How Many Stocks Beat the Indexes?

Unlike the children of Lake Wobegon, most companies are below average.

The Challenge

In 2018, the Journal of Financial Economics published the provocatively titled paper, "Do Stocks Outperform Treasury Bills?", by Arizona State's Hendrik Bessembinder. His answer: "Yes and No." Of course, the U.S. stock-market indexes had outgained cash; any Vanguard 500 Index VFINX shareholder could tell you that. But those gains owed largely to relatively few winners.

That paper received renewed attention earlier this year, when a Scottish firm cited Bessembinder's research to justify its investment approach, and was promptly denounced in the Financial Times for having crooned a "song for fools." (Colorful critics, those Brits.) The Financial Times' rebuttal also downplayed Bessembinder's results, accusing the author of having overstated his case for dramatic effect.

This column will stick to addressing the facts, not the portfolio debate. Is it true, as I believed when I first encountered Bessembinder's work, that most equities have returned less than have Treasury bills? Also, to what extent do the market’s higher-performing stocks drive the results of the indexes?

Most Stocks Fail, Revisited

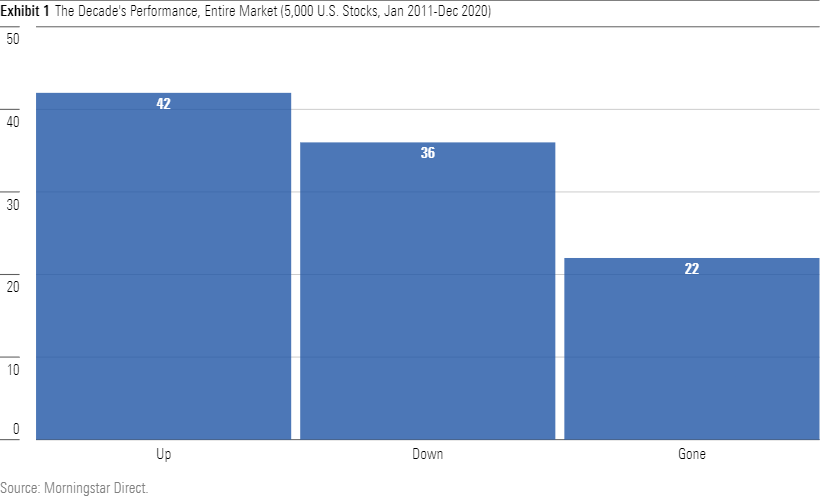

To respond to these questions, I updated Bessembinder’s findings by evaluating the results of publicly traded U.S. equities over the most recent decade, beginning in January 2011 and concluding in December 2020. The chart below shows the percentage of the 5,000 biggest U.S. stocks (as of January 2011) that: 1) ended the 10 years with a gain, 2) recorded a loss, or 3) disappeared from existence.

The numbers clearly support Bessembinder’s argument. Although the Morningstar U.S. Stock Index enjoyed a 13.90% annualized gain for the decade, only 42% of individual equities finished in the black. Nearly as many (36%) posted 10-year losses. The final 22% vanished. While I did not investigate the fates of the dead, Bessembinder’s research suggests that half the expired stocks were acquired, with decent results, while the other half were delisted, with dire consequences.

Even during a decade marked by an almost uninterrupted bull market, the average stock wasn’t much good.

Separating the Fish

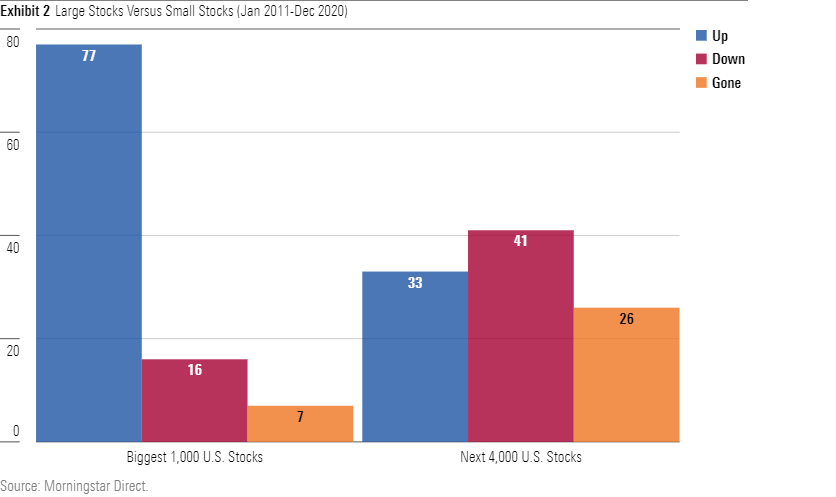

Then again, Amazon.com AMZN, Microsoft MSFT, and ExxonMobil XOM aren’t average companies. Although he didn’t dwell on the point, Bessembinder’s paper showed that larger companies were significantly more reliable than their smaller rivals. The major firms were not only likelier to survive, but also likelier to profit when they did persist. To test whether this pattern held through the 2010s, I separated the stock data into two groups: 1) the biggest 1,000 stocks, and 2) the next 4,000.

The larger companies were far more reliable than their smaller rivals. Whereas 42% of the overall stock universe persisted for the full decade and posted a positive total return, 77% of the biggest 1,000 companies did so. Conversely, once the larger fish had been removed from the list, the success ratio of the next 4,000 stocks dropped to just 33%. Even though the decade contained a prolonged bull market, most smaller stocks recorded a loss, not a gain.

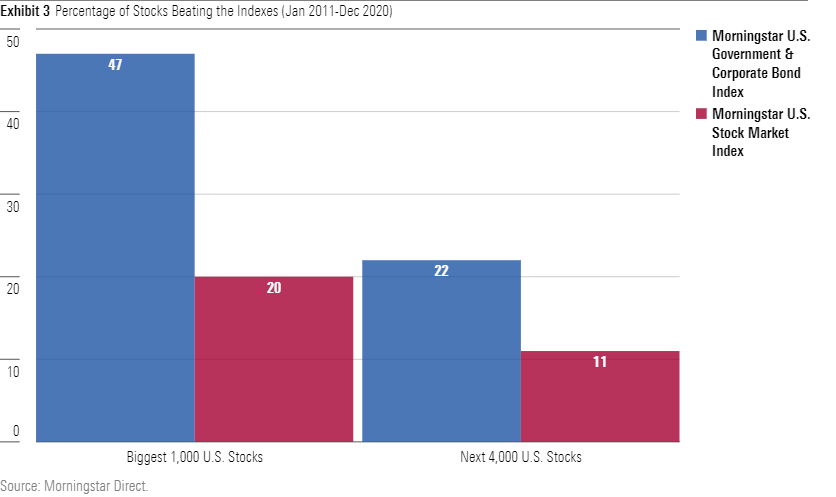

Another way of measuring the size difference is to calculate not how many stocks recorded gains, or beat Treasury bills (which yielded so little that they returned almost nothing), but instead how many outdid meaningful benchmarks. One such benchmark is The Morningstar U.S. Government & Corporate Bond Index; another is the previously mentioned Morningstar U.S. Stock Index. That test’s results appear below.

Once again, the disparity between the size groups is apparent. A randomly chosen company from the biggest 1,000 list was more than twice as likely to survive the period and surpass the bond index than was a stock picked from the next 4,000. The precept that most stocks disappoint applied much more to secondary stocks than to larger organizations.

That said, even the biggest 1,000’s results weren’t sterling. Although equities thrashed bonds for the decade, by the whopping cumulative margin of 267% to 49%, only half of the biggest 1,000 stocks beat the bond index. Against the stock index, their winning percentage plummeted to just 20%. In other words, four out of five large U.S. stocks trailed their own performance benchmark.

Shrinking the list from the biggest 1,000 to the Nifty Fifty doesn’t greatly change that conclusion. To be sure, evaluating only the truly huge companies boosts the result against bonds, as 76% of January 2011’s 50 largest stocks subsequently outgained the bond index, as opposed to the biggest 1,000’s score of 47%. But the outcome against the stock index remained steady. With the Nifty Fifty, as with the broader group, four out of five firms trailed the stock-market benchmark.

Top Contributors

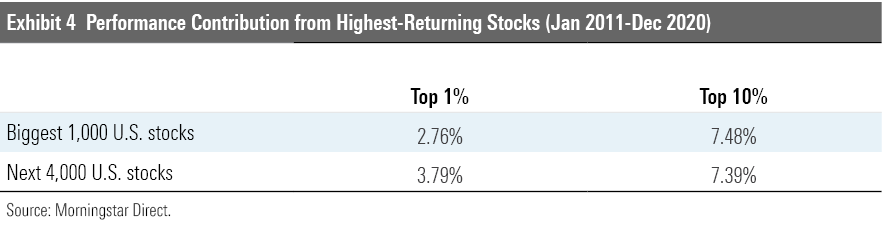

Bessembinder’s boldest claim was that 4% of the U.S. stock market’s companies accounted for its entire gains. Such math does not hold during bull markets. (If an index appreciated by 1% for the year, a single stock could well be said to have accounted for all its gains. If the index appreciated by 30%, then many, many stocks will be required for the task.) However, as shown by the following table, which measures the performance contributions of the highest-performing stocks, the principle remains intact.

To clarify what the numbers signify: The calculations assume an equal-weighted portfolio, then compute the total return generated by the given percentage of highest-performing stocks. Thus, had one formed an equal-weighted portfolio of the biggest 1,000 stocks in January 2011, and held those securities without rebalancing, the 10 best stocks (the column labeled “Top 1%”) would have delivered 2.76% of total return.

If the remaining 990 stocks did absolutely nothing--metaphorically stored under the mattress--the index would have gained 2.76% per year over the decade. Similarly, the biggest 1,000 stock portfolio would have realized an annualized gain of 7.48% from its 100 best stocks ("Top 10%").

Next Tuesday’s column will discuss the implications of this behavior. For now, suffice it to say that Bessembinder’s research remains valid. His conclusion that most stocks disappoint cannot be disputed.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)