6 Fast-Food Stocks to Savor

Of the menu options, these U.S. quick-service restaurants are worth tasting.

My love for fast food is undeniable.

I first got hooked as a kid on McDonald’s MCD pancakes and hash browns for breakfast, and their famous fries for a midday snack. Once I got my driver’s license, Chipotle CMG was my go-to, escape-the-house excursion. (I overdid Chipotle so badly in high school that it took four years for me to even consider going back.)

It wasn’t until years later that I realized that many of my favorite fast food restaurants were publicly traded. I knew that big names like McDonald’s and Starbucks SBUX had shares available to the public. But others like Burger King, Tim Hortons, and Popeyes Louisiana Kitchen are owned by publicly traded parent companies (Restaurant Brands International QSR owns those three). The same goes for Taco Bell, Pizza Hut, and KFC, all of which are owned by Yum Brands YUM.

Nostalgia (and potentially a side of fries) may pull heartstrings for some investors to consider these stocks. But the aroma of a crispy chicken sandwich shouldn’t be the only reason to buy a stock. Stock investing means becoming a part owner of the business, according to Morningstar’s Guide to Stock Investing.

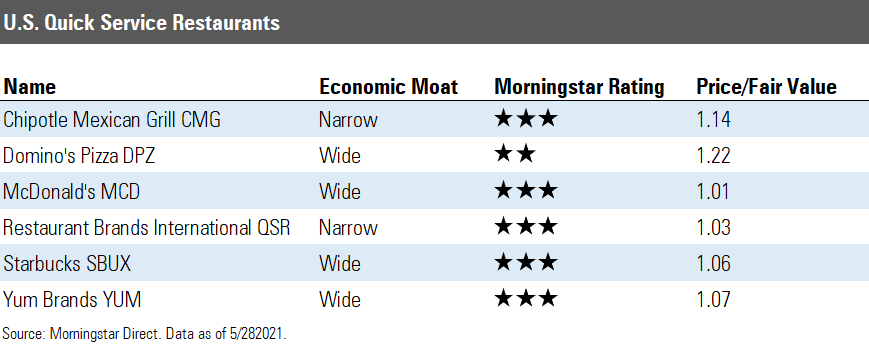

Instead, investors should consider quick-service restaurants that have successful concepts, effective replication of those concepts sprinkled across many regions, and a strong helping of brand recognition. Here’s a look at a few in the United States.

All six quick-service restaurants have carved out narrow or wide Morningstar economic moats, and most names are fairly valued with a 3-star rating. It’s worth waiting for these fairly valued restaurants to trade at a larger discount to their fair value before buying. Here’s a closer look at three names from the list, according to equity analyst Sean Dunlop.

Domino’s Pizza DPZ

“COVID-19 catalyzed sweeping changes across the restaurant industry, with operators scrambling to provide delivery-stable packaging and menus, build out e-commerce pages, and pivot to digital-driven models. Further, historically weak traffic levels augmented the importance of up-selling and cross-selling, while providing food suitable for feeding a family became a necessity. For Domino's, save for the firm’s rollout of contactless car-side carryout, very little changed. The operator's historical investments in "anyware" ordering, a best-in-class e-commerce interface, and a mix that skewed toward delivery (55%) pre-pandemic propelled 12.7% global system sales growth during a year where the aggregate food-service market shrunk by a quarter.

In our view, 2020 results strongly validated management's strategies (AI-enabled decision-making, automation of core processes and a focus on volume-driven traffic growth, shrinking service radii, and transparent delivery pricing), and we're encouraged by their relevance looking beyond the impact of the pandemic. Moving forward, the biggest challenges facing the firm are likely to be the democratization of delivery services (expanding consumer optionality and increasing price sensitivity as groceries and c-stores enter the mix) and input cost inflation, both of which are addressed by current strategies.”

McDonald’s MCD

“As the unquestioned leader in global food-service sales, we believe that McDonald's is taking adequate steps to adjust to an evolving competitive landscape, solidifying its brand competitive advantage by leveraging its scale, marketing spending, and strong unit-level profitability.

While we expect an uneven return to normalcy due to varying paces of pandemic recovery globally, we're encouraged by management's vision for the business, which we believe should enable McDonald's to maintain its competitive edge. The firm has widely embraced customer centricity and technological adoption since its 2015 turnaround, and while the processes have evolved since then, the focus on the customer experience has not. The introduction of all-day breakfast, real beef, and the 2021 rollout of a line of chicken sandwiches point to the firm's renewed attention to meeting evolving customer demands.”

Starbucks SBUX

“Starbucks is the largest specialty coffee chain in the world, with $23.5 billion in 2020 revenue representing nearly 9% of the aggregate café and bar market worldwide, easily eclipsing closest peer Dunkin ($8.9 billion and 3%). The firm’s attention to premium-quality coffee distinguishes it from chained competitors, allowing Starbucks to charge substantially higher prices while creating a unique buzz around what has historically been a commoditized product.

While the specialty coffee space has attracted significant competitive attention in recent years, Starbucks' premium positioning has allowed the firm to outperform the aggregate market, with annual price increases in the Americas segment (5.2%) and unit openings (4.1%) handily outpacing the industry (0% and 0.1%, respectively). We believe that the strategy remains appropriate moving forward, with specialty espresso and cold-brew beverages unlikely to be displaced by QSR competitors, coffee vending machines, or at-home consumption.”

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)