6 Charts on the Stock Market Rotation

Investors are shifting out of pricey sectors and styles and into areas of the market that have been less richly valued.

While the headlines have focused on the jobs and inflation data, the big story in the stock market continues to be the "rotation." Investors are shifting out of pricey sectors and styles and into areas of the market that have been less richly valued.

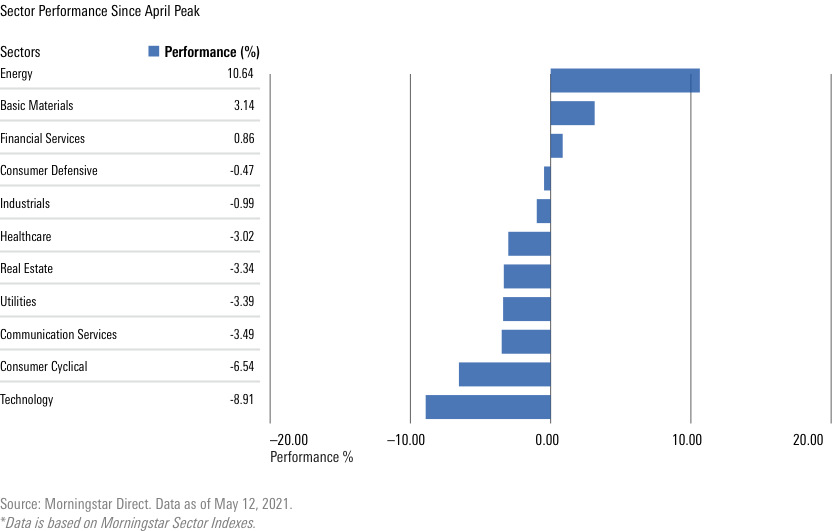

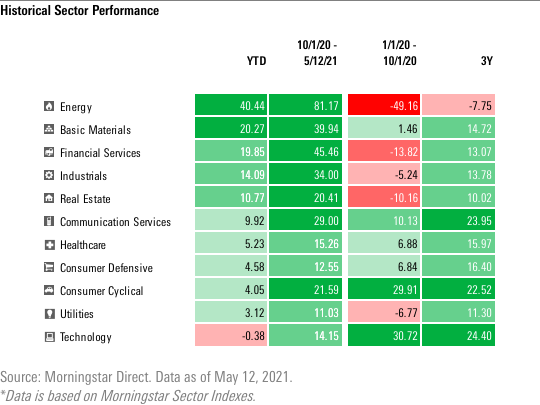

These trends have been playing since the start of the third quarter of 2020 and, even as the stock market hit an air pocket last week, continued to dominate the market. Energy is the top-performing sector, returning more than 10% since the most recent peak in the Morningstar U.S. Market Index on April 26. The basic materials and financial services sectors saw positive returns, while the rest of the market saw losses. Technology saw the greatest loss at nearly 9% since the most recent market peak.

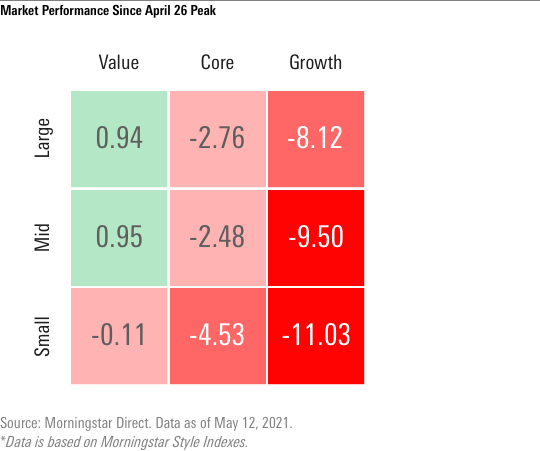

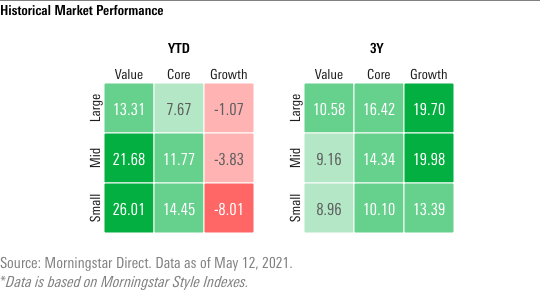

Stylewise, since the most recent peak, growth indexes have fallen by the widest margin; large-growth lost more than 8%, while mid- and small-growth fell further behind. Value stocks outperformed, as large- and mid-value were the only style Morningstar Categories in positive territory.

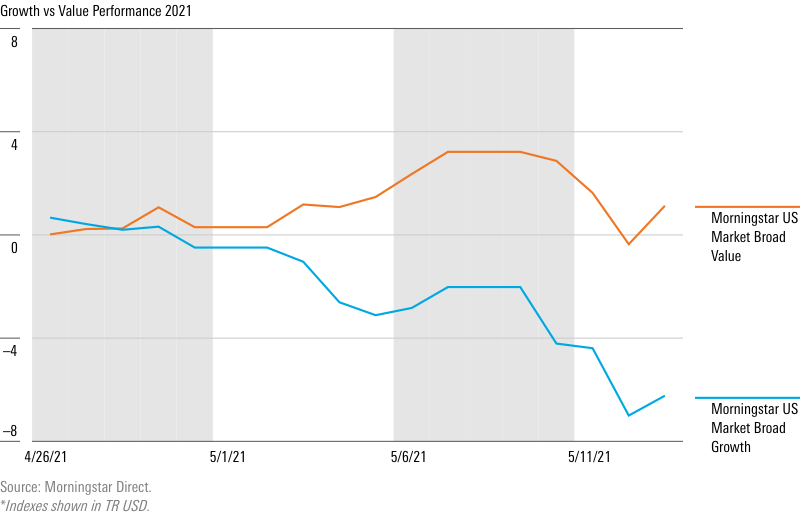

As a result, the performance gap between growth and value widened in favor of value stocks, as investors shifted from expensive growth to relatively cheaper value stocks. As this shift takes place, Morningstar's equity analysts still see stocks that fall into the value category as slightly undervalued.

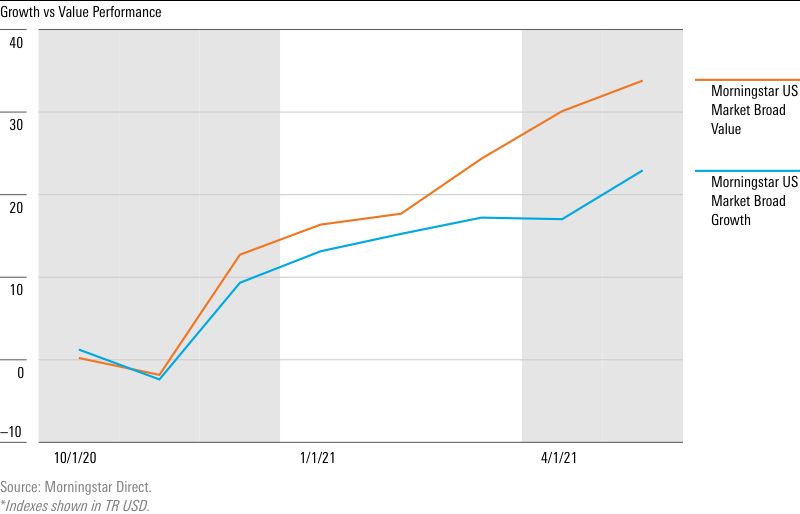

The outperformance of value stocks began early in the fourth quarter of 2020, as investors began to grow more optimistic about the potential for widespread coronavirus vaccinations to end the economic lockdown that had sent the global economy into a tailspin.

This shift into value marks a significant swing from the investor experience of recent years, a time where value stocks lagged both during market upswings and downturns. That outperformance of growth indexes means that despite value’s recent gains, those stocks still lag far behind when it comes to longer-term performance.

Underlying the value versus growth trends is a similar shift in sector performance. The Morningstar U.S. Energy Capped Index, which has struggled for years and in 2020 was down nearly 50% through the beginning of October, jumped 81% from October to May. The Morningstar U.S. Technology Total Returns Index, which led the market with 30% returns up until Oct. 1, has since posted meager returns.

For the year to date, Energy is up more than 40%, and the basic materials, financial services, and industrials sectors all saw strong returns. Technology brings up the rear with a loss of 0.38%. Morningstar’s equity analysts for some time have viewed energy stocks as broadly undervalued, trading at an approximately 15% discount to fair values. The communications sector is the next most undervalued at a 5% discount to our fair value.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)