Emerging-Markets Sovereign Bonds: A Risk Worth Taking?

Their yields are certainly compelling in this low-rate environment.

A version of this article previously appeared in the January 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

With bond yields at or near historic lows, fixed-income investors face a choice between more risk and lower expected returns. But yields in even the riskiest sectors of the bond market are paltry by historical standards, and it is unlikely that they offer sufficient compensation for the risk they court.

Emerging-markets bonds are a prime example. This sector has attracted investors’ capital as interest rates have trended lower. Exchange-traded funds belonging to the emerging-markets bond and emerging-markets local-currency bond Morningstar Categories have seen combined inflows in nine of the past 10 calendar years, amassing $29.4 billion in net inflows over that span.

U.S.-dollar-denominated emerging-markets sovereign bonds currently offer higher yields relative to investment-grade U.S. fare. For example, as of Jan. 7, 2021, the SEC yield on iShares JPMorgan USD Emerging Markets Bond ETF EMB was 3.48% versus 1.14% for iShares Core U.S. Aggregate Bond ETF AGG. While this spread in yields is significant in the current low-rate environment, it is difficult to say that it adequately captures the very different credit profiles of the two sectors. Are investors in emerging-markets debt being paid fairly for the risks they’re taking?

Background on Emerging-Markets Bonds

Bonds issued by emerging-markets governments carry additional credit risk relative to developed-markets sovereign bonds because there is an increased amount of uncertainty surrounding their ability to honor their obligations. The uncertainty is driven by numerous factors, including the ability of the state to extract funds from its populace and to manage its finances responsibly (especially from the perspective of an international investor). At the risk of stating the obvious, U.S. Treasuries contain less risk and offer a smaller yield relative to Argentine and Lebanese sovereign debt.

Bonds issued by sovereign states are denominated either in their own currency or in the currency of a developed market (usually U.S. dollars). This creates two distinct subsectors within emerging-markets bonds. Local-currency bonds are denominated in the issuing country’s own currency, while hard-currency bonds are typically denominated in U.S. dollars.

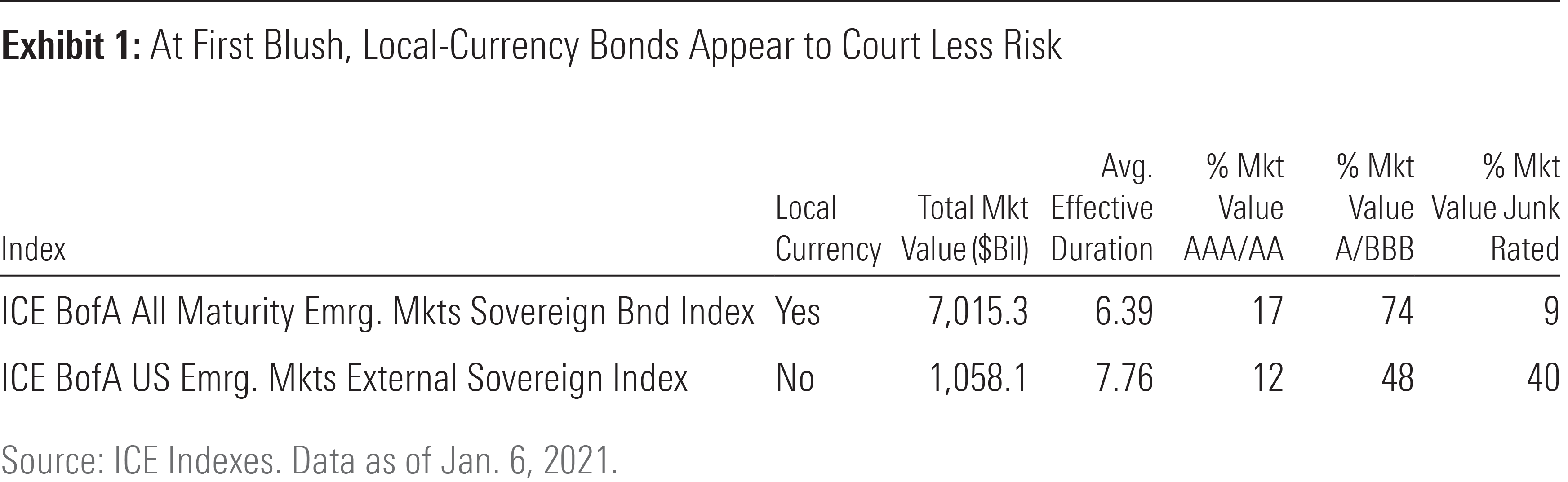

The market for local-currency emerging-markets sovereign bonds is much larger than the hard-currency market. As of the beginning of mid-April 2021, the market for local-currency bonds (as proxied by the ICE Bank of America All Maturity Emerging Markets Sovereign Bond Index) was nearly 7 times larger than the hard-currency market (proxied by the ICE Bank of America U.S. Emerging Markets External Sovereign Index). And, as evidenced in Exhibit 1, the local-currency market also courted much less credit risk.

Currency and Credit Risk

Currency risk is the fault line between local- and hard-currency exposure. Currency fluctuations are the primary performance driver for the local-currency market. As a result, it is better suited for expressing a view on the strength of the U.S. dollar. Hard-currency bonds are better suited for taking a view on credit spreads.

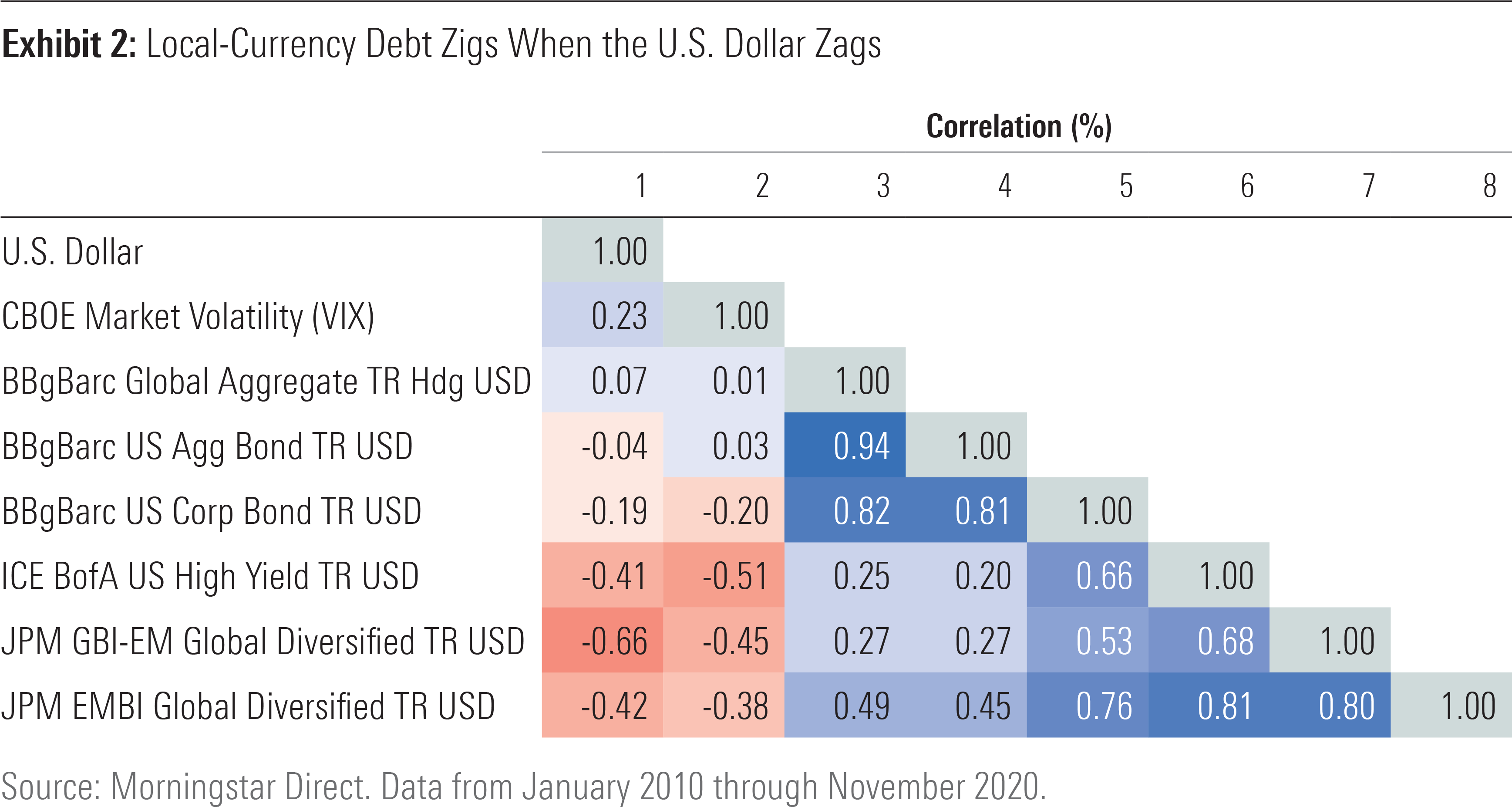

Research by State Street Global Advisors [1] showed that currency exposure accounted for 70% of the volatility Barclays Bloomberg Emerging Markets Local Currency Liquid Index experienced between 2010 and 2019. And as seen in Exhibit 2, the performance of the U.S. dollar has shown a strong negative correlation to the JPMorgan GBI-EM Global Diversified Index, the emerging-markets local-currency bond category benchmark.

Also depicted in Exhibit 2 are the category indexes for the USD world bond (row 3), intermediate core bond (row 4), U.S. corporate bond (row 5), and U.S. high-yield bond (row 6) categories. Taken together, these categories represent the bulk of the taxable-bond market, and thus, most of investors’ fixed-income allocations. The performance of the hard-currency category index (row 8) showed the strongest positive correlation to the high-yield bond market.

A Decade of Disappointment

Exhibit 3 contains performance metrics for the category indexes featured in Exhibit 2, spanning the trailing 10 years to April 2021. In a decade that rewarded both traditional pillars of fixed-income performance, credit risk and interest-rate risk exposure, emerging-markets sovereign debt lagged. The hard- and local-currency category indexes had the lowest Sharpe ratios, the highest standard deviations, and largest drawdowns over the past decade.

Tough Tracking

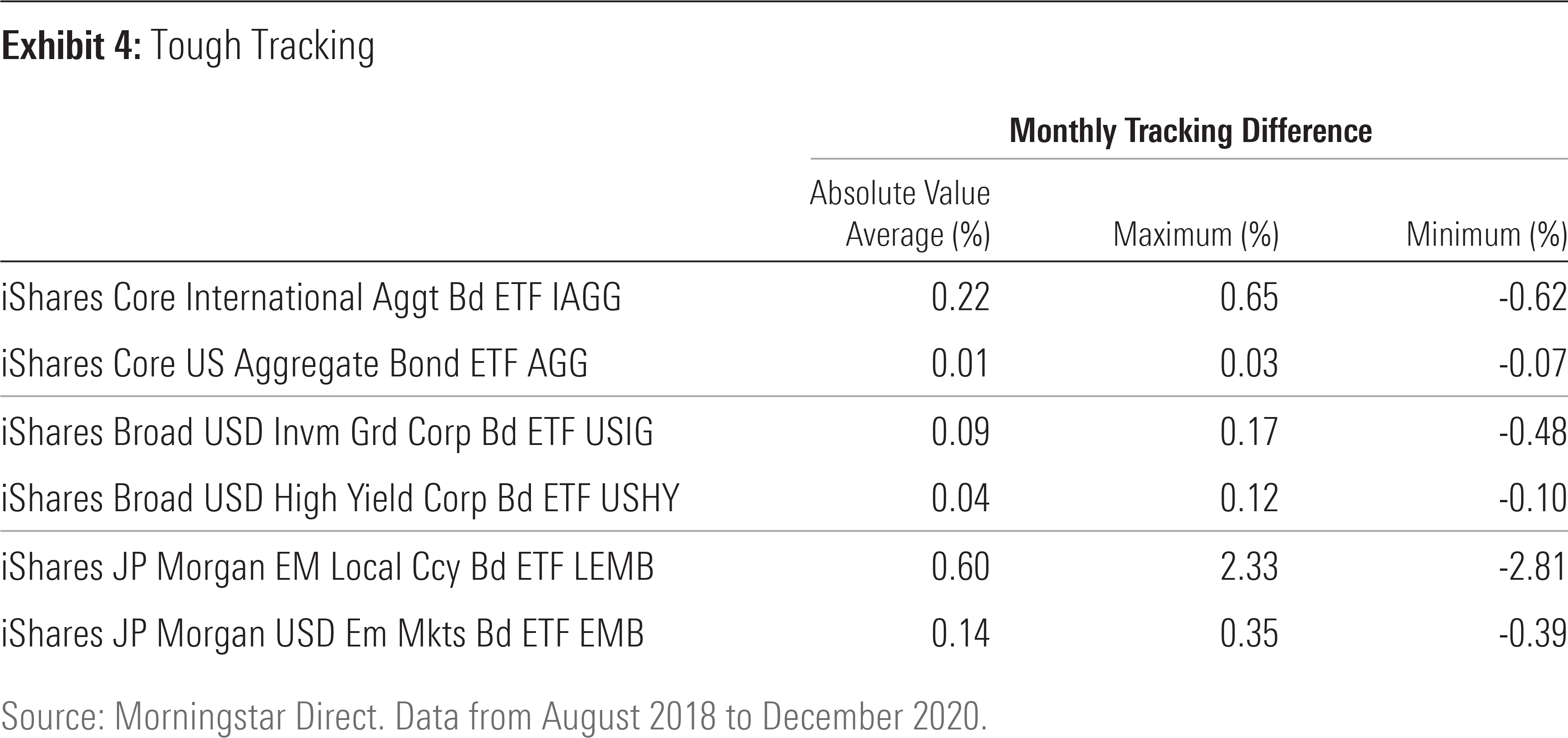

Unlike index funds and ETFs targeting larger, more-liquid markets, tight index tracking is not a given with emerging-markets sovereign debt index-trackers.

Exhibit 4 speaks to the difficulties emerging-markets bond ETFs have hewing closely to their bogies. It depicts the absolute value of the average monthly tracking difference, the maximum monthly tracking difference, and the minimum monthly tracking difference for a variety of ETFs representing the major fixed-income sectors from August 2018 (when iShares Broad USD Investment Grade Corporate Bond ETF USIG began tracking its current benchmark) through March 2021. Each of these ETFs is backed by the same team, so aside from differences in fees, the differences in their tracking performance can be attributed to the challenges and costs involved in replicating their benchmarks.

Indexing emerging-markets bonds is difficult because it requires buying and selling large volumes of relatively illiquid bonds in markets lacking the volume of active price discovery enjoyed in larger, more liquid markets (such as the U.S. investment-grade market).

Definitions May Vary

Much as is the case with emerging-markets stock indexes, index providers’ definitions as to which markets are emerging varies. And as is the case with equity benchmarks, which side of the emerging/ developed divide South Korea lands on can have meaningful implications for the makeup of the index. Per ICE, South Korea qualifies as an emerging market. The nation’s sovereign debt carries a AA credit rating and it is the third-largest issuer in ICE’s local-currency index, accounting for 10% of its total market value as of January 2021. South Korea is also included in the local-currency indexes backed by Bloomberg Barclays and MSCI. It is excluded from local-currency indexes sponsored by S&P Dow Jones and JPMorgan.

Given South Korea’s prominence in some of these indexes and its relatively higher credit rating, the credit complexion of these benchmarks is materially different. Accordingly, strategies that seek to provide market-value-weighted exposure to the local-currency market will provide materially different outcomes depending on how the sponsoring index provider defines an emerging market.

As of April 2021, three ETFs offer market-value-weighted exposure to the local-currency market; two ETFs, iShares JPMorgan Emerging Market Local Currency Bond ETF LEMB and VanEck Vectors JPMorgan Emerging Market Local Currency Bond ETF EMLC, track JPMorgan indexes, while the third, SPDR Bloomberg Barclays Emerging Market Local Currency Bond ETF EBND, tracks a Bloomberg Barclays index.

Unsurprisingly, EBND performed much better than either LEMB or EMLC during the period from November 2011 through December 2020, the oldest common inception date for the strategies. EBND outgained both JPMorgan-index-tracking ETF counterparts by nearly 2.5 times with slightly less volatility. Consequently, EBND’s Sharpe ratio was nearly 3 times larger than either LEMB or EMLC’s during that period.

Wrapping Up

The fork in the emerging-markets debt market can lead investors on two very different journeys. Local-currency bonds are basically a dollar bet, while hard-currency bonds are a means of expressing views on credit.

But regardless of route, the destination is unlikely to be a desirable one considering the traditional role of a bond fund within a diversified portfolio. Even in the current low-interest-rate environment, the return investors reap isn’t likely to be commensurate with the risk. And these markets’ correlation with stocks diminishes their appeal as a diversifier of equity risk.

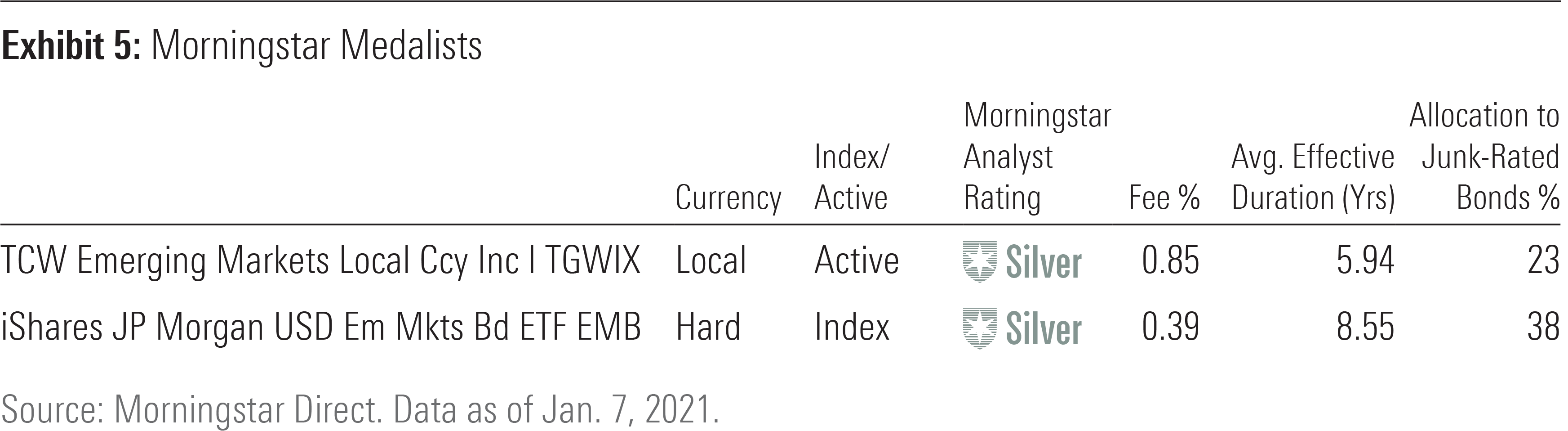

For those considering an allocation to emerging-markets debt, Exhibit 5 features our highest-rated strategies in the local hard-currency markets.

For local-currency exposure, TCW Emerging Markets Local Currency Income TGWIX, which earns a Morningstar Analyst Rating of Silver, is an actively managed fund that benefits from an experienced and well-equipped team that employs a flexible process focused on managing downside risk. For hard-currency exposure, category peers have found it difficult to best EMB over the long term. Aided by its low annual fee and boasting a broadly diversified portfolio, this market-value-weighted strategy minimizes exposure to the riskiest issuers, a sensible approach in this risky market.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)