Best Stocks for the 5G and Cloud Infrastructure Boom

What to look for and what to avoid in this area.

This is an updated version of an article that originally published on April 26, 2021.

5G wireless Internet made its debut today, with Verizon VZ and AT&T T offering service to much of the United States. The real benefits, Morningstar analysts believe, will go to makers of the underlying technology--such as cloud infrastructure company Ericsson ERIC and chipmaker Intel INTC--not the cell service providers making that technology widely available.

For most of us, "5G" just means an upgraded phone and slightly faster Internet, and "the cloud" is an ethereal place where most of our information gets stored. But digital infrastructure, and investing in it, is more complicated than that.

Technology of the future--self-driving cars en masse, robotic farming technology, social-media eyeglasses--is simply not possible without developments in both 5G and a subset of cloud computing known as infrastructure as a service, or IaaS.

Many publicly traded companies claim that they will benefit substantially as the world's digital infrastructure evolves thanks to 5G connectivity and new developments in IaaS. But the list of companies that will enjoy meaningful economic benefits is smaller than many investors might expect. At the same time, some companies will see their fortunes suffer amid the proliferation of these technologies. Therefore, investors must sort the reality from the hype.

Taking a closer look is important, as benefits could be significant for those companies that do offer meaningful exposure to these themes. Both 5G and cloud infrastructure technology are in their nascent stages and growing fast.

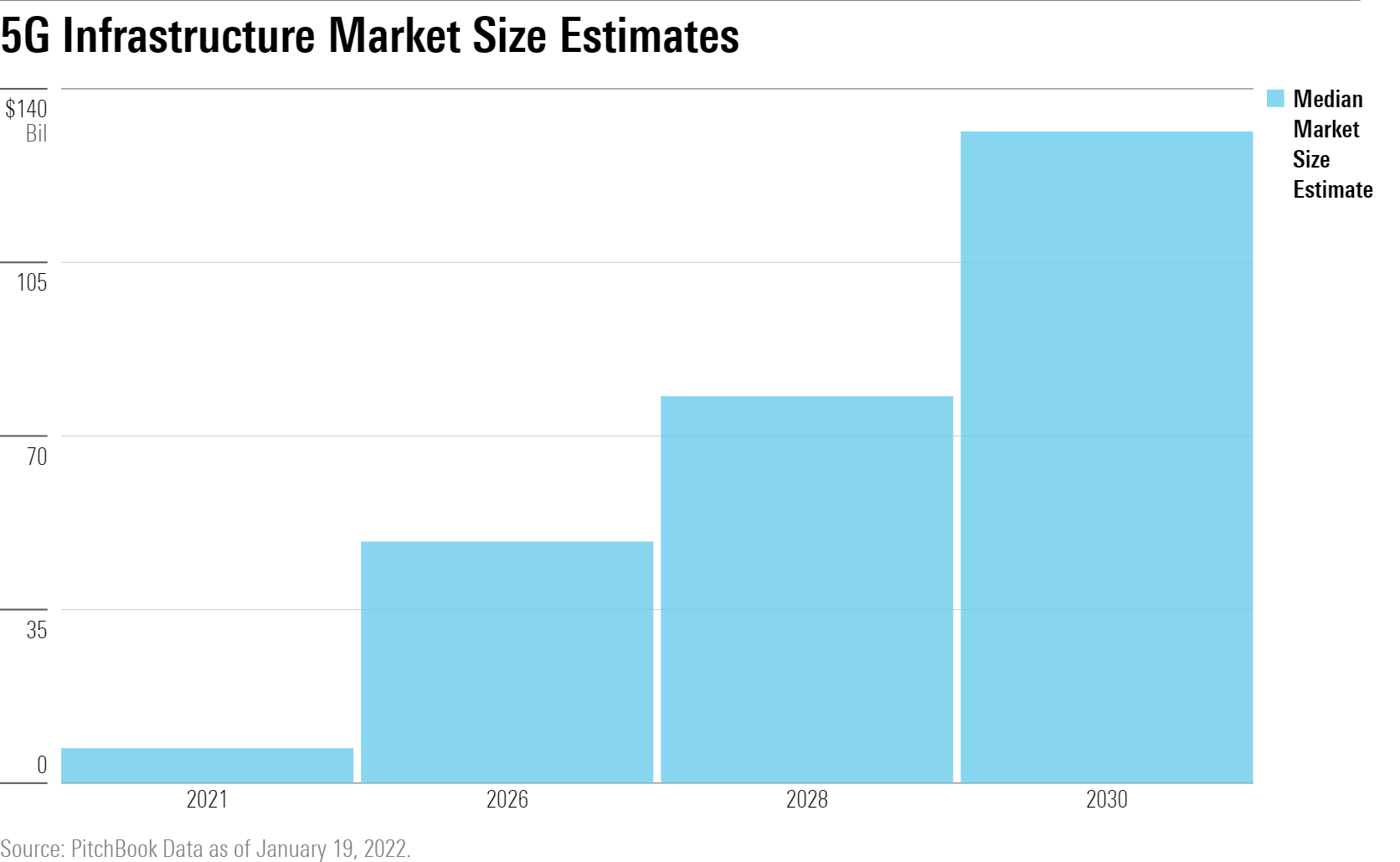

Market size projections shed light on the growth potential of these trends. PitchBook Data estimates that the total market value of the 5G infrastructure vertical could reach $130 billion by 2030 from over $7 billion today.

Searching for the Potential Winners

With such high growth, there is great potential for investors to capitalize on digital infrastructure advances enabled by both 5G and cloud. To find the winners, investors must first understand exactly what digital infrastructure encompasses:

- 5G technology provides next-generation wireless connectivity. It can reach speeds over 100 times faster than current 4G-enabled networks and allow for the use of millions of devices simultaneously.

- IaaS is essentially the infrastructure behind the cloud. It is the leasing of web servers, storage, and network access. IaaS is the backbone that allows every cloud-based website, app, or service to live on the web. Because IaaS is highly specific and complex, most software companies and web products source their cloud infrastructure from IaaS providers.

Companies that provide 5G connectivity and IaaS are most likely to enjoy significant economic benefits as the underlying technologies gain adoption. Firms with high exposure to the 5G theme either sell processing and networking hardware or provide 5G data services. Firms with high exposure to cloud infrastructure either rent out server capacity or directly support cloud vendors. Additionally, we only qualify a company as having meaningful exposure to these themes if the exposure will increase the company's net profits rather than simply displace existing profits.

We can look to the Morningstar Global Digital Infrastructure and Connectivity Index for examples of companies that fit these descriptions. To be included in this index, Morningstar's equity analysts must believe the firm will generate a substantial portion of revenue from either theme. Importantly, this list of stocks does not include downstream adopters of these technologies, only the firms that develop and provide them.

Ways to Play the 5G/IaaS Themes

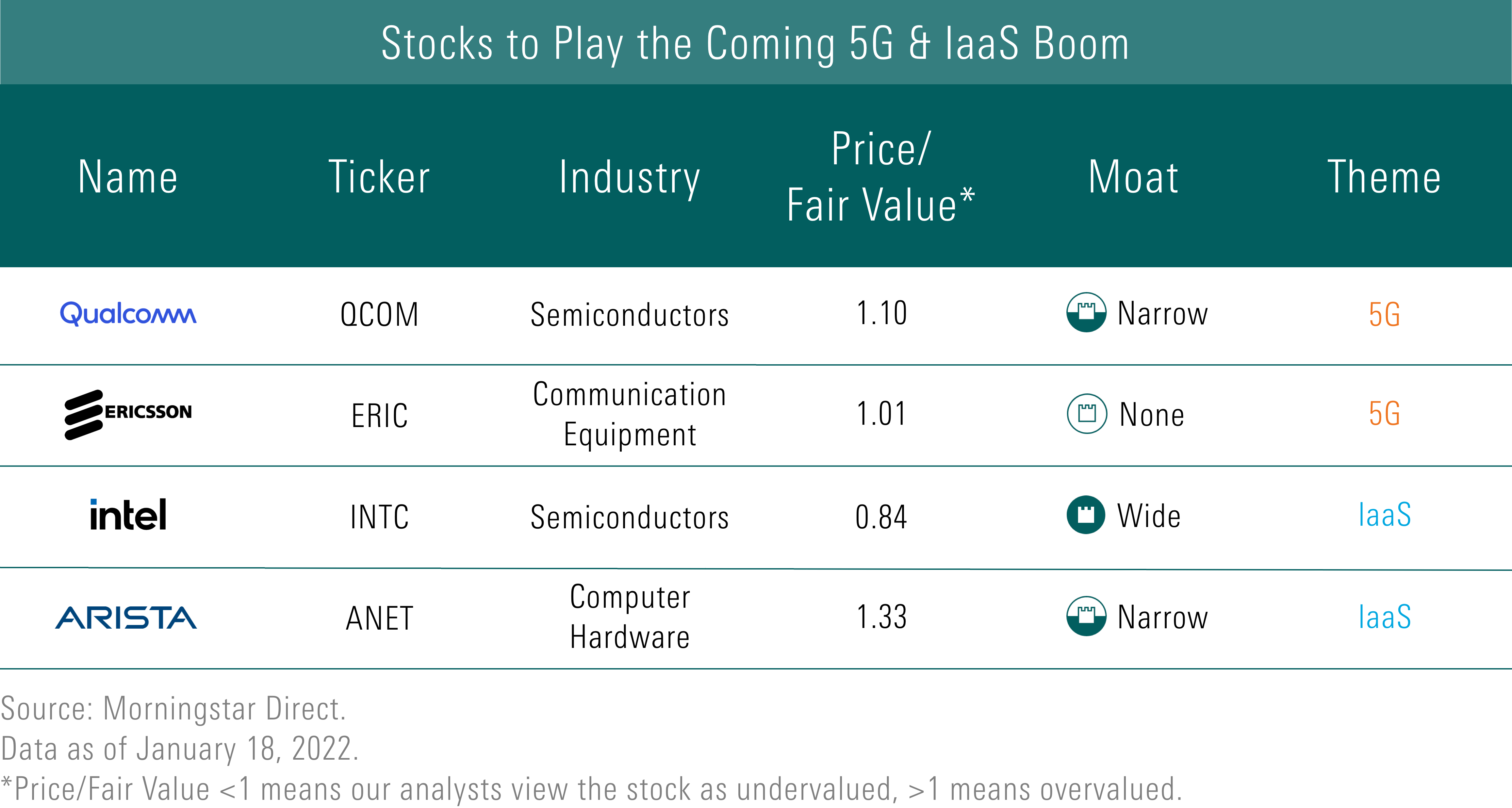

Morningstar research indicates that the following companies offer meaningful exposure to these themes. We note that their inclusion in the Morningstar Global Digital Infrastructure and Connectivity Index is based solely on the degree of thematic exposure they provide rather than any considerations relating to valuation.

Qualcomm Qualcomm QCOM licenses wireless network technology and designs chips for smartphones. Virtually all wireless devicemakers use Qualcomm's intellectual property. Qualcomm is on the forefront in 5G network development and is developing enough IP to ensure that it will collect 5G royalties well into the future.

Ericsson Ericsson provides hardware and software to companies in the communication-services sector (such as telecom and electronic media companies). Senior equity analyst Mark Cash expects Ericsson to benefit as 5G networks require dense arrays of small-cell antennas to achieve the fastest wireless network speeds.

Intel Intel is the world's largest chipmaker. It designs and manufactures server chips for PCs and data centers across the globe. Intel maintains a scaling advantage from its higher-than-peer-average research and development budget, which allows it to better control every step of the chip design and manufacturing process. As cloud computing grows, the firm's data center and server processing businesses will benefit.

Arista Arista Networks ANET supplies software and hardware that powers networks for hyperscale cloud data centers, service providers, and large enterprises. Arista is a key player in data center networking and achieves its narrow Morningstar Economic Moat Rating through its software prowess and co-developed customer solutions. Morningstar believes that Arista is well-positioned as networks transition to faster speeds and densify.

5G/IaaS Also-Rans

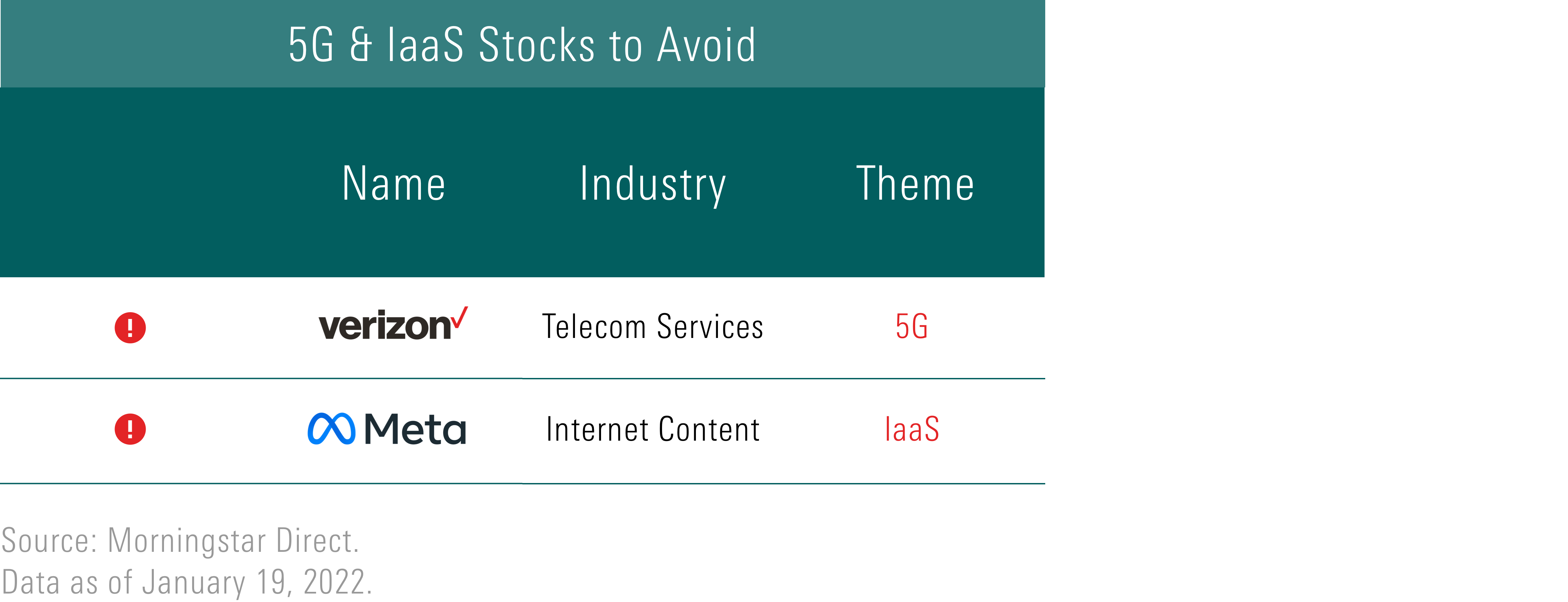

Many household names in the communication-services sector are often associated with 5G and cloud infrastructure, but Morningstar research suggests they ultimately won't be notable beneficiaries of the boom. A few examples:

Verizon Communications (excluded from 5G) Although telecommunication firms like Verizon play a role in providing 5G connectivity to end users, they will not benefit substantially from the shift to 5G. Morningstar analyst Michael Hodel, CFA, states: "In what we expect to be a repeat of the experience with 4G, wireless carriers will not be the companies to extract greater profits from these more advanced networks. Competition has restrained pricing power for them." For companies like Verizon, any profits from updated digital infrastructure will do little more than displace existing profits from 4G and current cloud technologies.

Meta Platforms (excluded from Cloud) Meta Platforms FB, formerly Facebook, offers great expertise in running large data centers. However, the firm is not an actual provider of cloud infrastructure solutions. Virtually all of its revenue comes from advertising.

Telecoms like Verizon and data/content firms like Meta Platforms both behave more like users of 5G and cloud tech than providers. Investors who seek to profit from these themes must note the distinction.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)