Manager Question of the Month: How Active Fund Managers Cope With Index Concentration

Managers from T. Rowe Price, Wellington, American Century, and others discuss the trade-offs.

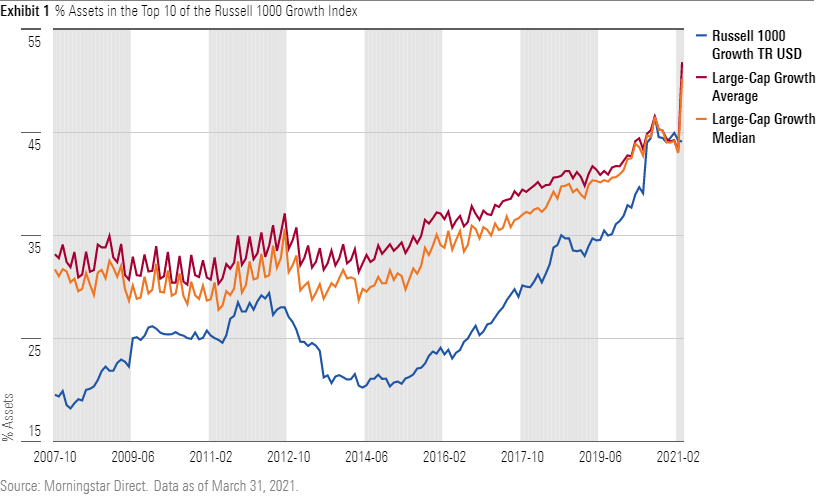

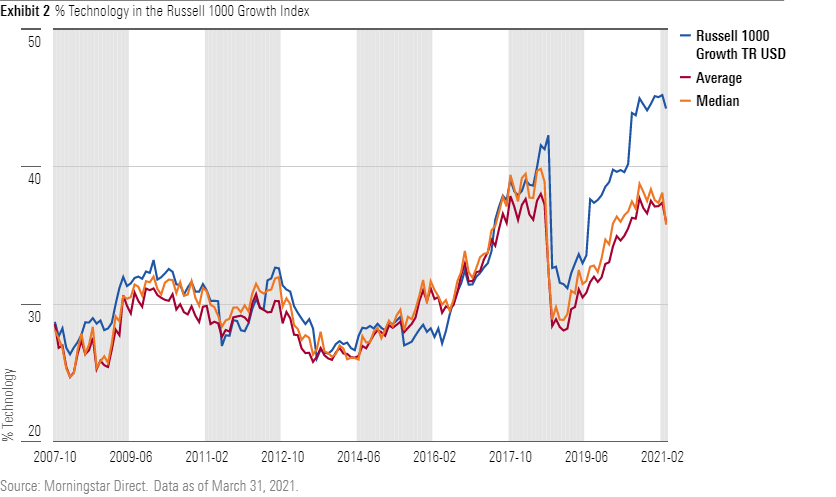

Equity benchmarks have gotten more concentrated, creating challenges for active managers who measure their performance against them. The problem has become acute for U.S. large-cap growth managers, who are often paid to beat the Russell 1000 Growth Index, which is now dominated by just a handful of technology-related companies.

This is more than a matter of personal preference or differing investing styles. To qualify as a diversified-stock offering, the SEC bars funds from devoting more than 5% of their portfolios to one stock or from owning more than 10% of a single company's stock. Those restrictions apply to three fourths of a mutual fund's assets, so managers still have 25% of their portfolios to concentrate elsewhere. For example, a manager could choose to concentrate 25% of assets in one stock or 12.5% in each of two stocks without violating the SEC's diversification strictures.

However, this has become problematic recently. For example, as of March 31, 2021, Apple AAPL accounted for roughly 10.5% of the Russell 1000 Growth Index. The next largest constituents Microsoft MSFT, Amazon.com AMZN, Facebook FB, and Tesla TSLA accounted for 9.5%, 7.1%, 3.8%, and 2.8%, respectively. Those top five stocks accounted for roughly 33.7% of the benchmark's weighting. If, however, you replace Tesla with Alphabet's A GOOGL and C GOOG shares, which total 5.1%, that top-five weighting jumps to 36.0%. Many diversified managers struggle to maintain neutral weightings in these stocks, let alone overweight them.

Just 76 of 368 unique funds in the large-growth Morningstar Category classified themselves as nondiversified as of March 2021, but some diversified growth managers are considering making the switch.

T. Rowe Price Growth Stock PRGFX and T. Rowe Price Blue Chip Growth TRBCX have asked their shareholders to approve a switch from diversified to nondiversified. T. Rowe Price Growth Stock manager Joe Fath has said the fund owns less Microsoft than the index not because he and his team lack conviction in the software titan, but because it can't own more as a diversified fund without trimming another large position to make room--a tough trade-off. The fund also might not be so underweight Apple, a stance that hurt the fund in 2020, if it became a nondiversified strategy. T. Rowe Price Blue Chip Growth managers Paul Greene and Larry Puglia would like to own more Alphabet but can't under current constraints. Neither strategy plans to slash its holdings or forsake diversification; they'd just like more freedom to manage their position sizes and bets relative to an increasingly concentrated benchmark.

Even managers who claim to pay no heed to index concentration haven't been able to completely ignore the issue. Federated Hermes Kaufmann Large Cap's KLCIX managers tend to shy away from the largest companies in the Russell 1000 Growth and cap individual position sizes at 5%. The portfolio has been underweight Amazon, Apple, and Facebook FB for several years. While the fund's managers say their investors want a differentiated product and argue that younger, smaller companies offer better value, they bought a small stake in Apple in 2018 because not owning it had hurt their relative performance.

Other managers can afford to adapt more nuanced approaches. Value manager Michael Reckmeyer of Wellington Management, who runs Hartford Equity Income HQIYX and most of Vanguard Equity Income VEIRX, is cognizant of benchmark weightings but also considers other factors, such as equity yields and his strategies' sector constraints. Hartford Equity Income, for example, can differ from its Russell 1000 Value Index benchmark by up to 8 percentage points, though Reckmeyer usually doesn't stray that far. Hartford Equity Income had a roughly index-matching 1.36% stake in Verizon VZ as of January 2021, in part to keep its communication-services sector underweighting of 4.9% from getting higher than Reckmeyer has typically tolerated since taking over the fund in 2007.

Index concentration has not been as big an issue for value managers, but some of them still study it. American Century Equity Income TWEIX manager Phil Davidson doesn't envy growth managers these days. Increased benchmark concentration forces them to choose between minimizing their portfolios' differences with the index to stay competitive with it or to differentiate to stand out from benchmark trackers down the road.

Becoming nondiversified would give managers the flexibility to follow either course in this concentrated market. It also gives them the ability to over- or underweight any of the benchmark's biggest stocks based on their convictions. This courts volatility, though. Nondiversified fund Baron Partners BPTRX, for example, finished the past two calendar years at the top of the mid-growth category, including a 149% gain in 2020 gain that owed to an enormous 41% stake in the gravity-defying shares of Tesla (a figure that reached almost 47% at the end of 2020). In his firm's 2020 fourth-quarter commentary, manager Ron Baron touted the fund family's early Tesla investment: "We have since 'earned' about $5.5 billion realized and unrealized profits on our Tesla investment! We are hopeful we will triple our money again by 2030. Of course, there can be no assurance that will be the case." Indeed, the fund fell to the peer group's bottom quartile in 2021's first quarter, when the electric carmaker's stock retreated by 5.35%. That doesn't make Baron's Tesla investment a mistake. Far from it. But it does show that choosing to slip the bonds of diversification entails risks and investors should pay attention if their funds do it.

Several active managers have been forced to reckon with increased index concentration as mega-cap technology-related stocks have crowded at the top U.S. large-cap growth benchmarks. It’s not an easy choice, particularly for large-cap growth managers. If they keep their diversified status, they have to underweight large benchmark constituents even if their research tells them to own more. If they become nondiversified, they could end up chasing hot stocks just before their fortunes turn. It's a test not only of stock-picking but also of risk-management skill.

/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)