How Can Climate-Aware Funds Fit Into Your Portfolio?

Our analysis shows how these funds stack up on specific climate-related metrics.

Just as governments around the world have spent the past year racing to get the coronavirus pandemic under control, we should be racing to contend with a similarly harmful global event: the threat of climate change. To be sure, a growing number of entities are doing their part. Regulators are ratcheting up efforts to combat climate change, and the investment community is offering more disclosure.

How can individual investors play a part in this effort? To start, they can familiarize themselves with climate-aware funds and fit them into their portfolios where appropriate. The funds we consider "climate-aware" represent a broad range of approaches to meeting various investor needs and preferences, such as the divestment from fossil fuels or participation in carbon solutions.

In our report "Investing in Times of Climate Change," we dig into the global landscape of climate-aware funds. We map out the products that fit into each category, explore how well funds deliver on their promises, and demonstrate how investors can assess the efficacy of these products. Morningstar Direct and Office clients can access the full report here.

How We View the Climate Product Landscape

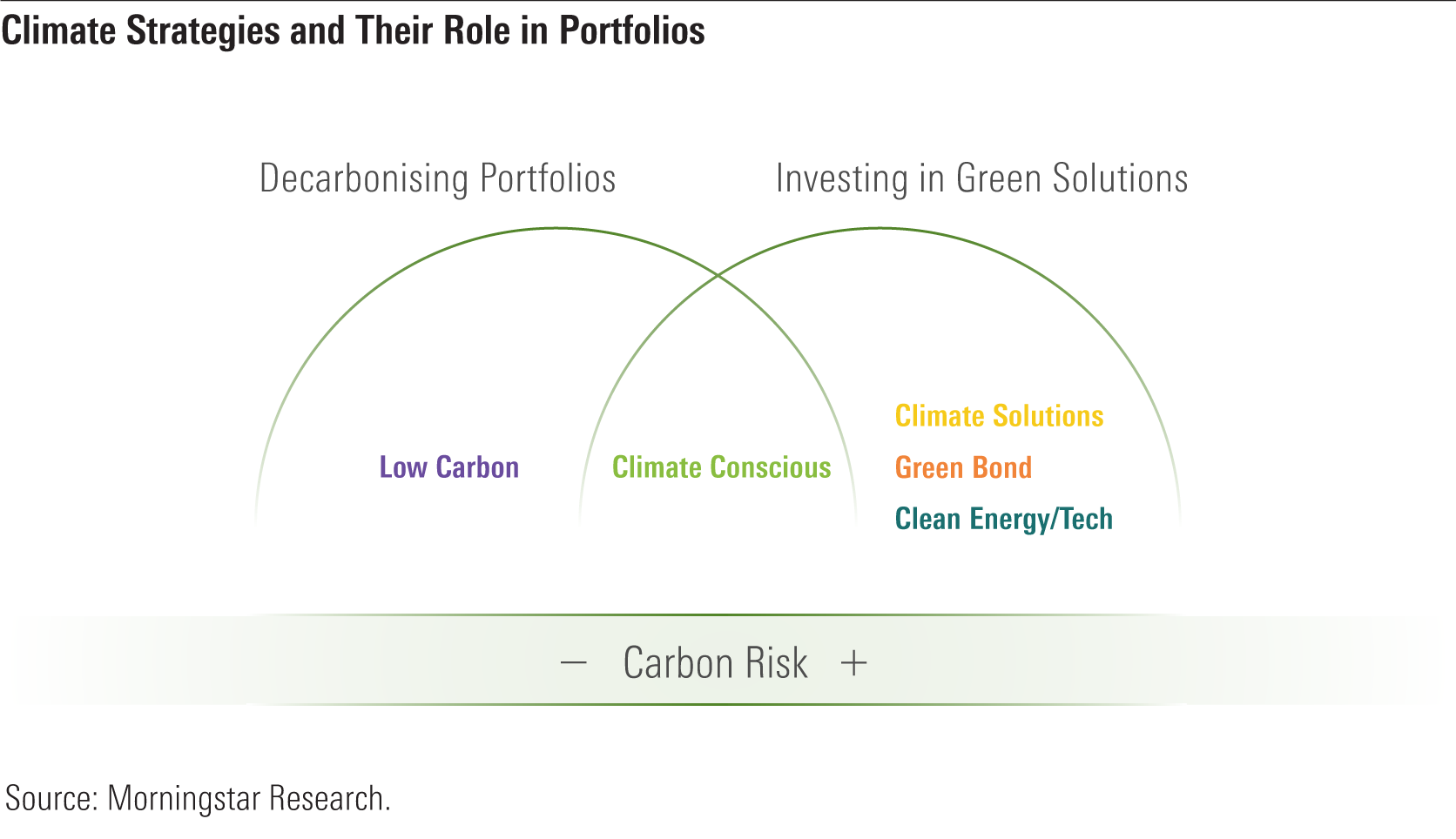

We divide the landscape of climate products into five groups:

- Low Carbon funds seek to invest in companies with reduced carbon intensity and/or carbon footprint relative to a benchmark index. These funds are well diversified.

- Climate Conscious funds select or tilt toward companies that consider climate change in their business strategy and therefore are better prepared for the transition to a low-carbon economy. These funds are also well diversified.

- Climate Solutions funds only target companies that are contributing to the transition to a low-carbon economy through their products and services and that will benefit from this transition. These funds are less well-diversified and tilt toward industrials and technology.

- Clean Energy/Tech funds invest in companies that contribute to or facilitate the clean energy transition. These funds are concentrated in the industrials and technology sectors.

- Green Bond funds invest in debt instruments that finance projects facilitating the transition to a green economy.

The graphic below displays the different roles that these strategies play in portfolios.

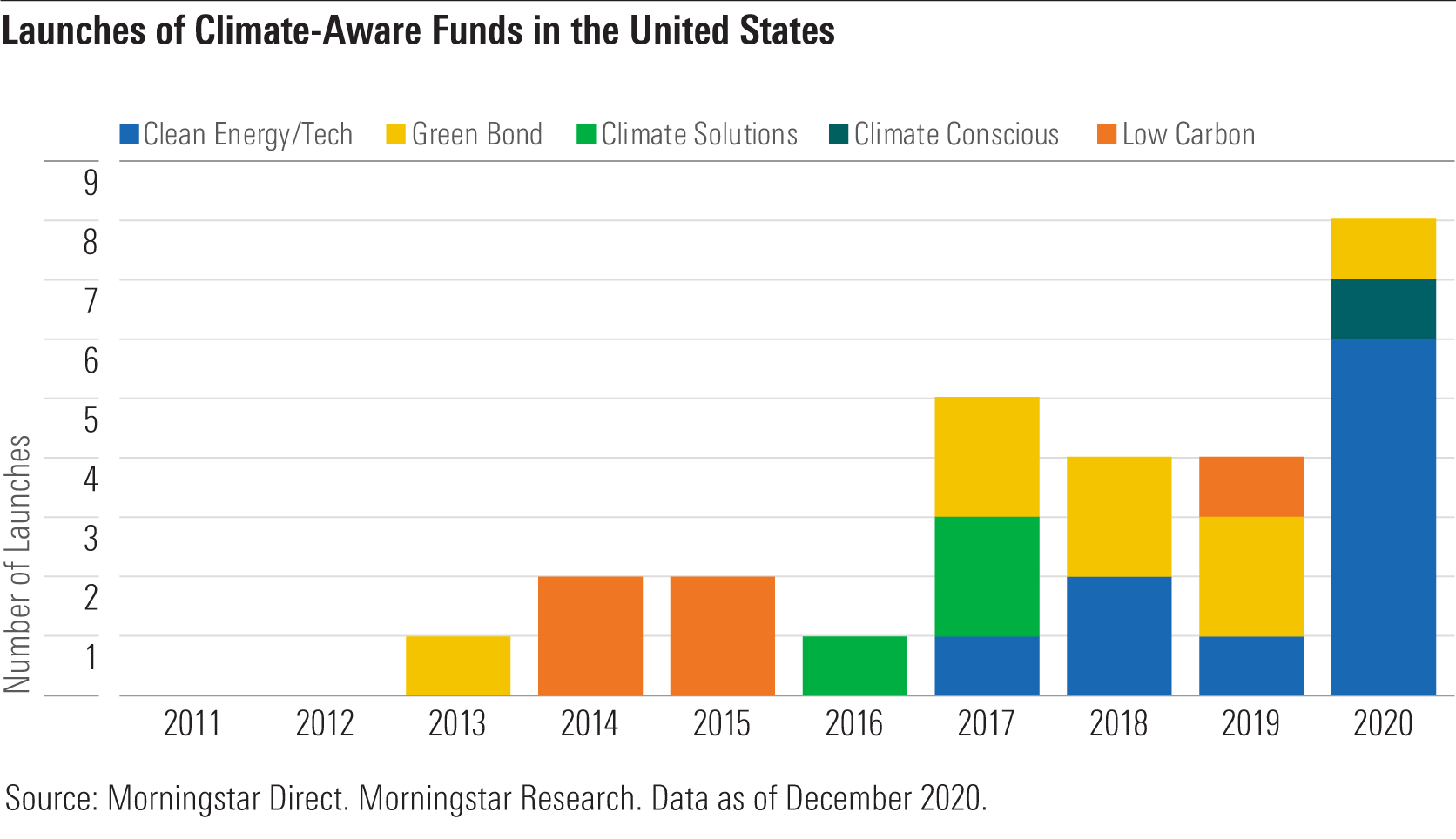

A Slow Start for Climate-Aware Funds in the United States

The United States has been relatively slow to adopt these types of products. We have currently identified 42 available in the U.S., as compared with Europe, where we have identified 282. Though we have sought to gather as many funds as possible, this list is not intended to be exhaustive but to be a clean selection with which to analyze the funds' efficacy.

Even so, the chart below shows that the U.S. saw a record number of climate-aware product launches in 2020, with eight. We also anticipate that the number of fund launches may continue to increase now that President Joe Biden has re-signed the Paris Accord.

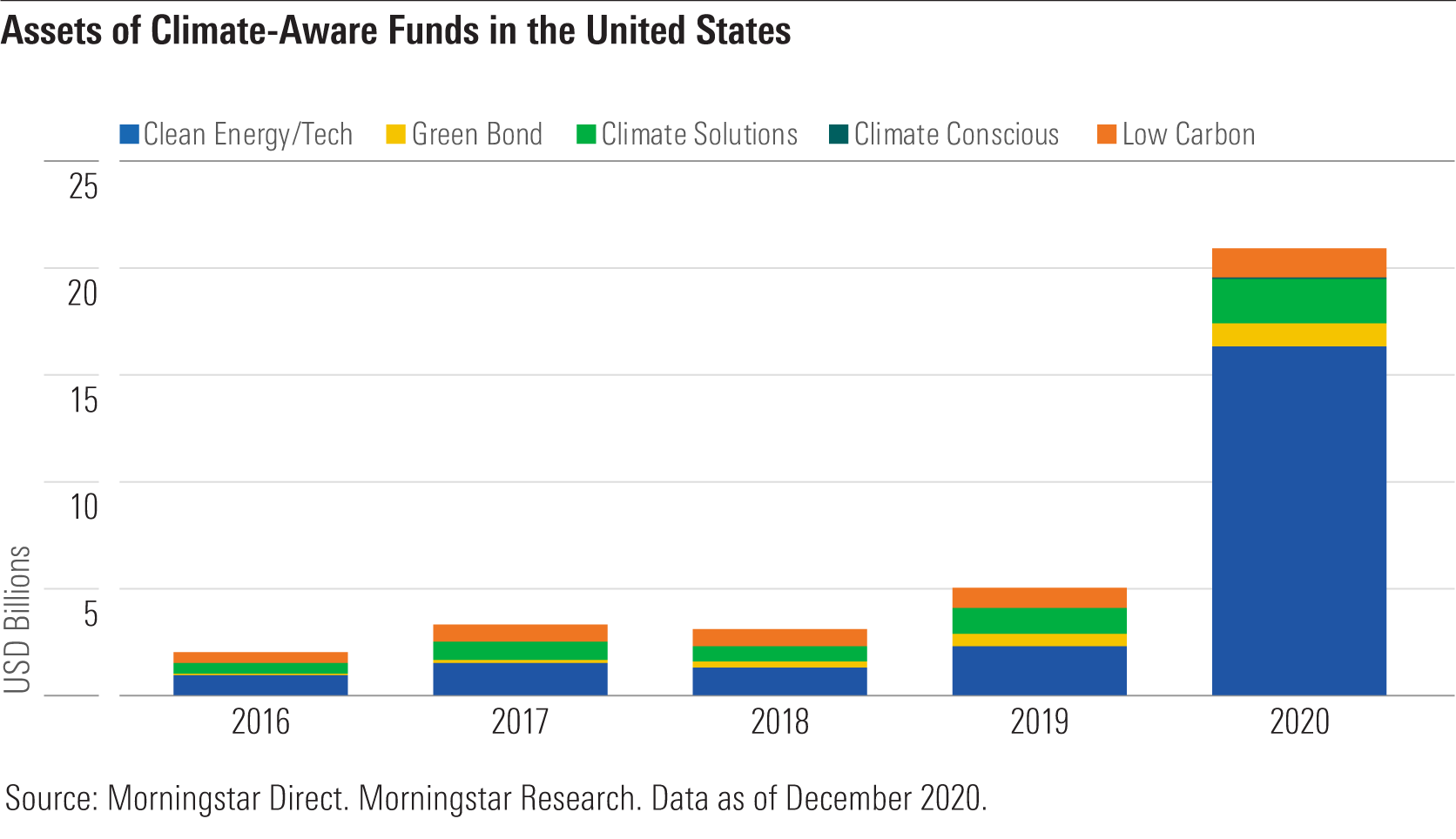

Of these five categories, Clean Energy/Tech funds have constituted the bulk of U.S. climate products in recent years. The chart below shows how the assets in this category far outpace the assets in the other four categories.

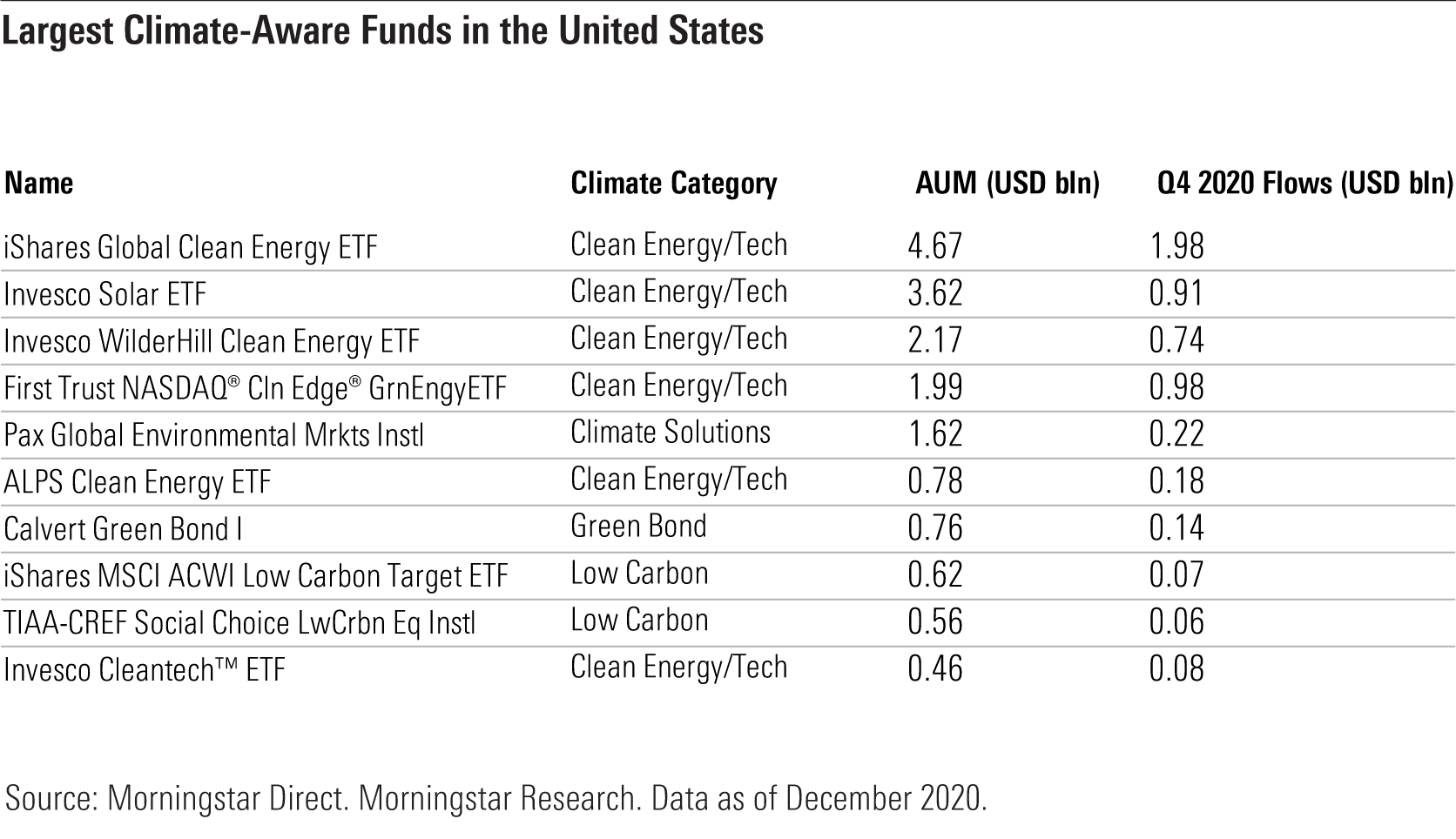

The two largest funds available to U.S. investors fall into the Clean Energy/Tech group: iShares Global Clean Energy ETF ICLN and Invesco Solar ETF TAN. ICLN also led the global landscape in flows in the fourth quarter of 2020 with $1.98 billion in inflows.

Which Types of Funds Are Best--and Worst--on Each Measure

We also assessed how these strategies compare on specific climate-related measures and how well they deliver on their premises. We evaluated the global universe of climate-aware products against the relevant Morningstar metrics and also plotted them on the Morningstar Global Target Market Exposure Index, which we used as our benchmark.

Here's what our findings revealed for each metric:

- Carbon Intensity. We found that 54% of the funds included in our analysis with carbon-intensity numbers offer an improvement on the benchmark. The majority of these are Low Carbon and Climate Conscious funds. By contrast, most Climate Solutions and Clean Energy/Tech funds exhibit higher carbon-intensity scores than the index.

- Fossil Fuel Involvement. We found that more than 80% of Climate Conscious funds and more than 70% of Climate Solutions funds have lower fossil fuel involvement than the index. However, only 52% of Clean Energy/Tech funds do.

- Oil and Gas Production Involvement. The vast majority of funds included in our analysis have lower exposure to oil and gas producers than the benchmark. Only 16% of Green Bond funds keep their involvement below the benchmark's.

- Thermal Coal Involvement. Low Carbon funds exhibited the lowest level of thermal coal involvement, with almost 80% of them beating the benchmark. Conversely, only 30% of Green Bond products beat this benchmark, and about half of Clean Energy/Tech funds had high exposure to thermal coal.

- Carbon Solutions Involvement. As expected, Clean Energy/Tech and Climate Solutions funds offered the highest exposure to carbon solutions, although the level of involvement varies greatly. By contrast, only about half of Low Carbon funds beat the global benchmark.

- Carbon Risk. Climate Conscious and Low Carbon funds have the lowest Morningstar Portfolio Carbon Risk Scores. On the other hand, Climate Solutions and Clean Energy/Teach funds tend to carry more carbon risk, because they tend to invest in more-diversified businesses.

Which Funds Are the Right Fit for Your Portfolio?

Clearly, these five strategies reflect a broad range of approaches that aim to meet different investor needs and preferences. The choice of one type over another largely depends on an investor's investment goals, risk appetite, and preferences.

For instance:

- Investors who are concerned about climate-related risks can look to Low Carbon funds to decarbonize a portfolio. Our analysis shows that these approaches provide broad and diversified exposure to the market and are therefore suitable as part of a core portfolio allocation. However, it would be a mistake to believe these are investments in the transition to a low-carbon economy.

- Investors who are looking to take advantage of the transition to a low-carbon economy can turn to Climate Conscious funds. These typically exhibit low carbon risk and fossil fuel exposure, with the added benefit of higher carbon solutions involvement. These are suitable for investors wanting to strike a balance between mitigating risk and looking to benefit from the green transition.

- Investors who have a greater risk appetite and consider climate change an alpha-generating opportunity can look to Climate Solutions and Clean Energy/Tech strategies. Because of their narrower market exposure and bias toward mid- and small caps, these funds represent more-volatile investments. They are also more suitable as part of a satellite allocation to complement rather than replace existing core holdings.

- Investors looking for a steady stream of income while investing in green projects would find Green Bonds a good fit. They may be inherently lower risk, but investors must be sure that the projects within them are indeed providing green solutions, since many green-bond issuers have high exposure to traditional brown industries such as those involved with thermal coal.

The Climate Is Right for Climate-Aware Investing

As investors look to incorporate climate-aware funds into their portfolios, it's important that they do their homework. To avoid any unpleasant surprises, they should 1) understand the funds' investment objectives and how the portfolios are constructed, 2) ensure they are comfortable with the level of carbon exposure, and 3) look at the funds' holdings.

We anticipate that this product universe will only expand as climate-related regulation continues to roll out and investor interest continues to grow. This is an opportunity for fund managers to showcase their commitment to client service and education--and to a cleaner world.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)