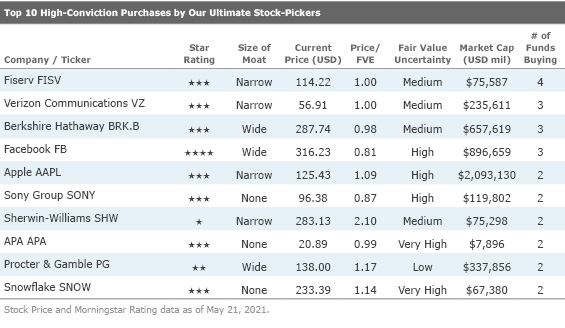

Our Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

Several funds see value in technology, energy, and communication services.

For roughly the past decade, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that reflect the most recent transactions of our Ultimate Stock-Pickers in a timely enough manner for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment. With 24 of our Ultimate Stock-Pickers having reported their holdings for the first quarter of 2021, we now have a good sense of the stocks that piqued their interest during the period.

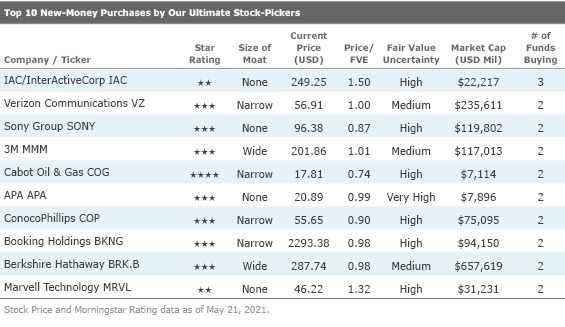

Recall that when we look at our Ultimate Stock-Pickers' buying activity, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the portfolio's size. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers' decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of January, so the prices paid by our managers could be substantially different from today's trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

The last few months have seen the global economy recovering from the economic headwinds brought on by the COVID-19 pandemic. This market recovery has been buoyed by a largely successful COVID-19 vaccine rollout in the United States. Even so, certain industries remain hard-hit (e.g., tourism, in-person shopping), though governments worldwide continue to take steps to mitigate the economic impact. The U.S. Federal Reserve has maintained the federal-funds rate to 0.00%-0.25%, and the U.S. government has taken many drastic measures since then to cushion the blow on the economy, including stimulus programs for consumers, unemployment benefits, easing pressures on debt markets, and establishing the PPP facility to help small businesses. With a democrat in the Oval Office, we could expect these measures to continue as the American economy readies itself for a comeback. Similar programs have been implemented across Europe and Asia as countries seek to boost their economies. The U.S. economy has also been aided by a successful vaccine rollout with the majority of the adult population having received the COVID-19 vaccine by the time this article was written. With vaccine rollouts accelerating across the world amid all this volatility and uncertainty, our Ultimate Stock-Pickers have managed to find value in individual stocks in a wide range of sectors such as technology, communication services, financial services, and healthcare.

In the top 10 high-conviction purchases list, the buying activity heavily leaned toward the technology sector, which received four high-conviction purchases this quarter. Communication Services was not far behind, with two high-conviction purchases this quarter. Keeping with a trend we have witnessed over the years, seven out of 10 companies in the high-conviction purchases list received a wide or narrow economic moat rating from Morningstar analysts. The three names we find most interesting on the high-conviction purchases and new-money lists are wide-moat rated Facebook FB, no-moat rated Sony SONY, and narrow-moat rated Cabot Oil & Gas COG. Three money managers made high-conviction purchases of Facebook. Sony received two high-conviction purchases that were also new-money purchases, indicating money managers put significant money into the company despite not having any prior ownership of Sony’s shares. Finally, Cabot Oil had two new-money purchases to start off 2021.

There was a moderate amount of crossover between our two top 10 lists this period, with four names appearing on both lists. This quarter, four stocks received three or more high-conviction purchases from our Ultimate Stock-Pickers. These names include Fiserv FISV, Verizon VZ, Berkshire Hathaway BRK.B, and Facebook. All these companies have economic moats according to Morningstar research, which indicates that money managers are sending big bucks toward blue-chip stocks such as these in a period of uncertainty.

The top 10 new-money purchases list had strong representation from the energy sector, with three out of 10 firms on the list being energy companies. Energy stocks are still some of the most undervalued names in the market according to Morningstar estimates. This can be seen in the three names present on the new-money list as well, with two of them trading at significant discounts to their fair value estimates.

Wide-moat Facebook particularly stood out for us, as it attracted three high-conviction purchases to kick off 2021. Facebook currently trades at a 19% discount to Morningstar analyst Ali Mogharabi’s fair value estimate of $390.

Facebook is the largest social network in the world, attracting more than 2.5 billion monthly active users. Mogharabi believes that the growth in users and user engagement, along with the valuable data that they generate, makes Facebook attractive to advertisers over both the short and long term. Mogharabi also highlights Facebook’s continued innovation that helps the business increase its user base and engagement. This innovation has taken the shape of additional features and apps to keep users engaged within the Facebook ecosystem. With more Facebook user interaction among friends and family members, sharing of videos and pictures, and the continuing expansion of the social graph, we believe the firm compiles more data, which Facebook and its advertising clients then use to launch online advertising campaigns targeting specific users.

Mogharabi also sees further economic tailwinds for the company as it is expected to benefit from an increased allocation of marketing and advertising dollars toward online advertising—more specifically to social network and video ads where Facebook is especially well positioned. The firm is also taking more steps to monetize its app portfolio while utilizing AI and virtual and augmented reality to drive further user engagement. This overall strength is driven by an ever-expanding social graph that helps the firm compile more data, which is used by Facebook and its advertising clients to launch targeted online advertising campaigns.

We believe Facebook merits a wide moat rating based on network effects around its massive user base and intangible assets consisting of a vast collection of data that users have shared on its various sites and apps. Facebook is a textbook example of how network effects can form an economic moat. It is worth noting that all the firm’s applications become more valuable to its users as people both join the networks and use these services. These network effects serve to both create barriers to success for new social network upstarts (as demonstrated by the firm’s success against Snap) as well as barriers to exit for existing users who might leave behind friends, contacts, pictures, memories, and more by departing to alternative platforms.

Mogharabi highlights the firm’s intangible assets as an economic moat source. These intangible assets are related to how much information the company has about its user base. Unlike any other online platform in the world, Facebook has accumulated data about everyone with a Facebook and/or an Instagram account. Facebook has its users’ demographic information. It knows what and who they like and dislike. It knows what topics and/or news events are of interest to them. With access to such data, Facebook is able to enhance the social network by offering even more relevant content to its users. This virtuous cycle further increases the value of its data asset, which only Facebook and its advertising partners can monetize.

Two of our money managers made high-conviction new-money purchases of Sony, a no-moat company currently trading at a 13% discount to Morningstar analyst Kazunori Ito’s fair value estimate of $111.

With name recognition across the globe, a market cap above $130 billion, and a history of profitability, we understand how some readers may be surprised at our no-moat rating of the company. However, at the same time, we must observe the competitive landscape in which the company operates. Ito asserts that Sony does not have an economic moat as a large percentage of its products have very low switching costs, even though we identify economic moats in some parts of its business. In particular, we believe that consumer electronic products (25% of revenue) will be exposed to fierce competition with Asian manufacturers. With many products in this part of the business being commoditized, and a replacement cycle of digital appliances being three to six years, it is generally difficult for consumer electronic companies to build up an economic moat that generates sustainable excess returns on capital.

At the same time, however, Ito positively evaluates Sony’s efforts in building an ecosystem within its PlayStation business. While PlayStation 4 accumulated shipments reached approximately 97 million units by the end of fiscal 2019, the number of PS Plus users exceeded 36 million. This not only gives Sony solid cash flows with which to improve the profitability of its gaming segment but also provides a hook for customers, leading them to again purchase a PlayStation console in the next generation.

Ito also notes strength in Sony’s sensor business that focuses on improving picture quality. As a result, Sony has increased its market share, owing to growing demand from handsets. This strength can be quantitatively illustrated in Sony’s dominance in the global market share for image sensors. Sony’s global market share in this space is estimated to be in excess of 50% with the second-largest player, Samsung, holding 18% of the global market share. Security and automotive (autonomous driving) fields are the next growth drivers for Sony’s image sensor business. A critical factor for both fields is high sensitivity under various difficult conditions, and so we believe Sony could leverage its strength to expand this business in the near term.

Our Ultimate Stock-Pickers also made two new money purchases in narrow-moat Cabot Oil & Gas, an exploration and production company focusing on the Marcellus Shale. Narrow-moat Cabot currently trades at a 26% discount to Morningstar analyst David Meats’ fair value estimate of $24.

Meats believes that the firm's assets are ideally located in the northeast portion of the play fairway, which mainly yields dry gas with very little oil condensate or natural gas liquids content in the production stream. This geographic advantage not only allows the firm to keep costs low but also maintain very high daily production rates. These advantages have enabled the firm to be among the lowest-cost natural gas producers in the Appalachia region, and this competitive advantage enables it to consistently deliver very strong returns on invested capital. Meats does advise caution, however. The company has drilling opportunities in the Lower and Upper Marcellus. The opportunities in the Lower Marcellus are far more lucrative but are expected to last until the late 2020s. This means that the firm will eventually pivot to opportunities in the Upper Marcellus that are typically up to 30% less productive. Meats asserts that when the firm does pivot to the Upper Marcellus, it will be able to reuse existing roads and pad sites, and as there are no well configuration constraints in this undeveloped interval, it could enhance returns by drilling longer laterals. As a result, we expect well costs to decrease enough to offset the dip in flow rates, leaving potential returns unchanged.

Cabot is the only natural gas producer to earn a narrow moat rating. The main reason for this rating is the firm’s low operating and development costs in the Marcellus Shale, which puts Cabot at the lower end of the U.S. natural gas cost curve.

ESG is an important factor to consider when looking at exploration and production companies. This is due to the downside risk ESG factors possess for such companies due to reputational and regulatory risks. Meats does not think that these issues threaten the company’s economic moat due to the 5%-10% spread between projected returns and Cabot’s cost of capital that provides a comfortable margin of safety. The most significant ESG exposure for Cabot is greenhouse gas emissions. While greenhouse gas emissions are unavoidable for oil and natural gas producers, Cabot has taken steps to reduce greenhouse gas emissions intensity in 2020 while also reporting zero flaring in the year. It is also worth noting that while consumers get more skeptical of fossil fuels, much of this aversion is directed toward coal. Natural gas, on the other hand, is less carbon-intense than coal but does not have the intermittency issues that plague wind and solar generators.

Disclosure: Malik Ahmed Khan, Justin Pan, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)