33 Undervalued Stocks for the Second Quarter

Here are our analysts’ top ideas in each sector for the coming quarter.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

U.S. stocks finished the first quarter of 2021 with a 5.6% return, as measured by the Morningstar US Market Index. We think stocks are slightly overpriced today: The median stock in our North American coverage universe trades at a 3% premium to our fair value estimate.

Only 14% of the stocks we cover have Morningstar Ratings of 4 or 5 stars, observes Dave Sekera, Morningstar’s chief U.S. market strategist, in his latest stock market outlook. In aggregate, the energy, utilities, and communication-services sectors look undervalued; the basic-materials and industrials sectors, meanwhile, are the most overvalued.

Here are some specific undervalued stocks across sectors that are among our analysts' best ideas.

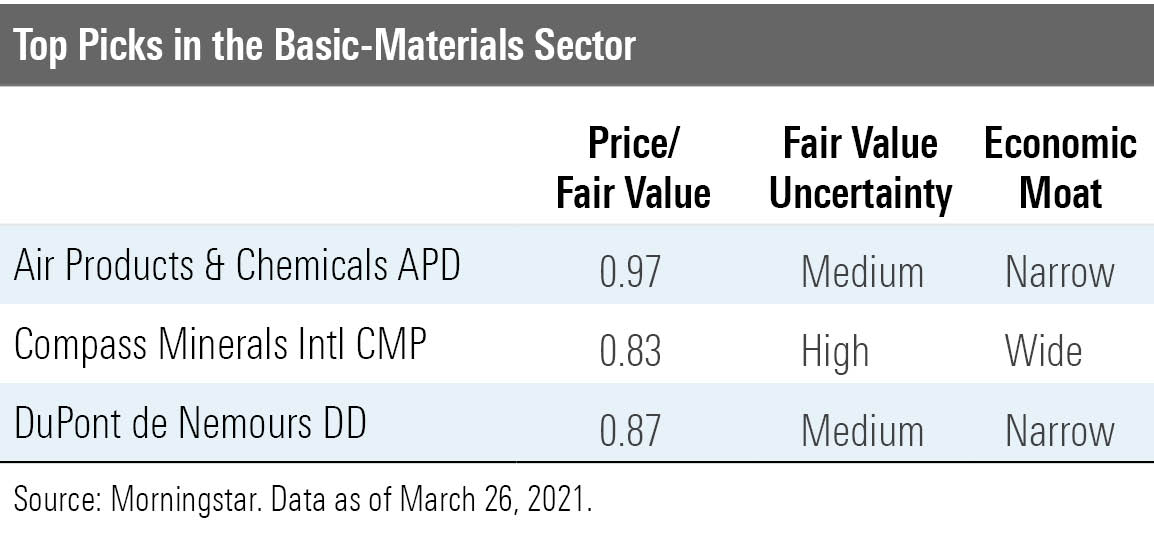

Basic Materials

Basic-materials stocks are on a tear and outperformed the broader index during the first quarter--adding to the outperformance they experienced during 2020, observes director Kris Inton. "Just two U.S basic-materials stocks we cover now trade in 4-star territory, and no stocks trade at 5 stars," he adds.

Specifically, we expect industrial gas firms to benefit from a rebound in merchant volumes this year, chemicals producers to see continued sequential volume recovery, and de-icing salt prices to rise in the 2021-22 season.

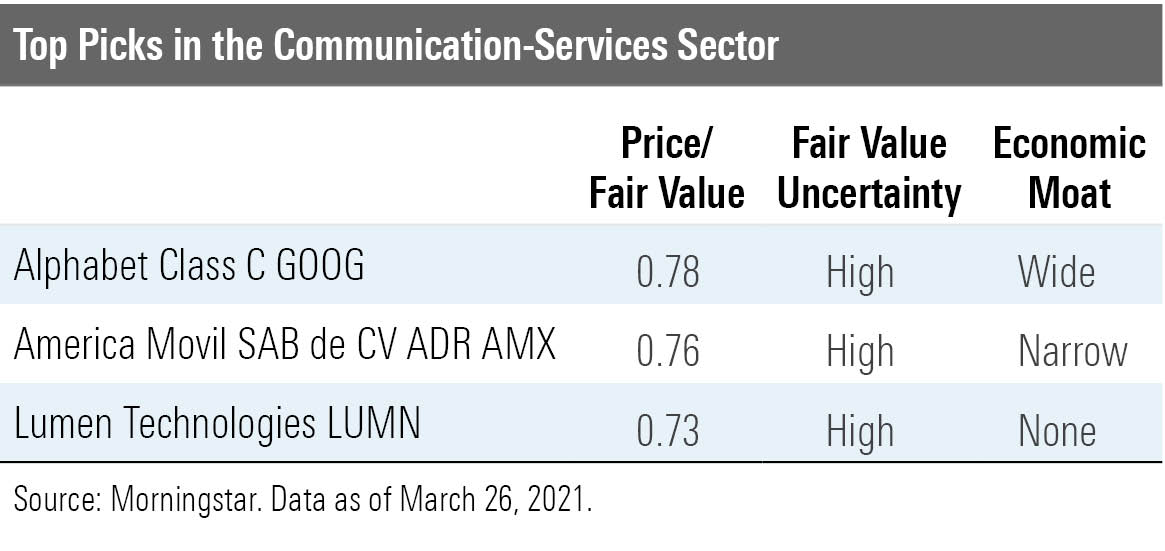

Communication Services

Communication-services stocks as a group have kept pace with the market, but smaller players rather than the internet giants have driven returns in 2021, notes director Mike Hodel. We suspect that investors have warmed to the direct-to-consumer content potential of these midtier media companies.

In wireless, Verizon VZ, AT&T T, and T-Mobile TMUS agreed to pay $90 billion to secure additional wireless spectrum. "While we believe the wireless business will continue to produce steady cash flow for the carriers, these investments reflect the challenge of maintaining competitive parity while earning attractive returns on capital over the long run," argues Hodel.

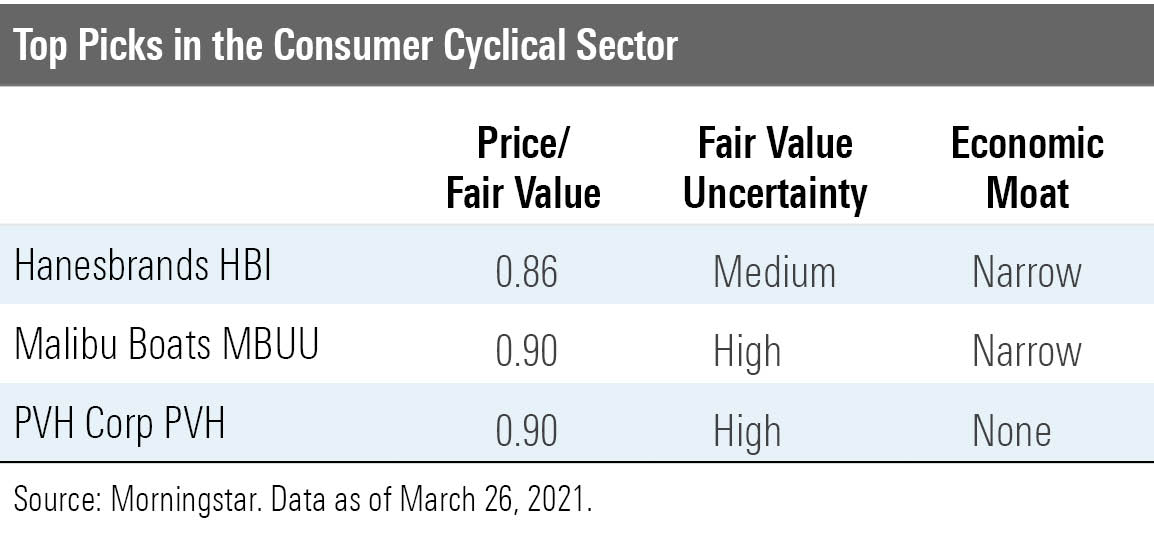

Consumer Cyclical

Consumer cyclical names lagged the market a bit in the first quarter after a blistering outperformance over the trailing 12 months. Not surprisingly, the median consumer cyclical stock is about 17% overvalued, estimates director Erin Lash. "The market's exuberance has been particularly pronounced for apparel retailers and manufacturers, which have benefited from a rise in 'athleisure' wear and increased e-commerce," she details.

We expect consumer spending to increase as more of the population becomes vaccinated, and we think leisure travel, in particular, stands to benefit.

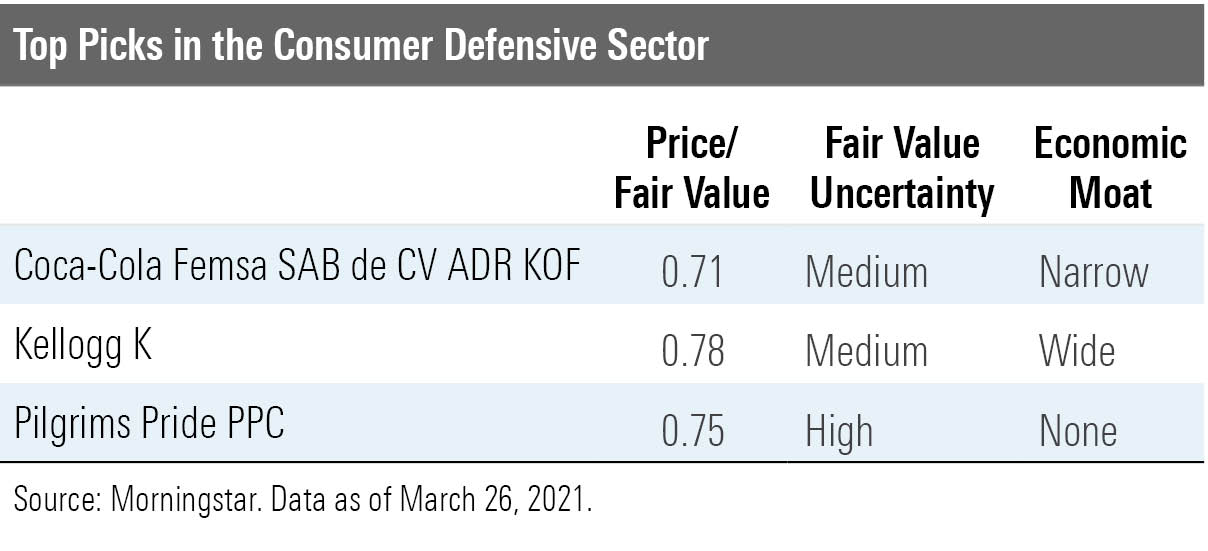

Consumer Defensive

Although the consumer defensive sector lagged the broader market during the first quarter, we still view the group as overvalued by 10%, points out Lash. Tobacco names, however, look particularly attractive.

Consumers changed their shopping habits during the pandemic, opting for click-and-collect delivery options for groceries. While we don't expect the significant spike in online grocery shopping to persist, we do think the pandemic accelerated adoption of such services, argues Lash.

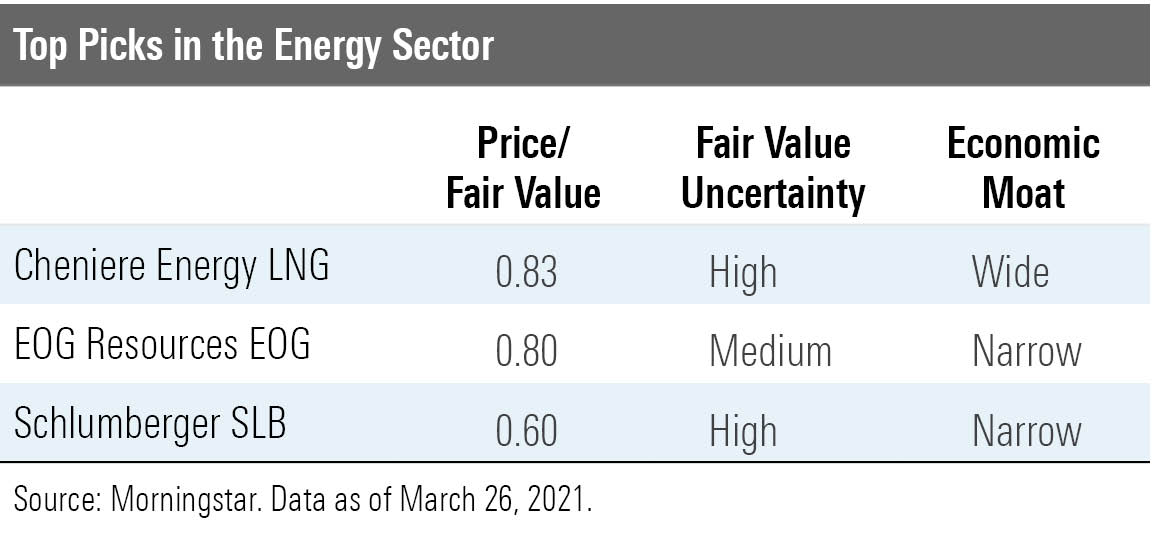

Energy

Energy stocks rallied for the second quarter in a row, and we expect global consumption to return to 2019 levels within two years, notes director Dave Meats. Despite the rally, energy stocks remain undervalued as a group, according to our metrics, with the average stock trading 9% below our fair value estimate.

While some exploration and production stocks are still undervalued (despite soaring during the past three months), we see the most opportunity in the midstream, services, and integrated segments.

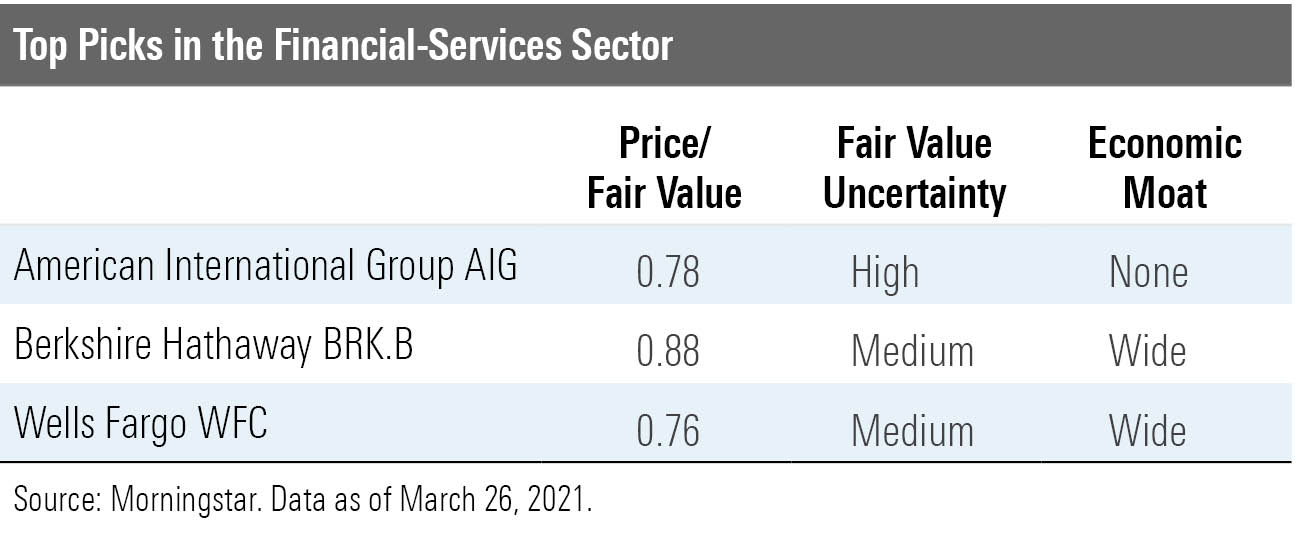

Financial Services

Financial-services names outran the market during the first quarter. Not surprisingly, many financial-services stocks are more than fairly valued today, with the average stock in the sector trading 10% above our fair value, comments director Michael Wong. Those names that are trading well below fair value tend to be turnaround stories with company-specific issues, he adds.

U.S. Treasury yields have increased dramatically during the past few months, and many financial sector business models stand to benefit in a rising-rate environment, including banks and companies with banking operations, as well as insurers that can benefit from higher yields on their investment portfolios.

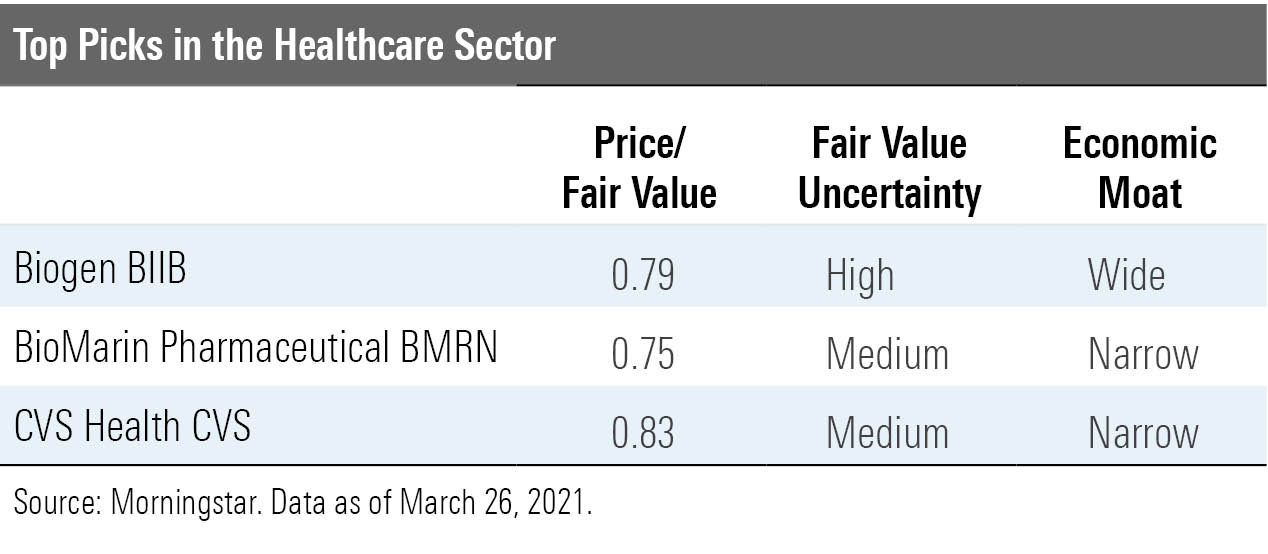

Healthcare

Valuations in the healthcare sector look a bit high, with the average stock in our coverage universe trading about 9% ahead of our fair value estimate. We think the sector's fundamentals are strong, and we expect to see accelerated earnings growth for industries affected by pandemic restrictions, such as elective procedures, asserts director Damien Conover.

The drug manufacturers and managed-care firms remain the most undervalued--more than likely driven by expected changes in U.S. healthcare policy. "However, given the only slight majority in the Senate along with the complexities of implementing new healthcare policies, we continue to expect only minor incremental changes that shouldn't have a major impact," says Conover.

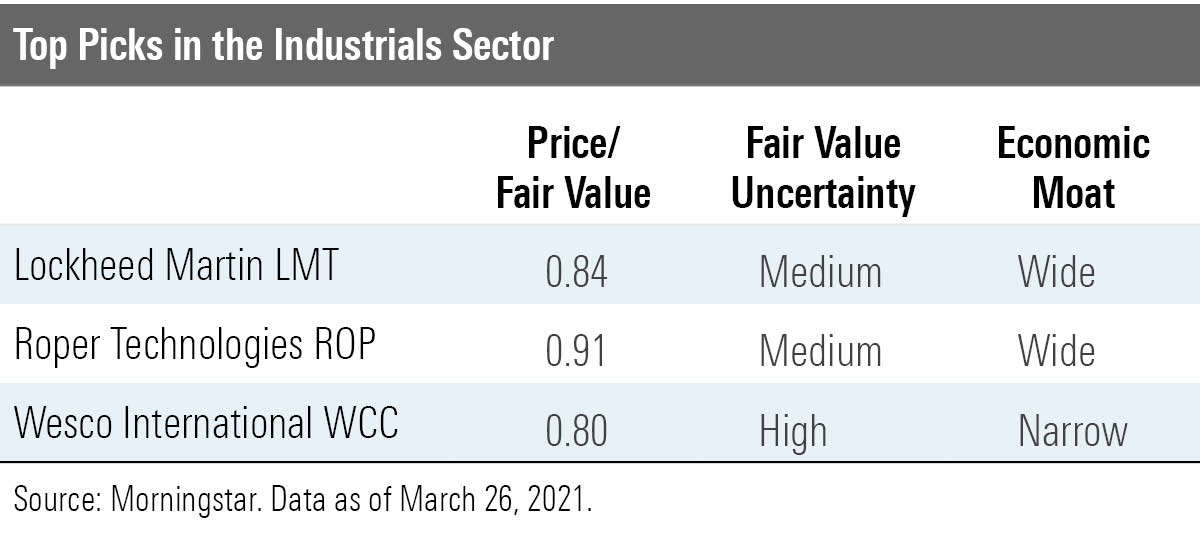

Industrials

Industrials stocks posted a strong first quarter, with farm and heavy construction machinery and construction stocks taking the lead amid optimism about a U.S. infrastructure spending plan. Nearly all of the industrials stocks we cover trade at 3-star levels or less, suggesting the group is overvalued, notes director Brian Bernard.

We expect demand for military products to remain strong and therefore see some upside with defense primes. We expect U.S. air travel to recover, but that recovery is already priced into the airlines we cover, he adds.

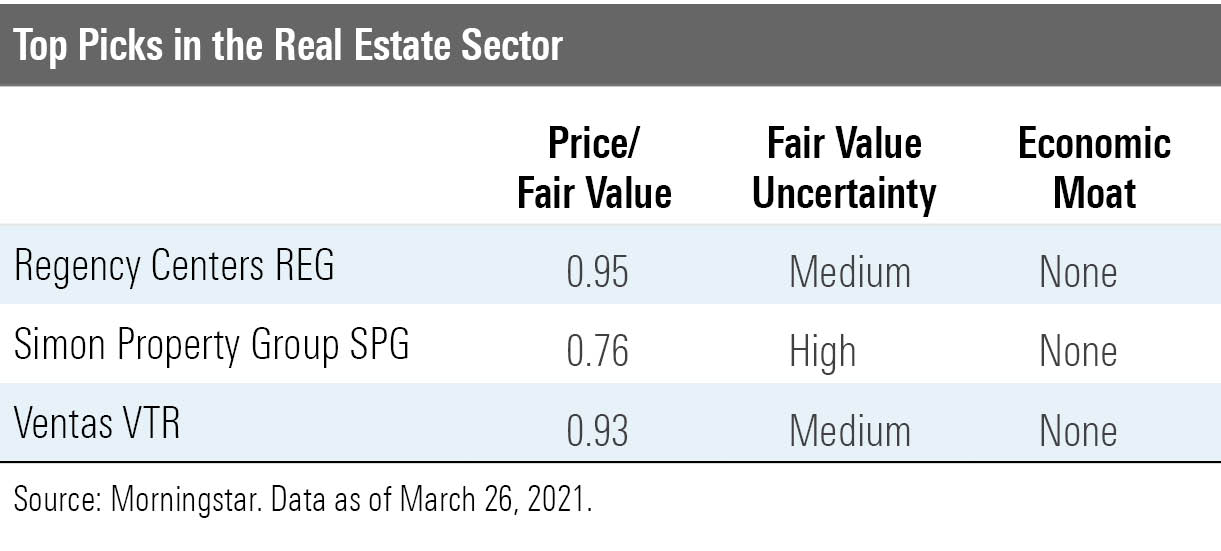

Real Estate

The real estate sector overall has lagged the broader market during the past year, yet the group is about 4% overvalued according to our metrics, says analyst Kevin Brown. During much of 2020, industrial and self-storage sectors outperformed, as they were relatively insulated from the effects of the coronavirus.

After lagging their peers for much of 2020, however, the hotel and retail industries have tremendously outperformed on news of successful COVID-19 vaccine developments. We still see some value picks among these subsectors today, asserts Brown.

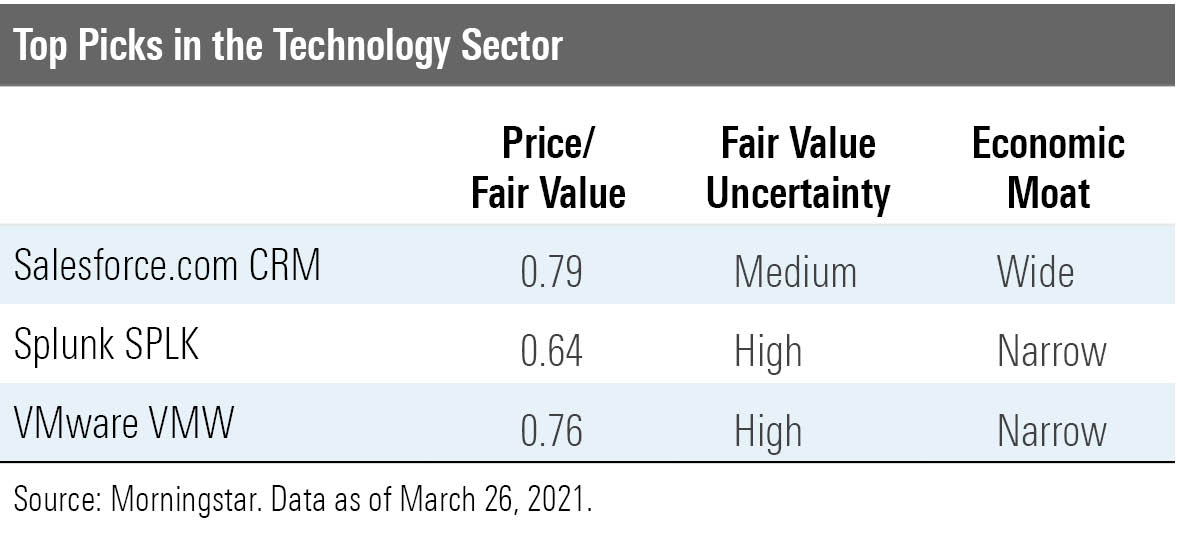

Technology

After tearing it up in 2020, technology stocks significantly underperformed the broad market in the first quarter. Director Brian Colello calls the pullback "healthy," noting that we're seeing some attractive opportunities in large-cap software. Nevertheless, the average tech stock in our coverage universe is about 13% overvalued.

We still see the technology sector as fundamentally sound, albeit pricey. "Across most of the sector, robust fundamental tailwinds still support future growth in areas such as cloud computing, 5G, and the 'Internet of Things'," explains Colello.

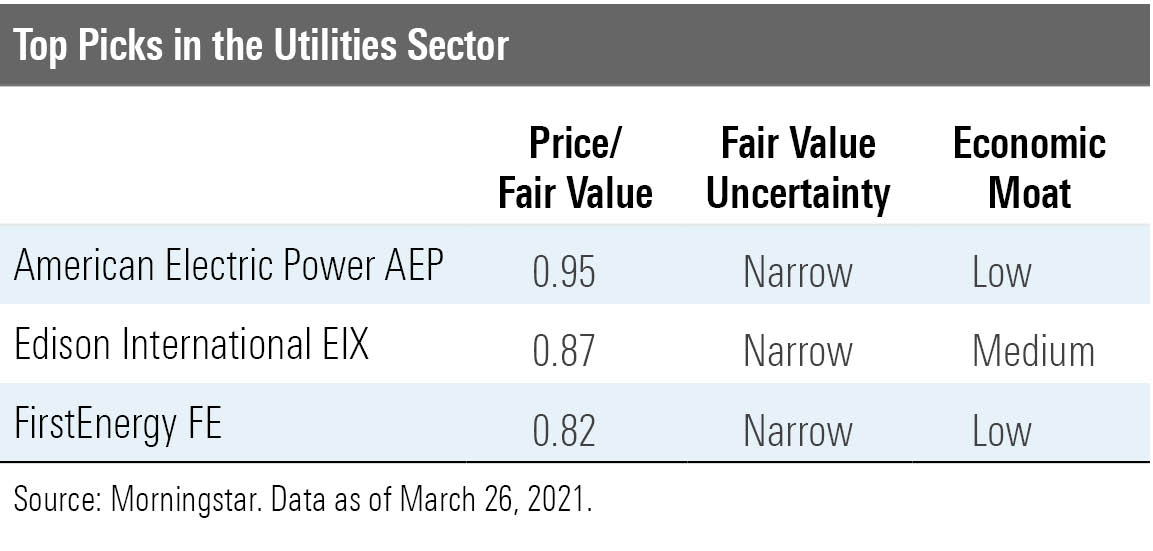

Utilities

Though utilities stocks have lagged the broader market, they've held up remarkably well, despite the rising-rate climate, notes strategist Travis Miller. Utilities continue to offer dividend yields that are attractive relative to Treasuries and most boast solid balance sheets, comfortable payout ratios, and growth opportunities, says Miller.

We’re especially fond of undervalued utilities that can benefit from renewable energy growth and network investment.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)