Which Sectors Saw the Biggest Valuation Boosts?

Three sectors saw the most fair value increases after the first-quarter earnings season.

Against the backdrop of the aggressive COVID-19 vaccination rollout and an improved outlook for the U.S. economy, Morningstar equity analysts increased their fair value estimates of cyclical stocks at a stepped-up pace during the first-quarter earnings season.

These fair value estimate upgrades were led by basic-materials companies bolstered by a strong pricing environment; communications companies riding an improved advertising landscape; and asset managers buoyed by continued strength in the stock market.

Morningstar equity analysts conduct fundamental analysis and create a financial model to determine a company's intrinsic value and a fair value for its stock. While our analysts stick to a long-term approach to investing, they monitor quarterly earnings results to update their assumptions and potentially their estimates.

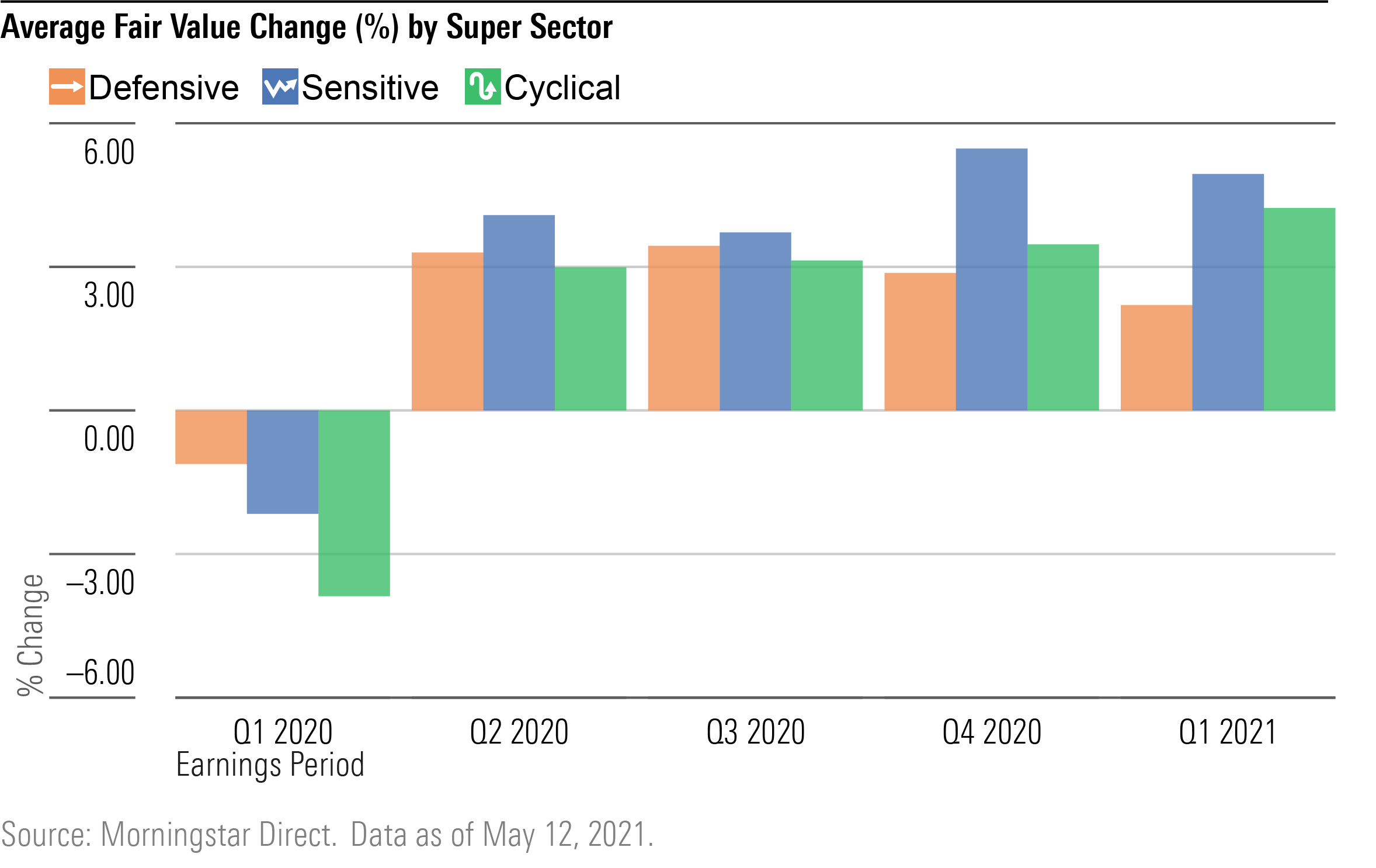

The chart below shows the average percentage change in fair value estimates throughout the past five quarters' earnings seasons. Fair value estimates were pulled from Morningstar Direct for the end dates of each quarter and compared with the estimates six weeks after each quarter.

This six-week period is meant to capture fair value increases as a result of earnings releases. However, keep in mind that some analysts may have upgraded fair value estimates prior to new earnings data based on other catalysts. (For a detailed explanation of the methodology, see the end of this article.)

The above chart shows the average fair value percentage change among what Morningstar calls the Super Sectors: cyclical, defensive, and sensitive. Cyclical sectors are those that are heavily correlated with the business cycle. As the economy grows and expands, cyclical sectors follow. Defensive sectors are anticyclical. Sensitive sectors are slightly correlated with the business cycle.

During 2020's first-quarter earnings, when coronavirus uncertainty toppled the market, cyclical and sensitive stocks had fair value downgrades of 3.9% and 2.2%, respectively. Defensive stocks had an average downgrade of 1.1%.

Sensitive stocks' average fair value upgrade led each ensuing earnings season. Defensive and cyclical stocks went toe to toe up until first-quarter 2021.

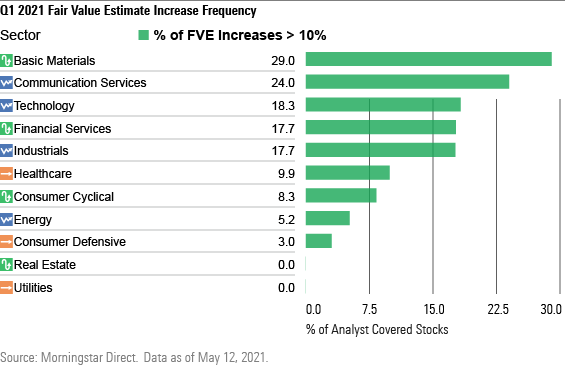

In the following table, we screened for fair value estimate increases of 10% or higher to capture the most meaningful changes.

Basic materials had the largest number of fair value increases among the stocks we cover in the sector. Our analysts raised the fair values for 29% of these stocks by 10% or more during earnings season.

The next four sectors with large proportions of fair value upgrades were communication services, technology, financial services, and industrials. These five sectors all are within the sensitive and cyclical Super Sectors.

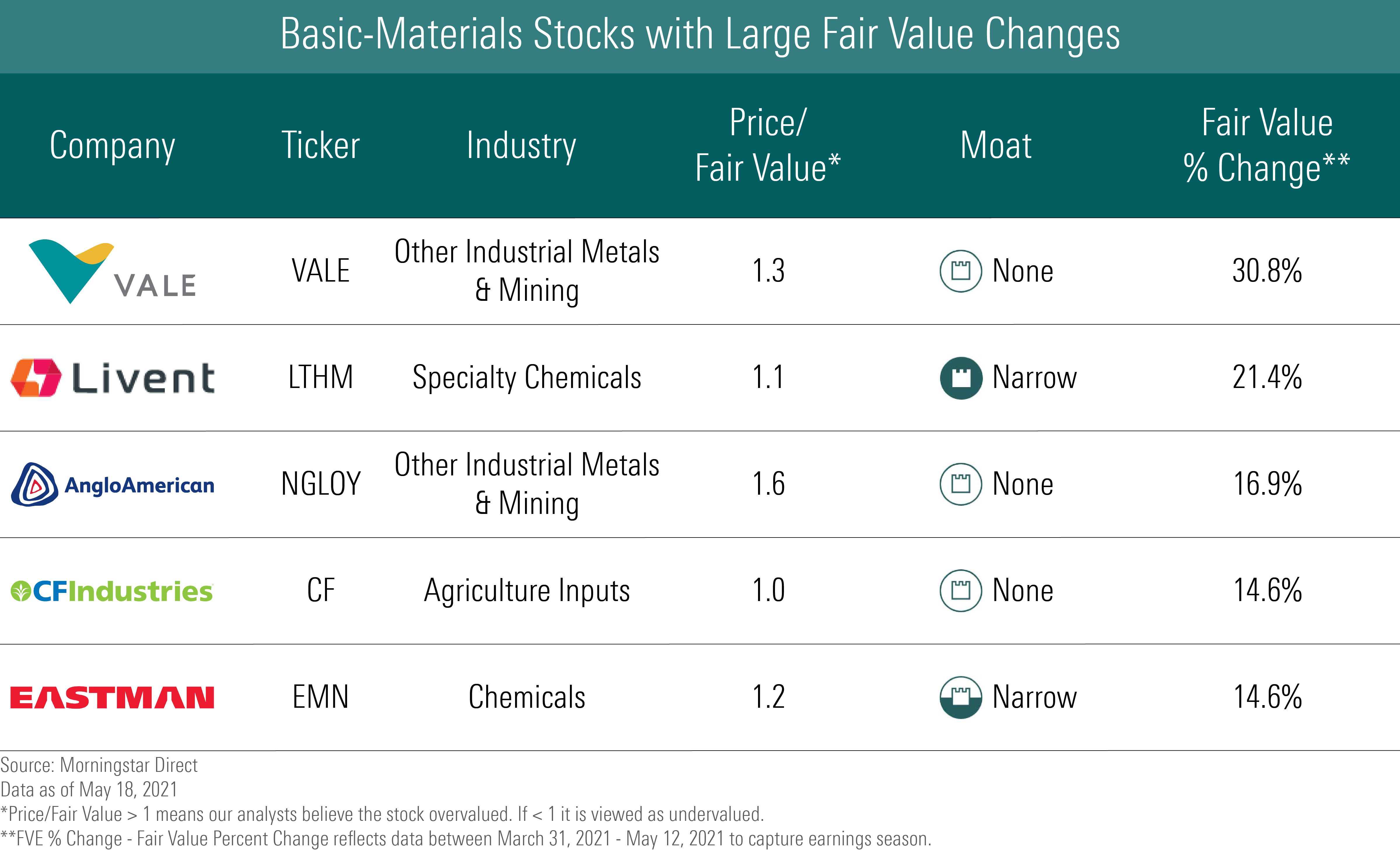

Basic Materials

The basic-materials sector recorded the greatest percentage of upward adjustments in fair value. Out of the 33 stocks covered by Morningstar analysts, 29% had their fair value estimates increase more than 10% following earnings season.

"The biggest factor is higher near-term prices," says senior analyst Seth Goldstein. Rising commodity prices placed companies in a better position in the short and medium terms. Eastman Chemical EMN, for instance, had its fair value raised to $110 from $96 in response to accelerating demand and prices for its specialty chemicals.

Rising commodity prices also provided mining companies an edge that raised our expectations. "Iron ore has been incredibly strong and rapidly moved to record highs. Copper has been similarly strong. And platinum group metals have been rising quickly," director of equity research Mathew Hodge adds. Vale VALE and Anglo American NGLOY, who have exposure to these materials, had their fair value estimates increase by 30.8% and 16.9%, respectively. Rising lithium and nitrogen prices raised the fair value estimate for Livent LTHM by 21.4% and CF Industries CF by 14.6% to reflect our analyst's revised outlooks.

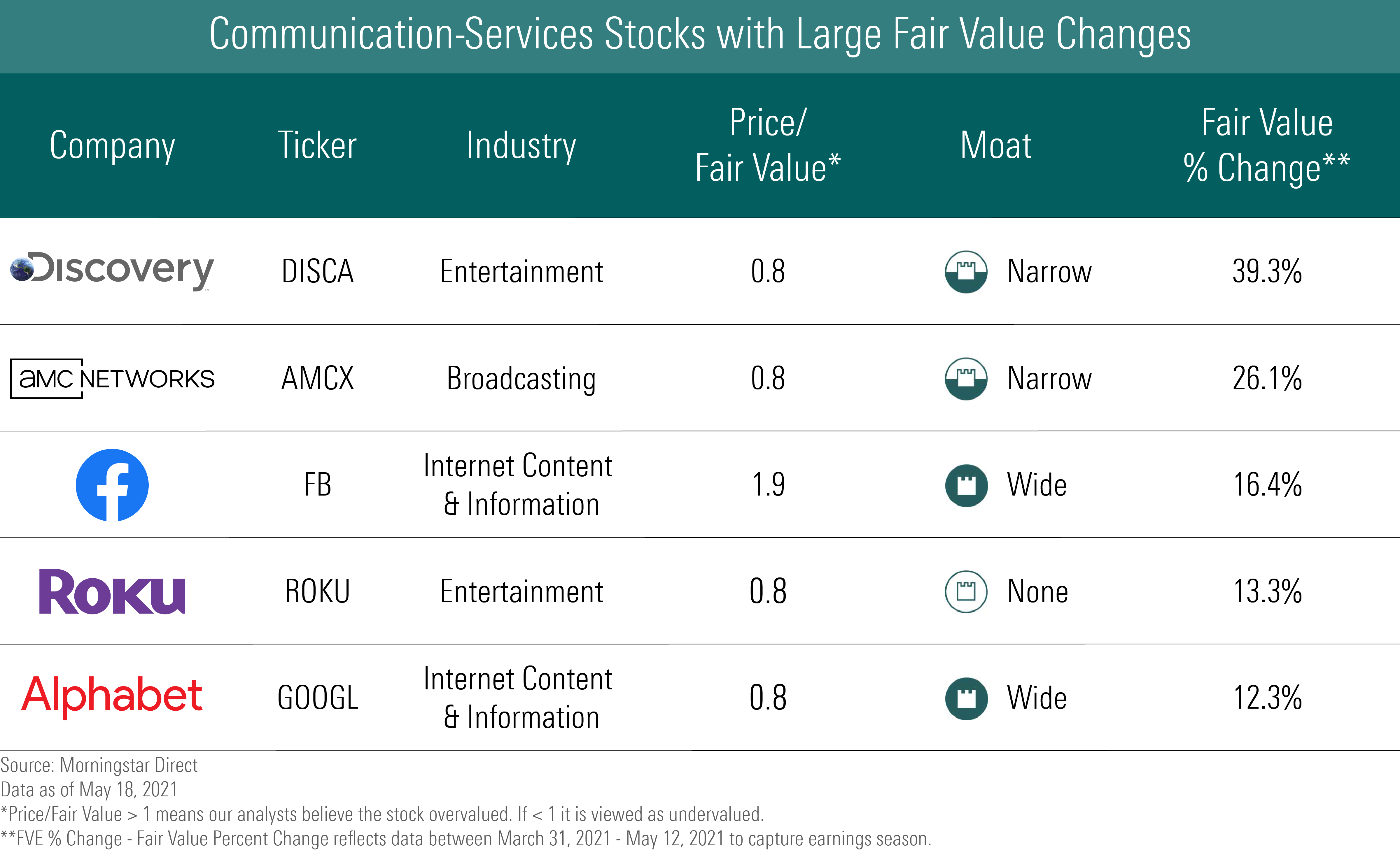

Communication Services

We found that 24% of the 75 communication-services stocks that we cover had their fair value estimate increase by more than 10% during the last earnings season. Below are several stocks that had significant fair value increases in the sector.

The two stocks with the largest fair value increases were Discovery DISCA at 39.3% and AMC Networks AMCX at 26.1%. Both companies have launched subscription-based media platforms. While these companies experienced a slowdown in revenue from advertisements, we expect their exposure to digital ad spending could provide a boost in future revenues. "We estimate digital ad spending in the U.S. to grow 20% this year, 15% in 2022, and average nearly 15% annually through 2025," says senior analyst Ali Mogharabi. "By 2025, digital advertising will represent 72% of total ad spending."

According to Michael Hodel, director of telecom and media equity research, advertising spending has surged more than anticipated in the latter half of 2020. Rising discretionary income and additional stimulus checks led consumers to spend more on consumer goods, especially on leisure products. This prompted more advertising spending, particularly on digital platforms. "It seems that firms are afraid of getting left behind rivals," he says.

Facebook FB and Alphabet GOOGL had their fair values raised by 16.4% and 12.3%, respectively. These companies already have a substantial digital media presence that captured the demand for ads last quarter.

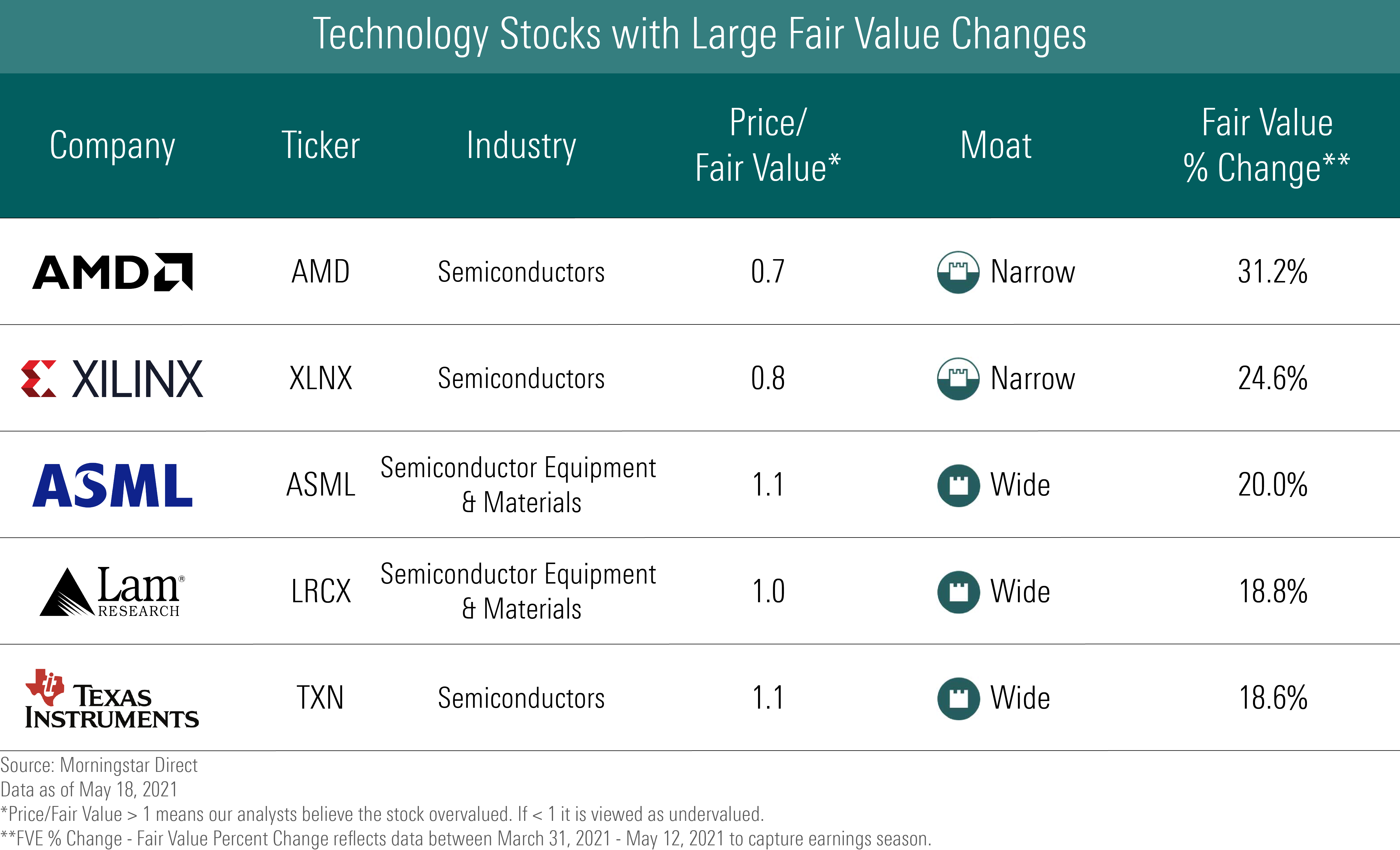

Technology

In the technology sector, 18.3% of our coverage list had their fair value increase by 10% or more throughout earnings season. According to technology, media, and telecommunications sector director Brian Colello, the semiconductor industry represented a significant number of the fair value increases in the tech sector following this earnings period. Below are some semiconductor stocks with large fair value moves.

The coronavirus pandemic disrupted the semiconductor industry's manufacturing capabilities. As the economy recovers, many businesses--especially the auto industry-- are seeking out semiconductors for their products. As such, "demand exceeds supply, especially for analog and mixed signal semiconductors," Colello says. "It will likely last to the end of 2021." The shortage also provides a boost to the semiconductor industry's revenue as prices rise in response.

"Revenue is a key component of how we determine our fair value estimates, and, in the near term, it will depend on manufacturing capacity and a company's ability to secure enough supply to meet demand," Colello adds.

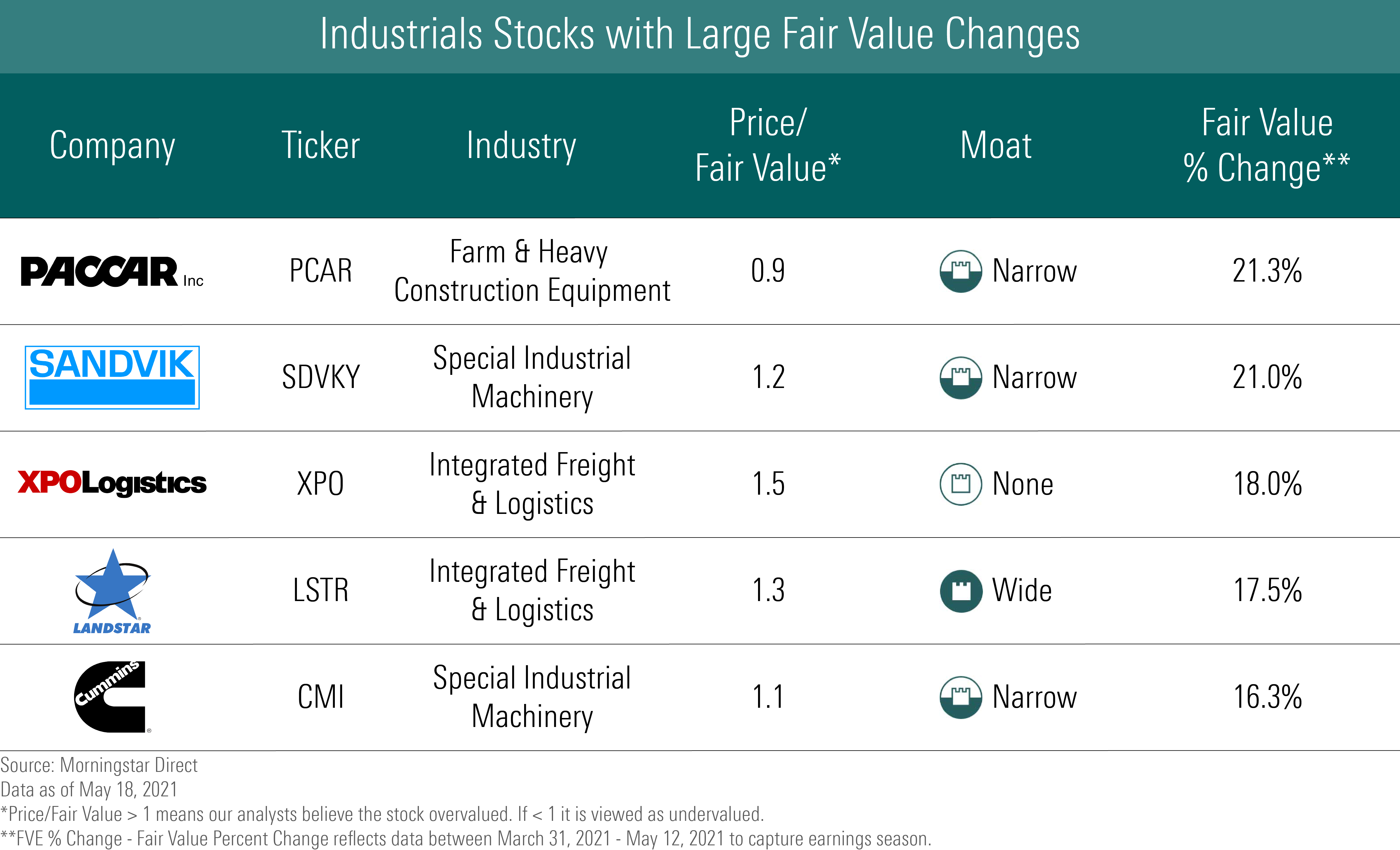

Industrials

The industrials sector had 17.7% of covered stocks get a fair value upgrade of 10% or more. A number of top movers were concentrated among transportation stocks.

"It stems from robust demand and pricing conditions for asset-based truckers and asset-light freight brokers, stemming in part from the spike in retailers' inventory restocking and tight capacity," says analyst Matthew Young. "This is driving up medium-term free cash flow generation for the names we cover."

XPO Logistics XPO and Landstar System LSTR are among the stocks that benefit from the increased retail demand. Stocks that manufacture transportation vehicles or components, such as Paccar PCAR and Cummins CMI, are also set to benefit.

However, Young believes that even with the increases in fair value, the share prices for these stocks are still overvalued, citing that investors may be considering that the favorable demand for transportation services will extend longer than reality.

The sector overall is expected to experience growth in light of a recovering economy. "It's happening a bit faster than most expected," sector director Brian Bernard says. He notes that the demand for industrial goods and services could also be bolstered by President Biden's infrastructure renewal plan.

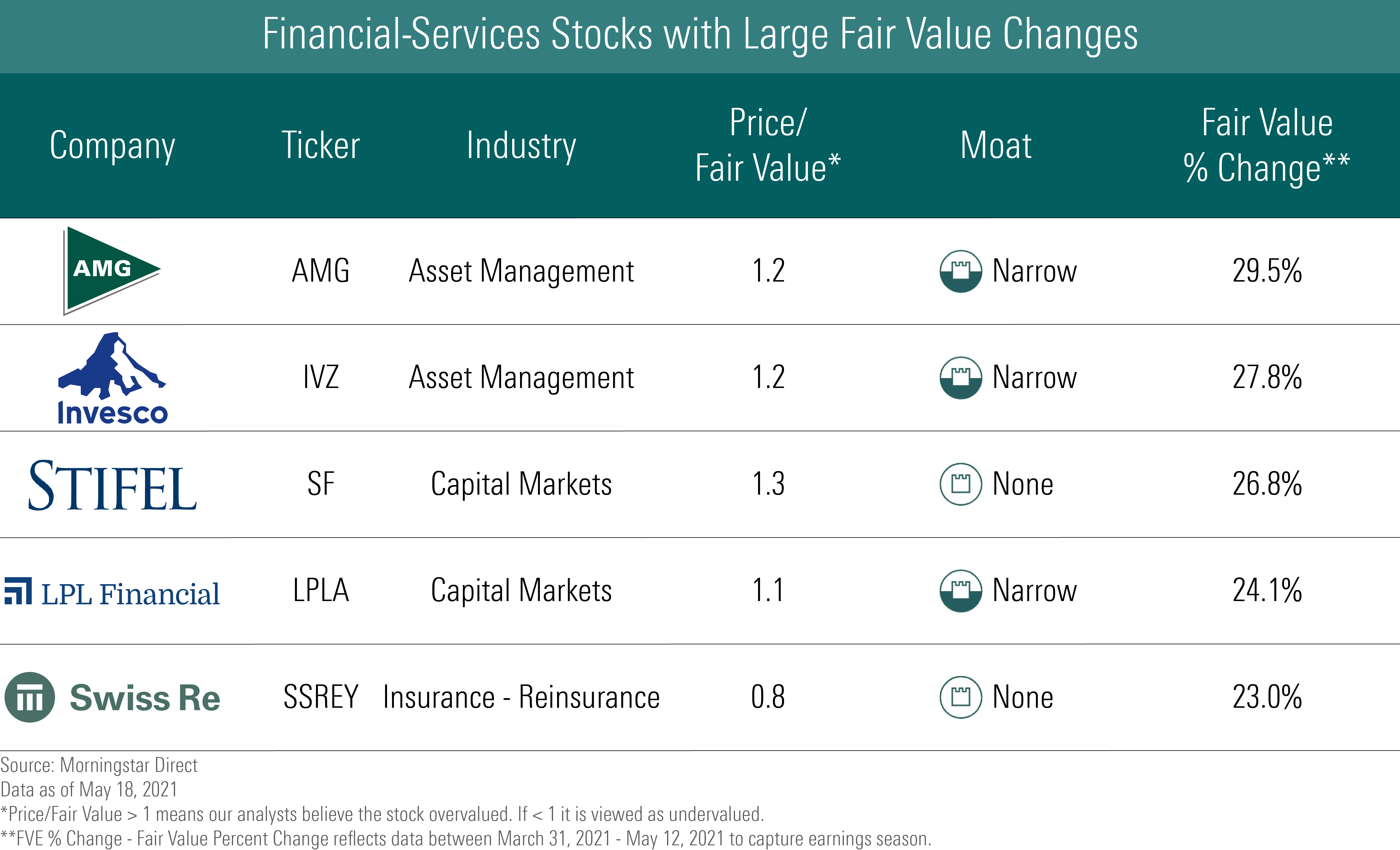

Financial Services

Stocks in the financial-services sector had 17.7% of their fair value estimates raised by more than 10% in the six-week period we reviewed.

The list is dominated by asset/wealth-management firms. And according to financial-services sector director Michael Wong, their fair value upswings were due to the firms' rising values in their assets under management or assets under advisement.

"We are always quick to note that where the asset and wealth managers are today from an AUM or AUA perspective has a big impact on where they will be five to 10 years from now," says financial-services sector strategist Greggory Warren. "We've now lapped the losses in the market from a year ago, so additional gains will likely be tougher to come by in the near term. As such, our fair value estimates are going to reflect the nearer-term twists of the markets as well as more-normalized expectations over time."

Many of these firms, such as Affiliated Managers Group AMG and Invesco IVZ, generate a majority of their revenue from fees, which scale with the value of their managed assets. They also have a high degree of operating leverage, which can lead to a greater expansion in earnings during good times and a meaningful reduction in earnings during market sell-offs like the one in early 2020.

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. In some cases, fair value adjustments may have been made prior to company earnings reports. Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. The underlying list of stocks can change from quarter to quarter owing to changes in analyst coverage or other factors. Stocks portrayed in sector tables may not reflect those that had the largest fair value moves within the sector. Demonstrated stocks were selected to emphasize sectorwide trends and/or by the recommendation of Morningstar analysts.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)