Value Funds Post Best Quarter vs. Growth in 20 Years

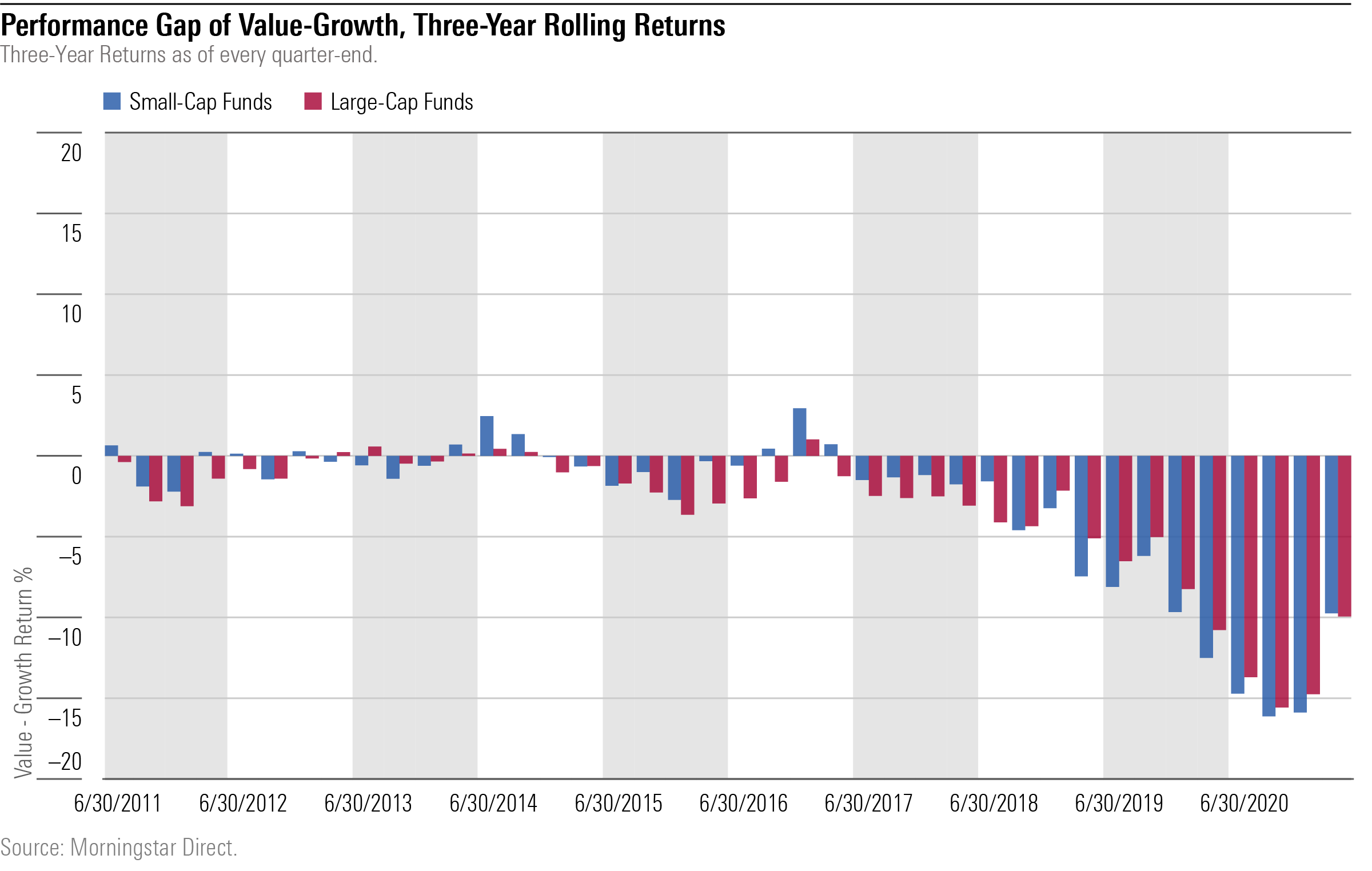

The long-term return gap between the two remains wide.

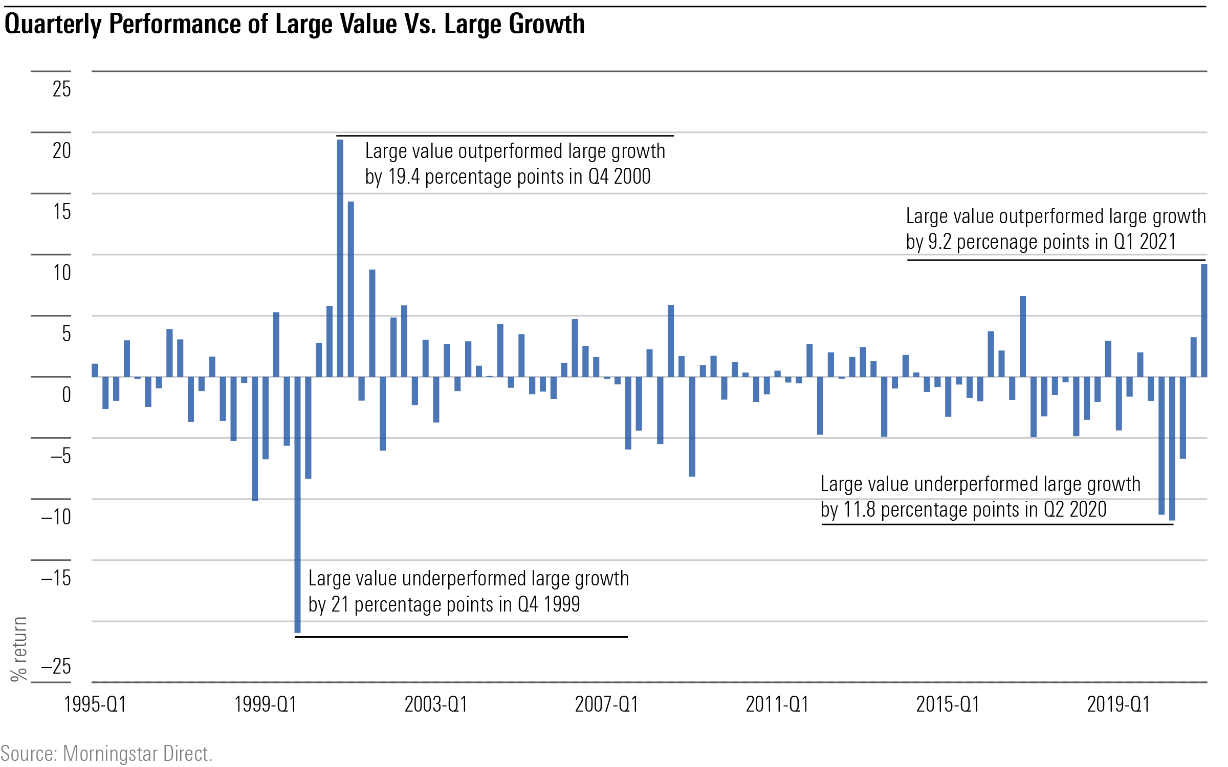

Following the worst year for large-value stock fund performance relative to growth, value funds recorded their greatest quarterly advantage in 20 years during the first three months of 2021.

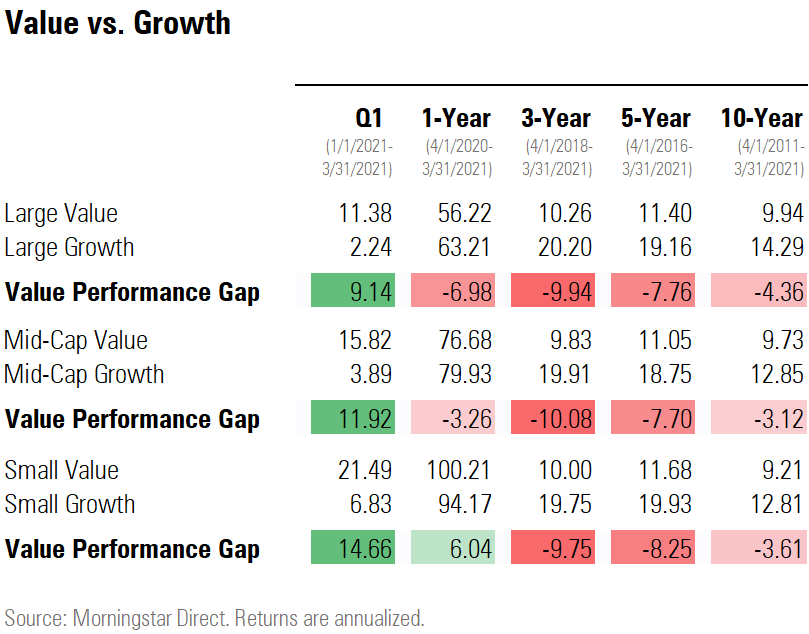

While the recent gains of small-value funds pushed the Morningstar Category average ahead of small growth for the last 12 months, for other market capitalization categories, and for time frames of three years or longer, value has a considerable gap to close.

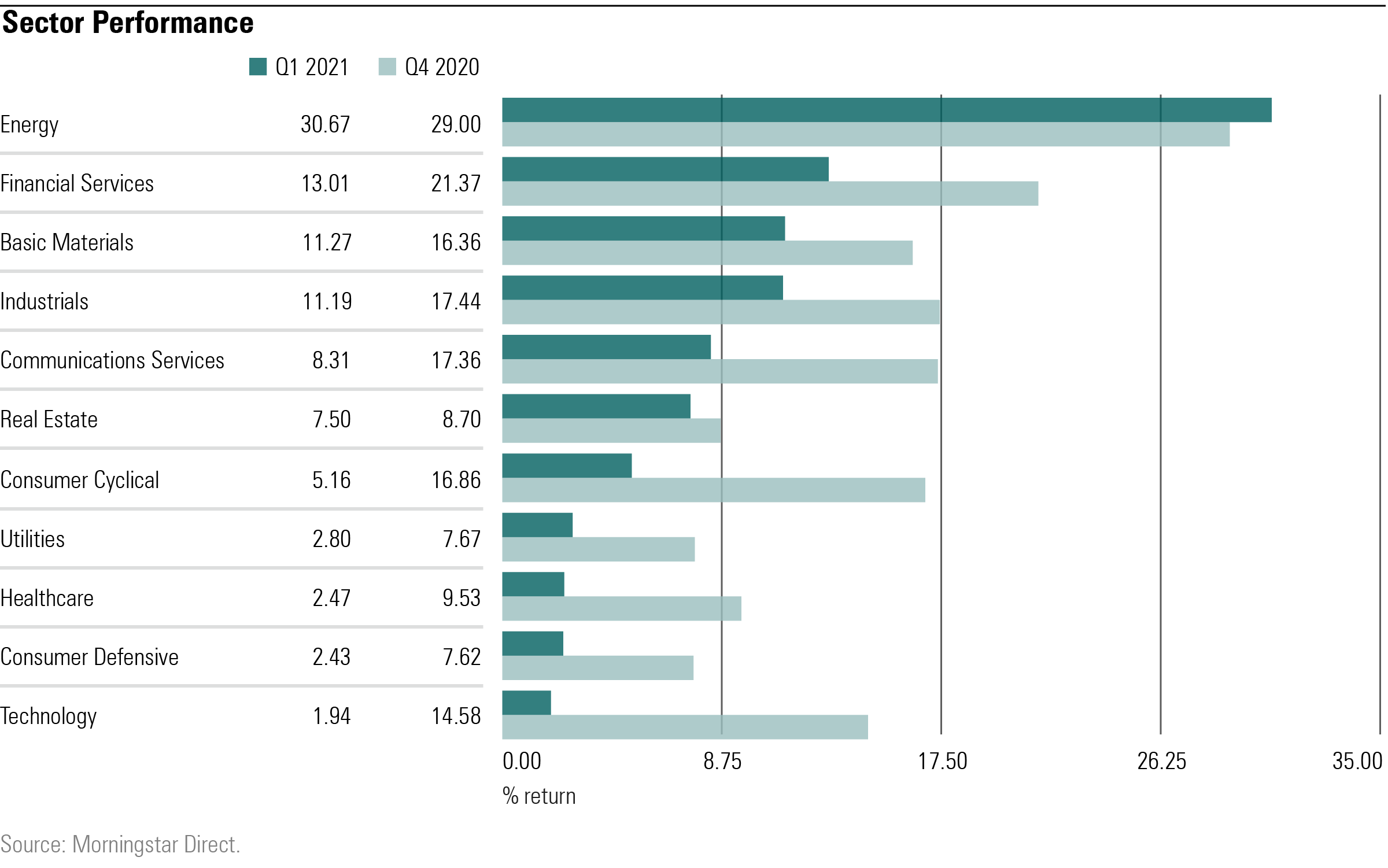

Still, it was good news for value investors whose funds were left far in the dust during 2021. Value’s outperformance over growth was widest among small-cap funds, as the average small-value fund gained 21.5%, while the average small-growth fund returned 6.8%. And thanks to the especially large declines by small-value funds during the coronavirus-pandemic-driven stock market collapse a year ago, small-value funds are up on average 100% for the last 12 months, a 6-percentage-point gap over the average small-growth fund.

The last time small value beat growth by this wide a margin was in 2001 when value funds outperformed growth by 18 percentage points in the first quarter. Likewise, large-value funds bested growth funds by 14 percentage points in the same quarter, and mid-cap value funds beat growth by 19 percentage points in the third quarter of 2001.

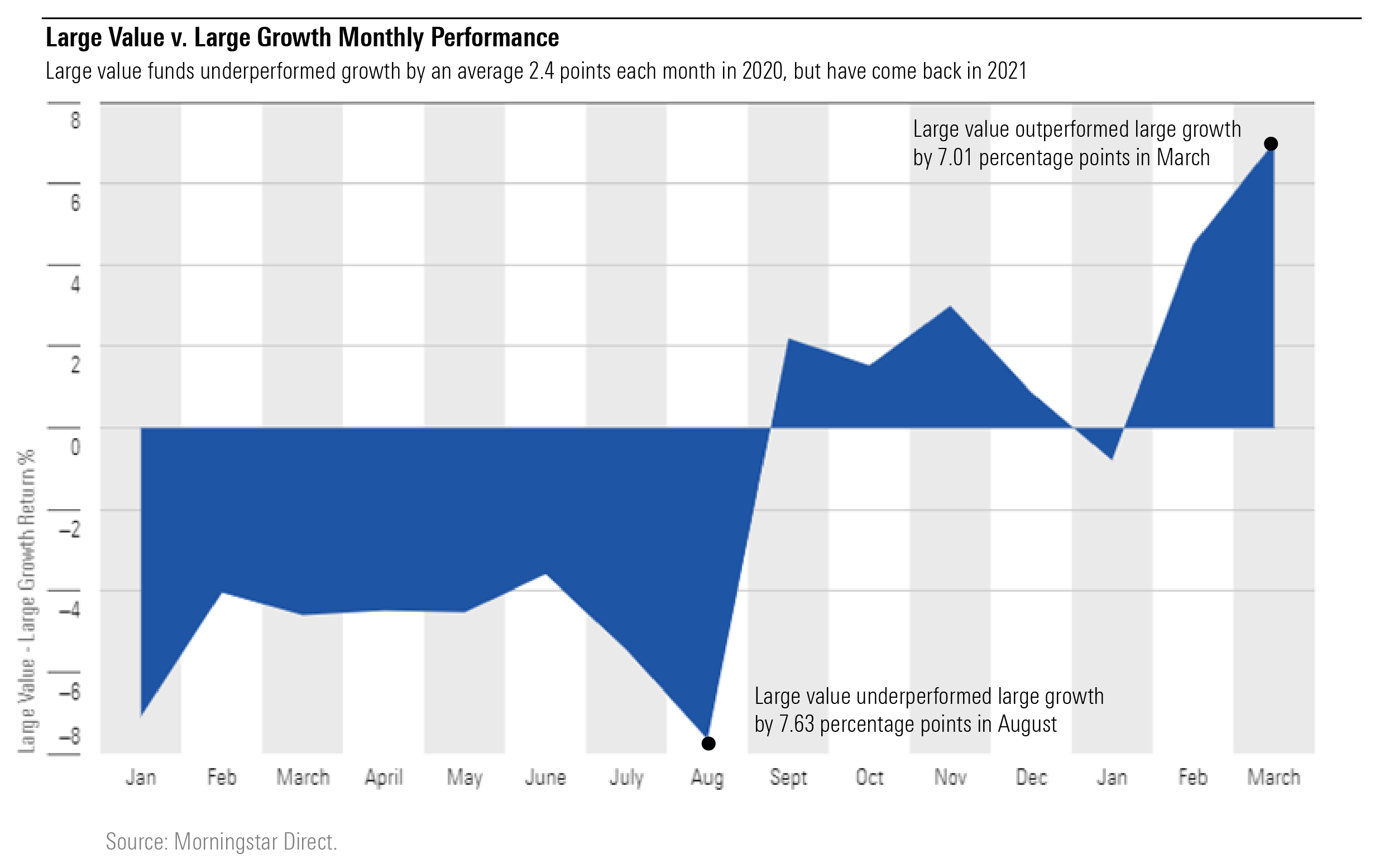

Heading into 2020, the track records on many value strategies relative to growth funds were already weak. Then came the COVID-19 pandemic, and value funds, which tend to be invested in more economically sensitive sectors, were hit hard by the economic collapse and underperformed growth funds by wide margins for the first eight months of 2021.

The reversal in value’s favor began in September, during a time when stocks were selling off, notes Morningstar’s director of manager research, Russ Kinnel: “At first, value was simply losing less than growth, and we saw that again in October. And then in November, the rally really kicked in, and value outperformed on the upside, and it's been doing that ever since.”

The late-2020 revival was small. Large-value funds still ended the year with the largest underperformance gap to the average large-growth fund on record.

But what was a trickle in 2020 turned into a flood in the first quarter of 2021. Record fiscal stimulus and a broader economic recovery lifted value-oriented sectors, and in February and March, value funds took off.

On a quarterly basis, value hasn’t outperformed growth for two consecutive quarters since 2016.

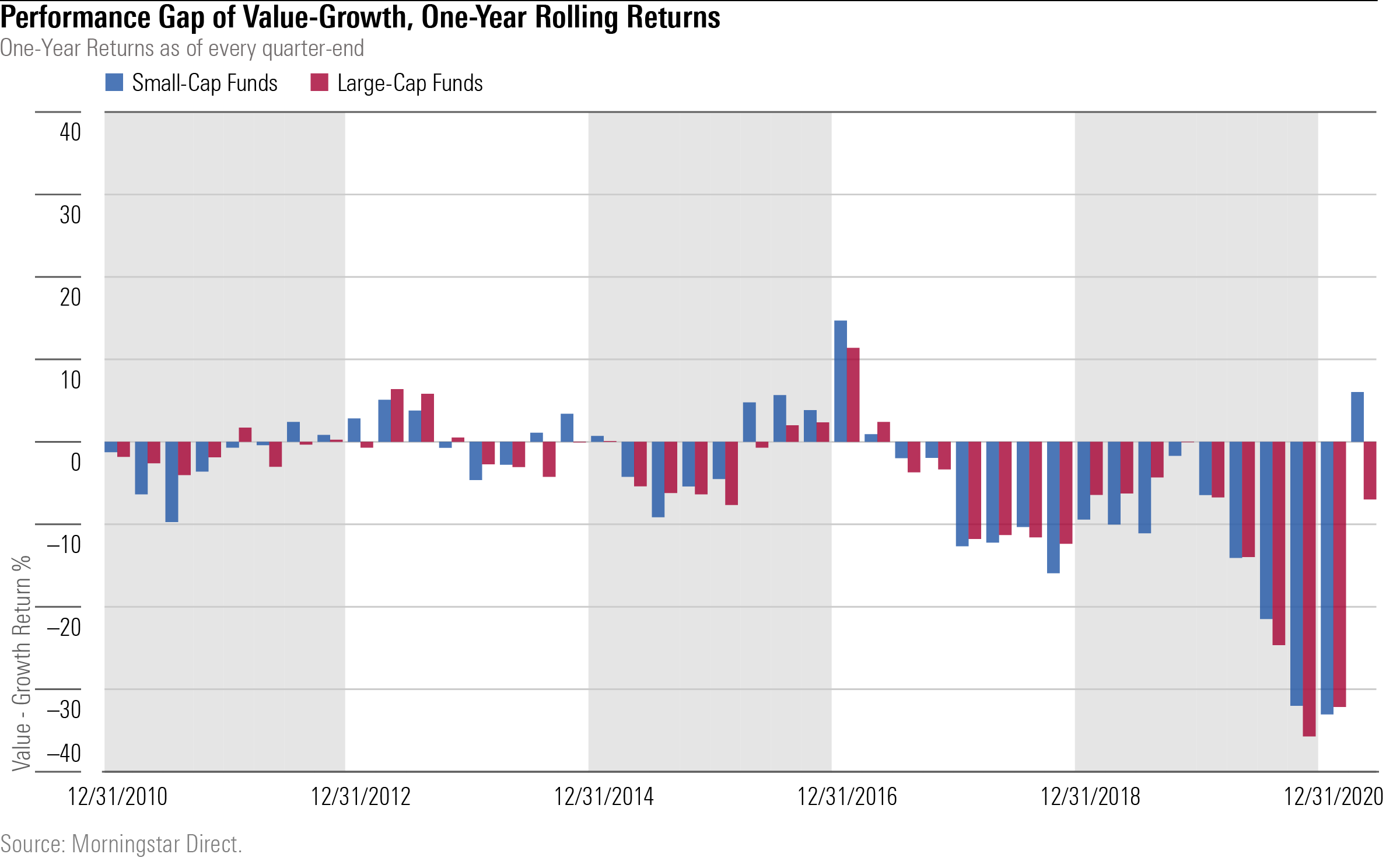

Over long-term periods, however, there's still substantial ground for value strategies to make up. Growth funds have outperformed value for five out of the past six years, and in 2020 by the widest margin ever, making it difficult for value, despite the stellar quarter, to dig itself out of a hole.

Large-growth funds still lag value strategies by 7 percentage points and mid-cap strategies by 3 percentage points over a one-year window.

Looking at a three-year return basis, value strategies have an even longer way to go. The average value fund falls behind growth by nearly 10 percentage points across market caps. Value hasn’t had a three-year advantage over growth since 2016.

This resurgence is owed in part to the rotation in the equity market. Sectors that suffered initially--energy, financial services, and basic materials--have gained in the past two quarters. Conversely, rising interest rates have benefited these sectors and hurt technology stocks.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)