What Did ARK's Space ETF Blast Off With?

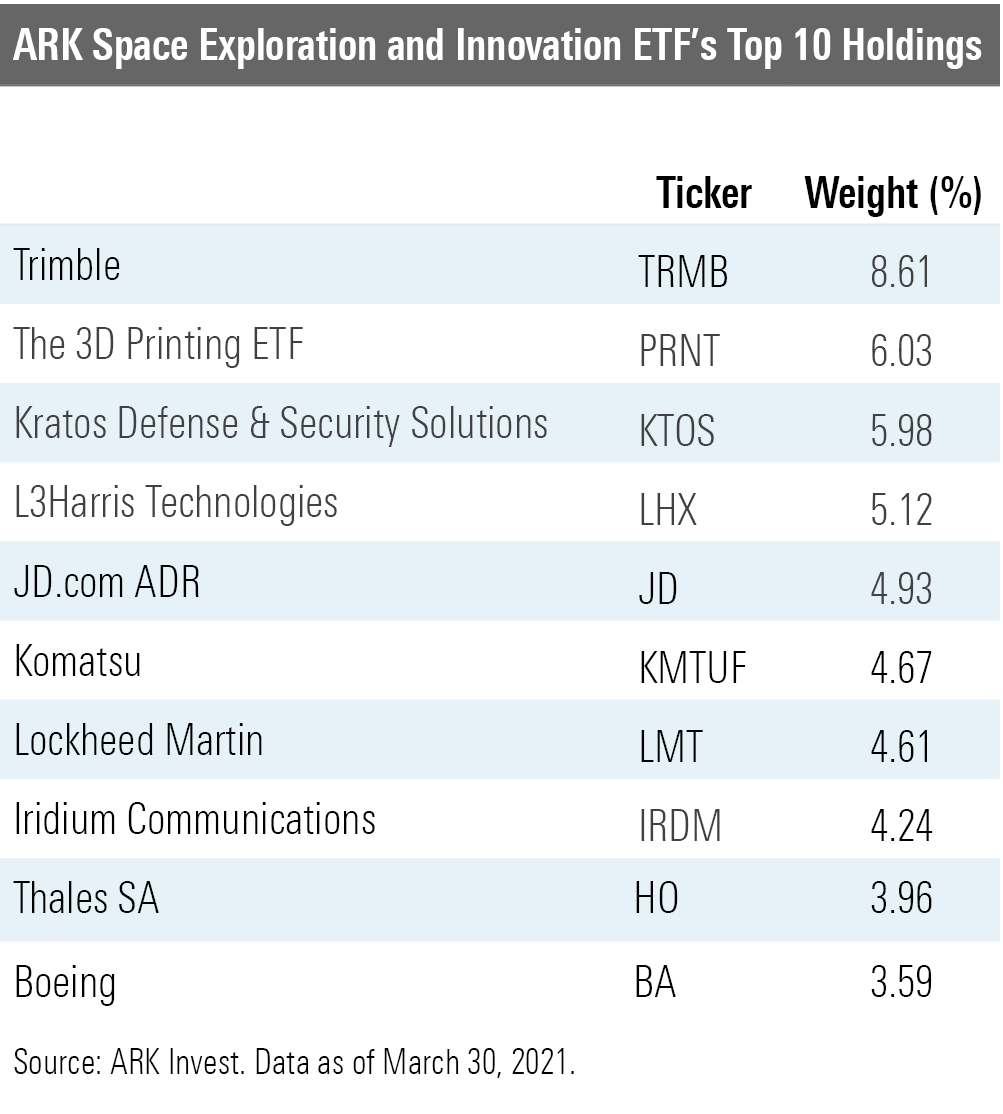

We look at ARK Space Exploration and Innovation ETF's top 10 holdings to see how they fit the mission.

With the launch of ARK Space Exploration and Innovation ETF ARKX this week, we decided to look at how ARK Invest managed to make an investment product out of something so new.

The commercialization of spaceflight may seem far off, and leaders like SpaceX aren't even public yet. However, every Starship represents a sum-of-the-parts effort from an array of companies on the ground that need only be space-adjacent. And you can invest today in those companies.

ARK looks for companies that are "leading, enabling, or benefiting from technology-enabled products and/or services that occur beyond the surface of the Earth," according to the fund description and objective.

ARKX divides these companies into four types:

- Orbital Aerospace: Companies that launch, make, service, or operate platforms in orbital space, including satellites and launch vehicles.

- Suborbital Aerospace: Companies that launch, make, service, or operate platforms in suborbital space but do not reach a velocity needed to remain in orbit around a planet.

- Enabling Technologies: Companies that develop technologies used by space exploration companies for successful value-add aerospace operations, including artificial intelligence, robotics, 3D printing, materials and energy storage.

- Aerospace Beneficiary: Companies whose operations stand to benefit from aerospace activities, including agriculture, Internet access, global positioning systems, construction, imaging, drones, air taxis, and electric aviation vehicles.

Launching to Where?

The fund's largest holding is location-based solutions provider Trimble TRMB. With technologies involved in global positioning systems, or GPS, it makes sense that a spaceflight might benefit from an Earth-based reference point, especially for take-off and landing. The company also produces solutions used in laser and optical technologies. Like most companies in the fund, while Trimble waits to head into infinity and beyond, it's active with established industries that range from agriculture to architecture.

DIY Rocketship to Mars

The second-largest holding in the exchange-traded fund is ARK's own The 3D Printing ETF PRNT. When in space, having the ability to print three-dimensional objects could be a game-changer. ARKX contains familiar names in its top 10 like HP HPQ, Microsoft MSFT, and Trimble that are involved in the 3D-printing space.

Defense Contractors Are No Surprise

Kratos Defense & Security Solutions KTOS is a high-tech defense contractor that provides microwave electronic products, satellite communications, training systems, modular systems, and defense and rocket support services. It also has an unmanned systems segment. Most of the company's revenue currently comes from the U.S. government, which could come in handy when commercial spaceships need parts.

L3Harris Technologies LHX is another defense contractor with a focus on sensors and radio components. The company, which has a Morningstar Rating of 3 stars, is highly specialized and has built up expertise and a security clearance that's hard to replace in the military equipment space. "A new entrant would likely need to develop this know-how entirely from the ground up," says Morningstar analyst Burkett Huey. With governments drawing from military resources for their space programs, "the only serious outside threat to a small subsegment of defense contracting, space launches, are the pet projects of multibillionaires," adds Huey.

Space Beneficiaries

JD.com JD was the first holding on the list that had us scratching our heads. But then we remembered one of the ETF's key focal points: companies that benefit from space exploration. JD.com could be a beneficiary of a beneficiary. With space exploration providing improvements to satellite-based Internet infrastructure like Starlink, we could also see gains in online shoppers in a Chinese market that's currently dominated by Alibaba BABA. Only an extremely small percentage of China's land area has 4G service, which might explain why there are only around 900 million mobile "netizens" in a country of more than 1.4 billion as of the end of 2020. Morningstar senior analyst Chelsey Tam also thinks that GPS improvements will help with JD.com's drone-based delivery program.

Bulldozers … in Space!

Komatsu KMTUF might engender the same skepticism that surrounded John Deere's DE inclusion in this latest ARK ETF, but machinery that works well on Earth often works well in space. Why reinvent the hydraulic excavator?

"Komatsu's superior product quality and brand name have helped to solidify its leading position in the global construction machinery space," notes Morningstar analyst Ken Foong, adding that Komatsu has also been actively investing in research and development and focusing on artificial intelligence technology and the "Internet of Things." Foong adds that Komatsu's "notable technological innovations include the first hybrid hydraulic excavator, well-known GPS monitoring system Komtrax, and the first commercialization of an autonomous haulage system for mining."

Jets Make Sense

Some of the least surprising entrants in ARKX's top 10 are well-established aerospace and defense contractors Lockheed Martin LMT and Boeing BA. One makes fighter jets, and the other makes jumbo jets. Relevancy aside, these two companies make decent investments. Huey describes 4-star Lockheed as "the highest-quality defense prime contractor" and notes that 3-star Boeing occupies "the top of the commercial aerospace value chain."

Long-Distance Calls

Iridium Communications IRDM operates a constellation of low earth-orbiting satellites, offering voice and data communications services and products to businesses, U.S. and international government agencies, and other customers on a global basis. So, Iridium may be the one sending the phone bill to the government after each flight. Iridium's solutions are also suited for industries such as maritime, mining, forestry, and oil and gas.

The European Connection

Lastly, there's Thales HO. "The European defense and institutional satellite markets are shared between Airbus and Thales, with the two companies often in partnership on major programs," says Morningstar analyst Joachim Kotze. "The high technical barriers and the capability to manage large and complex space programs, in collaboration with governments, gives Thales a competitive edge. Thales has attractive positions in European and international defense markets and will benefit from growth in commercial aerospace."

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)