Value Funds Strike Back

Rebounds can be just as fast and surprising as sell-offs.

The article was published in the April 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

152%! I just about fell off my chair. No, it wasn’t the returns of a red-hot social-media stock. It was the one-year return through the first quarter of 2021 of Royce Opportunity RYPNX, a small-value fund that had been far away from the excitement. Small caps and value are back in a big way.

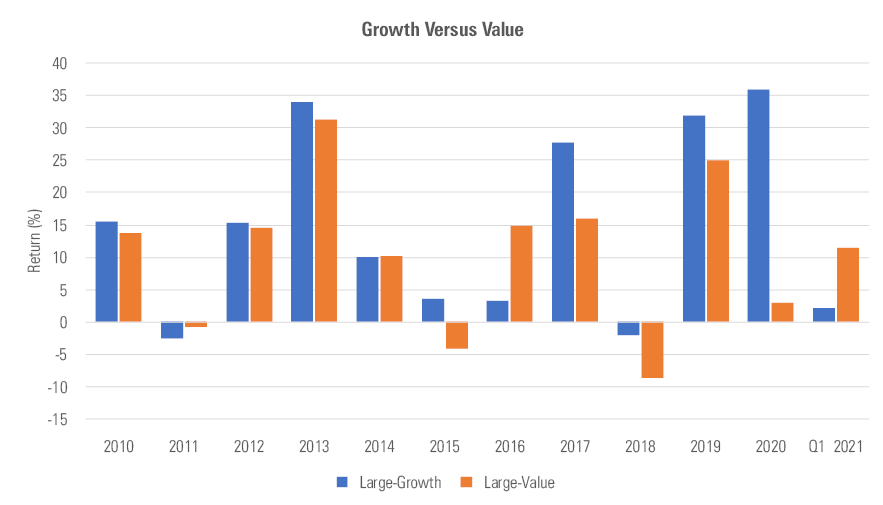

The comeback started last year when stocks were declining in September and October and large-value lost modestly less. Then in November, investors became more optimistic about the economy, and a seismic market shift was underway. The way the coronavirus slammed the brakes on the economy in March 2020 was jarring. All of a sudden, economically sensitive stocks--especially travel--looked awful, and powerful growth stocks looked brilliant.

But with signs of a ramp-up in vaccines and a hefty economic relief effort in the fall, stocks turned on a dime. The market rallied, and value beat growth every month, but the rally really took off in March 2021.

Small-value is the top-performing Morningstar Style Box category in 2021 with a 21.5% gain, compared with a meager 2.2% for large-growth. Small-blend’s 15.1% gain likewise dwarfs that of large-blend, which has gained 6.7%. A strong March has given all three small-cap Morningstar Categories 12-month returns of more than 89%, but the one-year returns are shedding the severe drawdown of March 2020.

Beside the dramatic economic story, valuations may be playing a role here. The valuation gap between growth and value stocks has been near an all-time high, and it could be that this is the start of that gap narrowing to some level closer to historical norms. However, I’d note that large-growth is merely going up less than the rest of the style box--it’s not that there’s correction going on.

If we step back a little further to look at returns of the past two years or more, the old pattern of the past decade re-emerges, but with a twist. Large-growth is up 25.5% annualized to large-value’s 13.6% annualized for the past two years; even back to the trailing 10 years, we see a 14.7% to 10.3% advantage for large-growth. But now small-growth is the leader of the trailing two-, three-, and five-year periods, with returns of 27%, 20%, and 20%, respectively. Only when we go out to 10 years are large caps slightly ahead of small caps.

- Source: Morningstar.

Really, though, returns for all categories look robust now. Small-value had the worst 10-year return of 9.1%, yet I would have happily accepted the promise of a 9% return for my equity funds 10 years ago, as I would today for the next 10 years.

Royce Opportunity has been a rocket thanks to its small-value tech and financials holdings. In large-value, Dodge & Cox Stock DODGX, which was battered a year ago, is up a remarkable 90% also thanks to tech and financials. The funds had taken it on the chin last March to the point where even their five- and 10-year records looked poor.

The violent turnaround illustrates that rebounds can be just as fast and surprising as sell-offs. With hindsight, the huge changes in economic outlook and the market reaction seem sensible, but who really saw it? Did I smartly dump value and small caps in February 2020 and then add them back in September 2020? Nope. But I did stick with my investment plan.

I have seen enough of these sell-offs to know how quickly things can turn. If recent events have been particularly harsh or generous to a fund’s favorite industries, it makes sense to be wary of their trailing returns.

To get our bearings, let’s see which funds’ performances have shifted the most. I took funds’ 10-year relative performance rankings within their categories through the end of March 2020 and compared them against 10-year relative performance through March 2021. Not surprisingly, bolder and deeper-value funds tended to be those that improved the most, while defensive funds saw their rankings decline.

Oakmark

For the third time in their careers, David Herro and Bill Nygren have gone from looking like dopes to geniuses. Three of the top 10 most-improved funds are Oakmark funds, and three more can be found in slots 10-20.

Herro’s Oakmark International OAKIX, which has a Morningstar Analyst Rating of Gold, bounced from a bottom-quartile 10-year figure to top-decile 10-year returns even as $6.7 billion went out the door. Nygren’s Oakmark OAKMX and Clyde McGregor’s Oakmark Equity and Income OAKBX went from the bottom quartile to the second quartile. The five Oakmark equity funds had returns ranging from 81% to 91% for the 12-month period ended March 2021.

I wouldn’t call the funds deep-value, but they are disciplined about valuations and tend to have a fair amount in financials and economically sensitive stocks. In addition, the funds are largely in blend categories where they have a clear value tilt relative to peers, thus emphasizing the swing in performance even more. Also, the funds are pretty concentrated, and that can add even more drama to short-term returns.

It has to help, though, that investors have seen Oakmark rebound before. The coronavirus-driven sell-off made things worse, but value managers have had to endure a whole decade of looking kind of dumb.

American Funds New Economy ANEFX

This Silver-rated fund wasn’t quite in the doghouse a year ago. It was a 3-star fund with a 59th percentile rank, but at the end of the first quarter It was 5 stars and in the top 3%. In fact, it’s the only one of the 20 biggest improvers that was in net inflows the past 12 months.

The fund’s growth bias helped in the COVID-19 sell-off, but emerging markets and mid-caps helped in the rebound. Unlike many of the funds listed here, this one has been a pretty consistent performer. It lagged the world large-stock category in only one calendar year out of the past 10, though that growth bias helped.

Fidelity Value FDVLX

Hmm. This fund lost 47.7% in the February-March bear market, then rebounded 107% over the ensuing 52 weeks. I guess you could say it’s volatile. That nifty rebound brought the fund’s 10-year rank to 24 from 63. Although lead manager Matthew Friedman has been on the fund since 2010, he doesn’t completely own that 10-year record. The fund has been run as a mix of sector-manager-run sleeves, plus Friedman’s more-diversified sleeve. Three of six sector managers have rolled off the fund in the past five years. It’s kind of an odd duck with that mix of sector managers and one diversified manager, but at least the duck now has nice returns.

FPA Crescent FPACX

Kind of like the Oakmark crew, Steve Romick was starting to seem like a dope. His heavy value tilt featuring energy stocks was just the wrong mix for the past decade, but now he’s back. A 55% one-year return has taken the fund to a 10-year rank of 32 from 68. That’s welcome news for a fund that suffered $4.5 billion in outflows even as returns were coming back. Romick’s financials and communications names have pushed the fund to the leaderboard once more.

First Eagle U.S. Value FEVAX

This fund’s ranking has improved significantly, yet it is still subpar. That shows how deep its hole was. The fund was bottom 5% and is now 58th percentile. That is still below average, but the Neutral-rated fund is at least improving. The fund is very risk-averse, and that left it out in the cold. Cash, gold, and value stocks were not a great combination for much of the past decade.

Success in a wide variety of sectors has helped, and gold at least has appreciated modestly for a change.

Ariel Fund ARGFX

This is a repeat performance for Ariel. The fund was absolutely crushed in 2008-09 when its holdings’ high debt levels led to brutal losses even as those companies largely remained profitable. The fund came roaring back the following two years.

This time around looks much better, as the fund’s 10-year returns fell to only around average but then popped to the top 24% thanks to a 103% one-year return. The fund’s consumer-oriented value plays like Viacom-CBS VIAC and Mattel MAT have led the way higher.

Meridian Contrarian MVALX

Meridian Contrarian likewise popped to the top 2% from the top 37%. The fund’s one-year return was a huge 104%, thanks to triple-digit gains in five of its top six holdings. Acadia Healthcare ACHC, Welbilt, and Colony Capital CLNY show that it isn’t just one industry doing the job.

Although it is in the mid-blend category, the fund skews to the small-value side of the peer group, hence its explosive outperformance in the past year. But, of course, its 10-year returns suggest that it is more than a small-value tilt at work here.

Vanguard Selected Value VASVX

Vanguard Selected Value popped to the top 33% from the top 62%. The fund was deeper-value than most peers, with big helpings of financials and industrials. That made for some pain in recent years but not in the big comeback. I should note that the 10-year record comes with a big caveat because Barrow Hanley was removed from the fund in December 2019. The firm had run most of the fund’s money over the past decade, so that 10-year record is not all that helpful. True, the fund has nice one-year returns, but that’s not enough to go on. We rate the fund Bronze because of a High Parent rating and low fees, but the People and Process Pillars are rated Average.

Primecap Odyssey Stock POSKX

This is the only Primecap fund to make the most-improved list, but all Primecap funds' records have all improved markedly in the past year. Just recently I wrote about why I still liked the funds despite a dreadful 2020. I didn’t expect to be vindicated quite so quickly. The funds have top-decile returns in 2021 thanks to financials and industrials overweightings--the same things that held them back last year. Fairly light exposure to the FAANGs (Facebook FB, Amazon.com AMZN, Apple AAPL, Netflix NFLX, and Alphabet GOOG) also helped.

Royce Opportunity RYPNX

And now we come to the fund with the biggest one-year returns. The Bronze-rated fund popped to the top 3% from the top 30% thanks to its 152% return the past year. An overweighting in tech and an underweighting in energy helped at the start, but names like digital advertiser Magnite MGNI and medical-supply distributor Owens & Minor OMI led the rebound. Lead manager Bill Hench’s M.O. is to seek out supercheap turnaround stories in small- and micro-cap stocks.

Now the bad news: I wasn't the only one who noticed. First Eagle hired Hench and the other three people on his team to run a fund for them. Royce has brought back semiretired manager Buzz Zaino to run the fund until a replacement can be found.

Conclusion

It’s been a crazy ride in the markets. The best strategy is to rebalance and then keep your portfolio in balance rather than trying to pick the winning style. Within a few months, the recent rally wiped away the longest stretch of value underperformance on record. The big 10-year returns across the style box suggest we should continue to be cautious.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)