Will the Treasury Rout Continue?

Quietly, high-quality bonds have taken a beating.

Surprisingly Risky

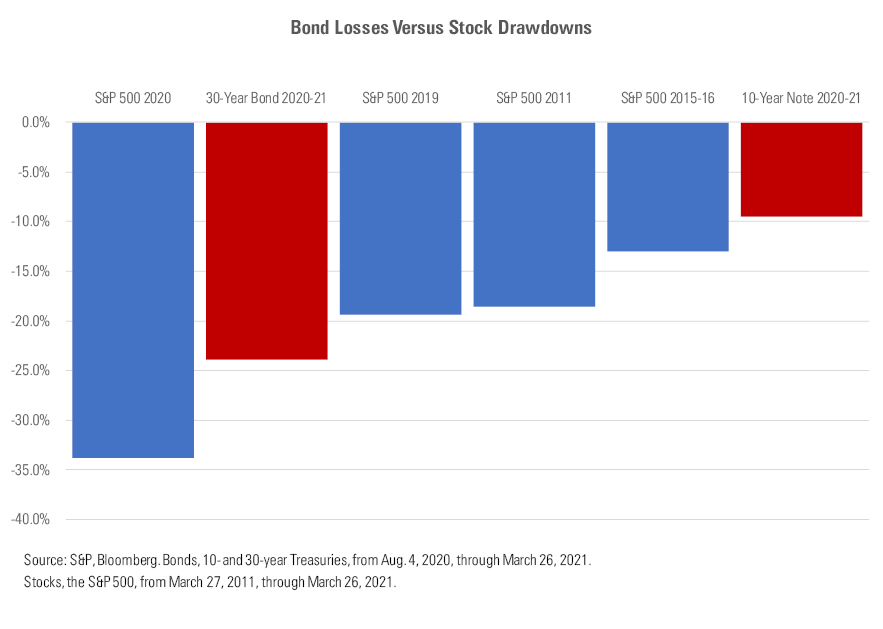

Today's investment headlines focus on the winners, such as GameStop GME, ARK ETF Trust ARKK, Tesla TSLA, and celebrity Special Purpose Acquisition Companies. But relatively little attention has been paid to what has been something of a historic bond-market decline. Over the past eight months, 10-year Treasury notes have shed 9.5% of their value, while 30-year bonds have dropped by 23.9%.

The chart below shows how those results compare with the largest drawdowns of the S&P 500 over the past 10 years.

Ouch! To be sure, the 10-year note’s loss pales next to the steepest S&P 500 downturns, but it nonetheless outdoes all but four stock-market slides over the past decade, a disappointing outcome for an allegedly safe investment. The 30-year bond’s battering, meanwhile, stings by any standards. Since Ronald Reagan was president, stocks have suffered greater drawdowns than the long bond’s 23.9% decline on only three occasions (2000-02, 2008-09, and early 2020).

There have been two reasons for the slide: One bodes well for the future performance of high-quality bonds, and the other bodes ill.

The Bright Side

The good news is that bonds have been on the wrong side of investment fashion. According to this explanation, customarily referred to as risk-on/risk-off, asset prices are often established by emotion, not economics. When investors possess animal spirits, aggressive holdings rally while cautious assets languish. Eventually, sentiment reverses, and so does performance. By this logic, Treasury owners need not worry. Before long, risk will once again be off and bond prices will settle.

Risk has certainly been on in recent months. Not only have global equity markets rallied, on the expectation of strong economic growth, but so too have alternatives, such as Bitcoin, vacation homes, and non-fungible tokens. Investors have sought capital gains. When risk is on, what matters is not guarantees or income, as with Treasuries, but instead the prospect of reselling an asset at a higher price.

The Danger

Unfortunately for Treasury owners, their losses do not owe to sentiment alone. There have also been increasing concerns about inflation. To date, these worries are theoretical rather than actual; as measured by the Consumer Price Index, inflation remains modest, particularly when the effects of food and energy prices are removed. But market expectations have changed sharply since last summer.

This can best be demonstrated by the break-even inflation rate on Treasuries, which is calculated by comparing the payouts on conventional issues with those offered by the government’s Treasury Inflation-Protected Securities. For example, 10-year Treasury notes currently yield 1.69%, while 10-year TIPS yield negative 0.66%. The break-even inflation rate is therefore 1.69% (negative 0.66%), or 2.35%. That represents the market’s consensus forecast for annualized 10-year inflation.

The break-even forecast for 10-year notes has risen steadily since March 2020, and is now at its highest level over the past five years.

The reason for these fears is so obvious in hindsight, one wonders why it was not reflected in 2020's bond prices. Even before the passage of this month's American Rescue Plan Relief Act, U.S. money supply was rising at its sharpest rate in recorded history. Although the link between money supply and inflation has greatly weakened, at some point more money will create more inflation. (That is a mathematical certainty; the question is not that the relationship exists, but rather whether today's money-supply increases are sufficient to trigger the response.)

In short, while initially it’s tempting to blame high-quality bonds’ problems on investor sentiment, which so clearly has favored speculation, the economic backdrop has worsened. Aggressive government spending, both in the U.S. and elsewhere, has meaningfully increased the possibility that inflation will resurface. This has hurt bond prices, which in 2020 assumed that inflation was indisputably conquered. Today, it must be regarded as being disputably conquered.

Looking Forward

That, I think, rules out the likelihood of a strong bond-market recovery. The fundamentals don't support such gains, at least not until the effects of the massive spending bills--which, if the president has his way, have not concluded--have become apparent. But what about this question posed by this column's headline? Will the rout continue?

The answer is: probably, as long as the stock market keeps rolling. Risk-on/risk-off is a powerful force. Once that process concludes, though, I expect bond prices to stabilize. Although the 10-year break-even inflation rate is high by recent standards, it remains below its long-term average. In other words, inflation has not suddenly become a problem. Rather, it was temporarily disregarded, sparking a Treasury rally. That Treasuries have since retreated is a return to normalcy.

Also, while break-even inflation rates reflect the wisdom of the crowd, and thus presumably are more reliable than those generated by individual experts, that doesn't mean that they are correct. Forecasting future rates of inflation may lie beyond the collective ability of bond investors, meaning that the increase in the break-even rate is nothing more than noise. (Such was the conclusion of a 2015 article by the Federal Reserve Bank of San Francisco--although, ironically, the break-even rate that existed in 2015 has so far proved highly accurate.)

Finally, this isn’t the first time that Treasuries have attended this unpleasant dance. In 2009 and then again in 2012-13, Treasuries also delivered painful losses. Just as has occurred over the past year, Treasury yields dropped dramatically, thereby increasing their prices, only to soon retrace their steps. Each time, inflation fears were the culprit. But the alarms were false, and Treasuries gradually recovered.

One unalloyed positive: Treasuries once again have successfully diversified an equity portfolio. Of course, it has not felt so successful in practice, to those bemoaning how their bond losses have watered down their equity gains. But better such behavior than what occurred in March 2020, when bonds and stocks briefly headed south at the same time. The less that Treasuries act like equities, the happier the investment math.

Heads I’m Right, Tails I’m Right

Morningstar's Russ Kinnel forwarded me an item of sports research. Fans widely believe that players and teams sometimes possess "momentum"--recent successes that will beget more successes. Good follows good. Consequently, many basketball fans maintain, teams that come from behind to tie games in regulation are favored in overtime, because they have momentum.

Whether that holds true, I will leave for you to investigate. What struck me is that basketball announcers win either way. If the come-from-behind team does prevail in overtime, it was because its players possessed momentum. If not, the loss came because the players used all their energy to tie the score and therefore were exhausted when the overtime began.

Perfect hindsight! We journalists know a few things about that.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)