Why the Best Values Are Still Abroad

A long-term slump for international stocks means lower price tags.

Stocks outside the United States have shown some signs of strength lately. In the fourth quarter of 2020, for example, the Morningstar Global Markets ex-US Index gained 17.4% compared with a 14.2% return for the Morningstar US Market Index. That quarter was a rare glimmer of hope amid an unusually long performance slump. Over the past 10 years, annualized returns from international stocks have lagged those of their domestic counterparts by more than 7 percentage points per year, on average.

The bright side of this long and painful performance slump: While few markets qualify as cheap, non-U.S. markets offer more attractive valuations in relative terms.

Lagging Performance

With the novel coronavirus pandemic affecting economies, companies, industries, and people on a global scale, most major international markets shed at least 30% of their value during the COVID-19-driven bear market in early 2020. Asia (including Japan) was the only major regional market to post less than a 30% loss.

Since then, global markets have enjoyed a sharp rebound. Most major markets have gained back the losses they suffered and are back to their precrisis peaks.

But a few markets still haven't fully recovered. The Morningstar UK Index had just barely pulled ahead of its precrisis level as of mid-April 2021, while emerging markets in Europe and Latin America are still below previous peaks.

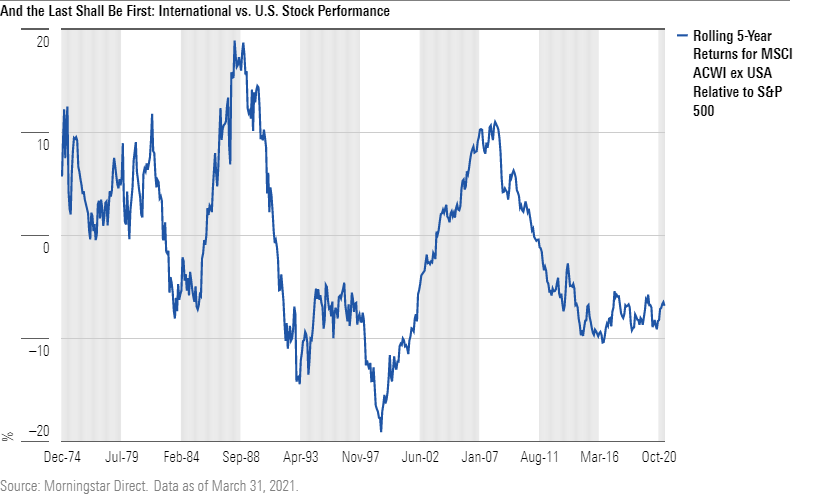

This recent underperformance continues a longer-term trend. As shown in the chart below, international stocks have lagged domestic benchmarks over every rolling five-year period since the period ended in March 2011. It's not unusual for U.S. and non-U.S. stocks to go through longer-term cycles of winning and losing, but reversion to the mean is a powerful force. After multiyear performance trends, the winners and losers eventually reverse positions.

International stocks have fallen behind for a few different reasons. In general, market benchmarks outside the U.S. are relatively light on all of the traits that have led the market until recently: growth, momentum, and technology. About 27% of the Morningstar Global Markets ex-US Index consists of growth stocks, compared with a 34% weighting for the U.S. market benchmark. Similarly, the ex-US index has only a 12% weighting in technology stocks--about half that of the US index.

An adverse currency environment has been another negative factor. The dollar's general upward trend over most of the past 10 years has weighed down returns for investors holding assets denominated in other currencies.

The Valuation Case

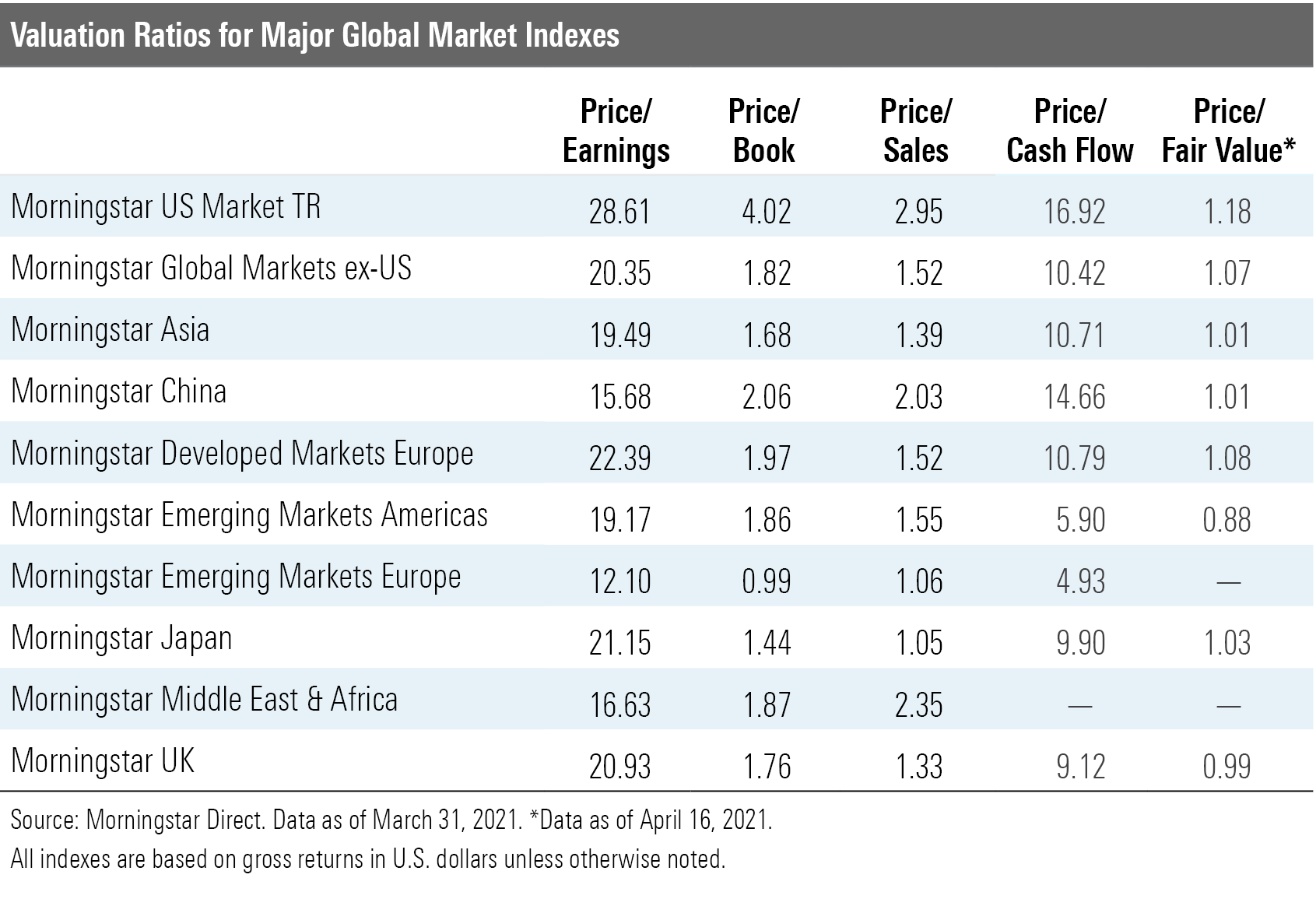

On the positive side, the long dry spell for international stocks makes for more attractive valuations. As shown in the chart below, traditional valuation metrics such as price/earnings, price/book, and price/sales are all significantly lower for non-U.S. stocks compared with the domestic market. Japan, some parts of Europe, and the United Kingdom look particularly cheap based on traditional valuation metrics.

Granted, part of this reflects weaker fundamentals for stocks outside the U.S. On average, non-U.S. stocks have lower net margins, profitability ratios, and historical earnings-growth rates compared with their U.S. counterparts. On average, stocks included in the Morningstar Global Markets ex-US Index have generated returns on invested capital of 8.5% over the past 12 months, compared with 12.6% for stocks in the U.S. market benchmark. This partly reflects differences in sector exposure; as mentioned above, foreign-stock benchmarks have heavier weightings in economically sensitive sectors such as basic materials and industrial stocks. Companies in these areas haven't generated profits at the same rate as companies in the technology sector but should enjoy stronger growth trends as global economies improve.

Non-U.S. stocks also look more attractive (albeit not exactly cheap) based on Morningstar's fair value estimates. We estimate a company's fair value by looking at the present value of the total cash flows we think the company will generate in the future. Because it's a measuring stick for determining long-term intrinsic value, the fair value estimate accounts for differences in growth and cash-generation-growth rates over time. The average non-U.S. stock is currently trading at a 7% premium to estimated fair value, compared with an 18% premium for those in the U.S. market. While most major regional markets are currently trading above fair value, stocks in the United Kingdom are at a slight discount, while those in Latin America are trading about 12% lower than estimated fair value, on average.

What It Means for Your Portfolio

It's important to note that international stocks still don't qualify as bargains in absolute terms. It's also not clear if international stocks will offer the same diversification value as in the past. As detailed in our recent study of portfolio diversification, correlations between most global markets have trended up over the past couple of decades. Correlation coefficients between U.S. and non-U.S. markets were as low as 0.10 in the past, but have edged up to about 0.90 over the past 20 years. Cross correlations between international markets have also trended higher.

Over longer periods, though, international assets don't always move in lock step with the U.S. market and have still provided diversification benefits. Currency exposure is another important aspect of international diversification. Now that the U.S. dollar has started showing signs of weakness, international diversification could become increasingly important.

How much to allocate to international stocks? Purists would argue in favor of owning a market basket, with the size of each asset class in line with its current market value. Because the U.S. made up only about 58% of global market capitalization as of March 31, 2021, that would argue for keeping as much as 42% of a portfolio's equity exposure in non-U.S. stocks, or about 25% of total assets for a portfolio with a 60/40 stock/bond split.

Conclusion

Even investors who aren't comfortable with that much exposure should still make sure not to put all of their eggs in the U.S. market basket. Despite its strength over the past 10 years, the U.S. may not dominate global markets forever, so it's prudent to keep a portion of equity exposure in other markets. The lower price tags available on non-U.S. stocks are another argument in their favor.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)