Morningstar World-Stock Categories Get Some Style

New world-stock categories break out funds by style to provide better comparisons.

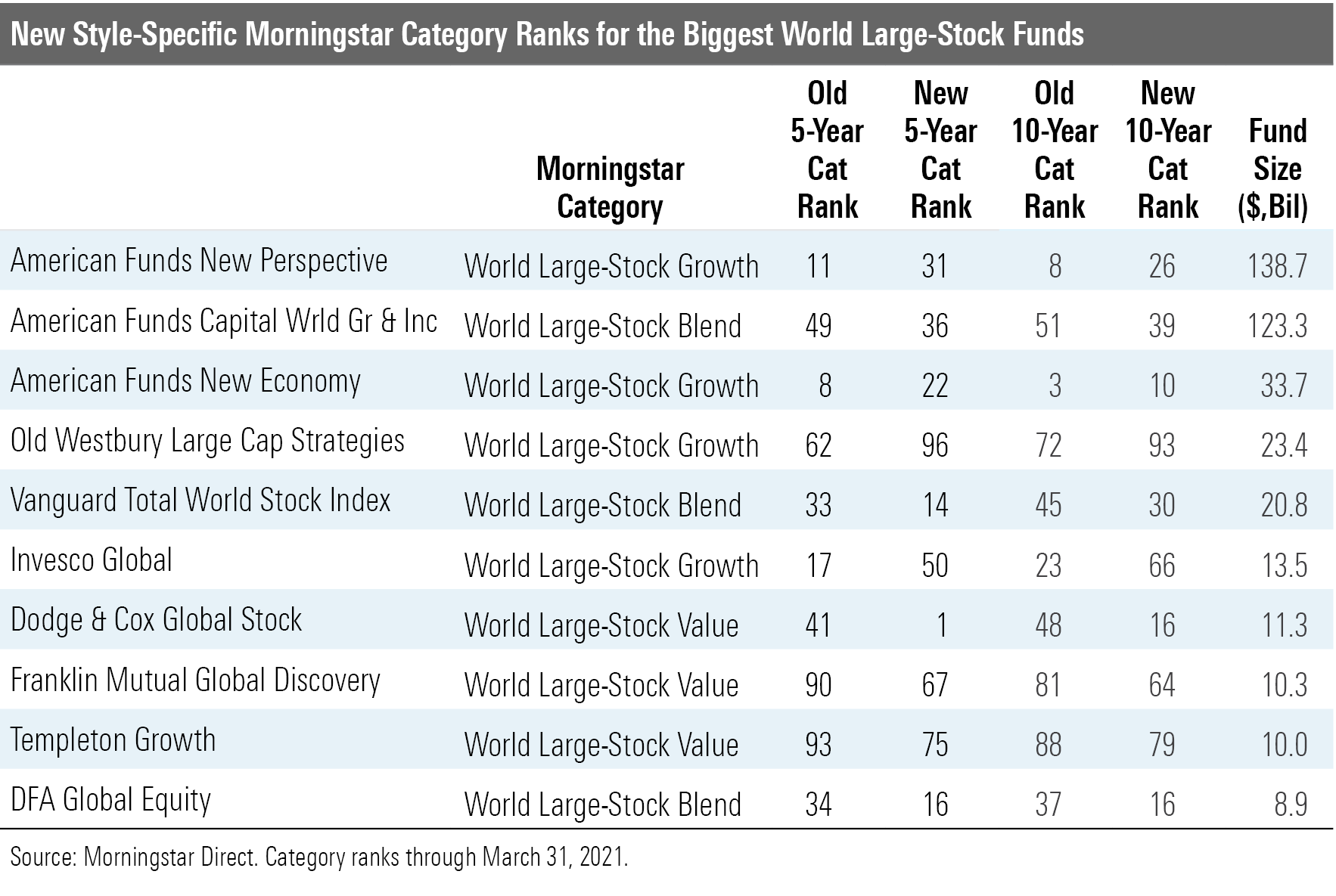

We recently broke up the world large-stock Morningstar Category into three style-specific categories to better capture the range of investment approaches used across this broad group of funds. The Morningstar Rating for funds and category performance rankings as of April 30, 2021, reflect the new groups--world large-stock value, world large-stock blend, and world large-stock growth. Here's where some prominent funds landed.

World Large-Stock Value

There were some obvious moves. Strategies with clear value roots moved into the world large-stock value category, including Dodge & Cox Global Stock DODWX, known for its contrarian style of investing and long-term mindset. It had about a third of its assets in financials and energy recently, on the high end of all world large-stock funds; indeed, some former peers didn't even crack double-digits in those sectors.

Oakmark Global OAKGX and its more concentrated sibling Oakmark Global Select OAKWX also moved to value. They're known for going against the grain and riding out rough patches, an investing approach that fits better in their new home.

Polaris Global Value PGVFX had among the biggest value tilts relative to the Morningstar Global Markets Large Cap Index, according to the Morningstar Risk Model. Boston Partners Global Equity BPGIX, Columbia Global Equity Value IEVAX, and Franklin Mutual Global Discovery MDISX also leaned heavily toward value.

Meanwhile, funds that have been among the broad world large-stock category's worst relative performers in recent years, including Tweedy, Browne Value TWEBX and Causeway Global Value CGVIX, will get a fresh start with more like-minded peers in the value category.

World Large-Stock Growth

Similarly, funds with less valuation sensitivity shifted into the growth category. American Funds New Perspective ANWPX, the biggest world-stock fund, clearly skews toward growth, with a recent 6% stake in Tesla TSLA. Sibling American Funds New Economy ANEFX has one of the largest U.S. stakes among all world-stock funds because it has gradually morphed from an innovation-focused fund measuring itself against the S&P 500 to one with looser geographic restrictions; it changed its benchmark to the MSCI All-Country World Index in early 2020. Its focus on invention has led it toward growth companies.

Growth also is an appropriate home for Morgan Stanley Institutional Global Opportunities MGGPX. Manager Kristian Heugh looks for firms with huge total addressable markets and keeps a big chunk of assets in China. T. Rowe Price Global Growth Stock RPGEX holds a significant emerging-markets stake, and true to its name, also moved to the growth category.

Meanwhile, PGIM Jennison Global Opportunities PRJAX had among the biggest growth tilts relative to the Morningstar Global Markets Large Cap Index, according to the Morningstar Risk Model, and the portfolio's price multiples such as price/earnings and price/sales were among the highest of all world large-stock funds. Some conservative funds edged into the growth category, too. BNY Mellon Worldwide Growth PGROX looks for industry leaders with wide economic moats, which has helped it hold up well in downturns.

World Large-Stock Blend

World-stock market bellwether Vanguard Total World Stock Index VITSX aptly lands in the blend category. So does its actively managed sibling Vanguard Global Equity VHGEX. Its subadvisor mix balances growth-leaning Baillie Gifford with Marathon, which invests in a range of companies at favorable points in their capital cycles.

While DFA is known as a value shop, DFA Global Equity DGEIX is designed as a one-stop, core option, making blend an appropriate home. The sum of the different dividend-favoring approaches of behemoth American Funds Capital World Growth & Income's CWGIX multiple managers adds up to blend. MFS Global Equity MWEFX, which plies a relatively conservative approach and limits emerging markets exposure, also falls in blend.

While Davis Global's DGFAX typically hefty financials stake screams value, it offsets that with one of the biggest China stakes among world large-stock peers and private-company positions such as Didi Chuxing.

Performance Implications

As growth outperformed value in recent years, growth-oriented world-stock funds tended to outrank value peers in the old, one-style-fits-all category. The new categories allow for more accurate comparisons and have led to some big relative ranking changes. For instance, Artisan Global Value ARTGX trailed about two thirds of its peers over the past five years through March 2021 before the change; in the new category, it beat 78% of world large-stock value funds for that period. Oakmark Global Select, which had landed in the middle of the broad category for the three and five years before the split, vaulted to the top decile for all trailing periods up to 10 years as of quarter-end. Polaris Global Value's, Franklin Mutual Beacon's BEGRX, and Dodge & Cox Global Stock's rankings also improved. However, Templeton Growth TEPLX, whose value-leaning approach belies its name, still landed in the bottom quartile of its new category for all trailing periods.

The change didn't alter leading growth funds' rankings much, including Morgan Stanley Institutional Global Opportunities, PGIM Jennison Global Opportunities, and T. Rowe Price Global Growth Stock. Others looked less competitive in the narrower peer group, including Invesco Global Growth AGGAX and Janus Henderson Global Research JANWX.

Growth-leaning Davis Global rose to the top of its new blend category. MFS Global Equity, whose results had looked middling at times in the broad category, shot upward.

Category returns versus style-specific benchmarks reveal some surprising twists. For instance, the median world large-stock value fund's 7.3% annualized 10-year gain through quarter-end lagged the broad MSCI ACWI by nearly 2 percentage points but beat the MSCI ACWI Value's 6.4%, suggesting active value managers have done well against a more appropriate benchmark. The median growth-oriented fund's 11.6% gain, meanwhile, had trouble keeping up with the MSCI ACWI Growth benchmark's 11.7% annualized rise. And the blend norm clocked in around 8.9% annualized, just below the MSCI ACWI.

Morningstar Direct and Office clients can find the updated category classification methodology here and an FAQ here.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)