Why Alternatives Don't Always Help Diversify

Investors seek out alternative funds for a variety of reasons, but the diversification benefits might be smaller than you'd expect.

Alternative investments are supposed to excel at diversification. As the name suggests, they're envisioned as fundamentally different from mainstream asset classes, such as large-cap stocks. But in our recent examination of asset-class correlations, the "2021 Diversification Landscape," we found that alternative strategies have a mixed record in terms of diversification value.

Alternative investment strategies attempt to expand, diversify, or eliminate the dominant risk factors contained in traditional market indexes, such as equity, credit, and interest rates. These strategies tend to focus on capital preservation, long-term portfolio diversification, or enhanced risk-adjusted returns in isolation or combination. Some alternative funds invest in a single asset class, while others invest across multiple asset classes using a variety of investment techniques.

But there's a lot of variation between different types of alternative investment strategies. As a result, performance and correlation levels vary significantly among alternative strategies. Because there's so much variation between alternative strategies, we used Morningstar Categories as proxies to capture the most common strategies. (Note: We recently made several changes to our category classification system to better equip investors to navigate the alternative investment universe. The discussion below is based on the categories that were in place when we first published this research in March 2021.)

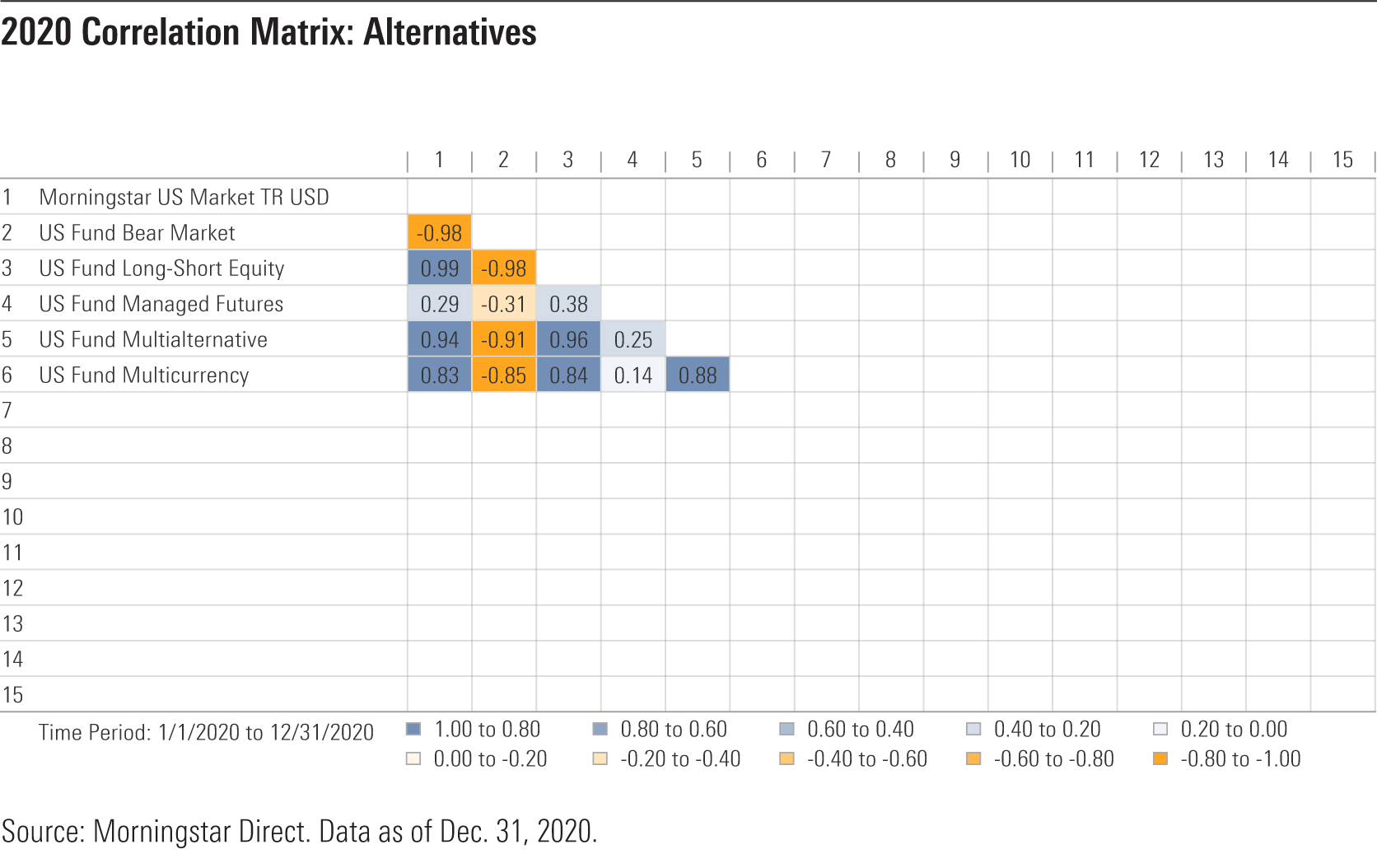

2020 Correlations for Alternative Investment Strategies

In early 2020, correlations for most alternative categories rose as market forces drove correlations higher across most asset classes. In the market overall, there was a significant amount of forced selling that drove down pricing for typically uncorrelated securities. The speed and severity of the sell-off caused correlations to spike in many areas, including alternative funds. Bear-market funds were a notable exception. Because they invest in short positions and derivatives to profit from stocks that drop in price, their returns generally move in the opposite direction of the benchmark index. As a result, they gained 62.4% during the first quarter of 2020, while the overall equity market dropped about 34.5%.

For 2020 overall, correlations for most alternative categories were also relatively high. Bear-market funds continued to move in the opposite direction of the equity market, but correlations for most other alternative categories either remained high or increased. Managed-futures funds were an exception and did surprisingly well in early 2020. Typically, these strategies suffer at inflection points, but many of these alternative funds benefited from long-term bond exposure and sharply cutting notional market exposure across the board. This also caused them to miss some of the market rebound, though, which kept correlations relatively low for the full year. The correlation coefficient remained at just 0.29, which was only a slight increase from previous levels.

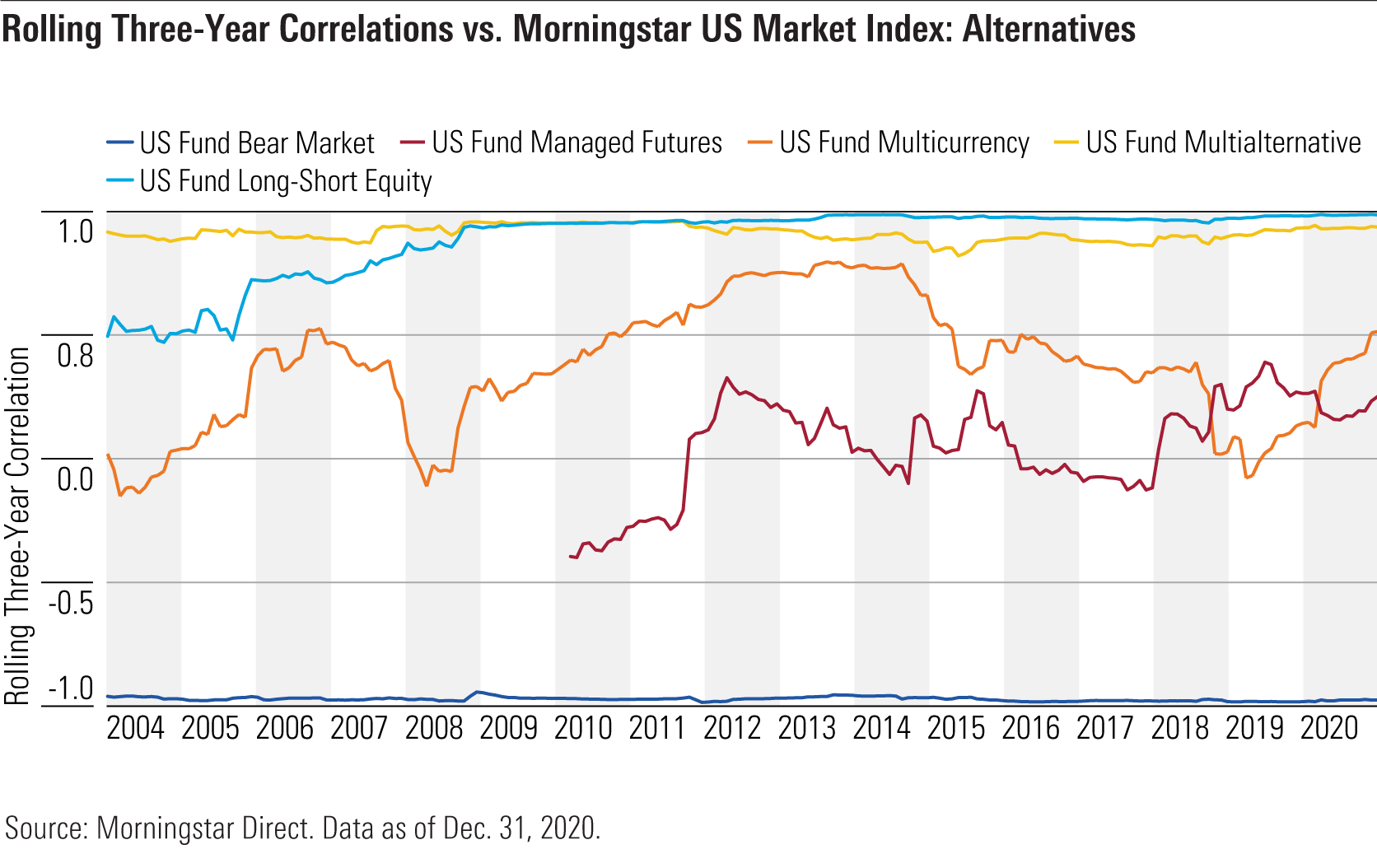

Longer-Term Trends for Alternative Investment Strategies

Apart from bear-market funds, correlations for most alternative categories have generally increased. Even correlations for multicurrency funds, which invest in multiple denominations by using short-term money market instruments, cash deposits, and derivatives, have increased over time, making them less useful as a portfolio diversifier. Correlations for managed-futures funds, which attempt to capture market trends by trading futures contracts, have gradually increased but remain relatively low. Over an extended bear market, managed-futures strategies would also likely show lower correlations as they profit from negative price trends.

Portfolio Implications

Investors seek out alternative funds for a variety of reasons (such as making bearish market calls or capturing short-term market trends). From a portfolio construction perspective, though, investors may not be getting as much diversification as they would expect from these alternative funds, especially in the long-short and multialternative categories. And while bear-market funds have continued to live up to their name by moving in the opposite direction as the equity market, negative long-term returns have kept them from adding value to diversified portfolios.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)