The Winners of the New Definition of Infrastructure

Depending on which broader infrastructure projects take shape, numerous companies could see increased demand.

Of the myriad programs and projects included in the $2 trillion-plus American Jobs Plan proposal, traditional infrastructure projects like roads and transportation are only expected to account for about a third of the bill's total cost. (We explored forecasts on those companies in this article.) The remainder is allocated for projects that have not historically been funded by the federal government or considered infrastructure, such as elder care and green initiatives.

This part of the proposed legislation is in the very early stages and has a lot of vague language that will likely go through multiple iterations before there is enough detail to determine which companies may benefit from new government spending. But because of the lack of precedent on funding for these programs, their inclusion in the bill will likely face stiff Republican pushback. We unpacked the plan in-depth in this article.

Here’s where our forecasts on companies not traditionally considered infrastructure currently stand.

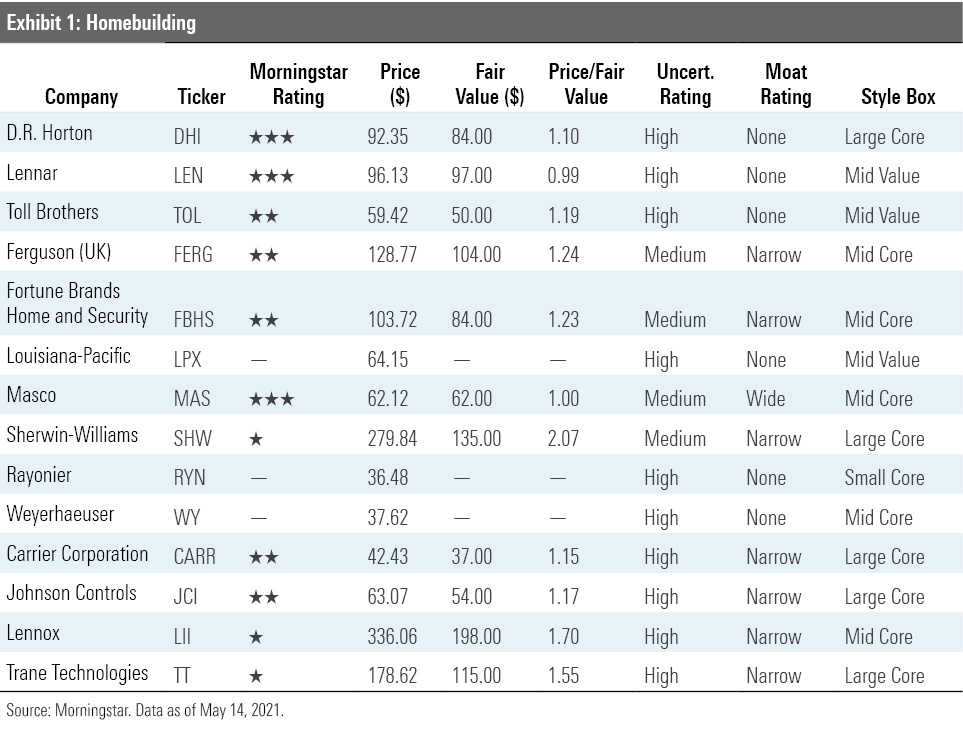

Homebuilders Unlikely to See Much Upside, but Additional Demand Is Expected for Building Products and Fixtures

Firms that specialize in development of multifamily homes and home remodeling will likely benefit from this program. However, the homebuilders that we cover, such as D.R. Horton DHI, Lennar LEN, and Toll Brothers TOL, are unlikely to benefit much as they concentrate mostly on traditional single-family construction, focusing on large-scale developments as opposed to one-off home rehabilitation projects.

If the infrastructure plan ends up subsidizing new single-family rental communities, we may re-evaluate these companies’ valuations. But for now, as they do not have a significant enough proportion of their business in the affordable multifamily category, we are maintaining our projections.

We also expect the infrastructure bill to boost demand for several subsectors.

- Home improvement, building products, and furnishings. Firms in this space, which include Ferguson FERG, Fortune Brands FBHS, Louisiana-Pacific LPX, Masco MAS, and Sherwin-Williams SHW, would likely see an uptick from additional remodeling and new construction. Our repair and remodel forecast already incorporates elevated home improvement spending above long-term trends for the next few years. The heightened demand includes increased spending from minority households, which would receive assistance from the infrastructure plan.

- Building materials, high-efficiency heating, ventilating, and air conditioning systems, especially in air purification and filtration technology. Elevated spending will benefit Carrier CARR, Johnson Controls JCI, Lennox LII, and Trane Technologies TT. Similar to repair and remodel, we have incorporated some heightened demand into our current forecasts, resulting in above gross domestic product growth and stronger profit margins.

- Lumber. Although lumber prices have already soared this year, more demand could push prices even higher in the short term, to the benefit of Weyerhaeuser WY and Rayonier RYN. Yet following this near-term boost, the market is pricing in higher lumber prices too far into the future, in our view. Based on the current trading levels across these industries, it appears that the market is pricing in even greater long-term increases in demand. We have recently placed our ratings for these two companies under review, and we recommend investors approach this sector with caution.

We have not yet re-evaluated these companies’ valuations but may do so depending on the final details of the infrastructure bill.

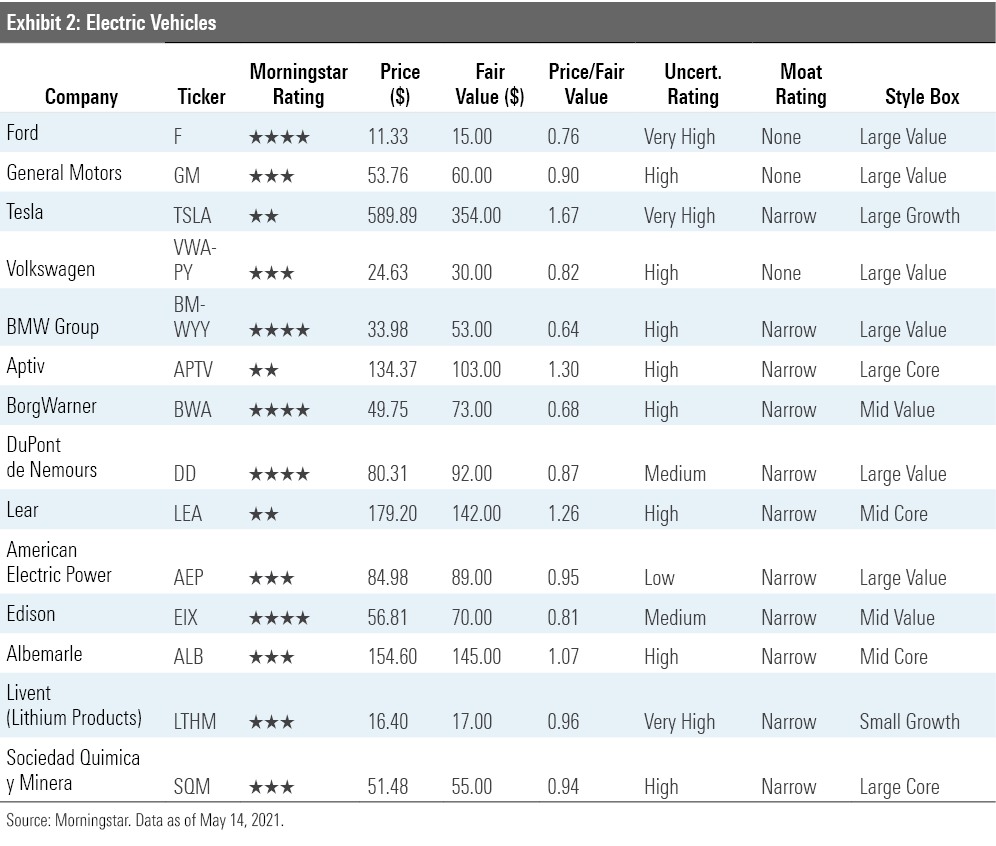

Supporting Transition to EVs Will Spur Demand, and Parts Manufacturers Stand to Gain

About $174 billion of the infrastructure bill is dedicated to a wide range of green initiatives, including building out and supporting the transition to electric vehicles.

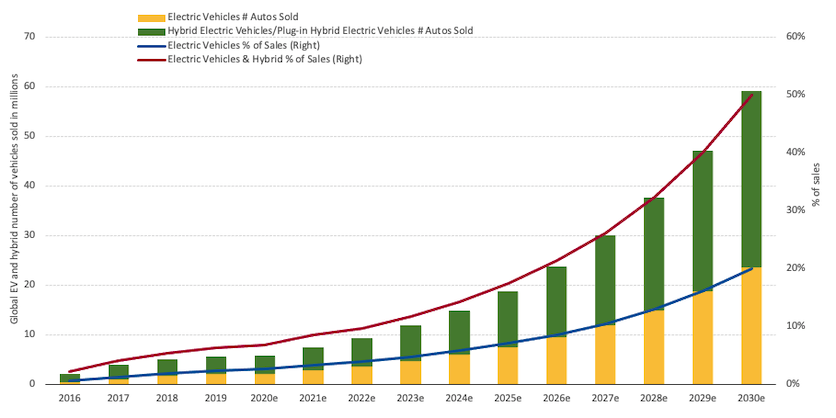

One of the initiatives is a tax credit paid out for the purchase of new electric vehicles, including autos as well as buses and trucks. As shown below, we currently forecast that by 2030, about 20% of new-vehicle sales in the United States will be battery electric vehicles and another 30% will be hybrids. But if the infrastructure plan is enacted as proposed, we expect this adoption rate will be even higher.

Source: Morningstar, U.S. EPA, International Energy Agency.

In the short run, the tax credit may primarily benefit Tesla, but their first-mover advantage will soon dwindle as other auto manufacturers also roll out EVs. We expect competition will increase in this segment from the global automakers who have outlined EV production goals, which include Ford F, General Motors GM, Volkswagen VWAPY, and BMW BMWYY. Of this group, we see 4-star-rated BMW as the most undervalued.

Specifically, a few groups that will benefit from increased EV adoption include:

- Automotive suppliers. We see upside for 4-star-rated BorgWarner BWA, which is well positioned for growth in hybrids and battery electric vehicles. Other parts suppliers to the EV market include Aptiv APTV and Lear LEA, but we think those two companies are currently overvalued at 2 stars.

- Specialty chemicals. We think 4-star-rated DuPont DD is well positioned with its portfolio of specialty chemicals and downstream products that serve the automotive, electronics, and communications sectors. DuPont may also see heightened demand from other areas in the infrastructure plan, such as the spending initiative on clean water, which should increase demand for its water filtration products.

- Utilities. This sector has been overlooked thus far, but will be key to charging all these new EVs. With one of the largest EV charging station programs in the U.S., Edison International EIX is well-positioned, in our view. In addition, the electrification of the U.S. will positively affect American Electric Power AEP, which is one of the largest owners of electricity transmission and derives a significant percentage of its revenue from energy transmission.

- Lithium. Increased EV adoption would lead to an even greater demand for lithium, a crucial component for the batteries that power these vehicles. The heightened demand would require even higher-cost lithium supply to come on line, thus leading to higher pricing. We think each of the three main lithium producers is fairly valued.

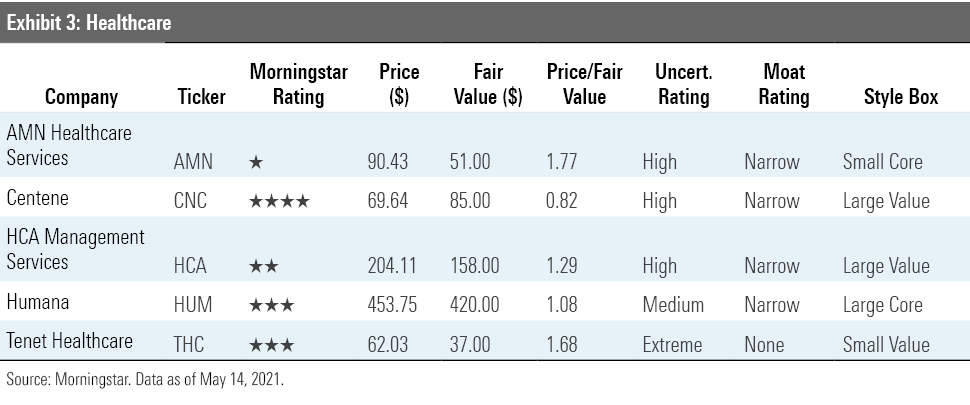

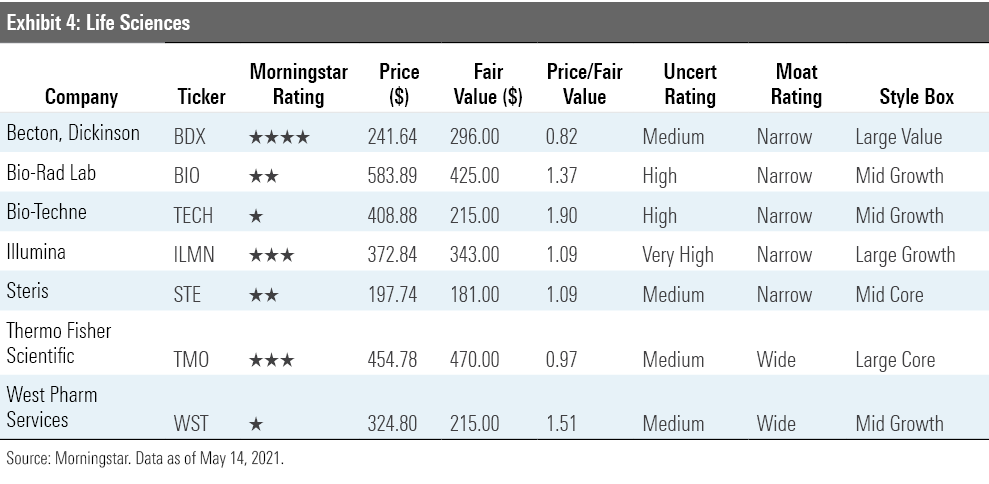

Healthcare Initiatives to Support the Aged: Nebulous Now, but a Few Interesting Opportunities

The infrastructure plan also funds several healthcare initiatives to provide home- and community-based care. About $400 billion is slated to expand access to quality, affordable home- or community-based care for aging relatives and people with disabilities. At this point, the language as to how exactly this money would be spent is especially nebulous, but we expect that this spending will include measures to increase coverage through Medicaid expansion and subsidies for the exchanges. It also may include funding for rehabbing extant or building new senior living centers, long-term care facilities, and/or skilled nursing homes.

In addition, it appears that the intent is to provide greater at-home care and increase the wages for those that are employed in this industry. We do not cover companies in this subsector, but if hospital chains such as HCA Healthcare HCA and Tenet Healthcare THC are able to increase the at-home care aspects of their business, either organically or more likely through acquisitions, they could benefit over the longer term.

Among the managed-care organizations, or MCOs, 4-star-rated Centene CNC is the largest provider of Medicaid plans and most concentrated in Medicaid of the six insurers we cover. Medicaid is the primary payer of nursing facility services. Of the other MCOs, Humana's HUM current at-home business is quite small relative to the rest of its business, and while that segment may benefit, it is unlikely to move the needle on our company valuation. Staffing providers such as AMN Healthcare Services AMN, the largest healthcare staffing company in the U.S., could see a greater demand for their services.

The healthcare initiatives also include $30 billion for new investments in biopreparedness and biosecurity. This includes funding for:

- Personal protective equipment. Shoring up the nation's strategic national stockpile of personal protective equipment would benefit healthcare supply manufacturers such as 3M MMM and Becton Dickinson BDX but is unlikely to have a material impact on our company valuations.

- Research and development on new vaccines. The firms that have been successful in producing vaccines for the novel coronavirus thus far would be likely candidates. However, considering the size and diversification of these firms, any additional revenue from this initiative would not result in changes to our valuation.

- Upgrading research infrastructure in laboratories across the country. This will boost sales of laboratory equipment manufacturers.

Between the expansion of long-term care infrastructure, biopreparedness, and the R&D initiatives, companies that make testing systems and supplies, such as Bio-Rad BIO, Bio-Techne TECH, and Thermo Fisher Scientific TMO, may see an increase in demand for their products. Thermo Fisher represents more than one fourth of the life sciences market, and any incremental investments in R&D will benefit it. Given its size, though, we think the magnitude of a valuation increase for these companies would be modest.

Other medical suppliers in the life sciences space, such as Steris STE and West Pharmaceutical WST, may also benefit. Finally, Illumina ILMN, which provides tools and services to analyze genetic material, could see an uptick in demand from R&D.

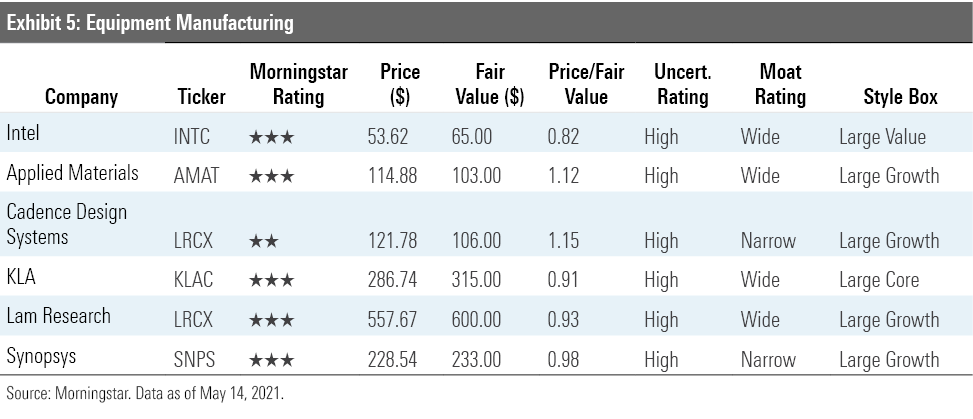

Revitalizing Chip Manufacturing in U.S. Will Require Investment in New Equipment

The overall framework also pushes incentives for corporations to revitalize American manufacturing, especially in those areas deemed to be of national interest: for instance, $50 billion in tax credits for manufacturing semiconductors in the U.S.

While Intel INTC is too large for this initiative to affect our fair value estimate for its stock, equipment makers such as Applied Materials AMAT, KLA KLAC, and Lam Research LRCX could see additional demand for their products. We note that there is a several-year time lag between when semiconductor manufacturers begin to build new facilities and when the equipment manufacturers would realize the sales to these new facilities.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)