More Money Flows Into Stock ETFs So Far This Year Than in All of 2020

Rich stock valuations don't deter exchange-traded fund investors in April.

Stocks continued to roll in April 2021. The Morningstar Global Markets Index--a broad gauge of global equities--gained 4.33% last month. After a lethargic January, three consecutive positive months have bumped the index's year-to-date return to 9.41%. Bonds rebounded in April as interest rates stabilized. The Morningstar US Core Bond Index added 0.82%, its first monthly gain in 2021.

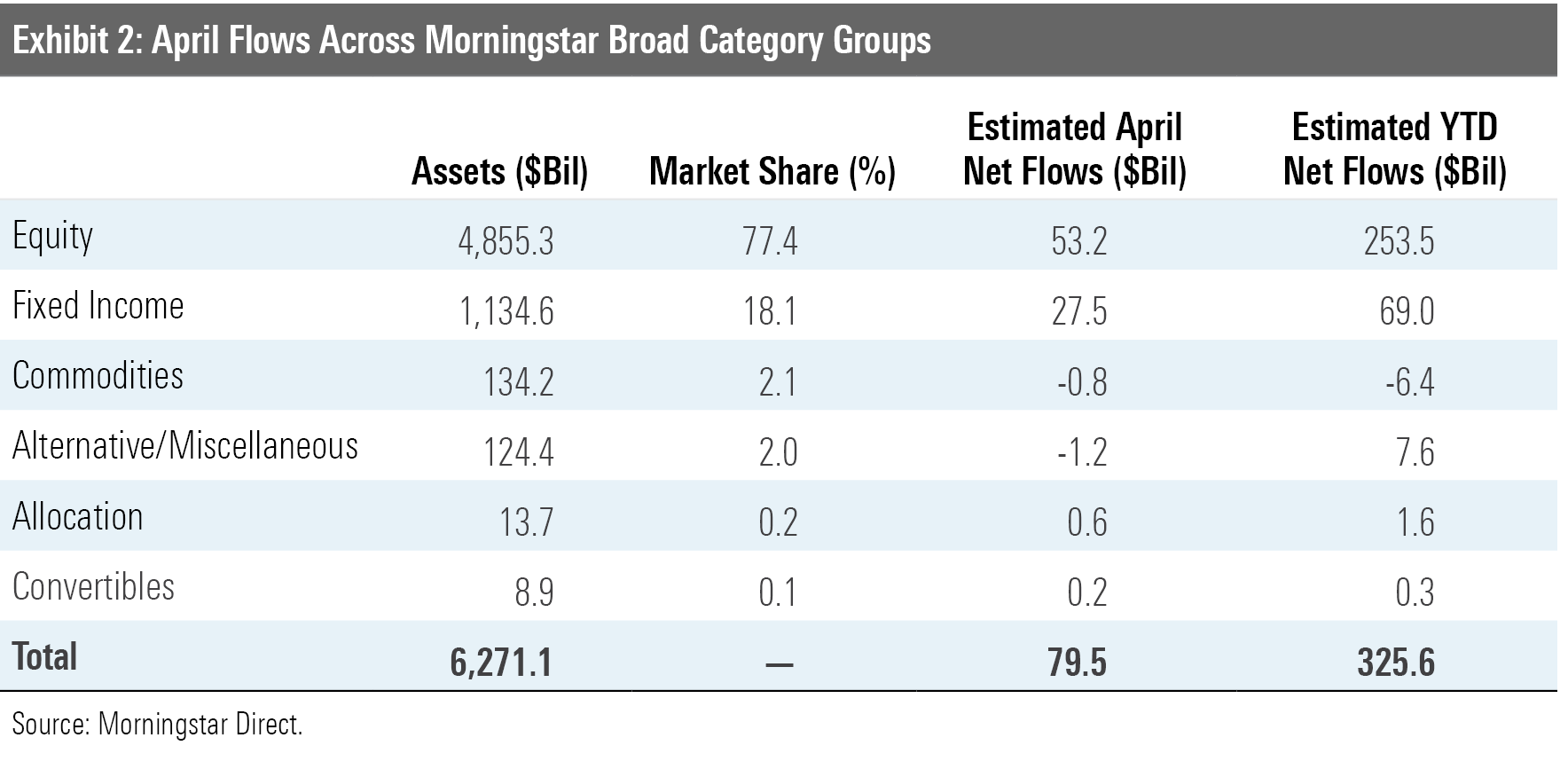

Stock exchange-traded funds needed only four months in 2021 to eclipse their inflows from all of 2020. After adding $53.2 billion in April, they have collected a total of $253.5 billion in flows so far this year. Stock ETFs absorbed $231.8 billion in all of 2020. Bond ETFs have taken a back seat after dominating inflows for most of 2020, raking in $69.0 billion over the first four months of this year.

Here, we'll take a closer look at how major asset classes performed in April, where investors put their money, and which corners of the market looked rich and undervalued at month's end, all through the lens of ETFs.

Stocks Continue to Sizzle

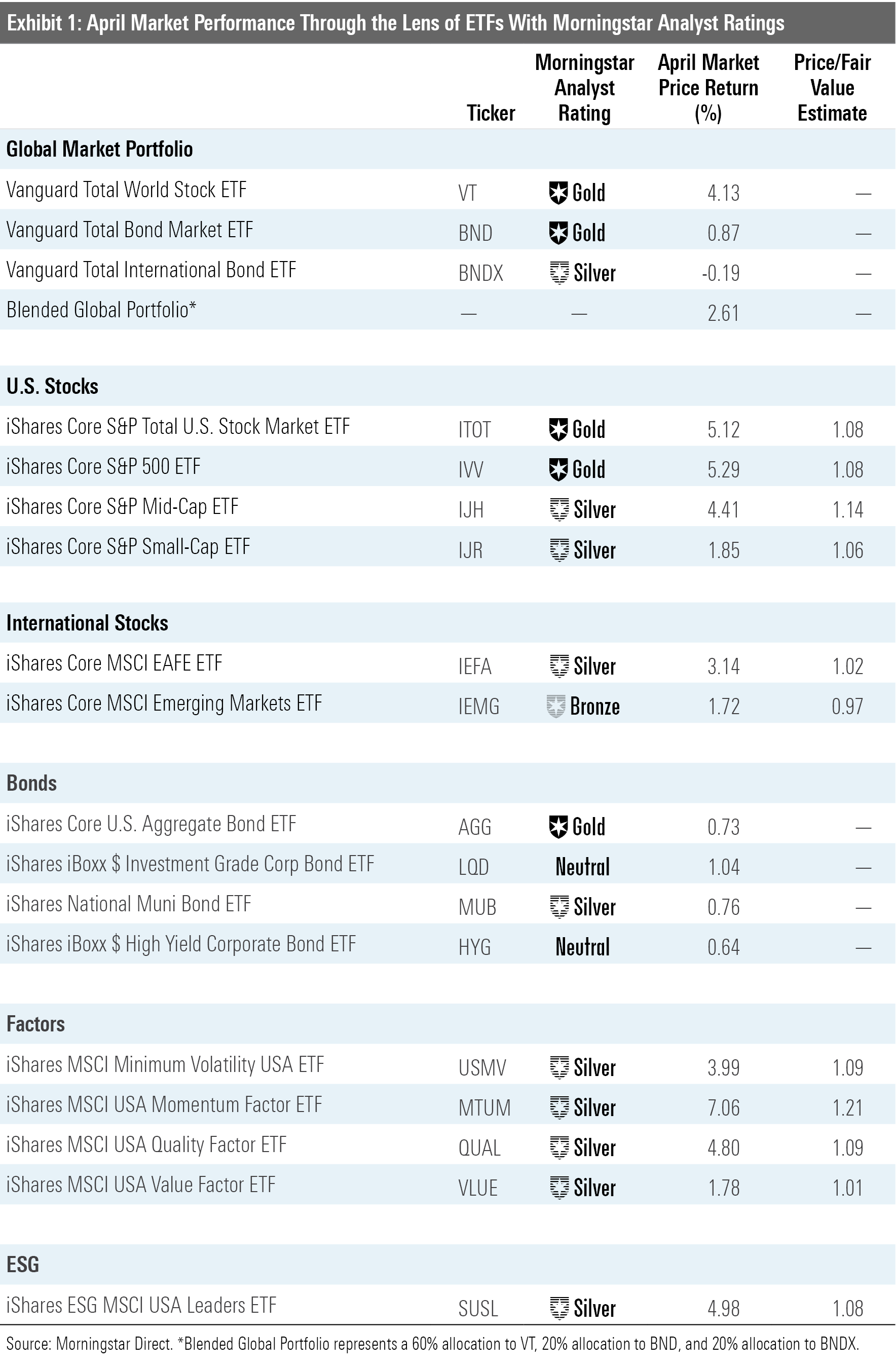

Exhibit 1 features the April performance for a sampling of ETFs that are rated by Morningstar Analysts and serve as proxies for major asset classes. Investors in a blended global market portfolio gained 2.61% last month. The fixed-income sleeve of the portfolio chipped in positive returns for the first time this year, but stocks continued to lead the way. Vanguard Total World Stock ETF's VT 4.13% gain in April was its largest monthly return of 2021.

U.S. stocks in particular have excelled. IShares Core S&P Total U.S. Stock Market ETF ITOT climbed 5.12% in April, compared with 2.91% for the foreign-only iShares MSCI ACWI ex U.S. ETF ACWX. Increased confidence in the timeline of a post-pandemic reopening of the economy likely contributed to this outperformance. Over 30% of the U.S. population was fully vaccinated at the end of April, according to Our World in Data.

Value stocks benefited from this increased optimism in 2021's first quarter, as stocks found in value-leaning sectors like energy, utilities, industrials, and real estate tend to be more economically sensitive than their faster-growing peers. A potential value comeback took a detour in April, however, as growth stocks barreled ahead. Vanguard Growth ETF's VUG 6.95% return last month nearly doubled Vanguard Value ETF's VTV 3.53% gain. Some of VUG's largest holdings lived up to their billing; Amazon.com AMZN, Facebook FB, and Alphabet GOOG all notched double-digit April returns after strong earnings reports.

Stellar returns from the market's leaders also helped large-cap stocks broadly outperform their smaller peers in April. IShares Core S&P 500 ETF's IVV 5.29% return handily outpaced iShares Core S&P Small-Cap ETF's IJR 1.85%. That marks two consecutive monthly victories for the S&P 500 tracker after IJR led the way for six-straight months. It remains to be seen whether April was a merely a bump in the road for smaller, cheaper stocks, or if larger, faster-growing firms will follow up their dominant 2020 with another strong campaign.

Returns among single-factor strategic-beta ETFs add context to the relative performance of value and growth stocks. After finishing 2021's first quarter in the red, iShares MSCI USA Momentum Factor ETF MTUM climbed 7.06% in April. IShares MSCI USA Value Factor ETF VLUE, on the other hand, cooled off, notching a modest 1.78% gain after a blistering first quarter. The market's balance of power seemed to be shifting toward cheaper stocks after their promising start to the year, but those on the faster-growing side of the spectrum rounded into form in April.

The broad U.S. market's sound recent performance has precipitated rich valuations. ITOT traded 8% above its fair value at the end of April, as measured by the fund's Morningstar price/fair value estimate. Funds with portfolios of fast-growing stocks are predictably frothy. For example, MTUM carried a 21% premium to its fair value at month-end. But even the market's relatively cheap corners have grown pricey. At the end of April, VTV and VLUE--two portfolios that weave cheap portfolios by design--traded at premiums of 4% and 1% to their fair value, respectively.

Stock Investors Step on the Gas

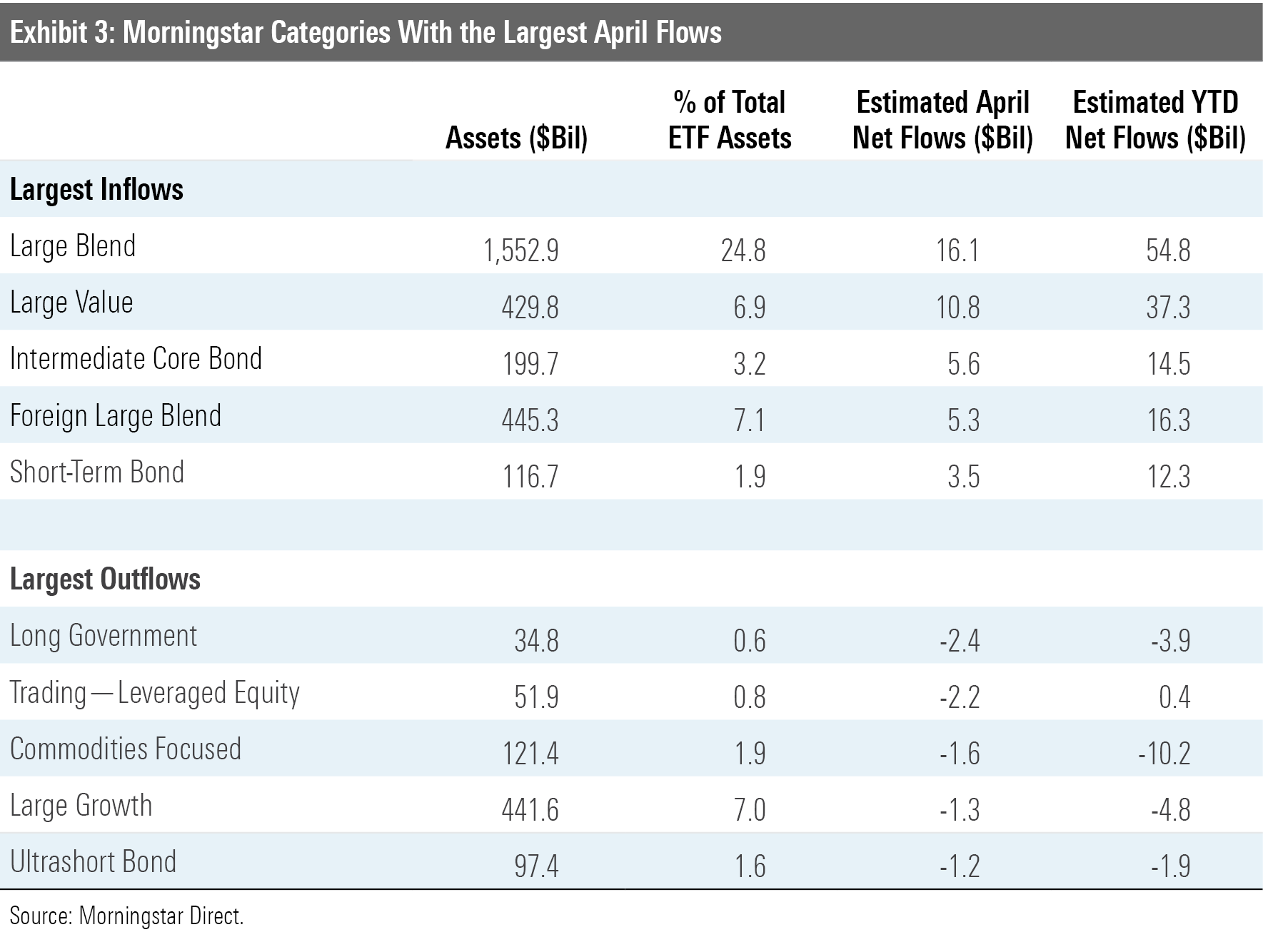

The stock market's lofty valuations did not spook investors. Stock ETFs claimed about two thirds of all ETF inflows in April. U.S. large-blend ETFs led all categories in flows for the third-straight month, pulling in an estimated $16.1 billion.

Investors seemed to seek out the market's cheaper corridors in April. While blend led the way, U.S. small-, mid-, and large-cap value ETFs hauled in a combined $12.3 billion during the month. U.S. large-, mid-, and small-cap growth ETFs saw $1.3 billion of outflows. U.S. value stocks don't necessarily look like bargains at the moment, but they're cheaper than their faster-growing peers, and investors have taken note.

Other investors have turned overseas in search of undervalued stocks. ETFs in the foreign large-blend Morningstar Category absorbed $5.3 billion in April, led by iShares Core MSCI EAFE ETF IEFA and Vanguard FTSE Developed Markets ETF VEA, which collected $1.2 billion apiece. Both funds, which have Morningstar Analyst Ratings of Silver, traded at 2% premiums to their fair value estimates at month-end. These would be a take-it-or-leave it valuations under most circumstances, but they register as mildly attractive when considering that ITOT was trading at 8% above its fair value estimate. Investors willing to turn over every stone for cheap stocks may eye emerging markets--iShares Core MSCI Emerging Markets ETF IEMG carried a 3% discount at the end of April--but the space entails a unique array of risks to consider.

Bond ETFs more than doubled their March inflows, hauling in $27.5 billion last month as interest rates leveled off after months of steady increases. Higher rates depress bond prices and diminish the appeal of long-term bond funds, so April's plateau could have aided flows. Not all sections of the bond market were safe--long-term government ETFs suffered the worst collective outflows of any category in April--but those with short to intermediate time horizons mostly fared well.

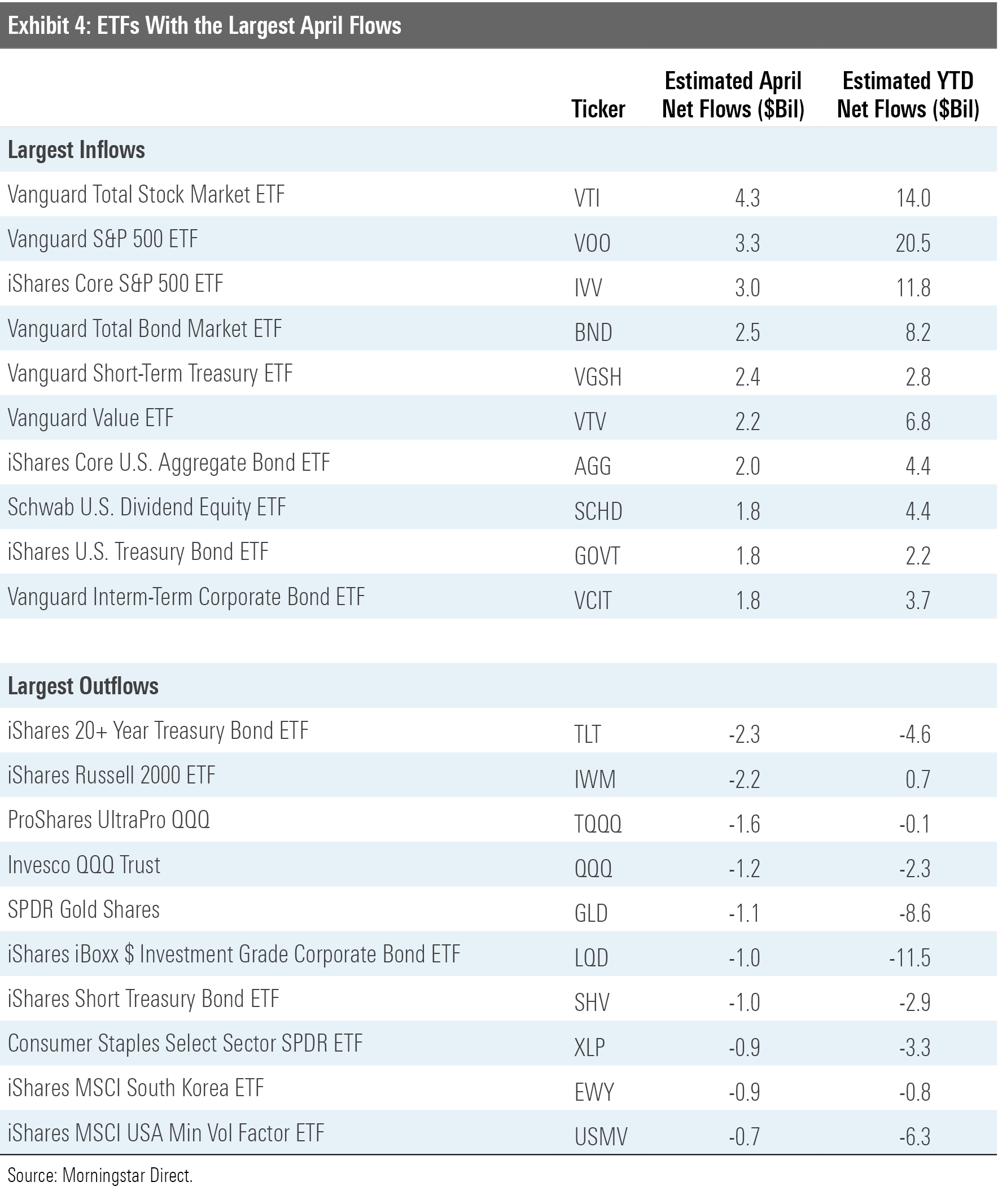

Most investors opted for a steady diet of broadly diversified market-cap-weighted index funds in April. Vanguard Total Stock Market ETF VTI, Vanguard S&P 500 ETF VOO, and IVV stood on the podium, riding their plain-vanilla index strategies to a combined $10.6 billion in net flows over the month.

Investors' preference for value stocks bore out at the fund level. Large-value category constituents Schwab U.S. Dividend Equity ETF SCHD and VTV both cracked the top 10 in overall flows. Meanwhile, appetite for the growth-tilted Nasdaq 100 Index waned. Invesco QQQ Trust QQQ, the index's keystone tracker, and ProShares UltraPro QQQ TQQQ, a triple-leveraged version of the same strategy, collectively leaked $2.8 billion in April.

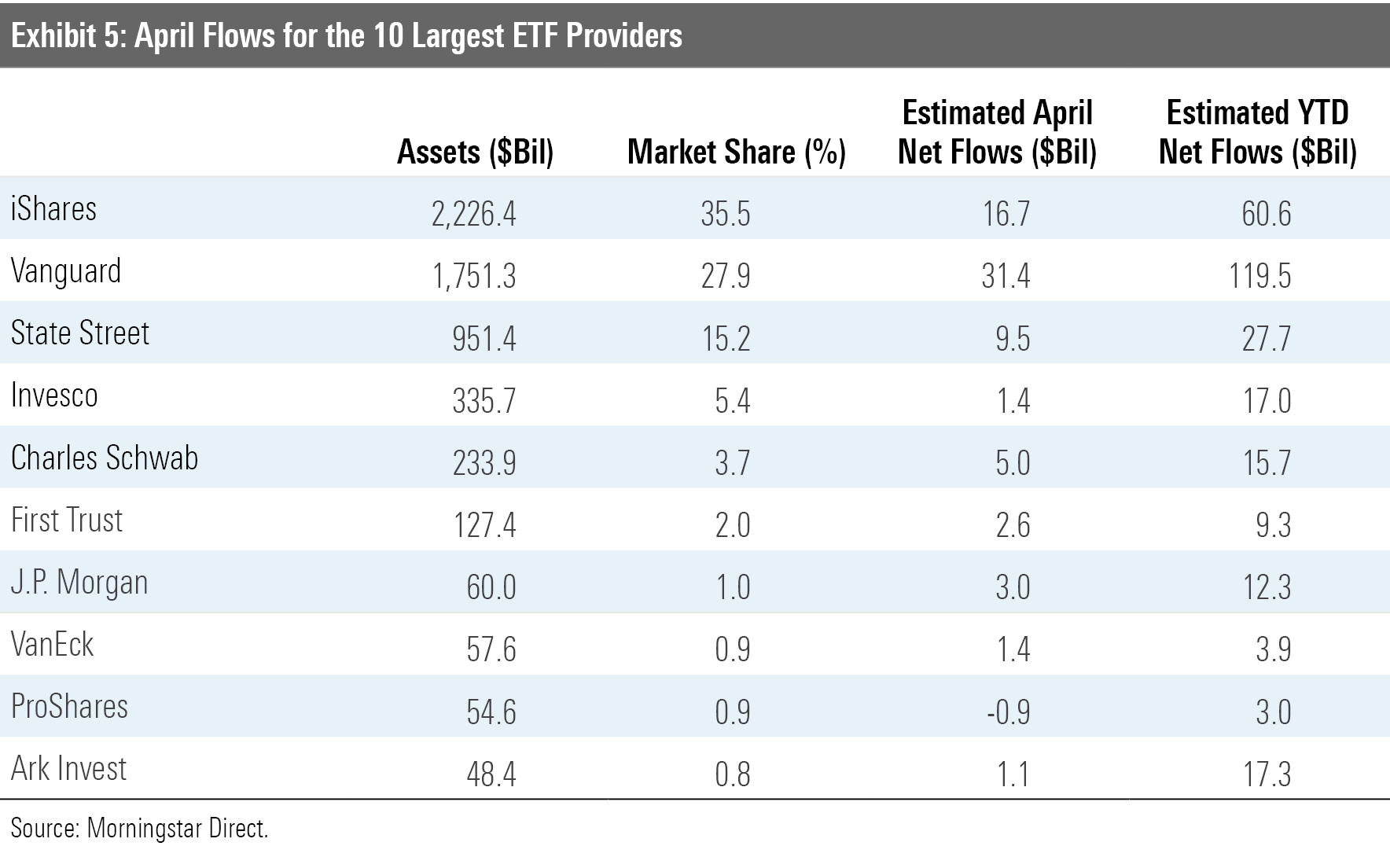

Steady at the Top

Vanguard extended its streak atop the ETF provider flows league table to five months, as the firm's ETFs raked in $31.4 billion in April. At the end of the month, Vanguard ETFs' $119.5 billion year-to-date haul was almost double that of its nearest competitor, iShares. Some of Vanguard's recent ETF flows have resulted from conversions of assets in its funds' Admiral share classes to ETF shares, which are now cheaper than the Admiral shares of the same funds after a wave of recent repricing. The firm has since either directly converted some of its investors' existing Admiral share-class allocations to the ETF share class or otherwise nudged them to do it on their own. That said, the majority of Vanguard's new inflows have come from new investments--not conversions. Most of these conversions have now run their course, and their impact on the firm's ETF flows has diminished.

ARK, the newest name on the ETF industry's leaderboard, has seen its inflows decelerate after a run of new investment catapulted them to the ninth-largest ETF provider in early 2021. Tempered inflows call to mind the adage that "flows follow performance." The firm’s flagship fund, ARK Innovation ETF ARKK, has come back down to earth after its 152.5% return ranked first among all U.S. mid-cap growth funds in 2020. It trailed its category benchmark, the Russell Midcap Growth Index, by 8.01 percentage points for the year to date through April and ranked second to last among its category peers. Whether investors jump ship or remain loyal to this fund remains to be seen, but the past few months have presented an early gut check.

Thematic Funds Look Pricey

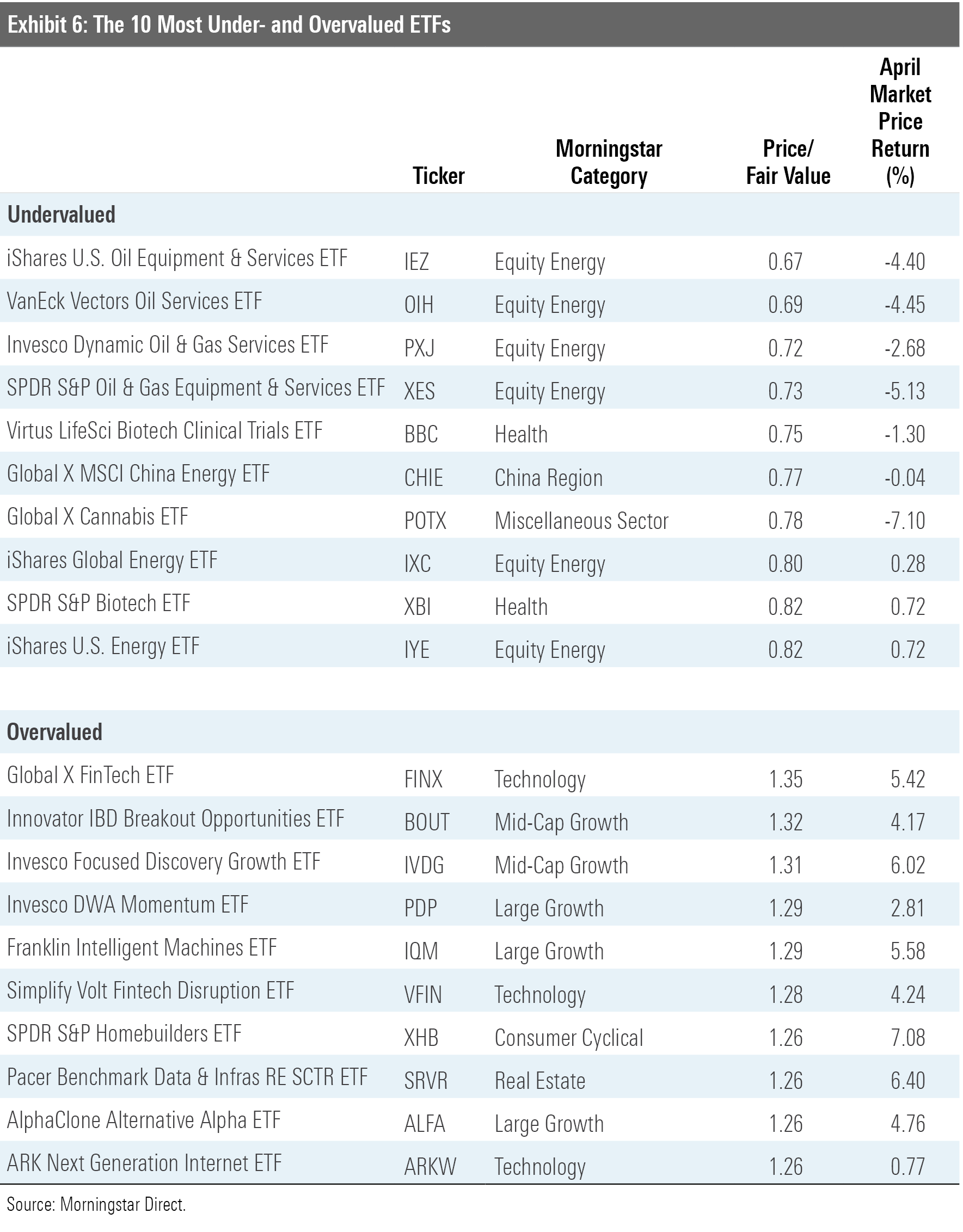

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing this value by the ETFs' market prices yields the price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Exhibit 6 features the 10 ETFs that were trading at the largest discounts and premiums to their fair value estimates as of the end of April. Seven of the 10 trading at the largest discounts have energy-focused portfolios. The energy sector took a nosedive when the coronavirus pandemic took hold last spring, as demand declined and supply continued to flood the market. As producers ran out of places to store their output, prices collapsed, as did the share prices of firms operating in the sector.

The market is a discounting mechanism, however, that had been pricing in a return to normalcy in the economy and balance in energy markets. The prospect of reopening the global economy had widely lifted oil prices and energy ETFs. But after a few months of smooth performance, the past two months have been turbulent. IShares U.S. Oil Equipment & Services ETF IEZ lost 4.40% last month, following a 4.53% decline in March, embodying a challenging couple of months for the energy sector writ large. So, while IEZ's 0.67 price/fair value ratio at the end of April was a material leap from its 0.29 level at the end of March 2020, these funds figure to feature prominently in the ETF bargain bin.

A pair of thematic funds ranked among the top of April's most overvalued ETFs: Global X FinTech ETF FINX (1.35 price/fair value) and Simplify Volt Fintech Disruption ETF VFIN (1.28). The funds have pursued their shared financial technology theme with mixed results in 2021. FINX has lost 0.28% year to date through April, while VFIN sank 18.33% over the same span. These funds' portfolios--and performances--look quite different from one another, highlighting the importance of looking under the hood of all options when considering a thematic approach.

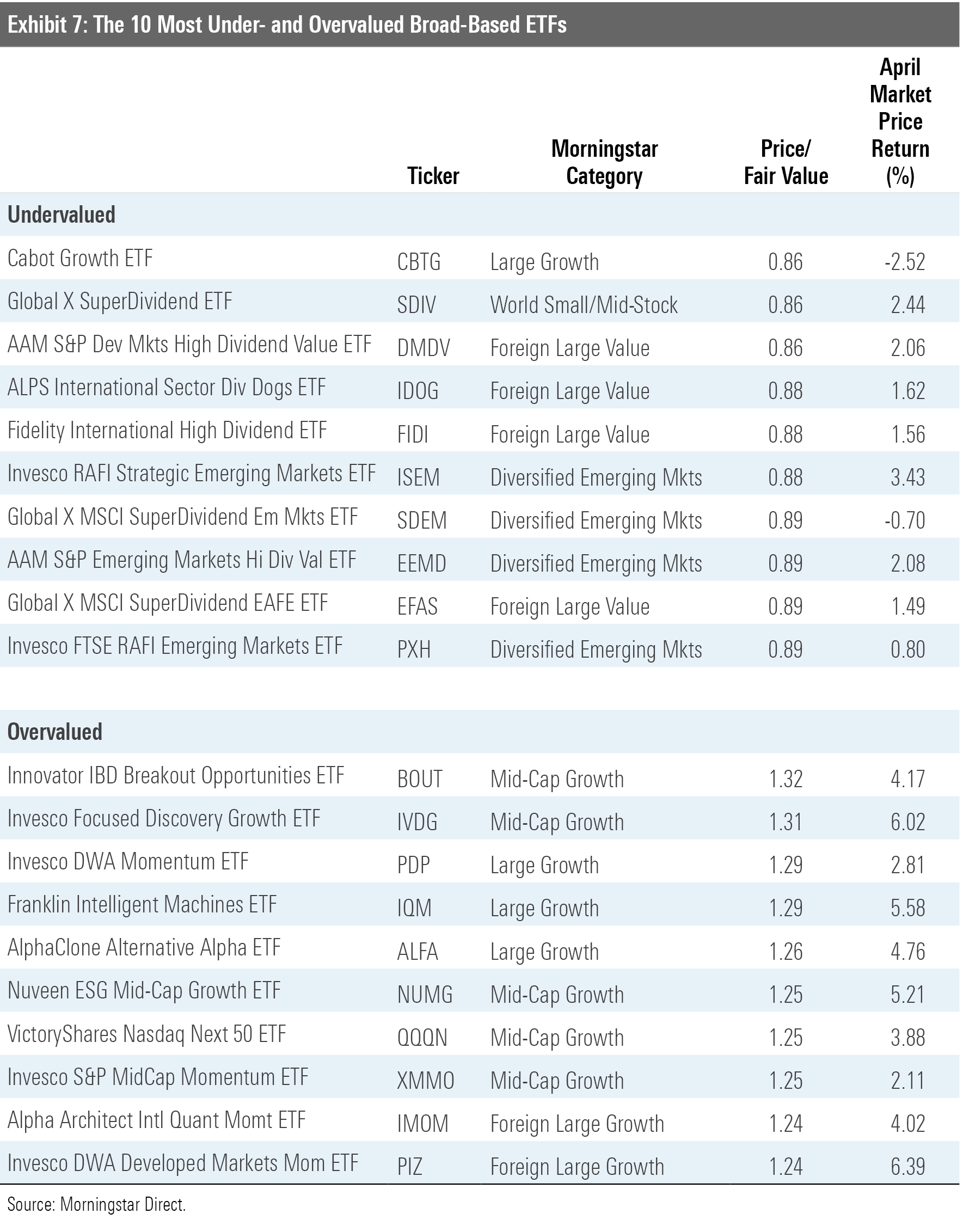

Exhibit 7 features the 10 broad-based ETFs (those belonging to one of the mainline Morningstar Style Box or other broader geographic categories) that were trading at the largest discounts and premiums to their fair value estimates as of month-end.

Four of the 10 most overvalued broad-based ETFs ply momentum strategies that sweep in the markets' best recent performers. So, it should come as no surprise that Invesco S&P MidCap Momentum ETF XMMO has fared well as of late. It outpaced the Russell Midcap Growth Index (its category benchmark) by 4.39 percentage points year to date through April. The list also features some thematic ETFs that home in on some of the market darlings of the moment. For example, Franklin Intelligent Machines ETF IQM gained 90.4% during the 12 months through April--a healthy margin ahead of the 53.97% return turned in by the Russell Midcap Growth Index. At the end of April, IQM was trading at a 29% premium to its fair value estimate.

If there's any value in today's market, it is likely overseas. Foreign-stock ETFs dominated the ranks of the cheapest broad-based ETFs at the end of April. The list featured four ETFs that zero in on emerging-markets stocks that are trading cheaply relative to their dividends or fundamental measures of their value more broadly. While these funds currently register as cheap, the more important question is whether they are cheap enough to offer adequate returns for the level of risk involved. For example, Global X MSCI SuperDividend Emerging Markets ETF's SDEM risk/return profile should give investors pause. The fund's standard deviation of returns--a measure of risk--has been consistently higher than the category index, the MSCI Emerging Markets Index. Also, its upside-capture ratio relative to that same bogy has been 91%, while its downside-capture ratio has been 139%. So, the stocks featured in some of these funds' portfolios may be cheap for very good reason and not nearly cheap enough to compensate investors for the risk that they entail.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)