10 Undervalued Wide-Moat Stocks

Here's a peek at the cheapest constituents of the Morningstar Wide Moat Focus Index--as well as names that have been added and cut.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. Its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

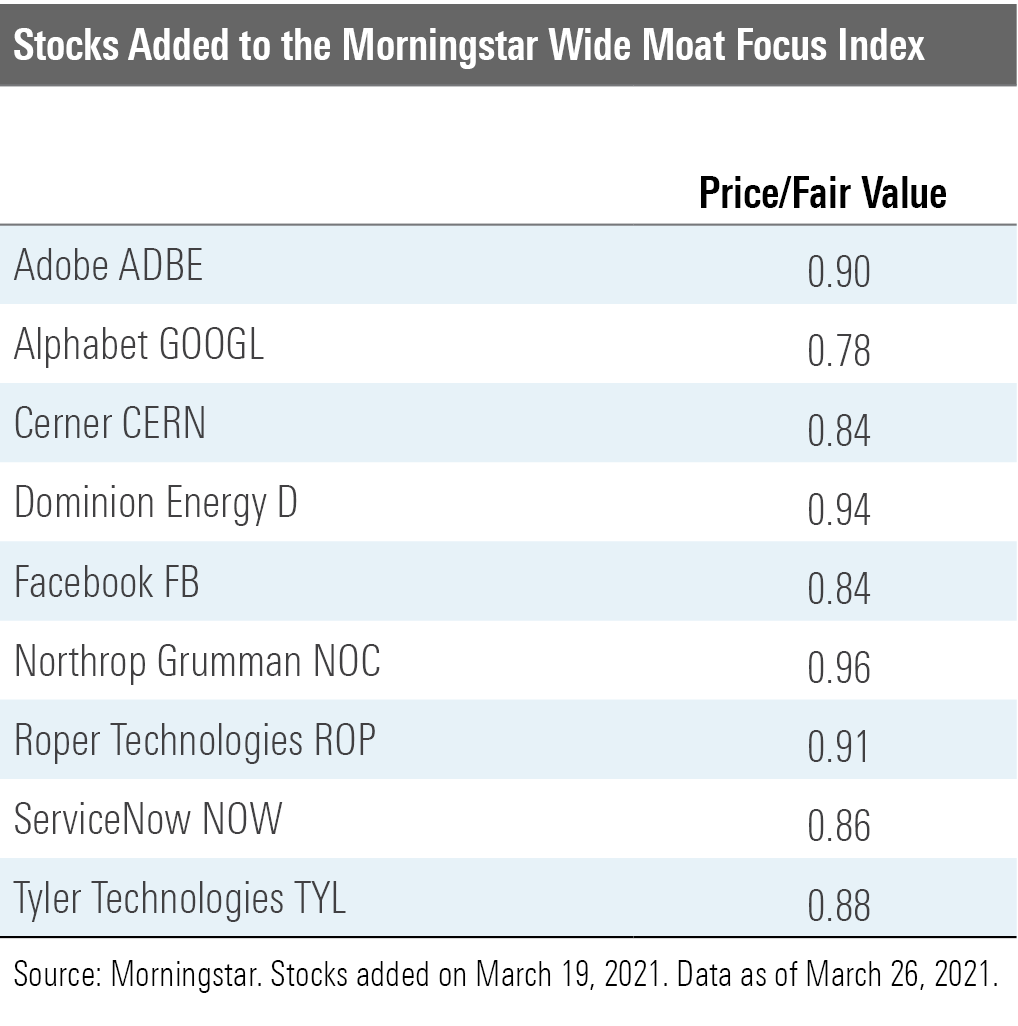

After the most recent reconstitution on March 19, 2021, half of the portfolio added nine positions and eliminated nine. The index now holds 44 positions.

The Additions

Five of the new names hail from the technology and communications sectors--Adobe ADBE, Alphabet GOOGL, Facebook FB, ServiceNow NOW, and Tyler Technologies TYL.

Software names have lagged this year, making Adobe attractive, says analyst Dan Romanoff. We think Adobe will continue to dominate in creative software, and that its well-rounded portfolio positions it as a digital marketing leader.

Dig deeper: Adobe Posts Impressive Results; FVE Raised to $520

Alphabet's Google made headlines earlier this month when it announced that it won't allow individual user tracking after 2022. We don't expect the move to have much impact on its ad revenue, though, says senior analyst Ali Mogharabi. Given Google's dominance in search and browsers, we think the firm will continue to attract advertisers.

Dig deeper: Google to End Individual User Tracking in 2022

As the largest social network in the world, Facebook remains attractive to advertisers. As such, expected continued growth in online advertising bodes well for the firm, says Mogharabi. Facebook continues to increase users and user engagement with additional features and apps in its ecosystem.

Dig deeper: Facebook Reports Impressive Q4; Raising FVE to $335

ServiceNow's success has been rapid and organic, notes Romanoff. It offers high-end software solutions to entrenched, large enterprises worldwide. Moreover, the average annual contract value among its clients has doubled in just three years.

Tyler Technologies is the leader in the niche market of government operational software, says Romanoff. We expect at least a decade-long runway for growth in excess of 10% per year or more, as legacy systems supporting many cities, counties, schools, and other government entities become obsolete.

The remaining four index additions hail from a hodgepodge of industries, including health information services (Cerner CERN), regulated electric utilities (Dominion Energy D), aerospace and defense (Northrop Grumman NOC), and multi-industrials (Roper Technologies ROP).

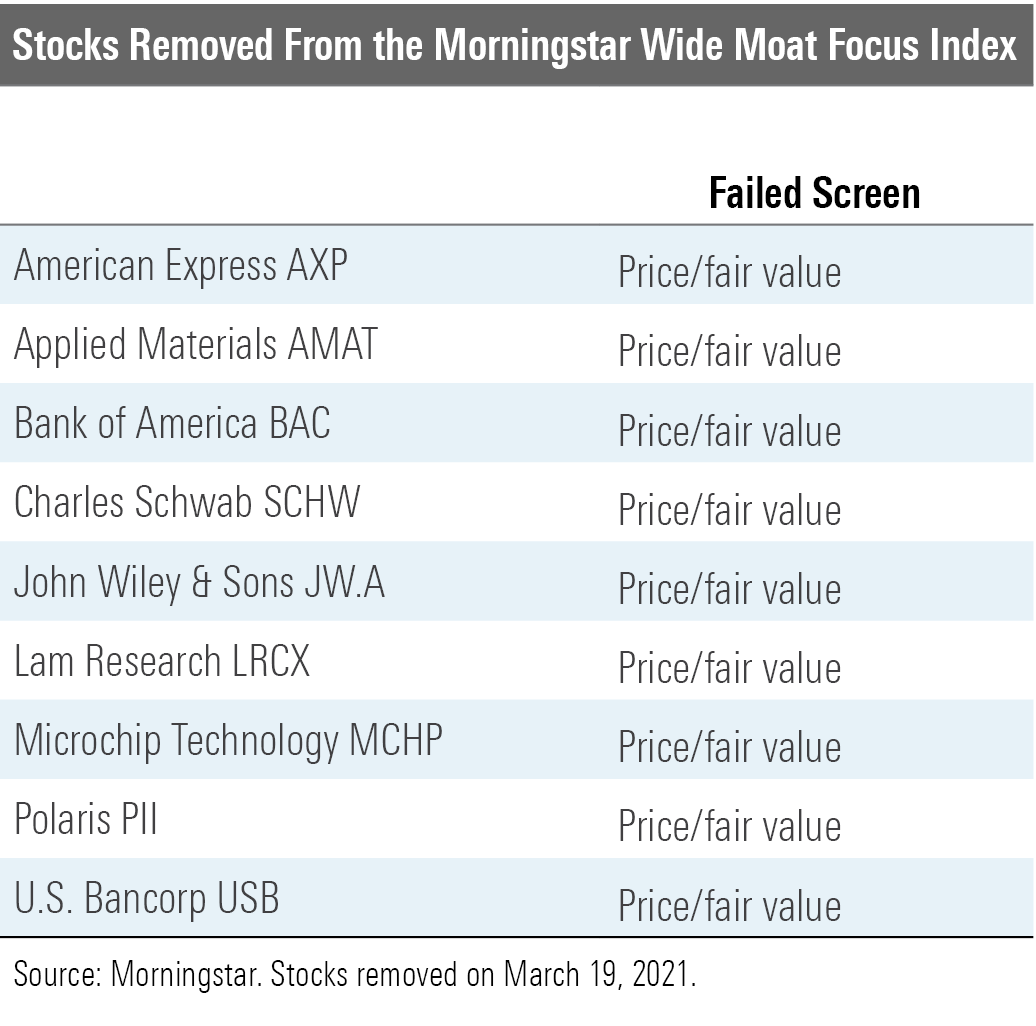

The Removals

Stocks can be removed from the index for a few reasons: If we downgrade their economic moat ratings or if their price/fair values rise significantly. All of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair values at the time of reconstitution.

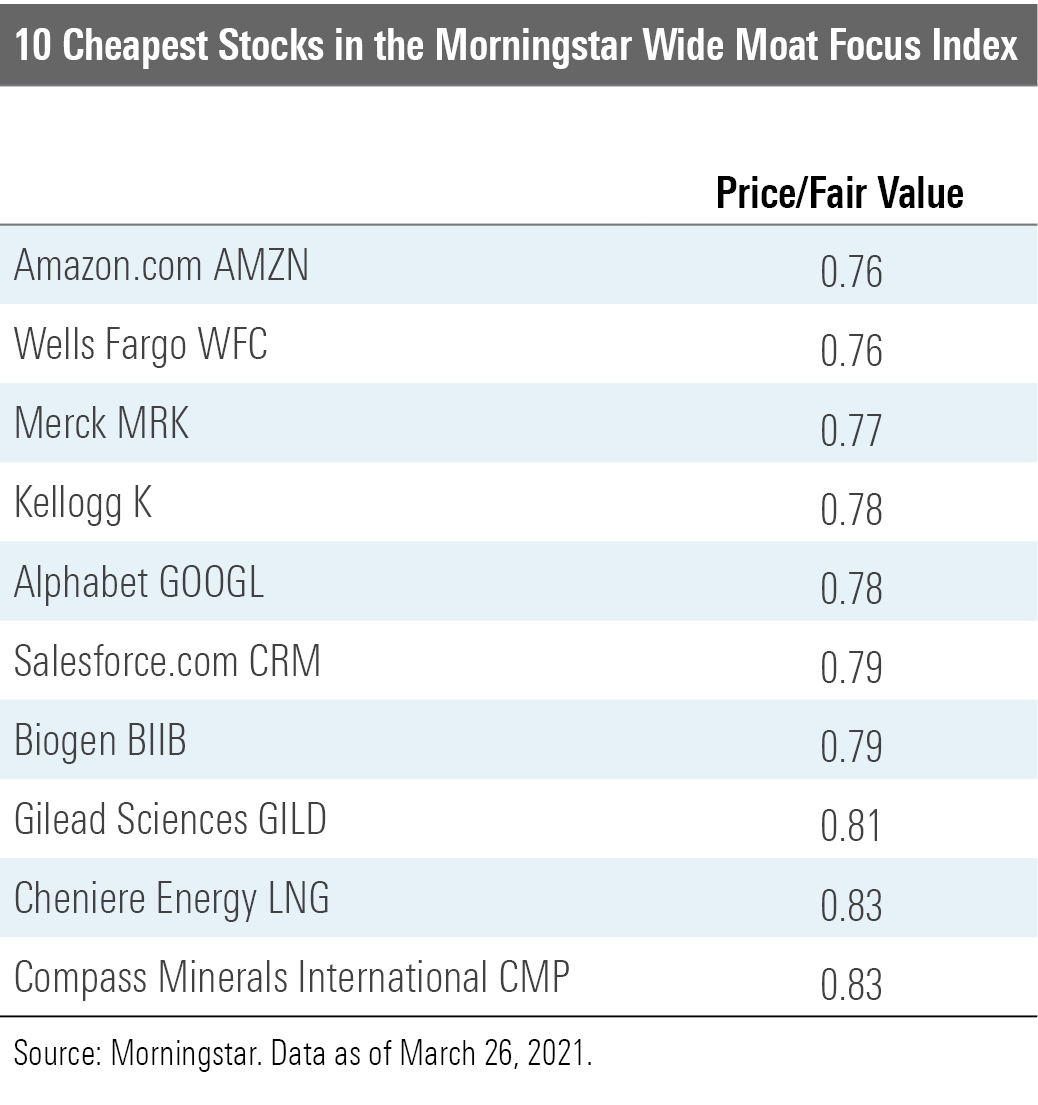

High-Quality Stocks in the Bargain Bin

Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of March 26.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)