9 Value Funds Whose Performance Has Flip-Flopped

These reversals highlight the spectrum of value strategies.

As laggard value stocks have come back into favor over the past two quarters, it has given a boost to a number of struggling mutual funds with deep-value strategies. Meanwhile, funds that land in the value Morningstar Categories but tend to hold stocks with stronger earnings-growth profiles have seen their fortunes turn for the worse.

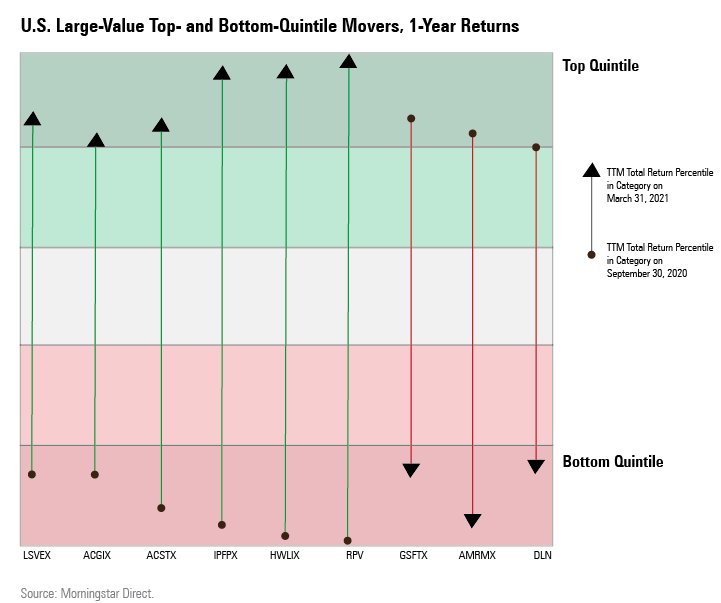

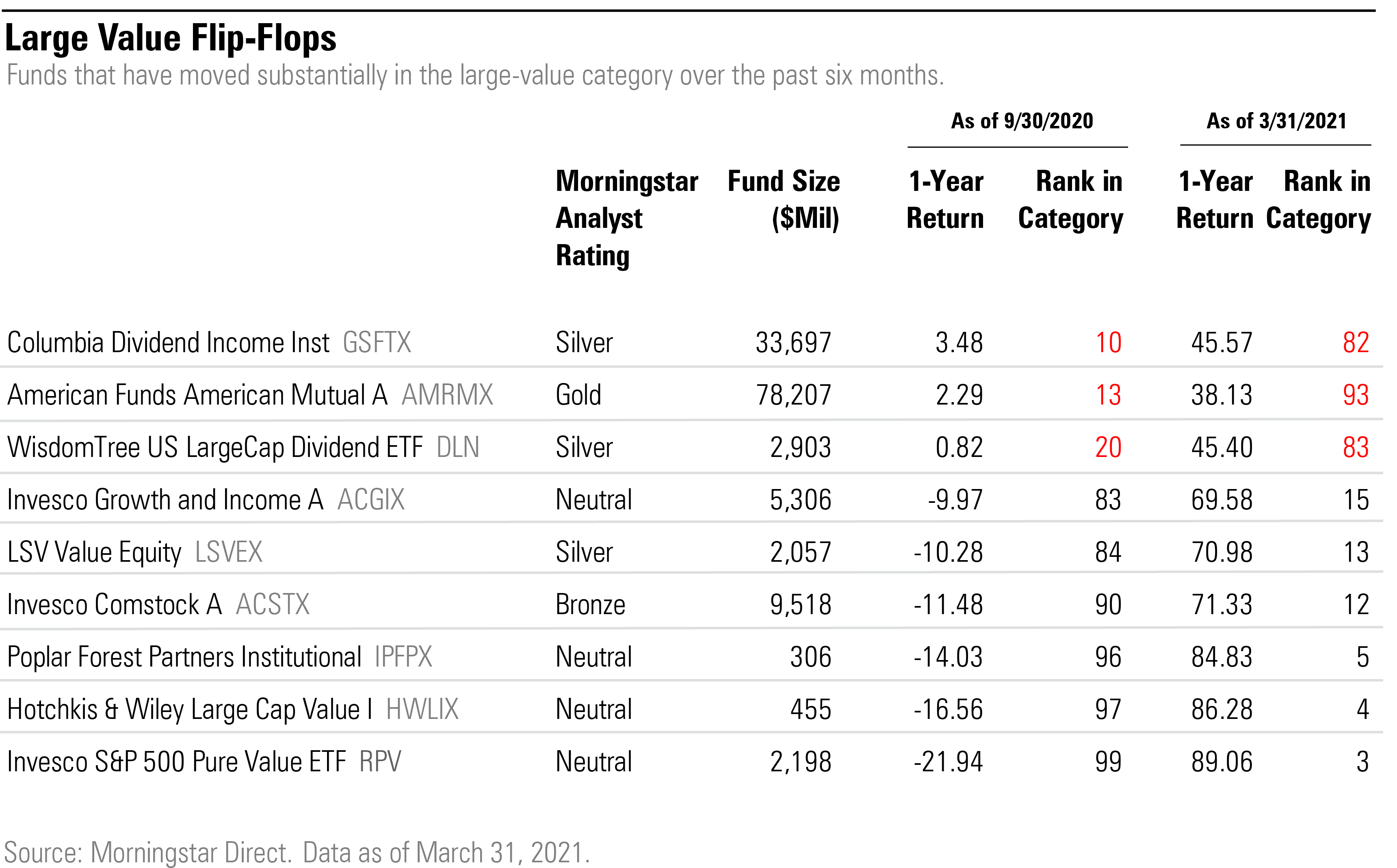

We drilled down into Morningstar's large-value category to look for funds that have had significant swings higher or lower in their category rankings. To do so, we compared funds' one-year return rankings as of Sept. 30, 2020, with their rankings six months later.

These time frames featured two distinct periods in the dynamic between value and growth stocks. From Oct. 1, 2019, through Sept. 30, 2020, we captured some of the worst performance on record for value stocks when compared with growth stocks. During this period, the Morningstar US Large Value Index declined 7.1% and was left far in the dust by the Morningstar US Large Growth Index's 40.5% return.

From October 2020 through the end of the first quarter of 2021, the Morningstar US Large Value Index returned 26%, and the Morningstar US Large Growth Index returned 8.1%.

Against this backdrop, we found six large-value funds covered by Morningstar analysts that moved up four quintiles in terms of their one-year category rankings and three analyst-covered funds that moved down four quintiles. (A full version of this article is available to Morningstar Direct and Office clients here.)

The performance flip-flops among mutual funds shouldn't come as too much of a surprise. Morningstar analysts evaluate funds over a full market cycle, so shorter-term flip-flops aren't necessarily a cause of concern; in many cases, funds' long-term rankings remain intact and their Morningstar Analyst Ratings stay unchanged. However, tracking these kinds of swings can provide helpful information about biases within funds' strategies and how these funds can fit into a portfolio.

In this case, the flip-flops highlight the spectrum of value strategies. Several deep-value funds now lead the category in terms of one-year returns.

Value Funds That Slipped

Among the spectrum of value managers, most tend to look for higher-quality companies with higher yields than the market that are trading below their intrinsic value. Those generally considered to be deep-value managers look for lower-quality, dirt-cheap stocks that may be turnaround stories or face secular headwinds and therefore may carry riskier prospects. Over much of the past decade, deep-value managers have tended to hold heavier stakes in the energy and financials sectors.

For American Funds American Mutual AMRMX, which has a Morningstar Analyst Rating of Gold, a poor six months made a dent in its long-term returns. It ranked in the top 5% of large-value funds in the early-2020 bear market, but one year later, the fund ranked in the worst 20% over a one-year period after it gained 38% compared with the category average of 57%.

Morningstar strategist Alec Lucas says the fund's dividend-focused strategy and ability to hold sizable cash and bond stakes has helped it hold up well in downturns, but the fund's defensive posture means that it often lags in market rallies.

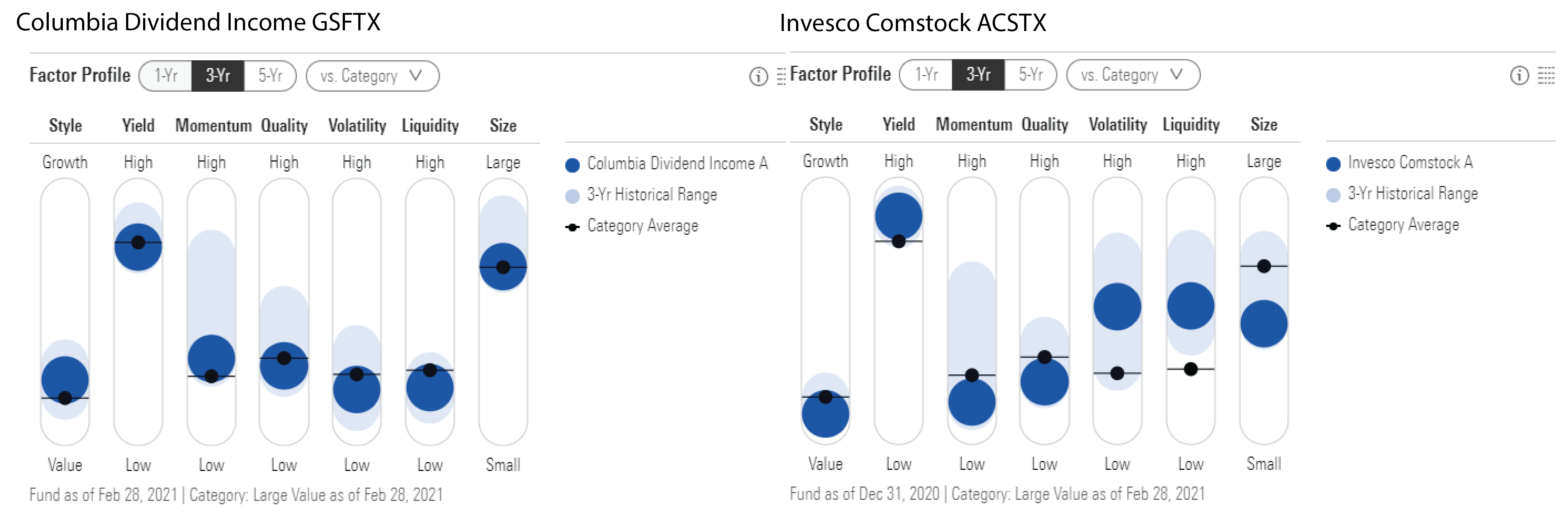

Columbia Dividend Income's GSFTX one-year return of 2.5% ranked in the top 20% of large-value funds as of September 2020. It weathered the coronavirus crash well, falling 27.0% versus the category average of 32.7%. The fund, which carries a Silver rating, performed well prior to October 2020 thanks to a defensive investment style and higher-quality portfolio, says Morningstar's associate director of U.S. equity strategies Tony Thomas. But in the rally that lifted the broad value index up 26%, the fund fell behind and ranked in the worst 20% of large-value funds over the 12 months ended March 31, 2021.

Over the long term, the fund still shines, ranking in the top quintile of large-value funds over the past three-, five-, and 10-year periods.

WisdomTree U.S. LargeCap Dividend ETF DLN also ranked in the top 20% of funds in large-value category as of Sept. 30 but recently fell to 83rd. What propelled the fund for much of the past 10-years may have been a detriment in the rally. The fund's outperformance since 2016 in part was attributed to its overweightings in the consumer defensive and healthcare sectors and underweighting in financial-services stocks.

From Worst to Best

Deep-value funds have been out of favor for a while, and the COVID-19-driven market volatility and recession put deep-value funds at the very bottom of the category, in part because of energy and financial-services stocks that suffered outsize losses relative to other sectors.

But as vaccines became available and economically sensitive stocks rallied on expectations of a recovery, deep-value funds benefited strongly.

Morningstar senior analyst Kevin McDevitt says the cyclical-driven rally was tailor-made for Hotchkis & Wiley Large Cap Value's HWLIX deep-value portfolio.

Before the value rally, Hotchkis & Wiley Large Cap Value had ranked at the bottom of the category over the trailing one, three, and five years. Its overweight positions in energy and financials led the way as oil prices bounced back and the market began to price in an economic recovery in 2020's fourth quarter.

But the turnaround spurred the fund and the past two quarters improved its 10-year rankings; the fund once ranked in the 74th percentile of large-value funds, but the strong six months pushed it to 24th.

Invesco Comstock ACSTX portfolio also made a comeback this spring. Fundholders have been rewarded as the fund has gone from the 91st percentile to the 21st in the five-year rankings.

In June 2020, Alec Lucas wrote that Poplar Forest Partners IPFPX had rebound potential under veteran manager J. Dale Harvey. He added that its underperformance could change in a hurry if deep-value stocks surge. He noted that last happened in 2016, when the institutional shares' 26.2% gain beat the index by 8.9 percentage points and placed in the large-value category's top 2%.

In fact, that's exactly what happened. In six short months, the fund went from the 96th percentile to the 5th percentile over a one-year window.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)