Does International-Stock Diversification Still Work?

Correlations have trended up, but there's still a long-term argument for international diversification.

Adding international exposure is one of the first steps toward a diversified portfolio. Even minimalist investors usually carve out a portion of their portfolios for non-U.S. stocks after adding exposure to domestic stocks and bonds. International stocks are subject to myriad factors that can lead to divergent performance, including local market conditions, currency movements, exposure to different sectors and industries, and political and economic factors. These traits mean they often show different performance patterns--both relative to the U.S. market and versus other international markets.

However, in our recent examination of asset-class correlations, the "2021 Diversification Landscape," we found that the benefits of international diversification can be surprisingly elusive.

2020 Correlations: International Stocks

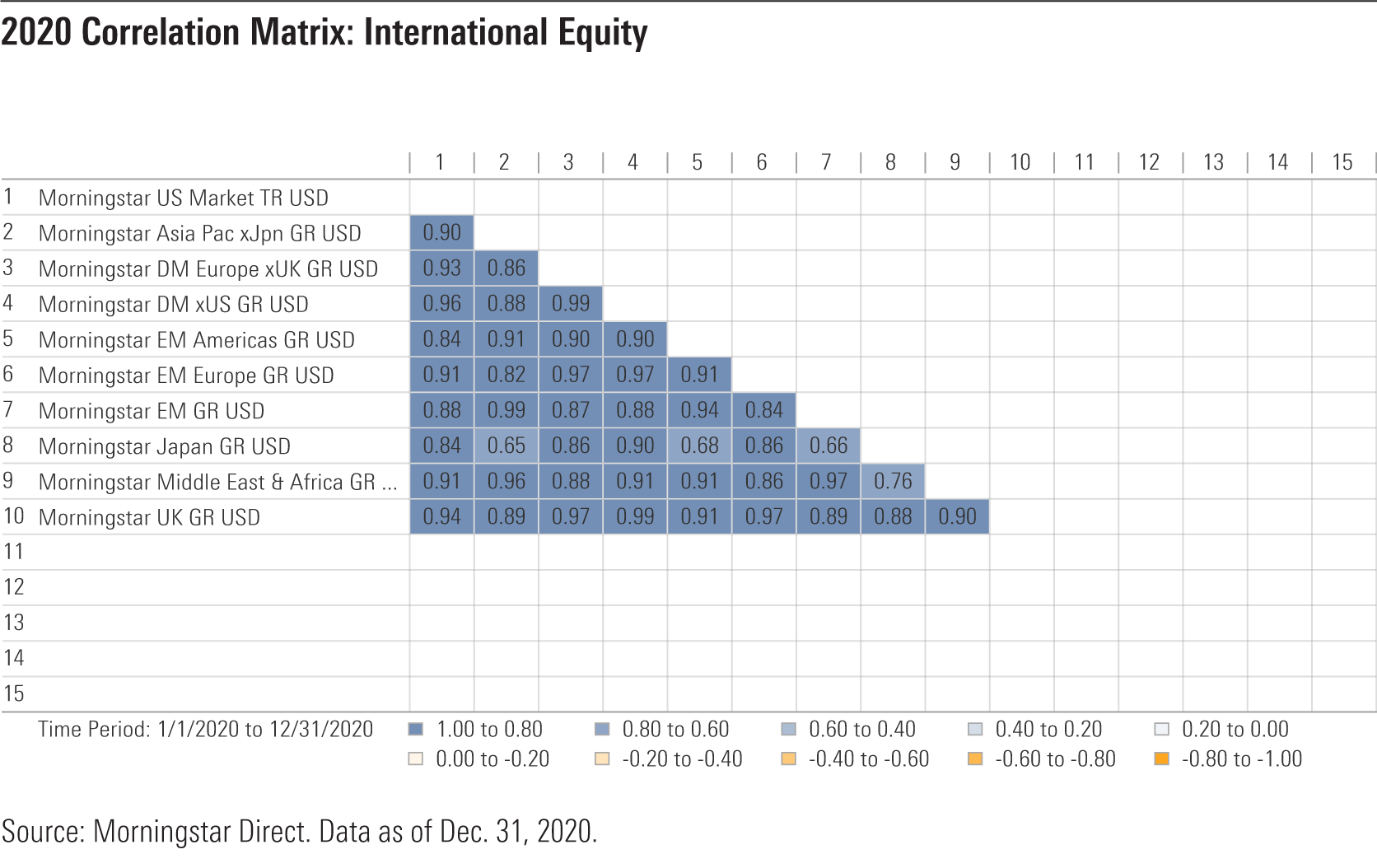

With the novel coronavirus pandemic affecting economies, companies, industries, and people on a global scale, most major international markets dropped at least as much as the U.S. market in early 2020. Japan was the only major regional market to maintain a lower correlation with the United States. It also suffered lighter losses than most other global markets.

For the full year, correlations also fell in a narrow range. The Morningstar Developed Markets ex-US Index showed the highest correlation with the domestic equity market, followed by Europe and the United Kingdom. Regional indexes for emerging markets showed correlations of at least 0.84 with the Morningstar US Market Index. Cross-correlations between Japan and the rest of Asia were among the lowest, as were correlations between Japan and Latin America.

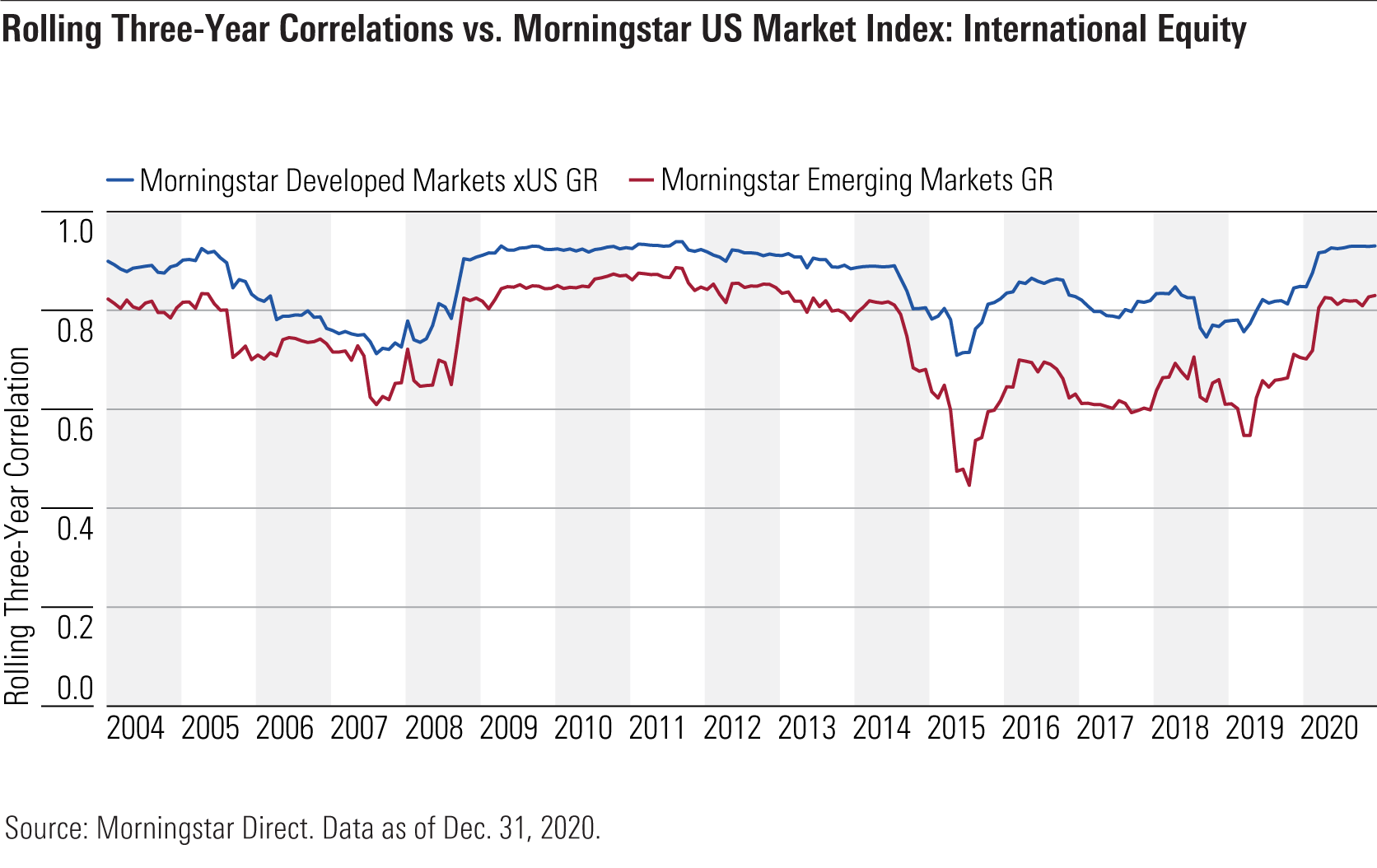

Longer-Term Trends in International Diversification

These patterns are generally consistent with patterns shown over longer periods, with developed markets showing the strongest correlation with the U.S. equity market and emerging markets showing the weakest. Over the past 20 years, correlations for international stock markets have remained relatively stable, except for Latin America. That region's correlation with the U.S. equity market has trended down to 0.58 over the past five years, compared with as high as 0.80 in some previous periods. This probably reflects the impact of tighter trade policy in the region, as well as style and sector differences. While growth sectors such as technology have increasingly dominated the U.S. market, value-oriented sectors such as basic materials and financials have played a bigger role in Latin America.

Portfolio Implications of International-Stock Correlations

The fact that international correlations rose during 2020's market turmoil might have some investors questioning whether international diversification is still worthwhile. Over longer periods, though, international assets don't always move in lock step with the U.S. market and have still provided diversification benefits. Currency exposure is another important aspect of international diversification. Now that the U.S. dollar has started showing signs of weakness, international diversification could become increasingly important.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)