Which Bonds Provide the Biggest Diversification Benefits?

Investors rely on bonds as ballast for their stock allocations, but their levels of effectiveness can vary greatly.

Most investors building portfolios take it as an article of faith that holding bonds helps diversify their stocks.

But which bonds, specifically, provide the biggest diversification benefits?

In our recent examination of asset-class correlations, the "2021 Diversification Landscape," Treasury bonds exhibited a consistently negative correlation with stocks--the best of any asset class. Meanwhile, other bond types proved less effective as diversifiers. While many investors have long understood that low-quality bonds tend to move in sympathy with stocks, categories like Treasury Inflation-Protected Securities, high-quality corporate bonds, and even municipal bonds also had a meaningfully higher correlation with the equity market than did nominal Treasuries. Moreover, intermediate-term core-plus bond funds, which investors often use as their core fixed-income holdings, were also much less effective diversifiers for equities than were Treasuries.

Those findings suggest that investors who are seeking ballast for the stock allocations in their portfolios should take care to include Treasury bond exposure, too. At the same time, it's worth noting that patterns of diversification benefits aren't static. Cash has recently looked nearly as effective as a diversifier as Treasuries, possibly because Treasury and cash yields are both so low. Whether the correlation patterns that held during a multidecade period of declining interest rates will hold true in a rising-yield environment is an open question.

We examined fixed-income correlations relative to equity over a range of time periods. We homed in on 2020 because it featured a short-lived bear market for stocks, but we also examined the diversification benefits of various fixed-income categories over longer time frames. Here's a closer look at our findings among various taxable-bond and municipal-bond fund types, as well as takeaways for portfolio construction.

2020 Market Correlations

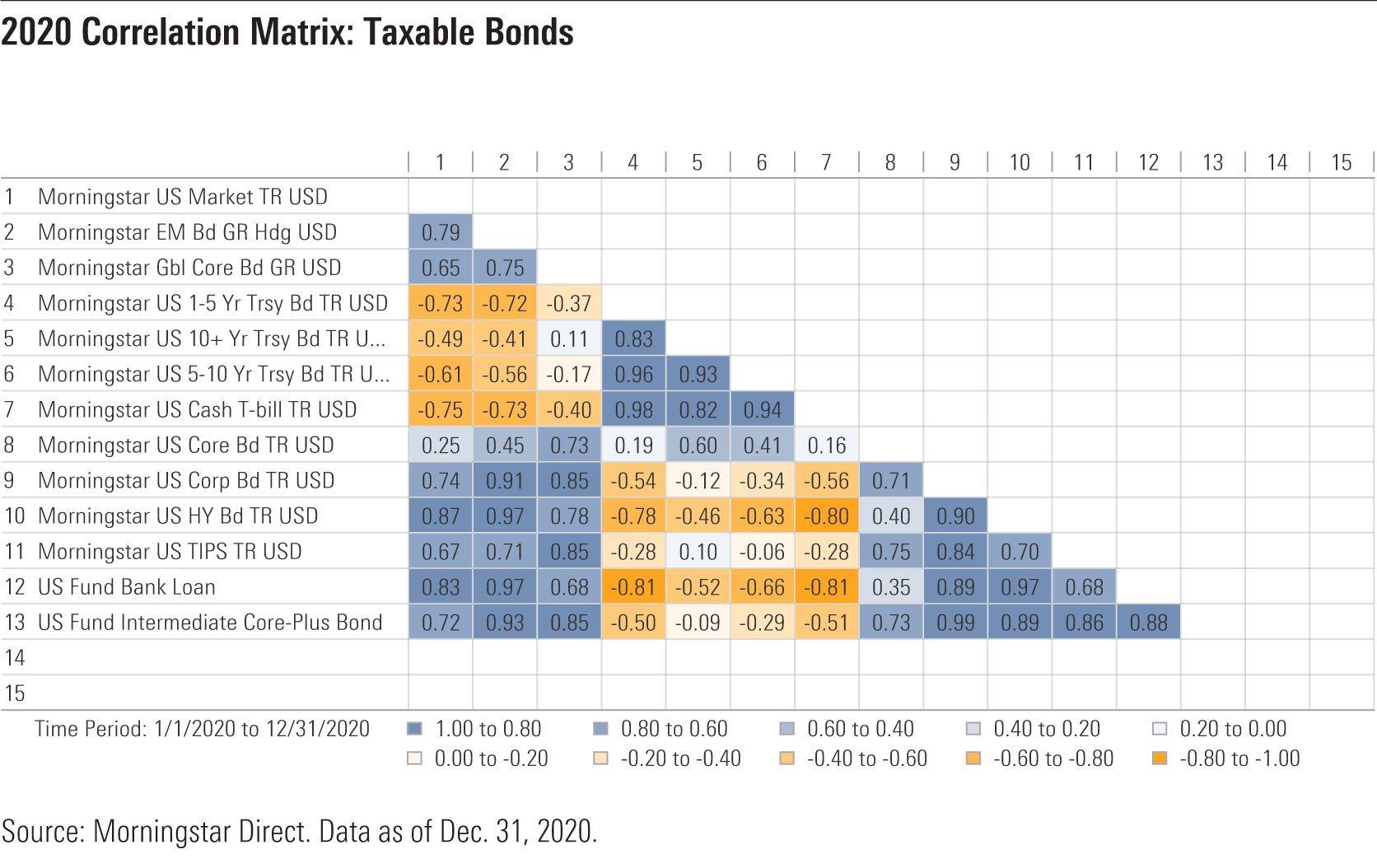

The first quarter of 2020 provided a major stress test for high-quality bonds' reputation as a portfolio diversifier for equities. As the pandemic came into view, stocks experienced a short but extreme sell-off, falling sharply from late February through late March. While high-quality bonds certainly held their value better than stocks, there was a high degree of variation among fixed-income types.

Treasury bonds benefited during that period's flight to quality and liquidity, with short-term Treasuries exhibiting the lowest U.S. market correlation. The next best diversifier for equities was cash, which exhibited a solid negative correlation with stocks during the period.

Most of the other fixed-income types, however, were weak to very weak diversifiers for equities. By extension, they were similarly correlated with one another and showed very little correlation with government bonds and cash during the period. Treasury Inflation-Protected Securities were among the worst fixed-income diversifiers for equities during the period. That might seem counterintuitive, in that these issues are backed by the full faith and credit of the U.S. government. But demand for such bonds tends to grow in periods when investors are concerned about inflation and slack off when they are not. Because inflation worries were close to nonexistent in the first quarter, TIPS didn't gain as much as nominal Treasury bonds during the period.

High-yield bonds, bank loans, and emerging-markets bonds are often aptly described as equitylike, so it is probably not surprising that their performance in the first quarter of 2020 was aligned with equities. Perhaps more surprising, however, was that the Morningstar US Core Bond Index and especially the intermediate core-plus bond Morningstar Category were lackluster diversifiers for equities. While their losses were smaller, their performance was much more in line with corporate bonds, high-yield bonds, and bank loans during the quarter than with Treasury bonds and cash. During the worst of the market swoon, both the Morningstar US Core Bond Index and the intermediate core-plus category posted losses, whereas Treasuries and cash ended up in the black.

Although stocks recovered starting in late March 2020, the correlation patterns of the first quarter persisted throughout the year. Treasury bonds across the duration spectrum also showed reasonably well from the standpoint of correlations with equities. Cash was a better diversifier than any of the bond indexes during the full-year period, however.

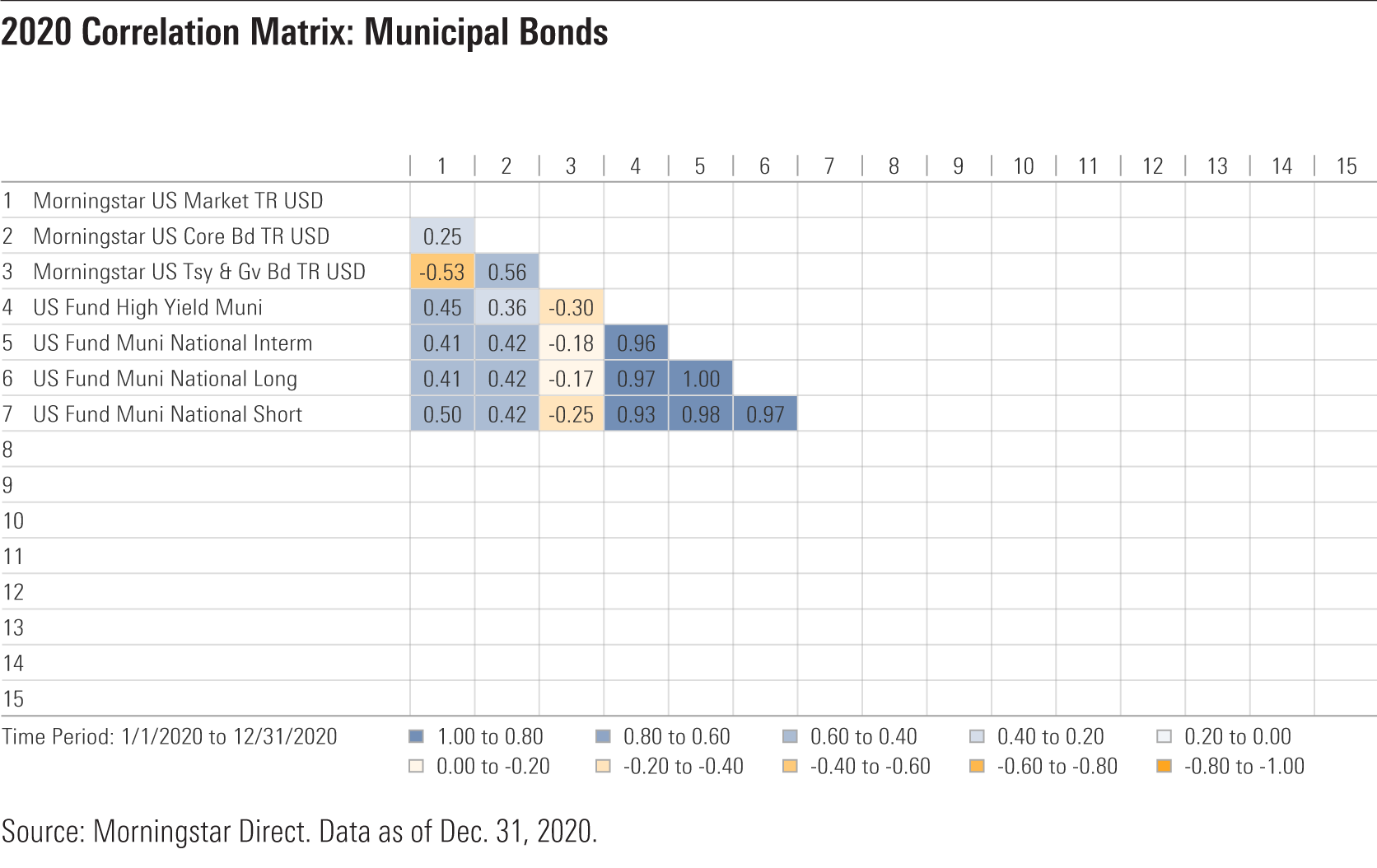

Compared with Treasury bonds, municipal bonds looked surprisingly unimpressive as diversifiers in 2020. In the flight to quality that characterized the short bear market at the outset of the pandemic, municipal bonds were notably less effective diversifiers for equities than U.S. Treasury bonds. Whereas Treasury and other U.S. government bonds exhibited a negative correlation with equities, munis' equity market correlation was strongly positive.

Across muni-bond groups, correlations with equities were about the same as the Morningstar US Core Bond Index--about 0.85 during the first quarter of 2020. High-yield municipal bonds--those issued by states and municipalities with lower credit ratings--had the lowest correlation with equities during the first-quarter equity weakness of any of the muni groups in our sample. That was surprising in that lower-rated taxable bonds were notably weak diversifiers for equities during the period. Moreover, state and municipal finances have come under pressure during the pandemic owing to both declining tax receipts as well as pandemic-related outlays.

However, high-yield munis may have benefited from their higher absolute yields, which provide a cushion against losses.

For the whole of 2020, municipal bonds' correlations with equities declined from first-quarter levels but remained higher than those of Treasuries and the Morningstar US Core Bond Index. The municipal market benefited from the Federal Reserve instituting a backstop via its municipal liquidity facility in the second quarter of 2020, giving a particular boost to lower-quality munis. Intermediate- and longer-term munis had a lower correlation with equities than did short-term munis during the year. It is also worth noting that in the first quarter and in the whole of the year, municipal bonds had a negative correlation with Treasuries.

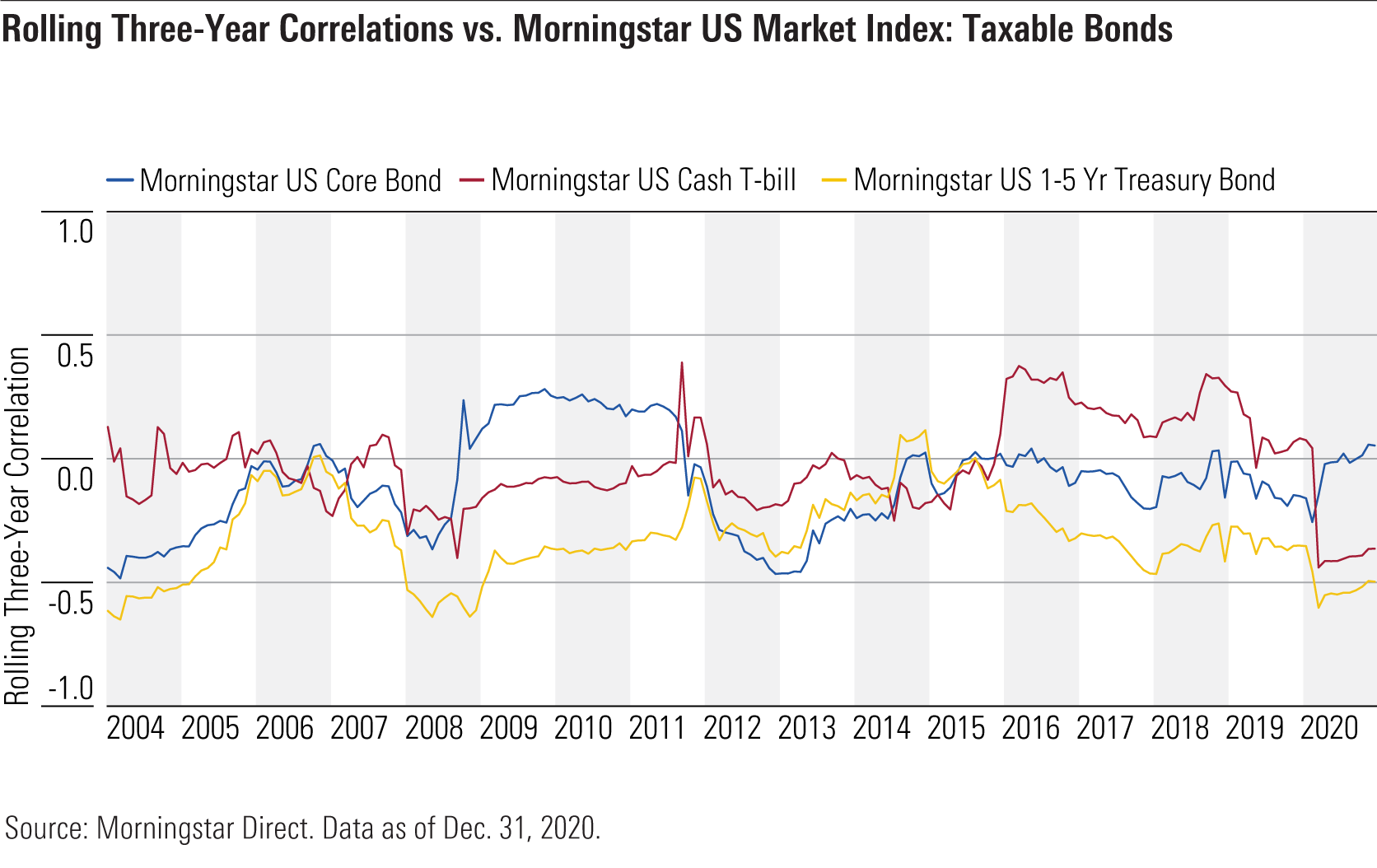

Longer-Term Trends in Diversification Benefits

Over the past two decades, Treasury bonds have provided the best diversification benefit of any bond type--and indeed of any asset class--for investors with equity exposure in their portfolios. The correlation benefit was similar for Treasuries across the duration spectrum. Cash has been the next most attractive diversifier for stocks. The Morningstar US Core Bond Index, which is dominated by high-quality U.S. bonds, has also delivered a negative equity market correlation, though correlations have recently increased.

Meanwhile, intermediate core-plus bond funds, which many investors use as their core fixed-income holdings, have provided less of a diversification benefit for equities. That is because these funds' portfolios are often heavy on corporate and asset-backed bonds and may also include a dash of lower-quality bond exposure. High-yield bond funds have proved to be the least effective equity diversifiers over the past two decades, followed by bank loans and emerging-markets bonds.

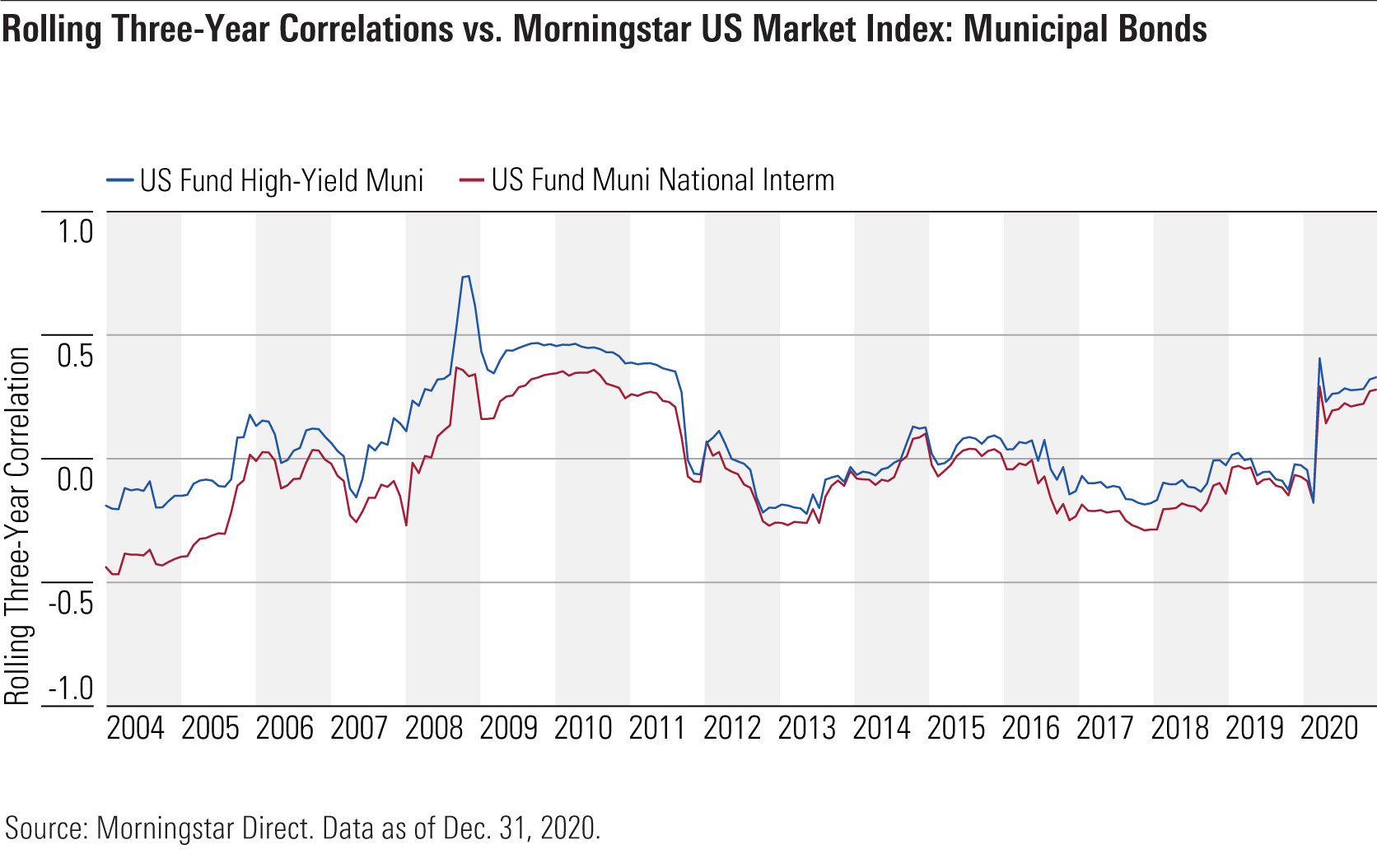

Over the past 20 years, municipal bonds have usually had a slightly negative correlation with equities. However, correlations with equities often jumped at inopportune times—during the global financial crisis of 2007-09 and again in the first quarter of 2020. In addition, all muni categories had a higher correlation with equities than did the Morningstar US Treasury & Government Index and the Morningstar US Core Bond Index. In short, high-quality taxable-bond exposure has been a better portfolio diversifier than municipal-bond exposure.

Munis' correlation with equities has also risen a bit over the past decade. Whereas correlations with equities were mostly negative in the 20-year period from 2001-20, they nudged into positive territory from 2011-20. Across all longer-term time frames, high-yield municipal-bond funds were the least effective diversifiers for equities of any municipal-bond-fund group. That is similar to the trend for high-yield taxable bonds; they are much less defensive and more sensitive to economic stress than high-quality bonds.

Portfolio Implications of Market Correlations

While Treasury bonds have been among the best diversifiers for equity exposure over the past two decades, whether that will hold true going forward is an open question. In particular, one scenario that has rarely been on display over the past three-plus decades is a rising-interest-rate environment. If yields were to jump up, that could hurt equity prices and would almost certainly punish Treasuries, which, because of their highest credit rating, tend to be extremely sensitive to interest-rate changes. In other words, if stocks suffered losses because of spiking interest rates, Treasuries may be less effective diversifiers. For example, as Treasury-bond yields rose sharply in the 15-year period from 1967 to 1981, Treasuries exhibited a modest positive correlation with stocks.

Another issue is that bond yields, especially Treasury yields, are still near multidecade lows even after an uptick in early 2021. Thus, while demand for Treasuries may be elevated in an equity market shock, Treasury-bond owners will not be able to rely on their yields to provide much of a cushion in volatile environments. That stands in contrast to the 1970s and early 1980s, when bonds' high absolute yields served as a shock absorber to offset their price declines. Today, investors in high-quality fixed-income investments have a limited yield buffer.

In a related vein, it is notable that cash has recently looked a bit better than Treasuries from the standpoint of diversification benefits. That may owe to the fact that as yields have declined across the board for several decades, high-quality bond yields have edged toward zero, so bond prices simply don't have a lot of room to move up. It may also be that, with yields on cash and Treasuries so tightly aligned, investors do not view bonds as worth their risks in a flight to quality. As always, matching a bond fund's duration to your anticipated holding period can help home in on the right types of bond funds to own.

It is also notable that TIPS have exhibited much weaker diversifying abilities than have nominal Treasuries over the past few decades. While their correlation coefficient with equities is lower than that of low-quality bonds, it is still positive and much higher than nominal Treasuries. That pattern makes intuitive sense, in that demand for TIPS' inflation protection is likely to stall out when worries about the economy are running high and equities are dropping. TIPS are also much less liquid than nominal Treasuries. In short, while TIPS play a role for inflation protection, investors have not been able to rely on TIPS to diversify their equity exposure. On the other hand, inflation has kept a low profile for the past decade. If a resurgence in inflation led to weaker stock returns, TIPS may confer a greater diversification benefit.

Meanwhile, all manner of lower-quality bond types are exceptionally poor diversifiers for stocks. That demonstrates that they are best used as supplemental holdings alongside high-quality fixed-income investments or, perhaps better yet, as equity alternatives. Funds in the intermediate core-plus bond category are a prime example. While these funds have better yields and better long-term returns than Treasuries and the Morningstar US Core Bond Index, the trade-off is more sensitivity to what is going on in investors' equity portfolios.

Municipal bonds have provided a decent, although certainly not perfect, diversifier for equities. Over longer time periods, munis have exhibited a higher correlation with equity markets than high-quality taxable-bond indexes and especially Treasury bonds. One of the key reasons may be that the muni market is less liquid than that of Treasuries, and it has often seized up in periods of equity market stress. That suggests that even investors who put a high value on the tax-saving features of municipal bonds should consider augmenting them with U.S. government bonds for diversification and ballast during equity market shocks. It also underscores the importance of not using a muni-bond fund as a source of liquid reserves, in that the muni market's bouts of illiquidity are an inopportune time to sell.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)