Climate Change Creates Immediate Opportunity in Salt

Compass Minerals will benefit from higher prices and lower costs.

Climate change is the largest environmental, social, and governance risk to salt producers as permanently warmer winters would result in less need for salt to keep roads safe. However, an average winter hasn’t really changed over the past 30 years. Instead, year-to-year volatility is the larger risk from climate change, which results in the once-stable salt business seeing a wider range of possible outcomes. One only needs to see the recent Texas winter or February in the Midwest, both of which had the most snowfall in the past decade, to see that snow isn’t going anywhere.

Following a mild 2019-20 winter that saw lower deicing salt volumes and subsequently lower prices, the market is questioning the long-term earnings power of Compass Minerals’ CMP salt business. Where some see caution as Compass’ profits fell for the second straight year, we see progress on a multiyear turnaround story. As unit production costs continue to fall and prices rebound following an average winter and reduced market supply, we see immediate profit growth for Compass Minerals--catalysts to push the shares closer to our $78 fair value estimate.

Climate Change Is the Biggest ESG Risk for Salt Producers

Snowfall is the biggest driver of deicing salt demand. The number of days it snows at least 1 inch is a good indicator of deicing salt demand, as this is the typical threshold for deploying deicing salt to keep roads safe. We view climate change as the biggest ESG risk for salt producers, including Compass Minerals, because of the potential disruption of deicing salt demand. While there are multiple indicators of climate change, we view warming temperatures and increasing precipitation as the two most important to track for a potential change in the average amount of snowfall each winter.

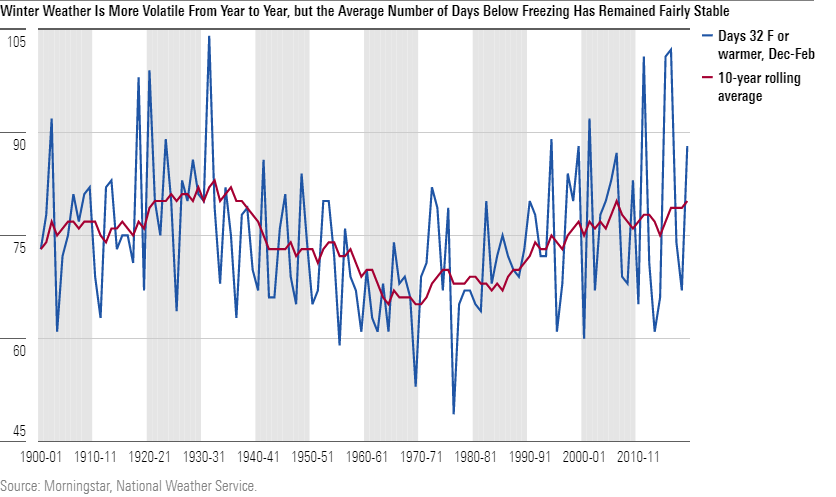

On their own, warming temperatures are the biggest potential threat for deicing salt demand. Snowfall that occurs when the temperature is above freezing is less likely to require salt, as it usually melts on its own. We’ve analyzed 120 years of weather data in 10 cities that make up a representative Midwest footprint: Buffalo (New York), Chicago, Cincinnati, Cleveland, Detroit, Grand Rapids (Michigan), Milwaukee, Minneapolis, Pittsburgh, and St. Louis. We’ve found that the number of days during a winter season (fourth quarter and first quarter) with a minimum temperature above 32 degrees Fahrenheit has not changed too much from 100 years ago on a rolling 10-year average basis. However, volatility has increased from year to year, as the rolling 10-year standard deviation has doubled to 16 days from 8 days. As such, we view volatility as a bigger risk that could affect salt producers’ results.

In any given year, the number of snow days in the Midwest is highly variable. However, the long-term average hasn’t changed much. Because of the winter weather volatility from year to year, we forecast deicing salt demand over a multiyear period based on average snowfall over a longer time horizon. Over the past 30 years, an average winter has stayed fairly consistent at roughly 140 total snow days during a winter season from the beginning of October through the end of March.

However, during this time, annual winter weather volatility has grown around 60%-- from around 25 snow days per year to 40--leading to far less predictability from year to year. Based on the current volatility, we would expect the number of snow days in a given year to range from 100 to 180, wider than the range in the 1990s of 115-165 days.

Greater volatility in the number of snow days means a wider range of deicing salt volumes in any given year. Compass Minerals’ highway deicing salt contracts reflect this volatility, as customers are typically allowed to purchase between 80% and 120% of the volume bid point based on need.

Through the first five months of the 2020-21 season, there were 130 snow days, above the 10-year average of 120 days. This follows a milder 2019-20 season that saw below-average snowfall. Given that the majority of the season has already occurred, we see the 2020-21 winter as a positive for deicing salt demand. As a result, we forecast a rebound in deicing salt volumes this year. This should set up Compass with a favorable pricing environment heading into the 2021 bid season.

Deicing Salt Prices Should Rise Next Season Following Normal Winter and Lower Supply

Changes in deicing salt prices typically lag the previous winter season. Following a harsh winter, salt inventories are low, which leads to tight market conditions and rising prices. Conversely, following a mild winter, salt inventories are high, which leads to excess supply heading into the following season and falling prices. Just as salt volumes are volatile from year to year, salt prices have recently seen large swings as well.

Contracts typically run from the fourth quarter through the end of the third quarter of the following year, so the fourth quarter typically reflects Compass’ new prices. For example, the 2019-20 winter (October through March) had 118 snow days, which was 16% below the average of 140 days. In the current season, which started during the fourth quarter of 2020, management expects prices to be 8% below the previous year, highlighting how the harshness of a winter affects future prices.

While the harshness of a winter is the biggest driver of future prices, changes in supply also affect prices. For example, although the 2011-12 winter snowfall was well below average, salt prices stayed fairly flat because of reduced market supply. A tornado hit the Goderich mine in 2011, affecting Compass’ production in 2011 and 2012 and forcing supply lower in line with demand.

We expect this dynamic to boost prices in the next season. In January, deicing salt competitor Cargill announced the accelerated closure of its Avery Island mine following a roof collapse in December. Compass Minerals’ management estimates the Avery Island mine had annual production of roughly 1.5 million metric tons, which will once again cause a supply void.

More snow and reduced supply create tight market conditions heading into the 2021 bid season to determine 2021-22 prices. As a result, we forecast prices will rise starting in the fourth quarter of 2021.

Falling Unit Production Costs Should Boost Profit Margins

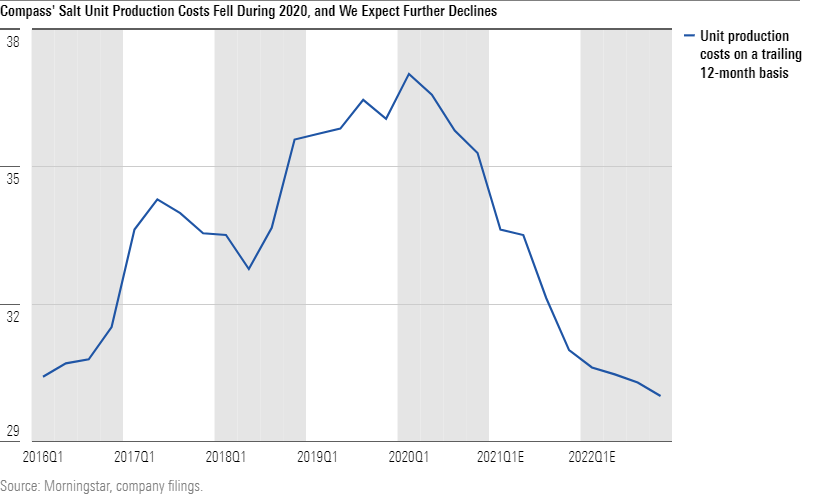

Since late 2017, Compass’ salt production costs have been elevated following a string of incidents at the Goderich mine. First, there was a partial ceiling collapse. Then, Compass ran into a patch of lower-quality salt that required the installation of optical sorters. After that, there was a worker strike that lasted 11 weeks. The incidents also came at a time when Compass was fully transitioning to the use of continuous miners, which essentially involved retraining some of the workforce. As a result, salt production at Goderich bottomed out in 2018 and has only recently recovered to more normal levels. Given the high-fixed-cost nature of salt mining, lower production volumes resulted in higher unit costs.

However, production has been nearly fully restored, and costs have begun to fall. Since peaking in the first quarter of 2020, on a trailing 12-month basis, unit production costs have fallen over the last three consecutive quarters. We expect further declines over the next couple of years and forecast costs will eventually return to 2016 levels.

Management’s Low 30s EBITDA Target Appears Achievable

As a result of declining unit production costs and higher prices, we forecast salt EBITDA margins will expand from 29% in 2020 to 32% in 2022, in line with management’s long-term targets. We see margins falling in 2021 as lower prices outweigh the benefits of declining costs. However, as prices rebound in 2022 and costs continue to decline, we see margin expansion.

Salt segment profits are volatile from year to year based on variable winter weather. However, we forecast based on an average winter, given the mean reversion tendency of winter weather over a number of years. Further, we see less operational variability for the salt business over the next several years as Compass moves past the issues that plagued the Goderich mine. While margins may fall below 30% or rise above 32% based on winter weather variability, we think the low 30s will be the new midpoint over the next several years for the salt segment.

Divestitures Should Provide Needed Balance Sheet Health

In February, Compass Minerals announced plans to divest its plant nutrition South America segment. Compass entered South America in 2016 with the acquisition of Produquimica for around $600 million. The segment sells specialty fertilizers and industrial chemicals primarily in Brazil. Agriculture generated nearly 80% of revenue in 2020.

Compass is divesting the segment in two transactions, selling the agriculture and chemical businesses separately. In March, Compass announced it had reached an agreement to sell the agriculture business at what amounts to a 9.75 times enterprise value/EBITDA multiple, inclusive of the earnout. The deal is set to close in the second half of 2021, which we think is achievable. Based on comparable transactions from PitchBook data, we thought the business could sell for 10-15 times EV/EBITDA. Given our favorable outlook for specialty fertilizer volumes in South America, the divestiture price is below our valuation of the business.

Despite the lower-than-expected price, the divestiture should allow Compass to pay down debt, which we view as a top priority. Compass’ balance sheet has been strained since 2016, when the company funded the Produquimica acquisition with debt, although we thought it paid a good price, given the solid long-term growth prospects of specialty fertilizer in Brazil. Compass ended 2020 with a 4.3 times net debt/adjusted EBITDA leverage ratio. Including the divestiture proceeds, management estimates Compass will end 2021 with a leverage ratio of 3.4, which is more manageable. Further, in April, Compass announced the divestiture of its North American micronutrients businesses for an additional $60 million. The company is also in the process of divesting its other South American business, which sells industrial chemicals. Assuming a high-single-digit multiple, we think Compass could sell the business for $120 million-$150 million. All in all, Compass could pay down $550 million-$600 million by the end of the year, which is around 40% of its total debt outstanding at the end of 2020. We are in favor of this strategy to reduce debt through noncore asset sales, as it allows Compass to restore its balance sheet while maintaining all of its best salt and sulfate of potash assets.

Given the volatility of the salt business from year to year, we think Compass Minerals should focus on maintaining a strong balance sheet in order to have financial flexibility following mild winters and falling salt prices. Once the plant nutrition South America segment is fully divested, salt will account for the vast majority of total profits. Excluding plant nutrition South America, salt would have generated roughly 93% of total EBITDA in 2020.

Based on our capital allocation framework, we assign Compass Minerals a Standard capital allocation rating. We rate the balance sheet as weak because of elevated leverage from the Produquimica acquisition, given that Compass’ revenue is subject to moderate cyclicality. However, with few near-term debt maturities over the next few years and the salt business being restored, Compass is not in danger of being unable to meet its financial obligations, in our view. We view management’s investments as fair, and we are in favor of the decision to prioritize the Goderich mine, which underpins our wide economic moat rating. We see shareholder distributions as mixed, given that the dividend payout ratio is high relative to our forecast earnings over the next several years. However, we think the company will generate enough free cash flow to maintain the current dividend of $2.88 per share.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)