With Specialty Funds, Bigger Has Been Better

The leading funds have compensated for the group’s overall struggles

At First Glance

I have long distrusted specialized equity funds, which emphasize a single industry or investment theme. Such funds tend to be launched by marketing departments, rather than by portfolio managers. In the words of Morningstar’s Ben Johnson, companies that offer specialty funds can relate “differentiated narratives.”

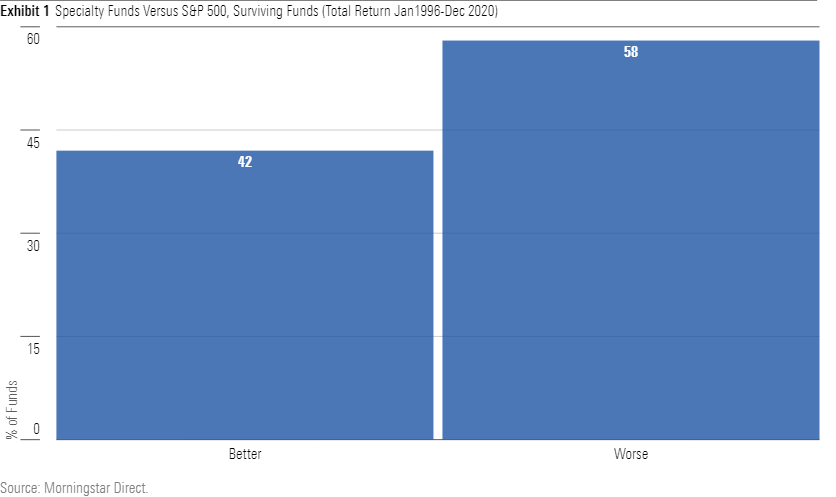

Regrettably, investors can’t spend differentiated narratives. We will therefore evaluate specialty funds not by the elegance of their promises, but instead by their performance records. At first glance, the results look respectable. The chart below shows the percentage of specialty funds that outgained Vanguard 500 Index VFINX for the 25 years from January 1996 through December 2020.

Not bad at all. True, investors would have faced better odds, as well as a simpler decision, by buying the nation’s largest index fund. (Vanguard 500 Index has since lost that honor to the Vanguard Total Stock Market Index VSMPX, which holds 3,000 additional positions but behaves similarly.) However, the S&P 500 has been among the world’s great investments over the past 25 years. That specialty funds even gave the index a battle is to their credit.

Staying Alive (or Not)

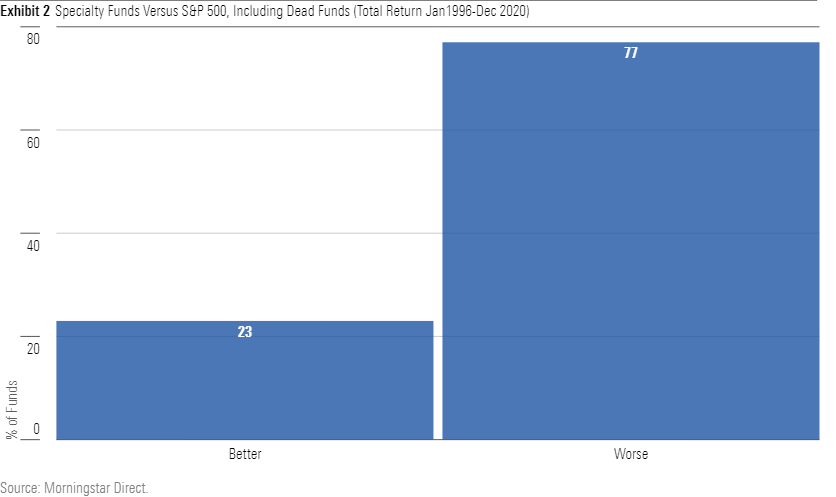

There is, however, a major catch. While Vanguard 500 Index continues to operate, nearly half the specialty funds that existed in 1996 have since shut their doors. Most expiring funds were merged into siblings, while some liquidated, returning their assets to shareholders. Either way, their results vanished from the trailing 25-year average, which can be calculated only on the funds that survived. The initial chart therefore overstates specialty funds’ achievement.

Placing the terminated funds into the "Worse" bucket--a more-than-reasonable assumption, given that fund companies rarely eliminate high performers--dramatically changes the narrative. Instead of losing the contest narrowly, specialty funds become crushed by Vanguard 500 Index, which posted higher returns than 77% of its specialty-fund rivals.

Incorporating Risk

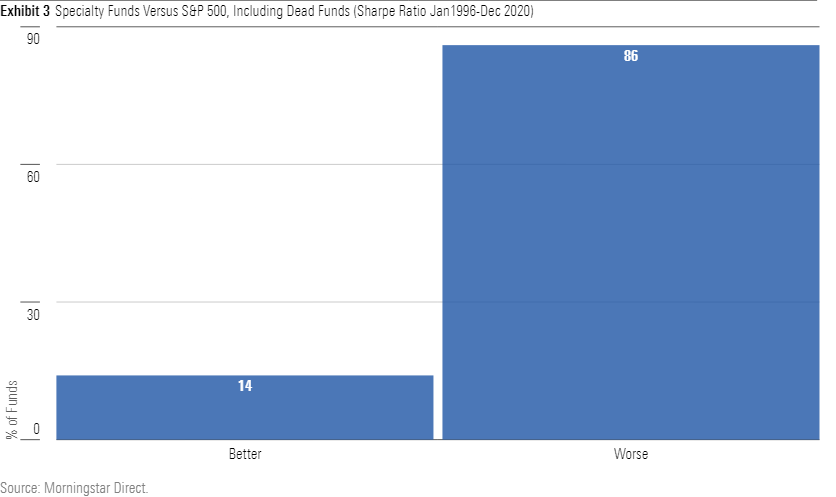

So far, I have evaluated returns only. I should also consider risk. While many specialty funds, such as those investing in technology, are more volatile than the overall stock market, others hope to offer a steadier ride. Among those are utilities and real estate funds. It is not surprising that such funds might trail during a long bull market. But perhaps their risk/reward profiles are superior.

That doesn't happen often, as it turns out. When the second chart substitutes a standard risk-return measure, the Sharpe ratio, for total returns, the results decline further. Now only 14% of specialty funds best the index.

Admittedly, this analysis is incomplete. What ultimately matters for investors is not how a fund performs when standing alone, but how it complements a portfolio. If specialty funds are sufficiently uncorrelated with an investor’s other holdings--or, better yet, negatively correlated, so that the specialty fund tends to rise when the portfolio otherwise falls--they can justify their existence, even if their Sharpe ratios are relatively weak.

Addressing that topic is beyond the scope of this column. However, the results would not change the conclusion. Although 10% of specialty funds invest in the precious-metals industry, which potentially can diversify portfolios, the remaining funds are largely correlated with the overall stock market. Owning a healthcare or communications or energy fund is unlikely to be helpful when equities crash.

More Is More

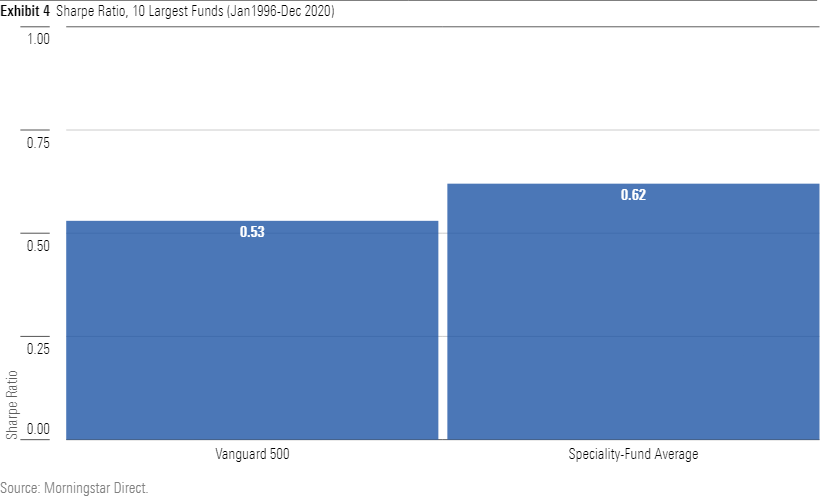

Fortunately for shareholder monies, the biggest specialty funds were the exception to the general rule. Of the 10 largest specialty funds on Jan. 1, 1996, four subsequently posted higher Sharpe ratios than did Vanguard 500 Index, four recorded lower ratios, and one matched the index fund. (Only one fund, AIM Global Science and Technology, folded before the period ended.) The average Sharpe ratio for those nine specialty funds beat that of the index.

The sample size here is modest, of course. One hesitates to draw lessons from the experience of a handful of funds, even if the analysis extends for 25 years. However, the analysis is consistent with other industry evidence, which suggests that the major funds (and fund companies) generally avoid pitfalls. They don’t always outdo the averages, but they rarely suffer disasters.

For example, of the 20 largest mutual funds from January 1996 (among all types, not just specialty funds), 18 remain in existence today. In contrast, the industry’s overall survival rate is a mere 40%. Moreover, five of those largest funds currently possess 5-star Morningstar Ratings, while none are rated at 1-star. Across the full fund universe, the percentage of funds that receive 5- and 1-star ratings is equal.

Indeed, one must count down to the 33rd biggest fund of 1996 to find an investment (Templeton Growth TEPLX) that is now rated at 1-star, by which point eight previously larger funds claim current 5-star ratings. As the star ratings are assigned solely based on the most recent 10 years’ performances, their verdicts are independent. They are not influenced by the funds’ pre-1996 results.

The pattern holds across investment types. Among taxable-bond funds, 10 funds off the 1996 asset leaders’ list receive 5-star ratings before the first 1-star fund is encountered. Within allocation funds, there are nine 5-star funds before the initial 1-star entrant, and within international-equity funds there are 12 5-star funds. With enough repetition, the anecdotal evidence eventually becomes meaningful.

Conclusion

There aren’t many strong arguments for specialty funds. For those who wish to speculate, buying individual stocks will yield higher potential profits. Specialty funds don't hold much appeal for long-term investors either. If one is to bet on industry fortunes, why not delegate the task to professional managers? It is, after all, their day job.

If one is to dabble, however, best to do so while using the largest specialty funds. As a group, they are both safer and better.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)