Seeking Diversification? Forget REITs and Consider Utilities

Few U.S. equity sectors came through in 2020's crash, but utilities diversification benefits are on the rise.

For years, many investors took it as an article of faith that they should include a separate allocation to real estate securities in their portfolios. Above-market yields were a key attraction, as were inflation protection and an element of diversification.

Fast forward to 2020, however, and the diversification benefits of REITs appear to have declined; REITs have been behaving a lot like the broad U.S. market. Meanwhile, another sector has looked more promising as a diversifier: utilities.

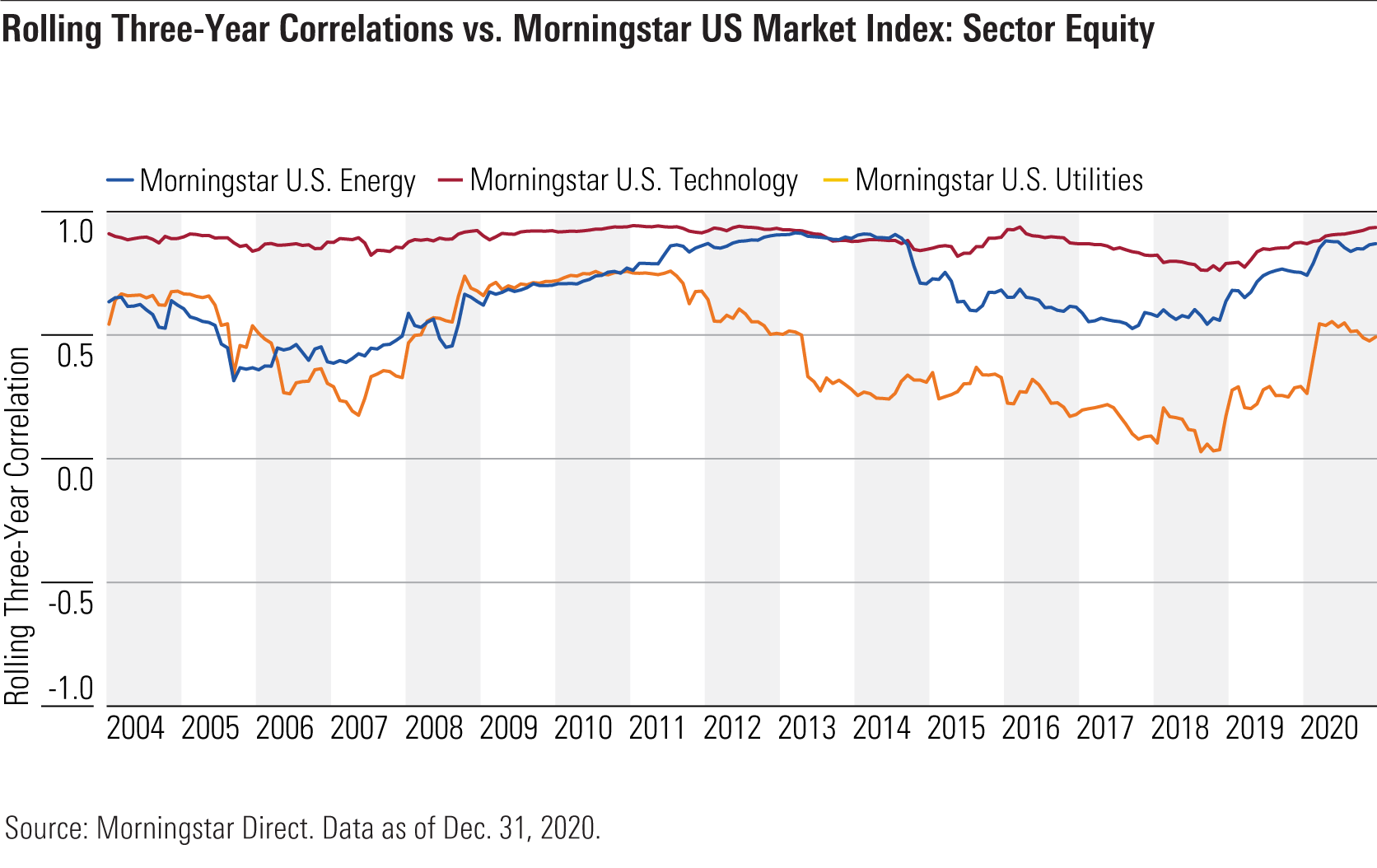

While no U.S. market sector offered true protection from the brief but severe market downturn in the first quarter of 2020, utilities have experienced the lowest performance correlation of any sector with the broad U.S. stock market in recent years. Nearly every other single sector has become more closely correlated with the U.S. stock market, and with other market sectors as well.

That was one of the conclusions of our recent research paper, "2021 Diversification Landscape," which examined which types of investments were the best diversifiers for U.S. market exposure. In previous articles we've explored the benefits conferred (or not) by bonds, international stocks, alternative investments, and commodities. Today's focus: equity-market sectors.

The Role of Sector-Specific Investments

Many investors do not use sector funds at all, relying on broadly diversified equity funds to provide broad market exposure. Indeed, there are roughly a tenth of the assets in sector funds that there are in broadly diversified ones.

But asset flows into sector funds have been strong over the past year. Some investors may employ sector funds to capitalize on industries they believe are beaten down but due for a recovery: In 2020, for example, financials-focused funds saw strong inflows, perhaps because of the expectation that rising interest rates would improve banks’ bottom lines. Other investors might gravitate to sectors they think will benefit from secular growth trends, such as healthcare or technology. Alternatively, investors might add in sector exposure to provide their portfolios with a higher stream of income (for example, utilities or real estate) or to counterbalance overweightings elsewhere in their portfolios.

Indexes that track specific sectors are often heavily tilted toward the biggest players in that industry. Within the Morningstar U.S. Technology Sector Index, for example, Apple AAPL and Microsoft MSFT make up 38% of assets. As a result, sector-specific index funds and ETFs are often double-concentrated--by industry, of course, but often in individual stocks as well.

2020 Correlations

The year 2020 provided a perfect lens to examine correlations among sectors. The market environment heavily bifurcated, with growth stocks trumping value and certain sectors (technology, mainly) winning out at the expense of others. The year also featured a painful but short-lived market downturn. Did any sectors help cushion the blow?

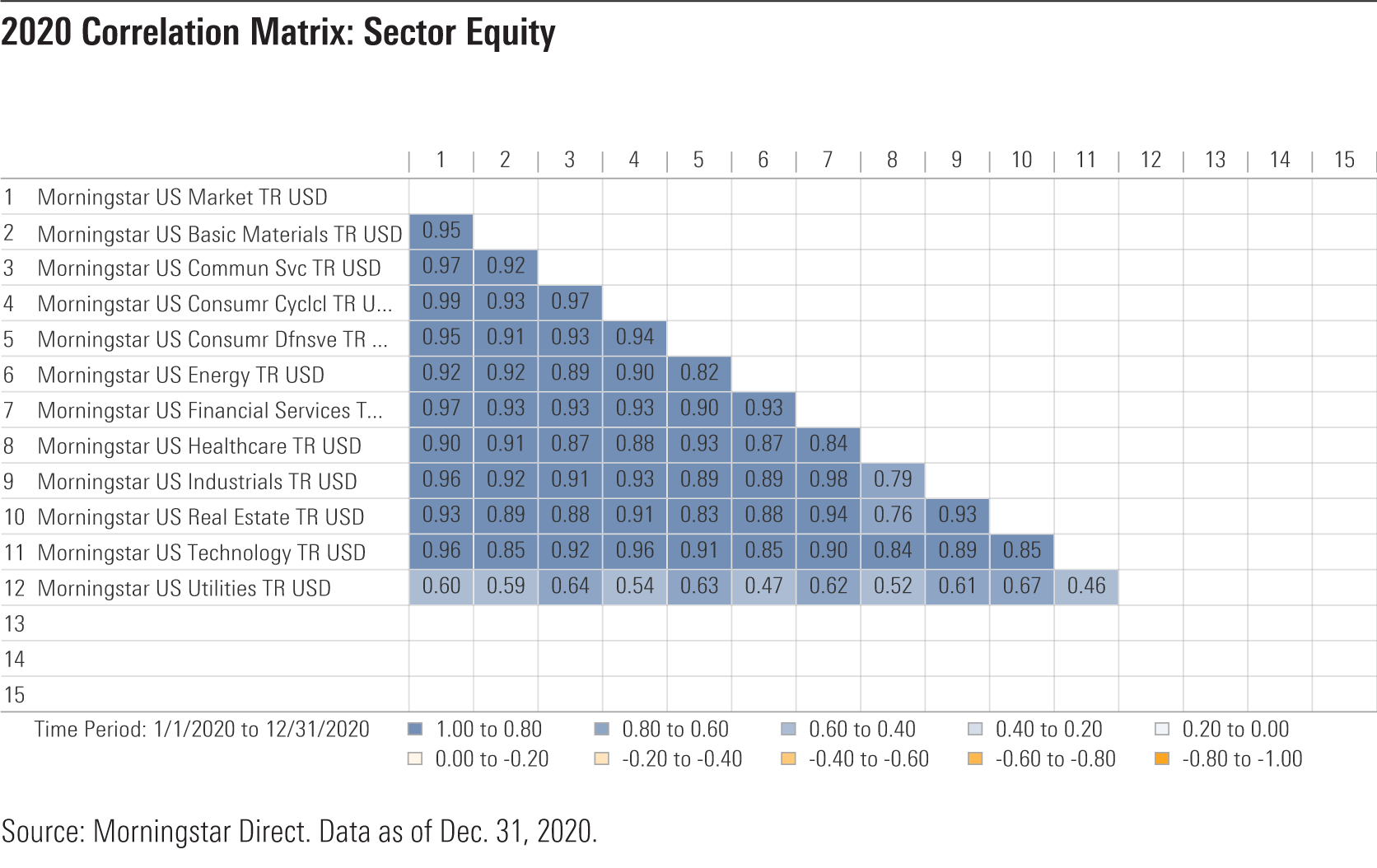

To help answer the question, we looked at the correlation coefficient--a measure of correlation between assets--for various sector-specific Morningstar indexes relative to the Morningstar U.S. Market Index. A correlation coefficient of 1.0 indicates two assets are perfectly correlated; a negative correlation indicates they’re inversely correlated.

As it turns out, few pockets of the U.S. equity market provided shelter from the storm during the first quarter of 2020. The consumer-defensive and healthcare sectors were the best diversifiers of any U.S. equity sector during the turbulence--a not-unfamiliar pattern in periods of economic weakness. Makers of pharmaceuticals, as well as staples like paper towels and laundry detergent, often hold up better than the broad market when investors are worried about the health of the economy. However, stocks in the sector didn’t escape the broader economic malaise, shedding about a fourth of their value during the period.

For the full year, utilities performed more differently from the broad U.S. market than any other single sector. The sector’s correlation with the broad market, while still positive, was 0.60, by far the lowest of all of the sectors. Utilities dramatically underperformed the broad U.S. market for the full year in 2020, losing a bit of value even as the Morningstar U.S. Market Index gained 21%. Although investors exhibited confidence that the U.S. economy would recover from pandemic-related disruptions, reduced electricity demand and concerns about rate-hike approvals weighed on the sector.

Longer-Term Trends

Of course, it’s cold comfort when a sector like utilities shows its diversification merit by losing more than the broad market. And the utilities sector has badly lagged the U.S. equity market over the past five- and 10-year periods, as well. But utilities do show well from the standpoint of diversification, at least relative to other sectors. While the sector’s correlation with the broad market has been positive, it has been substantially less than the other sectors. That held true over every longer-term period examined: three, five, 10, 15, and 20 years. While the 10 other sectors have generally exhibited a higher correlation with the broad market over time, utilities’ correlation has stayed low. That may be because utilities is the smallest of the 11 sectors, comprising just 2% of the Morningstar U.S. Market Index.

Meanwhile, the case for REITs as an income source may be intact, but the Morningstar U.S. Real Estate Index was an underwhelming diversifier over every long-term period examined. Its correlation coefficient with the U.S. market typically hovered around 0.70 or even higher. Indeed, REITs didn’t appear to offer much diversification benefit over several other sectors. Over the past 20 years, for example, REITs and energy had roughly the same correlation (0.70) with the broad market.

Portfolio Implications

With the exception of utilities, sector-specific indexes generally exhibited performance that was closely aligned with the broad market. Thus, there doesn’t appear to be a strong portfolio construction or diversification case for layering on sector-specific exposure. (Investors may wish to emphasize them for valuation or other factors, but that is a separate issue.)

Utilities have exhibited the most different performance pattern of any of the sectors. That, combined with utilities’ above-market yields and the fact that broad-market indexes typically allocate just a tiny slice to them, suggest that investors seeking diversification and income could reasonably add a small additional allocation to the sector.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)