Bank-Loan Funds Are Back: Here Are 2 to Consider

It's a new day for these unique vehicles, which are seeing inflows.

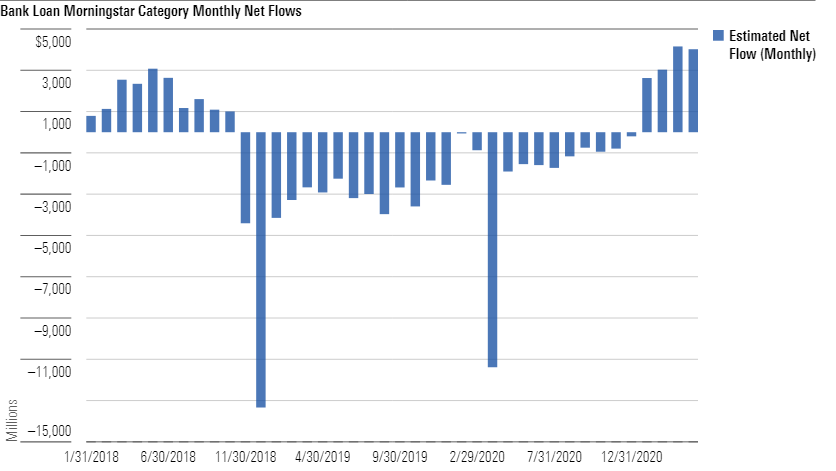

Bank-loan funds lacked investor appeal in 2019 and 2020 as interest rates fell. But economic recovery and the potential for rising short-term interest rates have put the category back in favor in 2021. Bank-loan mutual funds have received net inflows of more than $13 billion for the year to date through April 2021, which was almost a fourth of the category’s assets at the beginning of the year. Demand for high-yield bond funds has been milder this year despite the similarities of the two asset classes. While high-yield bonds have greater upside potential, bank loans’ defensive characteristics make them an attractive portfolio diversifier. Bank loans’ unique floating-rate feature, their hierarchy in the capital structure, and the loan market’s industry composition all make for an appealing relative value opportunity versus high-yield bonds.

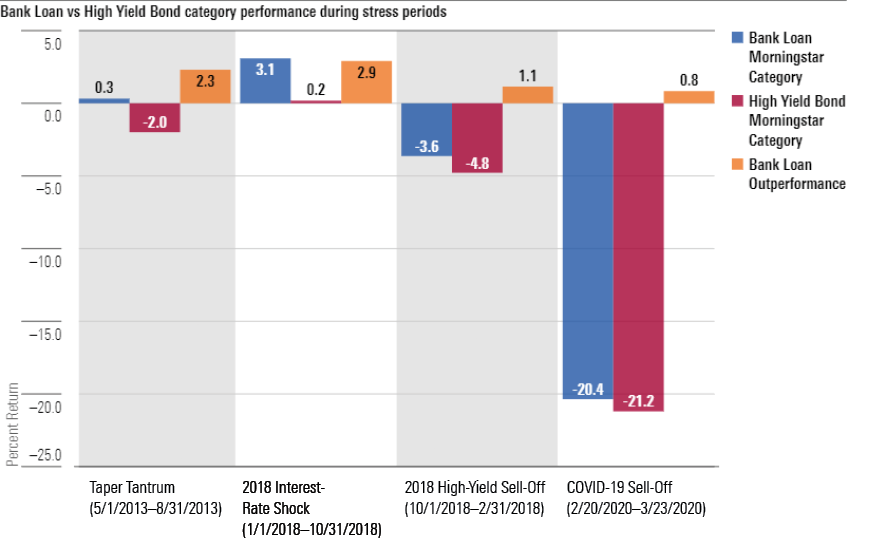

Although bank loans offer less yield than junk bonds, they have some attractive qualities. The coupon payments for bank loans float with Libor every few months, and therefore loans contain very little interest-rate risk. When yields rise, bank loans retain their value, whereas fixed-rate bond prices fall. For this reason, the bank-loan Morningstar Category has outperformed the high-yield bond category during historical periods of rising rates such as the taper tantrum in 2013 and the interest-rate shock in the first half of 2018.

Bank loans’ seniority to high-yield bonds in the capital structure of many issuing companies is another alluring feature. While the average default rates of loans and bonds have been very similar over the past two decades, the average recovery rate for loans was 1.5 times higher than for bonds. As a result, high-yield bonds may suffer more than loans during credit sell-offs. During the credit sell-off from Feb. 20, 2020, through March 23, 2020, the median fund in the bank-loan category was down 20.4%, while the median fund in the high-yield bond category was down 21.2%. The bank-loan category also outperformed by over 100 basis points when credit markets sold off in the fourth quarter of 2018. Granted, those performance differences aren’t large, and bank loans have also underperformed high-yield bonds during times of stress, such as in 2008, when leveraged buyers unwound positions to meet margin calls. But their seniority in the capital structure should provide some additional protection against permanent loss of capital in a default, which makes loans generally preferable to bonds when defaults rise.

Additionally, the composition of the bank-loan market contains fewer cyclical industries than the high-yield bond market. Energy is the largest industry in the high-yield market and made up 13% of the Morningstar US High-Yield Bond Index as of April 2021 compared with less than 3% for the S&P/LSTA Performing Loan Index. Instead, services, information technology, and healthcare made up a larger portion of the bank-loan market, which has led to less-volatile returns over time.

T. Rowe Price Floating Rate PRFRX, which has a Morningstar Analyst Rating of Gold, is one of Morningstar's top picks in the bank-loan category. Lead manager Paul Massaro has run the strategy since its inception in 2011 and is supported by a robust credit research team. The team's high conviction and selective approach have led to solid risk-adjusted returns since inception, and the strategy has done well during both sell-offs and strong markets. The team picks its spots carefully; it focuses on BB and B rated loans and is selective among CCC loans, which have generated the lowest total return and highest volatility compared with other credit rating tiers over the trailing 25 years. The team's selection ability has been demonstrated by its average default rate of 0.1% since inception, while the bank-loan market has averaged a default rate of 3%.

Massaro and his team have also demonstrated strong liquidity management through periods of credit stress and volatile fund flows. Maintaining a liquid portfolio is especially critical for bank-loan strategies as loans take longer to settle and redemptions have been particularly sharp when markets sell off. The team typically maintains more than 5% of the portfolio’s assets in cash and holds high-yield bonds as a liquidity buffer ahead of the loan allocation. One concern of late is the strategy’s asset growth in 2021 as bank loans’ have become popular. A deluge of inflows presents challenges for putting cash to work while maintaining high standards, but T. Rowe Price has developed a reputation for responsible capacity management by closing funds before asset growth could potentially impede a strategy’s investment process.

Silver-rated Fidelity Floating Rate High Income FFRHX is also a solid option. Fundamental credit research is the hallmark of Fidelity's bank-loan effort. Experienced managers Eric Mollenhauer and Kevin Nielsen run the strategy with the support of a deep supporting cast. Its 22-person analyst team as of September 2020 has two bank-loan-specific analysts who delve into loan-only issuers, while the rest of the cohort covers the entire capital structure across industries. In addition to the usual credit analysis, assessment of company managements, and earnings forecasts, the team pays close attention to the structure and covenant package of each transaction. The strategy focuses on larger companies--in part a necessity owing to its size--but that makes it a more predictable and cautious choice among its peers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)