Not All Sustainable Funds Are Equally Sustainable

Morningstar’s ESG metrics reveal the standout funds in the space.

What does it really mean to be a sustainable fund?

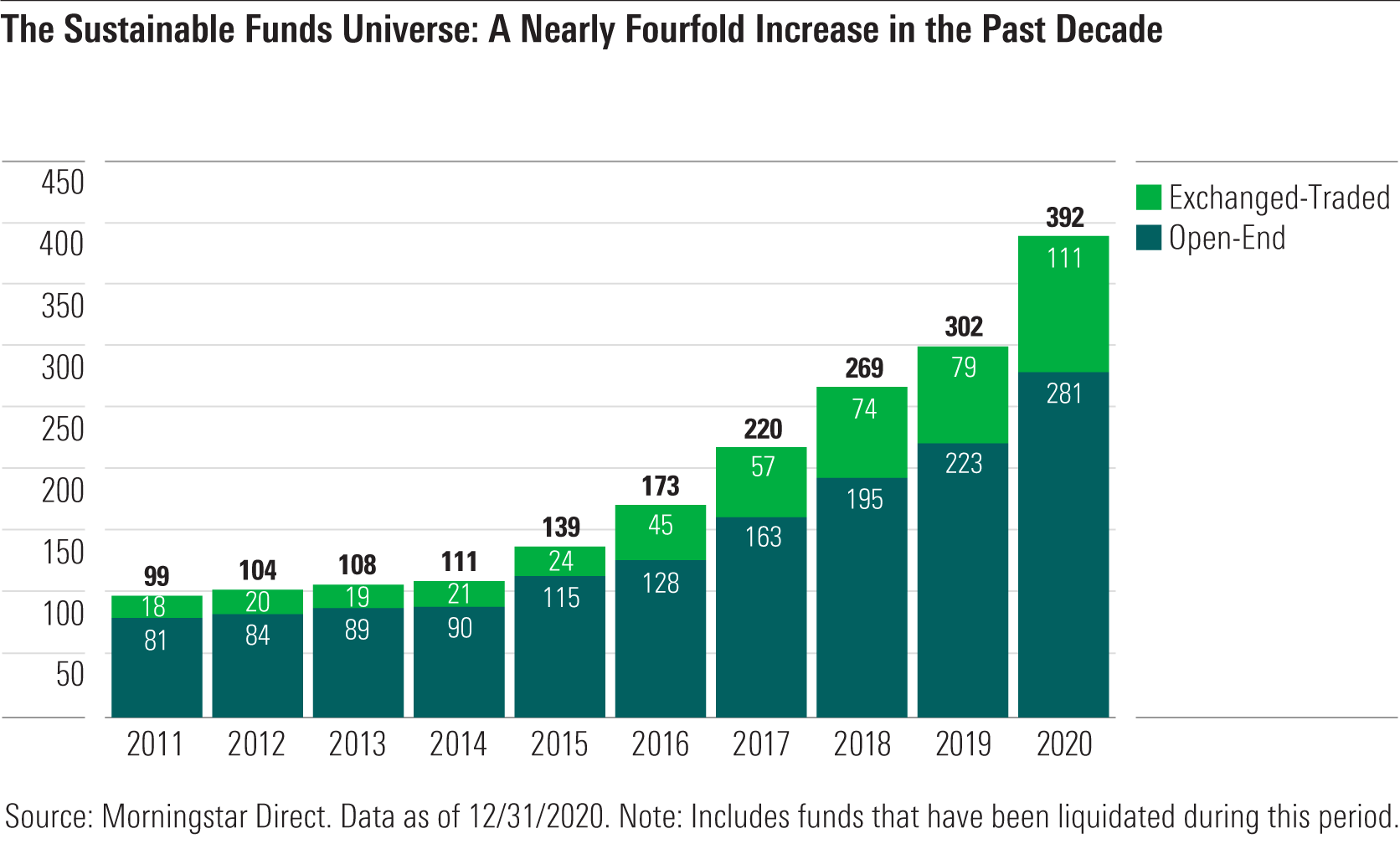

Our latest Sustainable Funds U.S. Landscape Report maps out the sustainable funds universe, which has seen rapid growth over the past decade: As of the end of 2020, nearly 400 sustainable open-end and exchange-traded funds were available to U.S. investors, and the group's total assets neared $250 billion.

There are certain parameters a fund must follow to be included in the sustainable funds universe: Environmental, social, and governance concerns must be central to its investment process, and the fund’s intent should be apparent from a simple reading of its prospectus. But when it comes to actually managing these ESG concerns, funds can follow a range of approaches.

Some funds focus on weighing the ESG issues that affect companies and their industries. These funds assess performance in areas like business ethics, treatment of workers, carbon emissions, and pollution. Other sustainable funds narrow their approach to focus on particular themes, like gender diversity or climate impact.

Mutual funds and ETFs represent the most direct way for investors to invest sustainably, but not all sustainable funds are alike. At a basic level, we need to assess whether sustainable funds are doing what they claim to be doing. Here, we examine how these funds stack up on a few different metrics.

The Morningstar Sustainability Rating

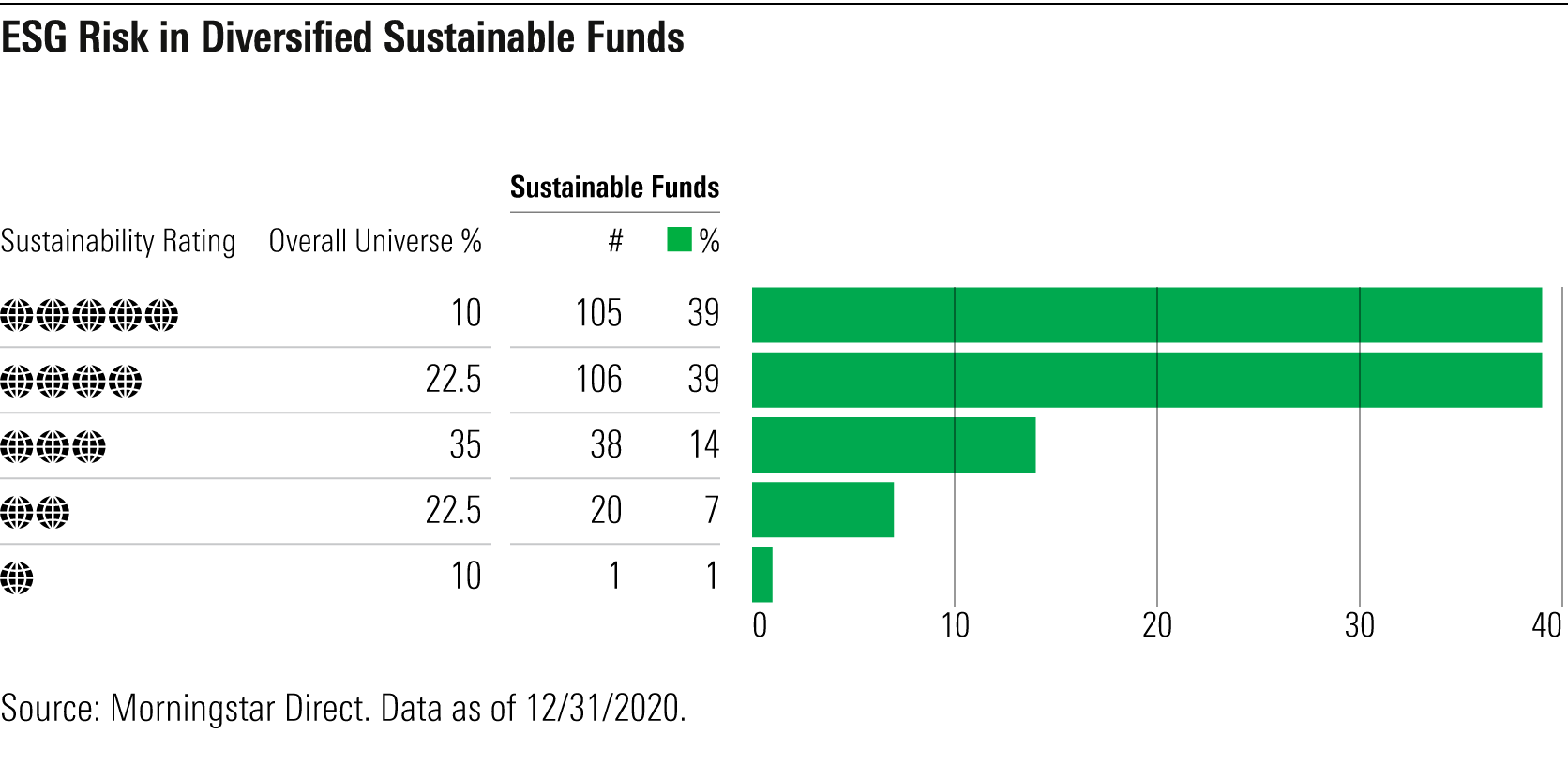

First, to what extent are sustainable funds actually investing in sustainable companies? We can turn to the Morningstar Sustainability Rating to answer this question.

As a group, sustainable funds have significantly lower levels of ESG risk embedded in their portfolios than the overall universe of funds available to U.S. investors. As shown below, 78% of sustainable funds receive the highest ratings, 4- or 5-globes. These funds invest in companies that have successfully mitigated their exposure to material ESG risks. Only 7% of sustainable funds receive the lowest rating, 1- or 2-globes.

Low Carbon and Fossil-Fuel-Free Sustainable Funds

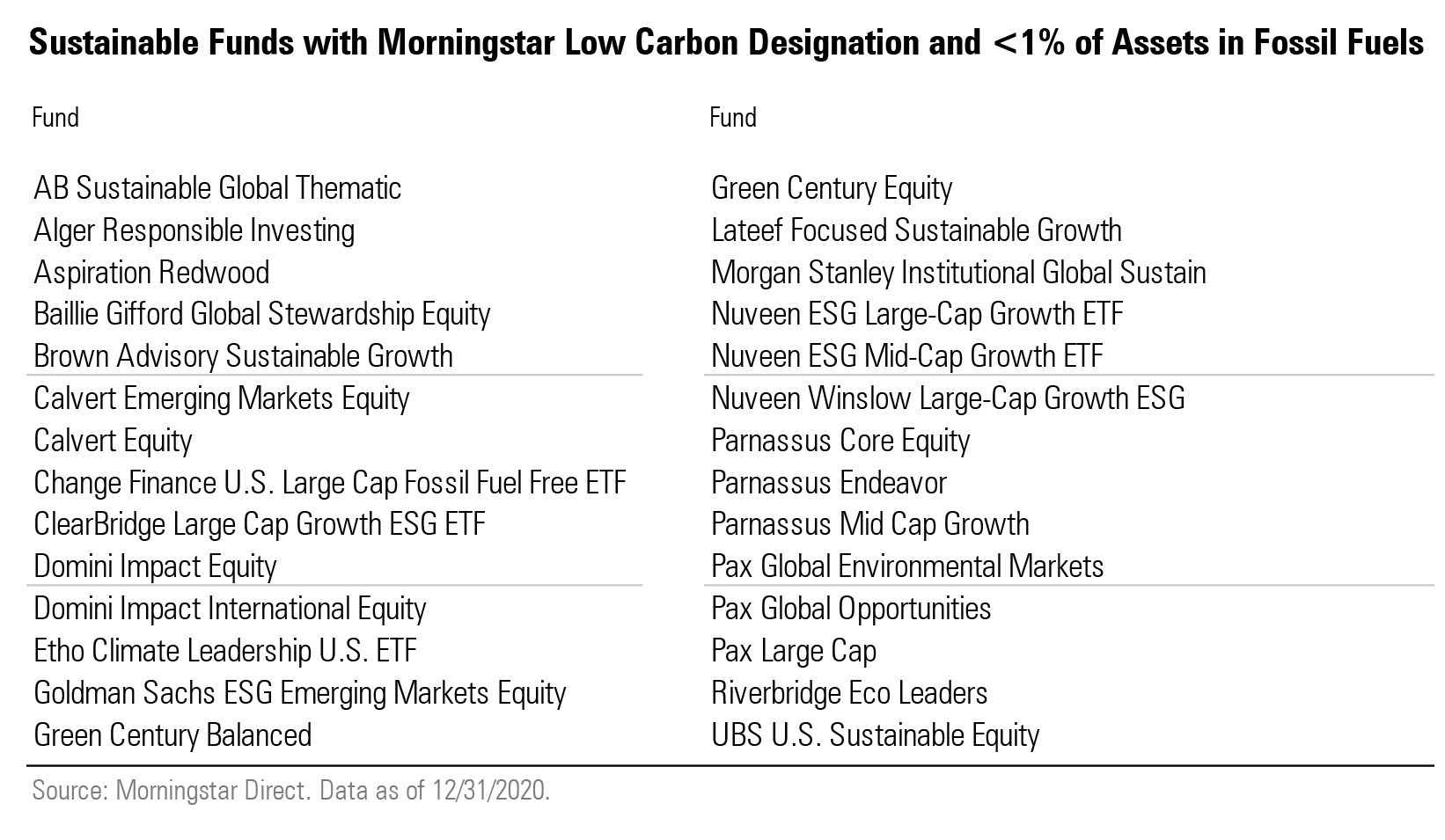

While more funds appear to be avoiding fossil fuels, investors should not assume that all sustainable funds do. We can look at the Morningstar Carbon Risk Score, which goes beyond carbon footprinting to assess the material risk from carbon exposure, to distinguish funds that have low carbon risk in their portfolios. Funds that have low carbon risk and low fossil-fuel exposure receive the Morningstar Low Carbon Designation.

At the end of 2020, 149 of the 203 sustainable funds with a Morningstar Carbon Risk Score (78%) received the Low Carbon Designation, substantially more than the only 43% of the overall universe of U.S. and international stock funds that received the designation.

Still, while some sustainable funds are fossil-fuel-free by prospectus, most are not. The proportion of sustainable funds with less than 1% average exposure to fossil fuel over the previous 12 months was only 20%. These funds are listed below.

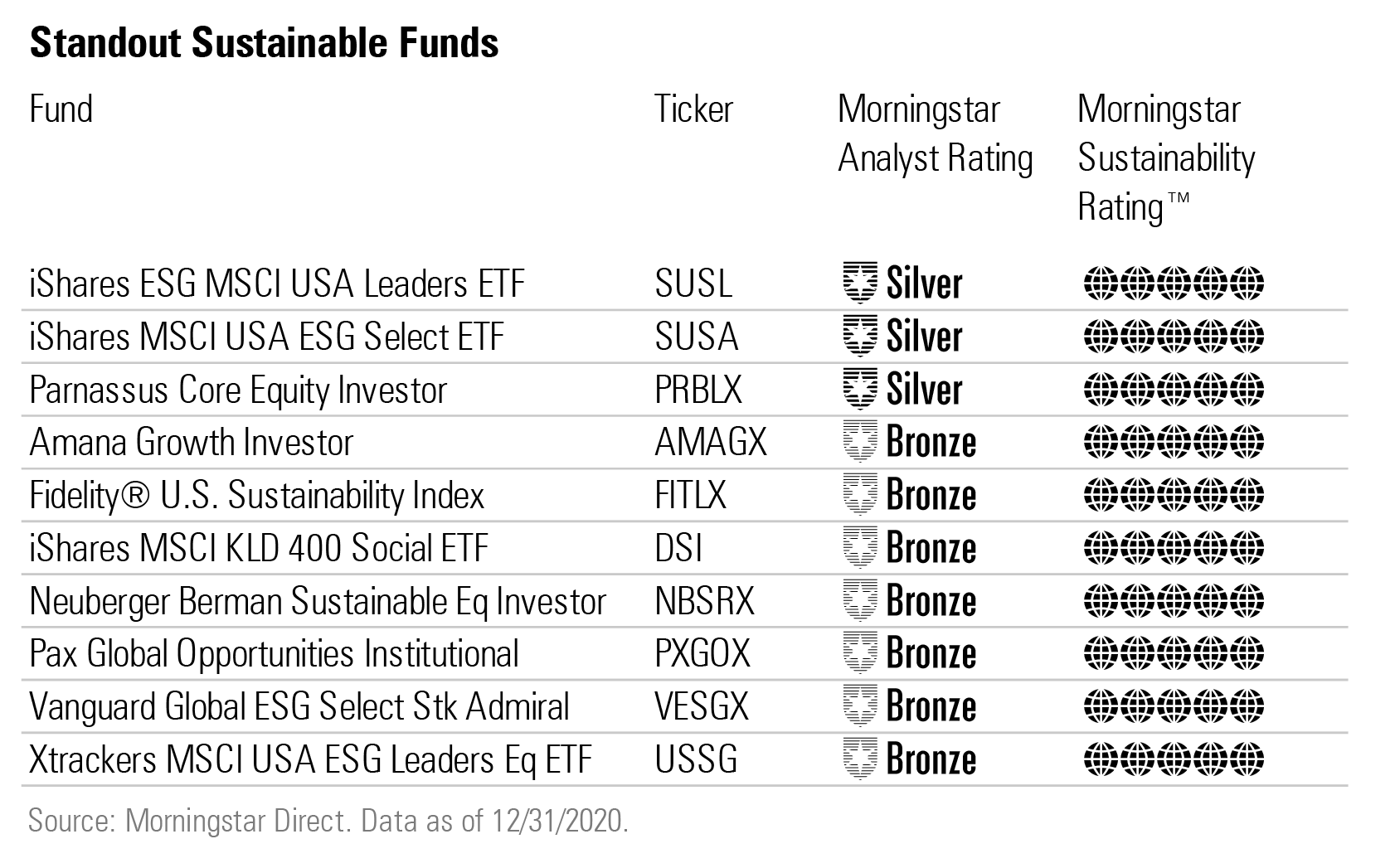

Standout Sustainable Funds

Just as sustainable funds approach ESG issues in different ways, investors have different values when it comes to ESG. There is no one measure that can indicate which sustainable fund is the best choice for all investors, but we can use Morningstar’s ESG metrics to get a better sense of how funds stack up in certain areas.

Below are 10 sustainable funds that stand out on a number of these metrics. In addition to receiving the Morningstar Low Carbon Designation and the top Morningstar Sustainability Rating, these funds are also Morningstar Medalists, which means that Morningstar’s manager research analysts think highly of their investment merits.

Are Sustainable Funds Doing What They Claim to Be Doing?

For the most part, yes. Sustainable equity funds are more likely than their conventional peers to invest in companies that effectively address material ESG risks. They are also more likely to avoid fossil fuels and better manage their carbon risk exposure. U.S. sustainable funds as a whole deliver on their sustainability claims, but there are still funds whose performance in sustainability falls short. There are many ways that funds can interpret and pursue sustainability, so investors should get to know the range of ESG approaches to decide which approach is the right fit for them.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)