3 Undervalued Media Stocks

There are other ways to play streaming media than Netflix and Disney

Discovery's DISCA announced merger with AT&T’s T WarnerMedia, the company’s second major acquisition in the last few years, was followed by a more than 6% drop in the stock’s price.

But the share price slide following the announcement only put the stock further into undervalued territory according to Morningstar analyst Neil Macker. He views the WarnerMedia and Discovery merger as a positive note for the company’s long-term performance.

“We think the deal provides Discovery with the scale and resources necessary to compete with Disney DIS, Netflix NFLX, and NBCUniversal,” he says. Macker raised his fair value estimate for Discovery to $42 from $39.

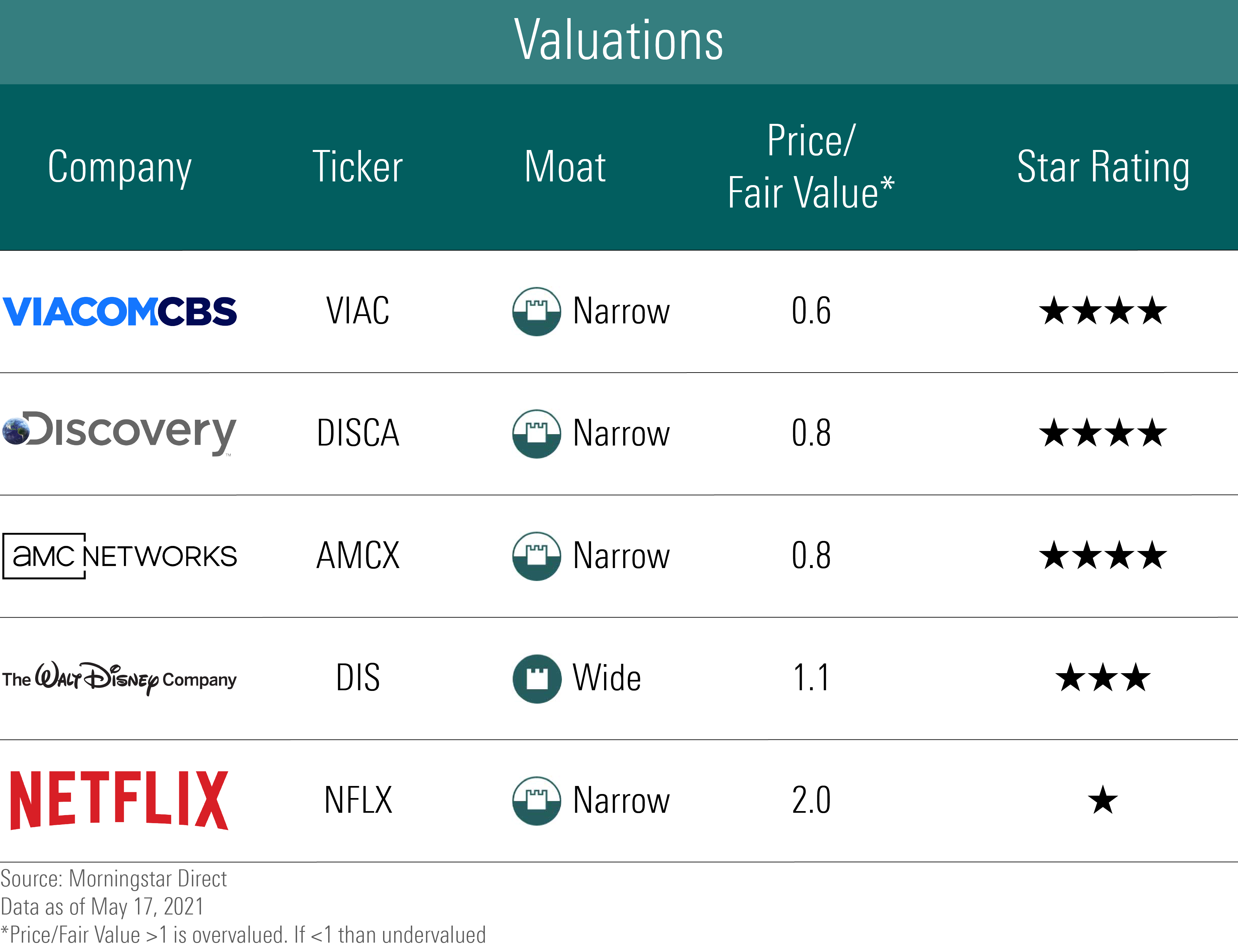

On the heels of the Discovery news we took at look at some of the big names in media stocks to highlight those trading below Morningstar’s analyst fair value estimates. Notably, two of the industry heavyweights on this list--Netflix and Disney--are not considered undervalued. Both those stocks are trading above Morningstar’s fair value estimates.

ViacomCBS VIAC

“In the (first) quarter, the streaming services benefited from lockdown restrictions and the rebranding/relaunch of Paramount+. Global SVOD subscribers increased by 6.0 million to 35.9 million, and Pluto, a free platform, added 6.4 million monthly active users to end the quarter at 49.5 million. The recent results reinforce our view that the long-term guidance of 65 million-75 million SVOD subscribers by 2024 is very conservative. While Paramount+ only launched in the Americas in March, we expect much wider distribution by 2024, making even the high-end target of another 40 million net adds seem modest.” -- Neil Macker, Senior Equity Analyst

AMC Networks AMCX

“AMC Networks has transformed its flagship AMC channel from a minor cable channel showing classic movies into a premier prestige platform for original scripted content. The transformation provides the smaller AMC with strong growth potential compared with larger rivals. However, this growth remains contingent on AMC’s ability to source and cultivate strong original content as well as monetize programs internationally and on streaming platforms. The niche subscription video on demand platforms like Acorn and Shudder, along with AMC+, continue to see increased demand with the services on pace to end 2021 with over 9 million subscribers, up 50% from the end of 2020.” -- Neil Macker, Senior Equity Analyst

Discovery DISCA

“Discovery Communications produces and owns unique content with proven appeal to audiences across cultures and languages. This transnational appeal provides the company with the ability to repurpose the content across multiple platforms and international borders. Discovery recently entered the streaming landscape with its Discovery+ service. We expect that the service will help offset the cord-cutting challenges to distribution and ad revenue growth in U.S. as well as spark additional growth internationally.” -- Neil Macker, Senior Equity Analyst

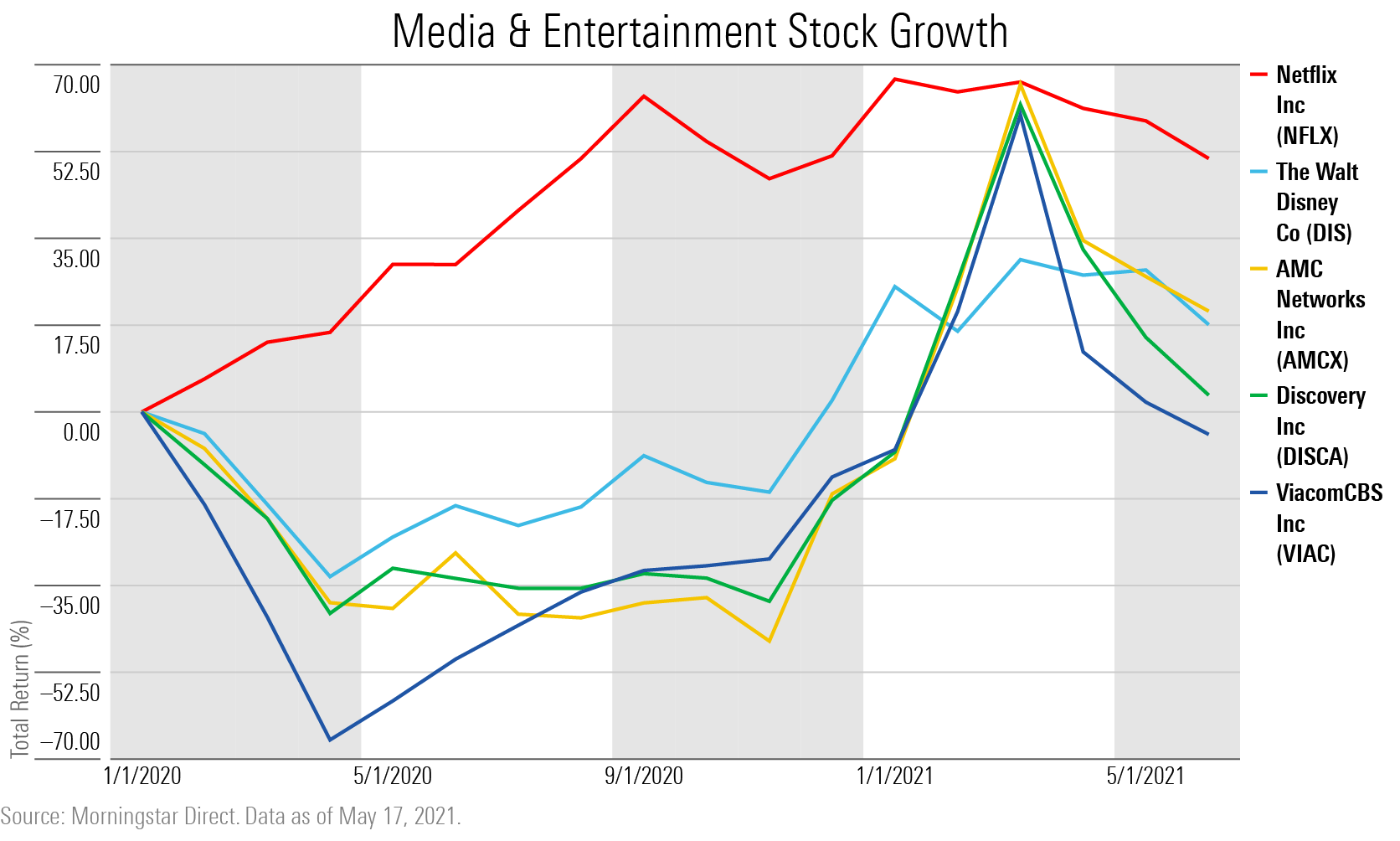

When it comes to recent stock performance, Netflix has led the pack. However, our analysts believe the stock, which is currently trading at around $490 per share, is significantly overvalued. This is in part because the direct-to-consumer media company is experiencing a slowdown in terms of subscriber growth since the beginning of 2020. The company reported only 4 million net new subscribers during the first quarter of 2021, with expectations to gain 1 million new subscribers for the second quarter.

Disney also dropped down to 8 million subscribers this recent quarter from the 21 million it gained during the last quarter of 2020, Macker notes. Meanwhile, AMC, Discovery, and ViacomCBS are all expanding their own direct-to-consumer platforms. “We continue to think that the expansion of Disney+, HBOMax, and other services will increase churn and pressure gross adds for Netflix over the near future,” says Macker. As more companies seek to enter the direct-to-consumer space, giants such as Netflix and Disney+ may face trouble retaining and growing their subscriber count.

Netflix NFLX

“We believe that many consumers use, and will continue to use, SVODs like Netflix as a complementary service, especially as SVOD prices increase and pay television bundle prices. Larger firms like Disney+ and WarnerMedia have launched their own SVOD platforms to compete against Netflix. We think this usage pattern and increased competition will constrain Netflix's ability to raise prices without inducing greater churn.”-- Neil Macker, Senior Equity Analyst

The Walt Disney Co DIS

“The firm’s direct-to-consumer efforts, Disney+, Hotstar, Hulu, and ESPN+ are taking over as the drivers of long-term growth as the firm transitions to a streaming future. The streaming service will benefit from the new content being created at Disney and Fox television and film studios as well as the deep libraries at the studios. Disney+ added over 8 million customers to end the quarter at 104 million subscribers, well below the 21 million new subscribers added in the fiscal first quarter. While subscriber growth has slowed, we still expect robust long-term growth for the service.” -- Neil Macker, Senior Equity Analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)