Should You Shop Around for a 529 Plan?

Some states offer a tax benefit that outweighs their plan's investment fees, tempting investors to stay close to home.

529 plans appeal to investors by offering federal, and in some instances state, tax benefits. Whether the cumulative tax benefits of individual plans make one more attractive than another depends on an investor's circumstances.

A federal tax exemption on the growth and distribution of withdrawals that cover a beneficiaries' qualified education costs encourage saving for college. The potential tax-advantaged savings don't always stop there. Since college savers have no obligation to invest in their own state's plan, some states choose to entice residents to pick their home state's plan over other options by offering an additional state income-tax benefit. Whether that state income-tax benefit results in enough cost savings to merit staying in-state varies across the more than 80 plans available nationwide, and investors should to take a closer look at the possibilities.

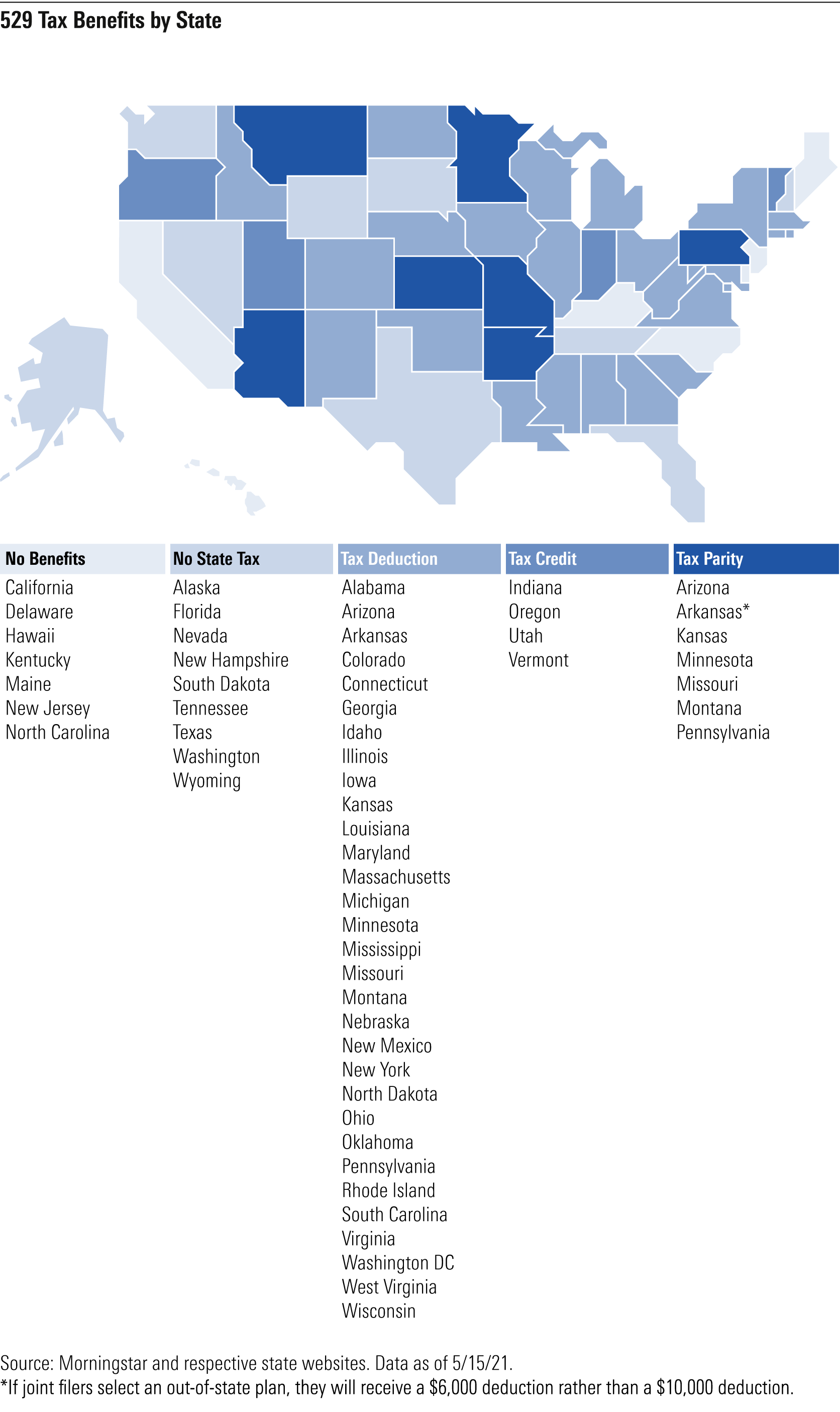

State tax benefits come in a variety of shapes and sizes. Thirty-five states, including the District of Columbia, offer a state income tax benefit on contributions to a 529 plan. Most benefits come in the form of a tax deduction, which reduces taxable income, while Indiana, Oregon, Utah, and Vermont offer a tax credit that directly decreases the tax dollars owed. Minnesota gives investors a wider breadth of options by offering a choice between a tax credit or deduction of varying amounts. Exhibit 1 illustrates which states offer tax benefits. Tax parity is a less restrictive version of a tax deduction, so the dark blue tax-parity designation trumps the light blue tax deduction in our map.

Attractive Plans Across State Borders

Roughly 50% of the U.S. population resides in a state that doesn't offer state-specific tax incentives, either because it's a tax-parity state, a state with no income tax, or a state that doesn't offer a deduction or credit for staying in state. These investors have ultimate flexibility to shop around, free to choose a 529 plan without tax consequences.

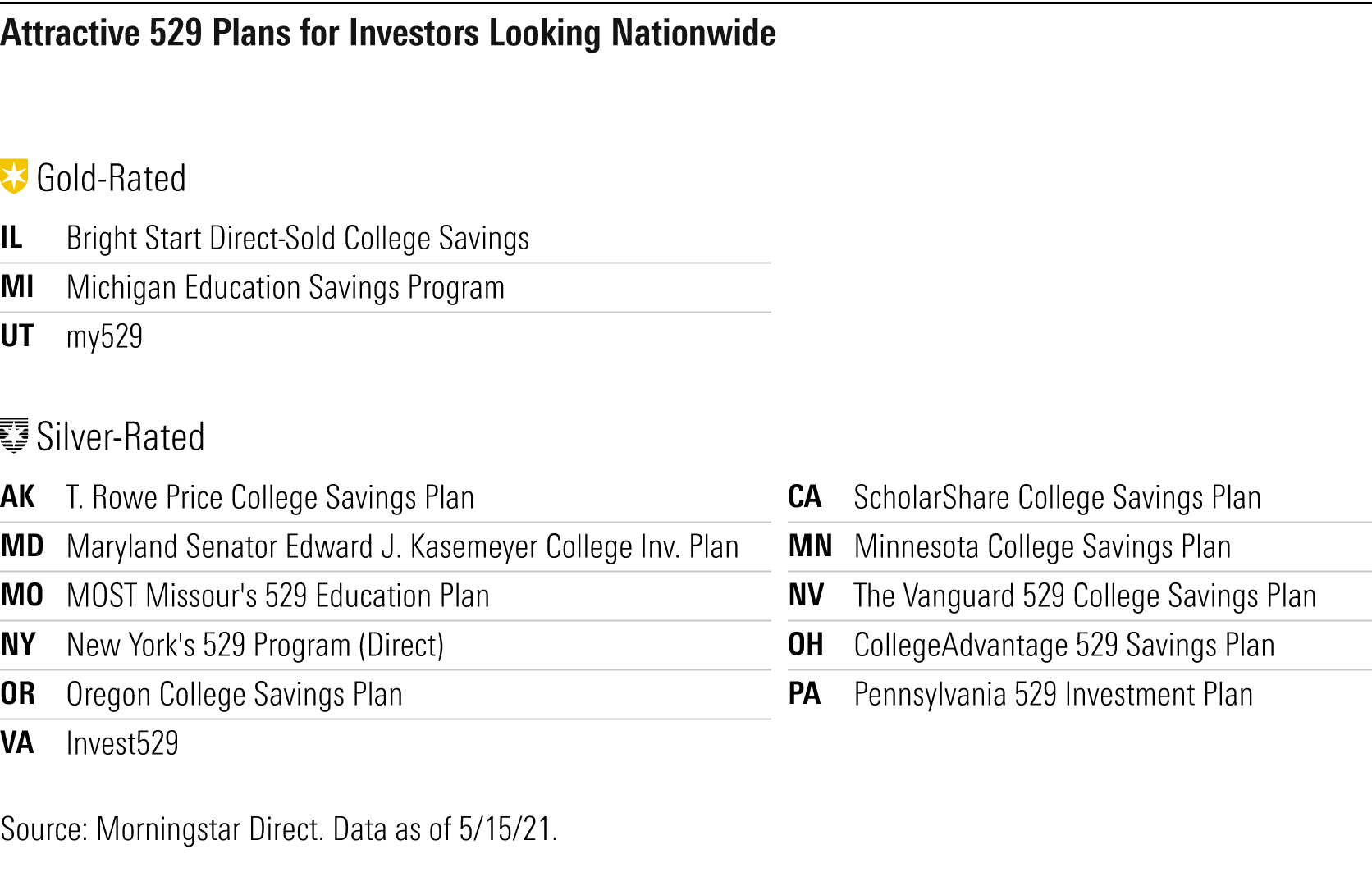

While these investors have the most options, a universe of more than 80 plans might seem daunting to research. Morningstar Analyst Ratings are a good place to start: Morningstar analysts assign ratings across 61 plans, considering the plan's relative strength as an offering for investors nationwide. (Morningstar ratings do not consider state-specific incentives.) Currently, 14 529 plans receive an Analyst Rating of Gold or Silver. Exhibit 2 outlines the Gold and Silver-rated plans.

Do Your State Tax Benefits Outweigh Your Plan's Fees?

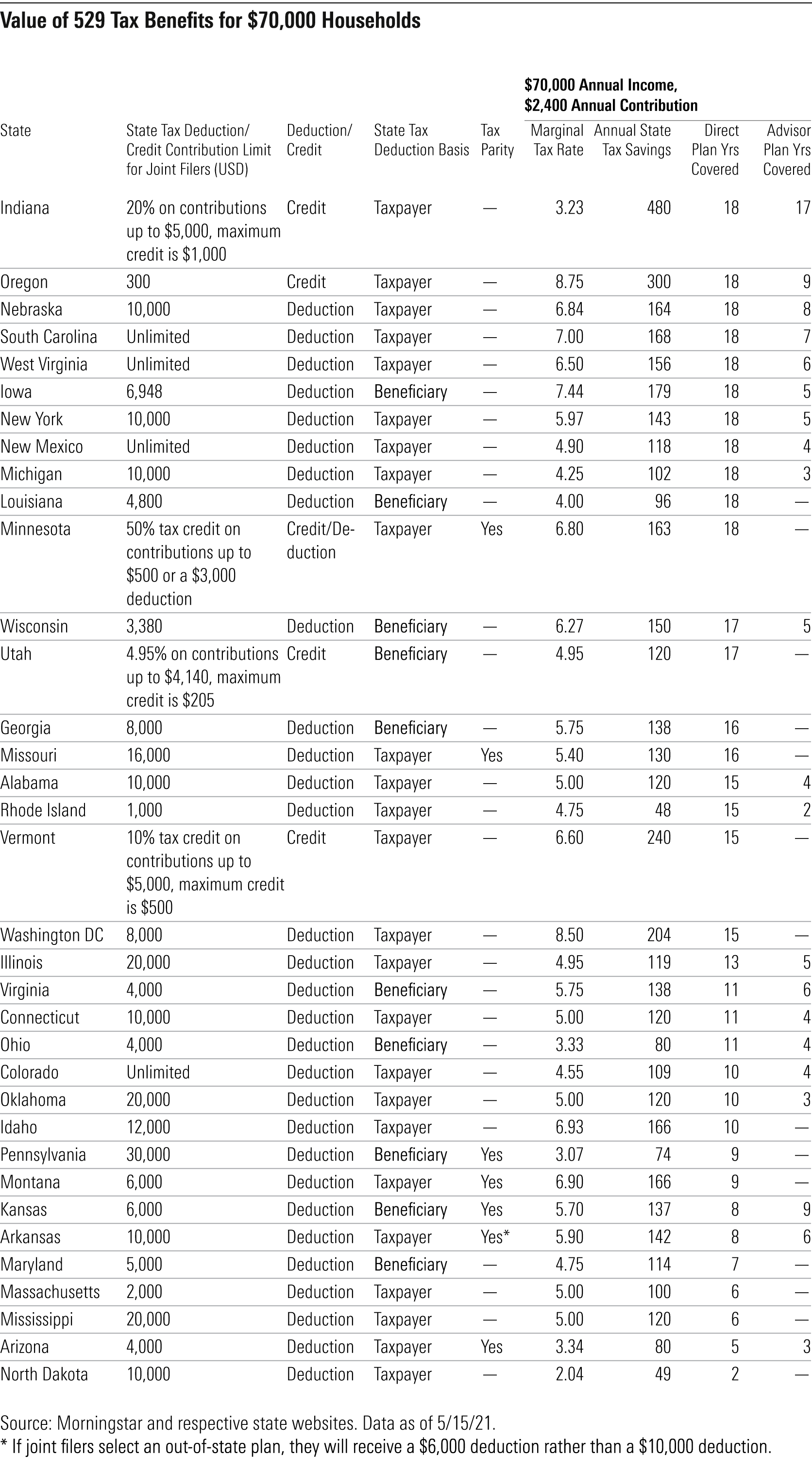

Meanwhile, state-specific tax benefits complicate the picture for investors. It helps to understand the potential value of the benefit. Since they vary widely from state to state, we evaluated whether it was possible to cover the average expense ratio of a plan's age-based portfolios with each state's available state-specific tax benefits (assuming both stay constant), and if so, how long that advantage lasts.

Tax benefits typically start off covering the full balance of a plan's fees when assets are low, but the annual cost in dollars charged by the plan increases as the account balance grows, whereas tax savings are capped based on the size of contributions. Eventually, the balance may grow to the point where fees charged are greater than the tax benefit. We assumed a family of four with a $70,000 income per year contributed $100 each month per child, or $2,400 a year. We also assumed each state's highest marginal state tax rate for the family's income level and an annual 6% return on investment. Across all plans, we assumed investors chose the age-based portfolios and took an average expense ratio across the plans' tracks to find the average price of each plan. When states offer more than one direct or advisor plan, we considered the one with the higher Analyst Rating.

In 23 states, including the District of Columbia, the tax benefit covered the cost of fees in the state's direct-sold plan for 11 years or more. Our prior research showed that most individuals don't start investing in a 529 plan until the beneficiary is more than 7 years old. Given our assumptions, investors in these 23 states would have their entire expense ratio covered while saving for college. Exhibit 3 outlines each state's annual tax savings and how long a plan's tax benefits pay for its fees.

Investors living in states with generous tax benefits have even more compelling financial incentives to stay within their states. For example, residents of Indiana receive a tax credit of 20% of contributions up to $5,000 with a maximum credit of $1,000. This covers the cost for its direct-sold and advisor-sold plans for 18 and 17 years, respectively. Oregon also baits residents with an attractive tax credit to stay in state. Joint fillers receive a state income tax credit up to $300, which would cover the cost of its direct-sold plan for 18 years.

Advisor-sold plans tend to come at a higher price tag than their direct-sold counterparts, dimming the effects of a state tax benefit. For example, even Oregon's generous tax credit only covers nine years of its advisor-sold plan.

Should You Stay or Should You Go?

While they are a durable predictor of future net-of-fee-results, lower costs do not always guide investors to the perfect plan. Morningstar's methodology assigns a 30% weight to the Price Pillar, and analysts consider three additional pillars that are critical to evaluate the merit of the plan: People (measuring the strength of the plan's investment resources), Process (determining whether there is a repeatable and thoughtful asset-allocation process), and Parent (signifying robust oversight).

Plans that are rated Gold, Silver, or Bronze typically receive a rating of Above Average or High across at least two of the four pillar assessments. In most cases, investors who have an in-state plan that's a Morningstar Medalist with a meaningful tax benefit probably do not need to look elsewhere. Even Neutral-rated plans may have merit if the state-specific tax benefits cover investments for a long stretch and the plan is otherwise sensibly constructed. But even when states offer investors a zero-cost plan, if it earns an overall low rating, investors should carefully weigh all their options before committing their education savings.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)