Our New Rating Measures a Stock's ESG Risk

We now measure the degree to which ESG risk could impact a company's financial health.

Every company is exposed to some degree of environmental, social, and governance risks. In large part, the industry a company operates in dictates the ESG risk it faces. For example, an oil and gas company will be highly exposed to environmental risk, while a consumer technology businesses tend to be more exposed to social issues such as data privacy.

But there’s another dimension to ESG risk, too: How well does the company manage the ESG risks it faces, both those native to the industry it operates in and those idiosyncratic to its business? Has the company taken appropriate actions and implemented effective policies to manage ESG risks? Or have there been controversies--and are there likely to be more?

It's important for stock investors to determine how much exposure a company has to unmanaged ESG risk, because these issues can have real financial impact. We believe companies that ignore or mishandle ESG issues could incur significant economic costs that jeopardize their ability to earn long-term, sustainable profits.

How to Quickly Size Up a Stock's ESG Risk

Morningstar's ESG Risk Assessment is a new rating that stock investors can use to measure the degree to which ESG risk could potentially put a company's enterprise value at risk. (The rating was developed from the Sustainalytics ESG Risk Rating. Morningstar acquired Sustainalytics, a globally recognized leader in ESG ratings and research, in July 2020.)

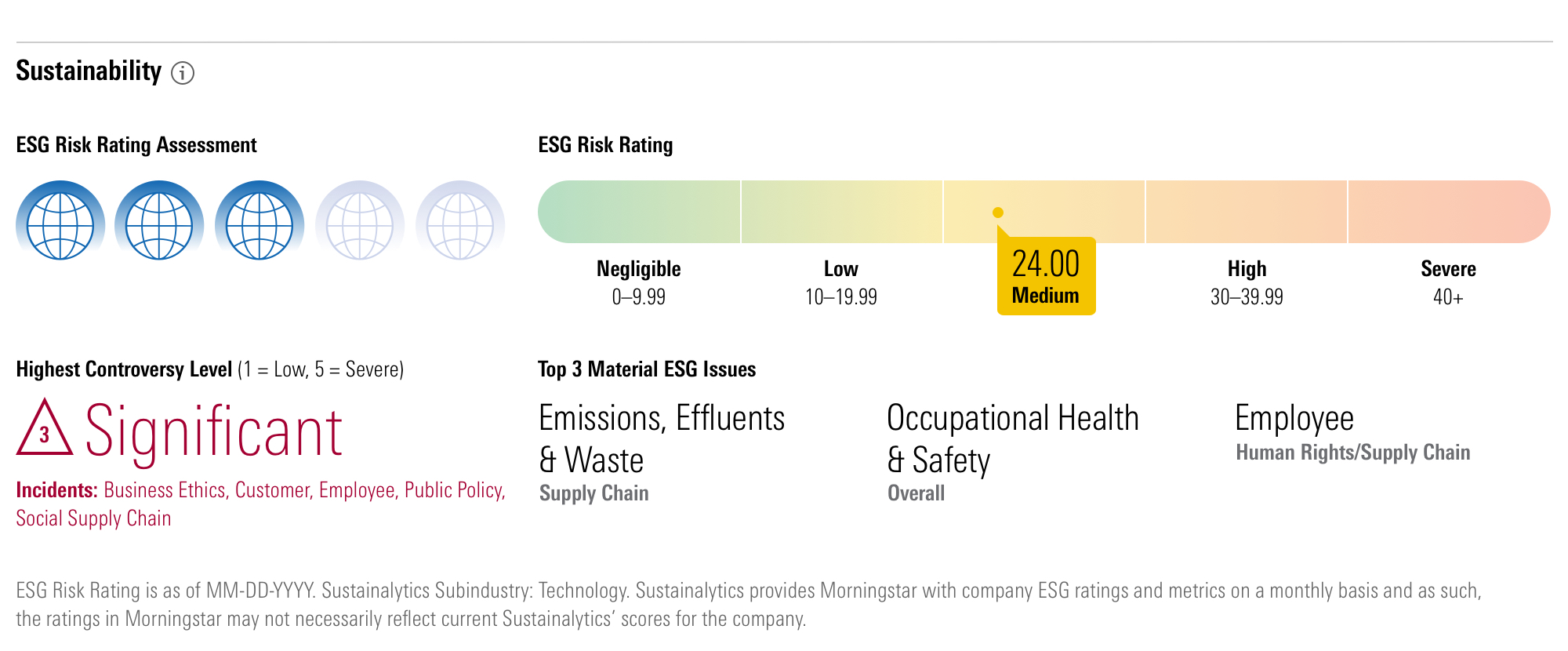

The rating is located on stock Quote pages on Morningstar.com; click on the tab that says “Sustainability” in the top navigation bar, and you'll see a graphic like this:

The rating is easy to interpret: A 5-globe rating means the company faces negligible financial risks from ESG issues; 1 globe means it is exposed to significant ESG risk. The top three Material ESG Issues, or MEIs, that Sustainalytics has identified for each company are also listed.

An important characteristic of the ESG Risk Rating Assessment is that it is an absolute measure of risk. In other words, the scores and ratings are comparable across different issues, companies, and industries.

The rating is a single score, but it is composed of two main parts: "Exposure" measures a company’s vulnerability or susceptibility to ESG risks. "Management" refers to actions taken by a company to manage a particular ESG issue. This can include a company’s ESG issues and policies. Controversies can have a negative impact on a firm’s management score because they often reveal that company initiatives were insufficient or ineffective.

The ESG Risk Rating Assessment blends the exposure score and the management score together into a single score that tells you how at risk a company’s enterprise value is from ESG issues.

How ESG Risks Affect a Company’s Fair Value and Moat

Because we believe unmanaged ESG risk poses valuation-relevant risks, Morningstar equity research analysts consider ESG risks when determining intrinsic value for stocks.

"Under our process, Morningstar analysts use Sustainalytics’ Material ESG Issues, which are the building blocks supporting the ESG Risk Rating Assessment, as key inputs into the equity research process," said director of equity research Adam Fleck.

Specifically, Fleck explains, Morningstar analysts use these assessments in two principal ratings: the Morningstar Economic Moat Rating and the Morningstar Uncertainty Rating. These ratings inform Morningstar’s assessment of intrinsic value and required margin of safety, respectively, and ultimately, are rolled into the Morningstar Rating for stocks. Here’s how the ratings will consider ESG:

Economic Moat Rating: The framework to determine a company’s moat rating, Morningstar’s measure of a firm’s sustainable competitive advantage, has been updated to capture the long-term threat ESG risks may pose to the value-creation capabilities of an otherwise competitively advantaged business, thereby precluding or limiting an economic moat.

Uncertainty Rating: The framework for the uncertainty rating, which gauges the relative predictability of future cash flows, has been updated to formally capture long-term ESG risks alongside other factors, such as a firm's sensitivity to the overall economy, product concentration, and pricing power.

For more information about how Morningstar is integrating ESG into our equity research process, see this user's guide.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q27ZB7KFPZBMHFKY6IURRWJQHM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)