With Biden Tax Proposals, Charitable Strategies Rise in Importance

Charitable giving might become the best way for wealthy investors to lower their taxes.

Get Morningstar's essential reading for financial professionals in Advisor Digest.

President Joe Biden's expected proposals around increasing capital gains taxes for the wealthy could lead to big changes in tax planning strategies for those investors. If these proposals become reality, a stronger focus on charitable strategies could be the answer.

When coupled with likely proposals around the elimination of the basis step-up at death, the usual approach of deferring gains to reach long-term status or until death will no longer offer any benefits.

To illustrate the potential landscape after the proposed tax changes, let's assume the following set of facts. Terry regularly reports income of greater than $1 million per year. Terry is 65 years old and owns Apple AAPL stock worth $5 million at a cost basis of $200,000. Terry is charitably inclined and tends to donate approximately $100,000 per year. Terry wants to diversify but doesn't want to pay a huge amount of tax.

Without a basis step-up at death, Terry wouldn't get the benefit of leaving the shares to his heirs without paying taxes on them, and the heirs would not receive a benefit of the increased cost basis. Thus, choosing not to diversify could be more problematic than simply selling the stock.

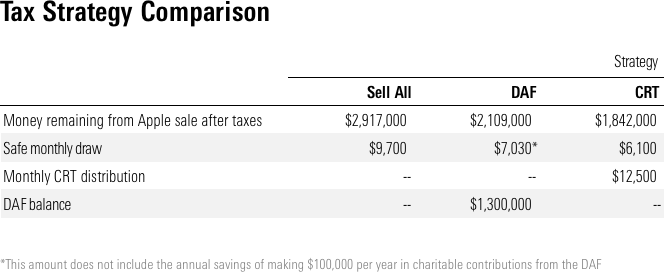

Under the expected Biden proposals, selling the stock would result in Federal tax of $2.083 million (at 43.4%), leaving less than $3 million to invest. (Note that this does not consider state tax.) Using a 4% "safe" withdrawal rate, Terry could spend about $9,700 per month from the remaining proceeds.

Donor Advised Fund

Generating tax deductions can be used to offset capital gains income. By utilizing a donor advised fund, or DAF, appreciated stock can be donated at fair market value without recognizing the accumulated appreciation as a gain. The funds produce an immediate tax deduction while the grants (donations) to charities can be spread out over future years. Annual tax deductions for contributions to DAFs cannot exceed 30% of adjusted gross income.

In the above example, let's say that Terry donates $1.3 million of Apple stock to a DAF and sells the remaining $3.7 million stock for diversification. Terry will use the DAF to make donations of $100,000 per year for at least 13 years. Since Terry's adjusted gross income is $4.7 million, the entire $1.3 million donation is deductible. The tax owed on stock diversification is now $1.591 million--a savings of almost $500,000!

This strategy works because Terry wants to donate to charity at that level in any event.

Charitable Remainder Trust

A charitable remainder trust, or CRT, can provide a huge benefit, especially for taxpayers who have a long-term charitable intent and are not too concerned about leaving all assets to heirs. With a CRT, appreciated stock is contributed at fair market value without recognizing taxable gains. Once in a CRT, the stock can be sold tax-free, and the proceeds can be diversified. The contributor gets income for life, the charity gets the principle remaining at death, and the contributor gets a tax deduction equal to the present value of the remainder interest. Let's put some numbers on this.

Let's say that Terry contributes $2.5 million of Apple stock to a CRT and sells the remaining $2.5 million for diversification. Since the annual return from a diversified portfolio is estimated at 6%, Terry sets the annual distribution percentage at 6%. Based on this, Terry will get a tax deduction of $968,000 and monthly distributions of $12,500. Since Terry's adjusted gross income is $3.5 million, the entire CRT deduction will be allowed. The tax owed on the stock diversification is now $658,000. This is a huge benefit compared with the "sell all" option.

Although the net amount of stock remaining is lower when implementing charitable strategies, the monthly cash distribution is much greater. With extra cash flow of $68,000 per year under the DAF scenario, not considering discount rates and taxes, break-even would occur after 12 years. The extra cash flow of over $106,000 per year under the CRT scenario would result in break-even after 10 years. Assuming Terry's life span will be longer than 75-77 years, the charitable strategies will save money during Terry's lifetime and more will be available to heirs.

Conclusion

The proposed tax changes could be quite severe for high-income taxpayers. Many of the usual methods for lowering taxes will no longer apply, such as gains deferral and basis step-up. Although some benefits may be derived from tax-loss harvesting and Roth conversions, charitable strategies might become more important than ever.

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and founder of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively work in the advisory business. Morningstar acquired her Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar or of Rowling & Associates LLC.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UWZH3VLHBVCIDP2ANJ73YKE4QA.png)