Dissecting Vanguard's New Dividend Indexes

A pair of popular Vanguard dividend funds are getting new indexes, but their approach remains the same.

Vanguard recently announced that Vanguard Dividend Appreciation Index VIG and Vanguard International Dividend Appreciation Index VIGI will change their benchmarks in the third quarter of 2021. Both funds will be replacing their current Nasdaq Dividend Achievers Select indexes with newly launched S&P Dividend Growers indexes. While these indexes are new, the funds’ approach will remain largely the same. Here, we will compare the funds’ new indexes with their current ones and discuss the implications for their Morningstar Analyst Ratings.

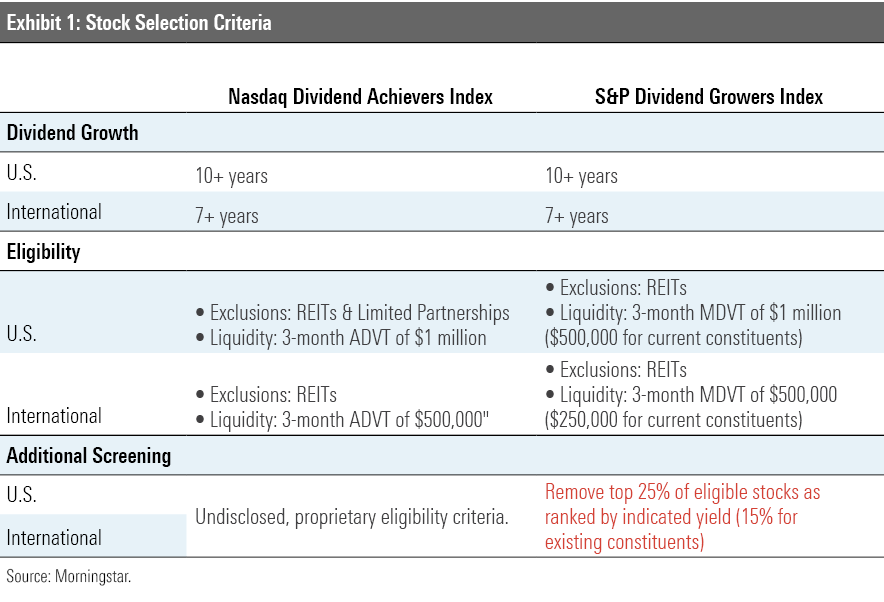

Stock Selection

Exhibit 1 compares the stock selection criteria for the two index series. In the case of the U.S. indexes, both require stocks to have increased their annual dividend for a minimum of 10 consecutive years to be considered for inclusion. The international benchmarks require seven years of uninterrupted dividend growth. This strict test of dividend durability is the key ingredient in these funds’ process, tilting them toward high-quality franchises that are likely to continue to return cash to shareholders in the form of dividends for years to come.

The new S&P indexes apply a yield screen to try to steer clear of value traps. The top 25% of eligible stocks as ranked by indicated dividend yield is not eligible to be added to the index, while current constituents ranking in the top 15% will be removed. We like the simplicity and transparency of this screen. The Nasdaq indexes feature a similar filter that aims to steer the portfolio away from stocks with unsustainable dividend streams. However, Nasdaq does not disclose the specifics of these proprietary eligibility criteria. The Nasdaq screen has improved the profitability and risk profile of the overall portfolio. This is evidenced by the fact that it has experienced less volatility than the Nasdaq Broad Dividend Achievers Index, which is identical to the “Select” index, save for the fact that it doesn’t apply the same screen. We expect that S&P’s yield screen should have the same effect.

It is unlikely that the new yield screen will filter many stocks out of either Vanguard fund’s current portfolio. For example, we used the Nasdaq U.S. Broad Dividend Achievers Index as a proxy for the new U.S. index’s eligible universe. The index holds all stocks passing the 10-year dividend growth screen. As of April 2021, stocks representing approximately 7% of VIG’s portfolio landed in the top 25% of eligible constituents as ranked by forward yield. None of them landed in the top 15%.

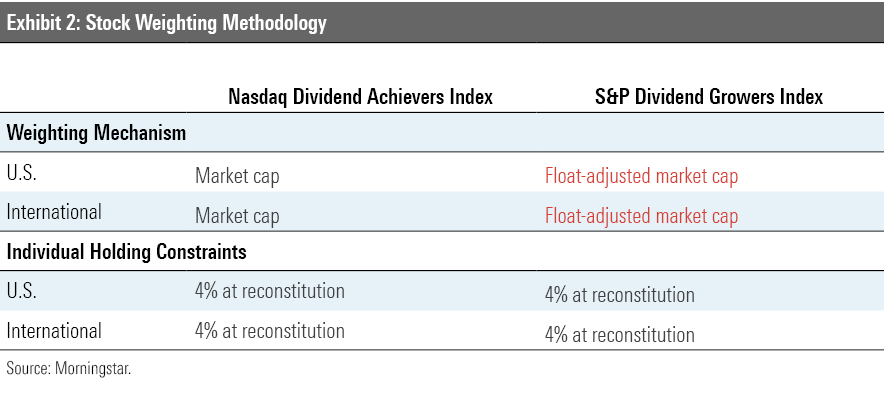

Stock Weighting

Like the current Nasdaq benchmarks, the new S&P indexes will weight stocks by market cap and apply a 4% limit on individual stocks’ weights. However, the S&P indexes will use stocks’ float-adjusted market caps in order to improve the funds’ liquidity, focusing on the portion of firms’ outstanding shares that is readily available to the market. This is an improvement over the Nasdaq index series, which weights stocks based on their total market cap and is especially important in light of the funds’ recent asset growth. As they’ve grown in size, so has the risk that they will push stock prices away from investors (that is, have negative market impact) when the fund rebalances.

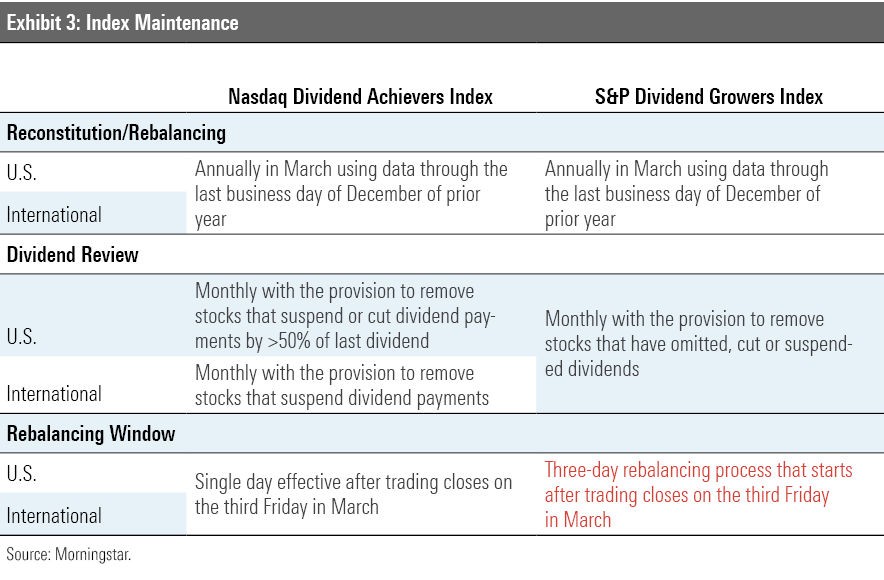

Maintenance

The new S&P indexes will stick to the same annual reconstitution and rebalancing schedule as the Nasdaq benchmarks. Less frequent reshuffling of the portfolio can mitigate unnecessary turnover. However, this review cadence has often allowed the indexes’ largest constituents to drift past the 4% individual position cap in the Nasdaq benchmarks between annual reviews. This can exacerbate the portfolio’s firm-specific risk. Nonetheless, these funds’ top holdings are often established industry leaders with stable businesses, so temporary breaches of the 4% cap between rebalancings aren’t cause for concern.

Both the Nasdaq and S&P index series review stocks’ dividends monthly. The Nasdaq indexes remove stocks that suspend or cut their dividend payments by more than 50%, while the S&P indexes will remove stocks that have omitted, cut, or suspended dividends. There is no grace period or buffer rule for temporary deviations, which might increase turnover. However, the index providers do have and will exercise discretion in extreme circumstances. For example, Nasdaq allowed Disney DIS and TJX Companies TJX to remain in the U.S. index until March 2021 even though both firms suspended their dividends in 2020.

A key differentiating feature of the S&P indexes is that they will spread rebalancing over three days instead of trading everything in one day. This will help mitigate the market impact of rebalancing trades. It is also consistent with similar modifications that were made to the CRSP indexes in September 2017 that underpin many of Vanguard’s U.S. stock index funds.

What’s the Verdict?

At their core, these funds’ new S&P indexes are near-identical to their current Nasdaq bogies. They are retaining all of the advantages of their longtime benchmarks while adding incremental improvements that provide greater transparency and try to minimize the impact these now hefty funds have on their their market.

We are in favor of this switch. Following our review of the specifics of these benchmark transitions, we are maintaining our Above Average Process ratings for both funds. As such, we are also maintaining their overall Morningstar Analyst Ratings. Vanguard Dividend Appreciation Index retains its Gold rating, and Vanguard International Dividend Appreciation Index retains its Silver rating.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)