Is There Opportunity in Airlines Stocks?

U.S. airlines turn a corner as travel demand picks up.

As more people in the United States receive COVID-19 vaccines, domestic air travel has started to pick up. In fact, TSA data show that airports are busier now than at any point during the pandemic. U.S. airlines are expanding their flight offerings to accommodate rising demand for leisure travel heading into the summer. Overall, things are looking up for airlines, which have been severely battered during the pandemic.

Challenges remain despite a more positive near-term outlook. Our analysts anticipate that vaccinations and an easing of travel restrictions will allow substantially more domestic leisure travel over the summer, but that airlines will likely face a second year of operating losses in 2021 even with government support.

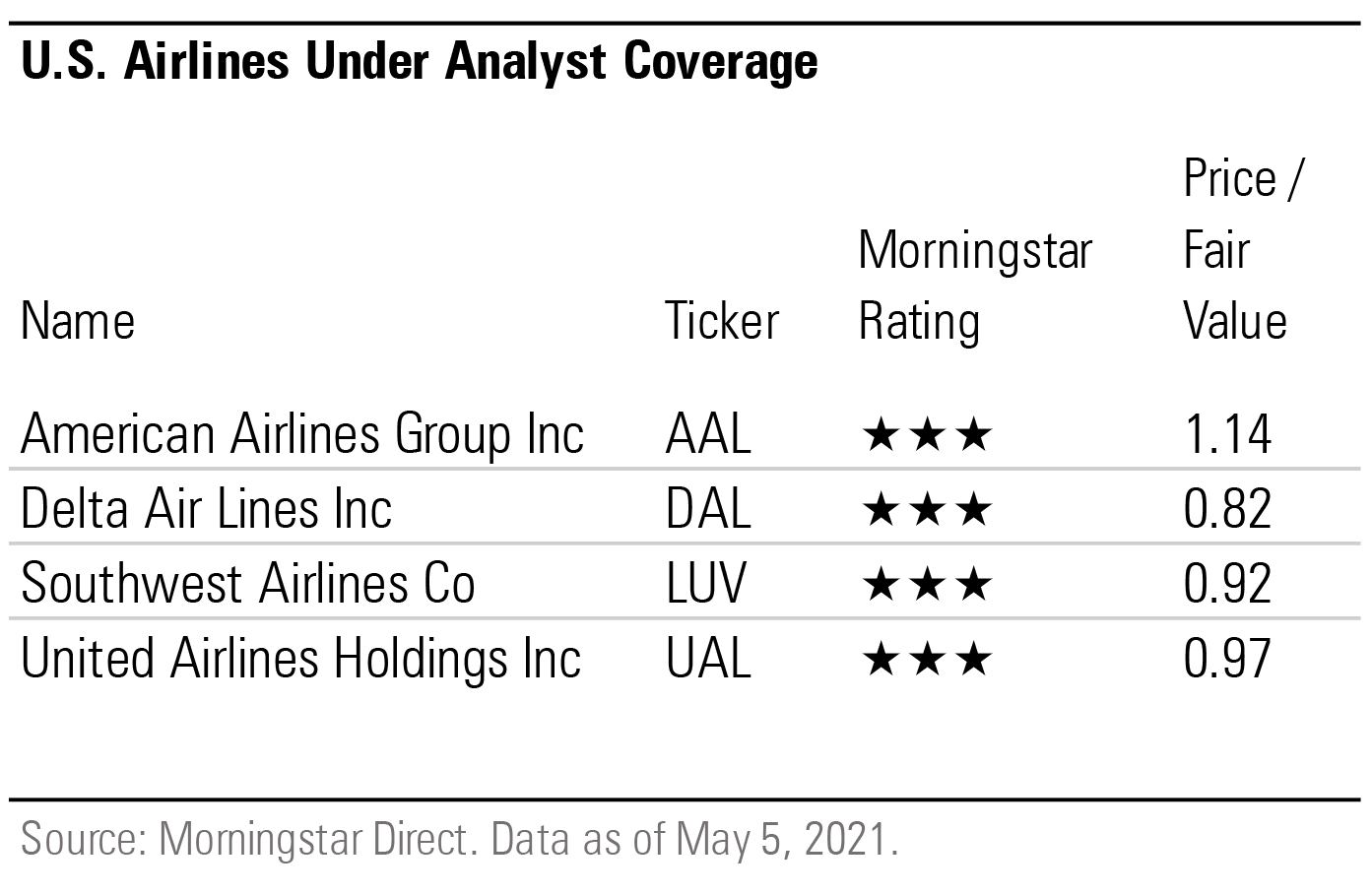

Though our analysts have recently increased their fair value estimates of the U.S. airlines they cover, they don't see compelling value in any of these stocks, though Delta DAL and Southwest LUV remain favorites within the group.

U.S. airlines reported their first-quarter earnings, and the rise in travel demand has exceeded our analysts' expectations. Passenger revenue is still significantly down across the board compared with 2019 levels, but the demand surge now looks large enough and rapid enough to allow all airlines to increase capacity materially while improving capacity utilization.

Many airlines turned a corner starting in March. Morningstar analyst Burkett Huey's take on Delta's first quarter reflects the outlook for the whole group:

"We think this quarter's earnings represent the start of a shift in Delta's story. Previously, airlines cut costs and restructured to prepare for when demand returns. Today, leisure demand is returning, and the remaining questions are: How quickly will demand return, and how profitable will Delta be on the other side of the pandemic?"

United Airlines UAL reported slightly worse results than its peers because international and business travel, which are still depressed because of the pandemic, make up a larger portion of its revenue. Even so, the boost to leisure travel was still significant. Huey remains optimistic about the future: "We continue to view the pandemic as a multiyear shock to travel, rather than a structural change that will permanently impair the airlines."

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)