WeWork Goes Public as Profitability Questions Remain

The SPAC deal is done, but investor enthusiasm seems to have cooled after the wait.

A version of this article was originally published on May 6, 2021.

It's been a long time coming, but WeWork is finally set to go public. Shareholders at special-purpose acquisition company BowX Acquisition BOWX voted on Oct. 19, 2021, to approve the merger with WeWork that was announced in March of this year. WeWork will start trading on Oct. 21 on the New York Stock Exchange under the ticker WE.

WeWork's deal with BowX attracted investor attention--the price of BowX jumped 20% on the day of the announcement--but that enthusiasm appears to have faded. In fact, BowX shares fell nearly 10% to $9.37 a piece on the day the vote to finalize the merger was announced.

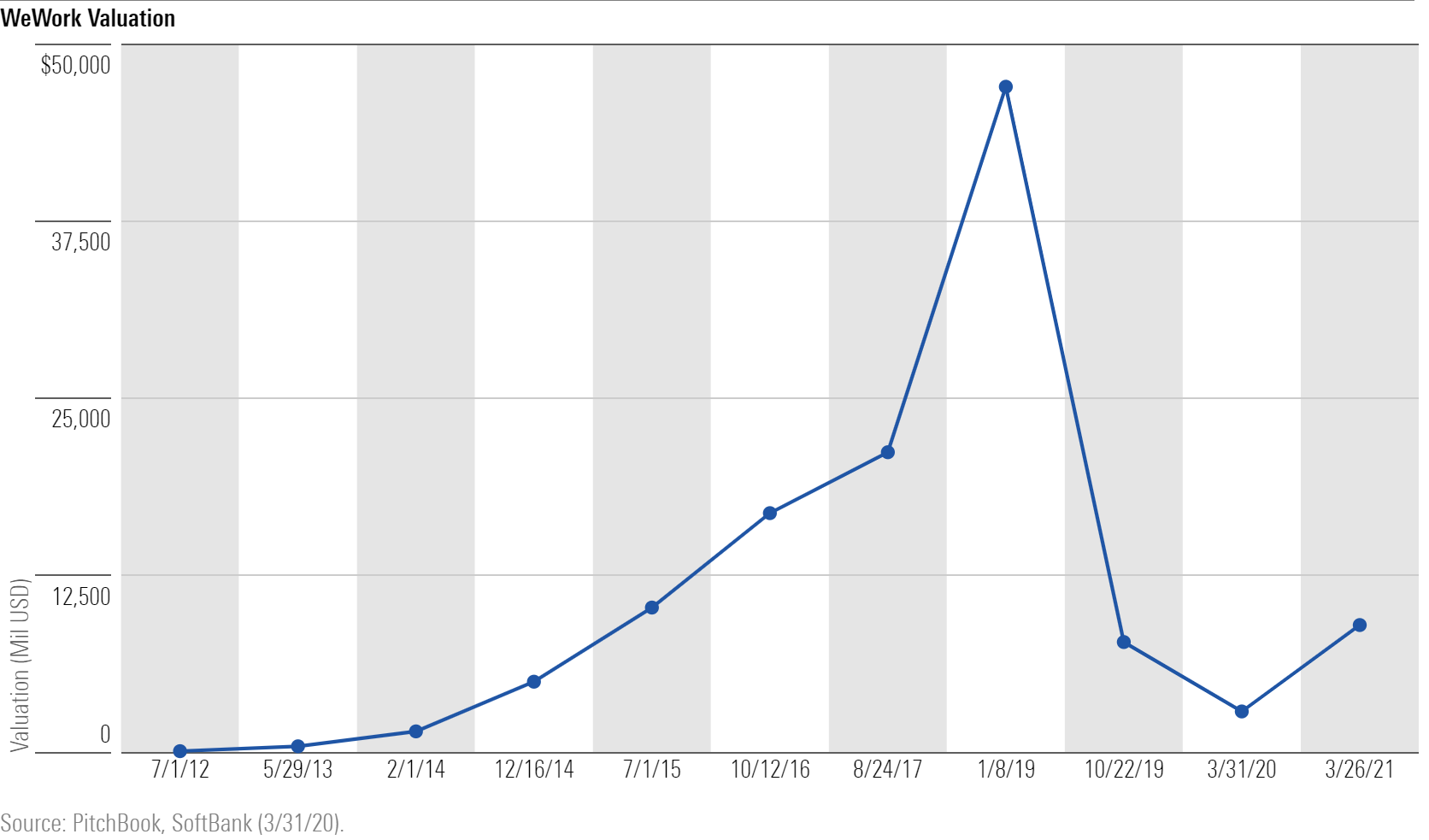

At the beginning of 2019, coworking company WeWork was a private equity darling. It was embraced as an innovator that helped reshape how we think of office space, and its valuation ballooned to a whopping $47 billion. Its IPO, however, failed spectacularly as investors questioned its corporate governance and business model.

WeWork's business is simple: Sublease space for more money than it pays for its leases. Once investors realized that its business model wasn't as innovative as its mission, the company's valuation plummeted. WeWork was headed toward bankruptcy before being bailed out by SoftBank SFTBY, its largest shareholder.

The terms of the SPAC merger haven't shifted since it was announced in March. The deal values WeWork at $9 billion, a far cry from the $47 billion prior to its initial IPO attempt. This valuation still may be overinflated. SoftBank, whose investments largely caused WeWork's inflated valuations, disclosed in May 2020 that it believed WeWork to be worth $2.9 billion as of March 31, 2020. In the fourth-quarter 2020 earnings call, SoftBank's CEO admitted that investing in WeWork had been a failure.

What Are WeWork's Challenges?

WeWork faces a challenging environment. The pandemic and the resulting shift to remote work pushed many coworking startups to retreat or shut down. While WeWork has managed to stay afloat, it hasn't come out unscathed: WeWork memberships fell during 2020, an issue for a company that relies on high occupancy rates of its office space to offset the rental costs of its buildings and other operational expenses.

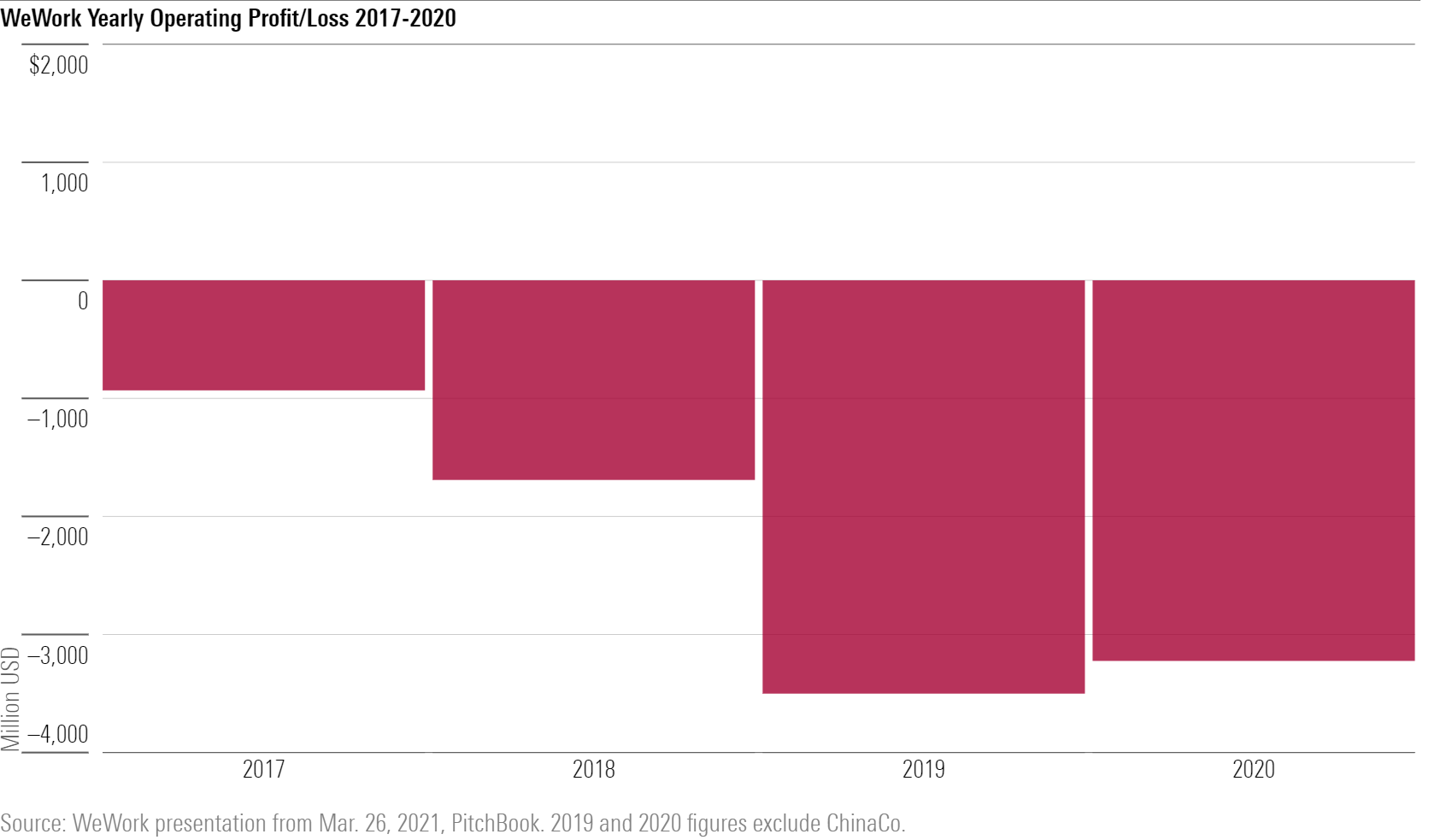

WeWork also faces continued profitability pressure that crashed its IPO even as it took steps to cut costs in 2020. In a move that was likely partially motivated by the pandemic, WeWork executed a massive overhaul that included cutting 67% of its staff and reducing selling, general, and administrative expenses by $1.1 billion.

WeWork lost $3.2 billion in 2020 despite these cuts.

Why Is WeWork Going Public Now?

WeWork expects to receive $1.3 billion from the deal with BowX to be used to invest in further growth.

Though the pandemic has cleared out offices and gouged WeWork memberships, the company believes that its flexible space model will flourish as offices look to reopen. In a March presentation, WeWork executives stated that they expect to reach profitability by the fourth quarter of 2021. While it isn't on track to hit that milestone in the fourth quarter, WeWork's revenue has been on the rise.

Even before the pandemic, the rise of coworking showed a growing preference for flexible office space. This trend may accelerate after the pandemic with the growth of hybrid remote work models. WeWork offers companies the flexibility to adapt to new work models that require less office space. Shorter-term leases may also be more appealing as companies continue to face heightened uncertainty.

WeWork has nearly 800 locations in more than 100 cities worldwide, and it may use the new capital to expand its reach. WeWork has held significant market share in the coworking space, but Morningstar analysts believe that this market concentration may decrease over time as coworking companies will likely struggle to differentiate themselves and establish a competitive advantage, so taking advantage of WeWork's current presence may be to its benefit.

WeWork's only direct public competitor is Europe-based IWG IWGFF, which is valued at about $5 billion. With fiscal 2020 revenue of GBP 2.5 billion, the business is about two thirds the size of WeWork's. Morningstar analysts see a potential path to profitability for WeWork if the company can shift away from the "treacherous" long-term lease agreements that have affected its bottom line. Operating agreements that feature a management fee to operate space may be a viable alternative.

IWG has demonstrated that profitability is possible, and potential opportunities exist for WeWork and coworking as a whole. The future, however, is anything but certain.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)