advanced MSCI USA ETF USXF uses the same screening process but takes slightly larger bets on those companies. For example, as of March 31, 2021, iShares ESG Aware MSCI USA ETF ESGU has a 1.5% position in electric vehicle company Tesla TSLA, while USXF has a 3% position.

For fixed-income exposure, it leans on corporate bonds, where applying an ESG screen is relatively straightforward compared with the other areas of the bond market like government bonds and asset-backed securities. IShares ESG Advanced Total U.S. Bond Market ETF EUSB, for example, has around 5% in below-investment-grade bonds, whereas iShares Core U.S. Aggregate Bond ETF AGG holds none.

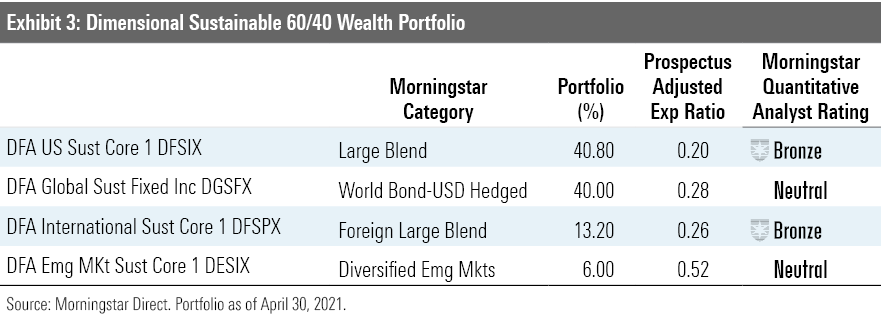

Dimensional Sustainable 60/40 Wealth

DFA uses a streamlined lineup of sustainable funds to create its ESG model portfolio. It gets broad global equity exposure through its three sustainable equity funds. These funds maintain the firm’s classic tilts toward smaller and cheaper companies, but they differ by a preference for companies with lower greenhouse gas emissions. In U.S. equities, for example, that has led to about one third the energy exposure as DFA’s unintentional funds on average over the three years ended March 31, 2021.

DFA Global Sustainability Fixed Income DGSFX uses a similar ESG process that is applied to the Bloomberg Barclays Global Aggregate Bond Index (hedged to the U.S. dollar).

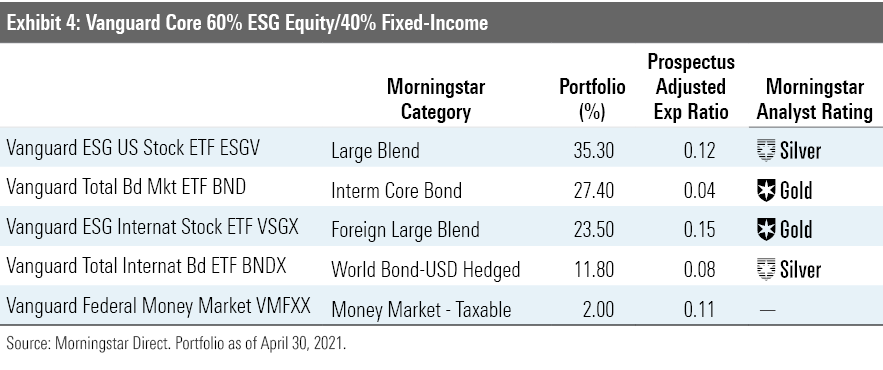

Vanguard Core 60% ESG Equity/40% Fixed-Income

As we mentioned earlier, for the Vanguard example we used the firm’s core model of four index funds and swapped out the market-cap weighted indexes for the ESG ETFs. Although Vanguard ESG U.S. Corporate Bond ETF VCEB was available, in the interest of simplicity, we opted to stick with the non-ESG Vanguard Total Bond Market ETF BND rather than trying to match that fund’s Treasury and asset-backed allocations using other ETFs.

Both of Vanguard’s ESG ETFs earn high marks, with Morningstar Analyst Ratings of Silver and Gold for the U.S. and international options, respectively. We have the same high confidence in both ETFs’ processes, but the wider opportunity for outperformance in the foreign large-blend category leads to the international ETF’s higher rating.

The ESG ETFs exclude companies with close ties to fossil fuels, nuclear power, vice products (alcohol, tobacco, gambling, and adult entertainment), and weapons. They apply additional screens to remove companies with poor conduct related to the environment, human rights, labor, and diversity.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)