How the Biggest and Best Funds Fared After the Crash

A look at how some notable U.S. equity funds have navigated the market's style and size reversals over the past year.

It's been quite a turnaround for U.S. stocks and the funds that own them since the market's March 23, 2020, bottom. The coronavirus pandemic sell-off, in which the Morningstar US Market Extended Index fell 35% in only 23 trading days, gave way to a rapid recovery and even higher market peaks. In the year since the bottom, the benchmark gained more than 85%.

Not every corner of the market took the same path upward. Although growth stocks, especially large caps, held up relatively well in the crash and then benefited from lockdowns and ultralow interest rates, the small-value Morningstar Category has outperformed since Pfizer PFE and BioNTech BNTX announced successful COVID-19 vaccine results on Monday, Nov. 9, 2020.

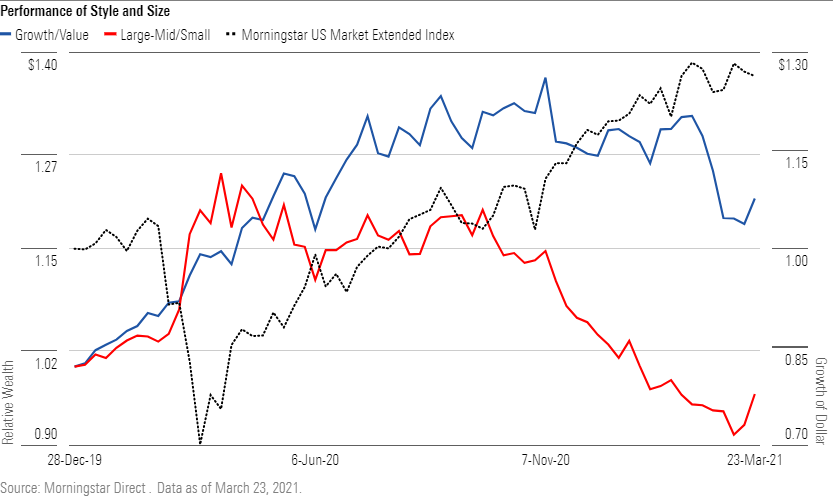

Using weekly returns from Morningstar style and size benchmarks, Exhibit 1 depicts the timing and magnitude of growth stocks' performance versus value stocks (blue line) and large/mid-cap stocks versus small caps (red line), all against the backdrop of the growth of $1 in a broad core index (dotted line).[1] Together, they show that the recovery's leadership changed in the fall. Growth held up better in the crash and led the rebound until value came back after the first November vaccine announcement. The reversal was even more pronounced for small caps as the red line's downward slope then becomes steeper and more consistent. So, although small-value may be ahead since the bottom, it gained its advantage only recently.

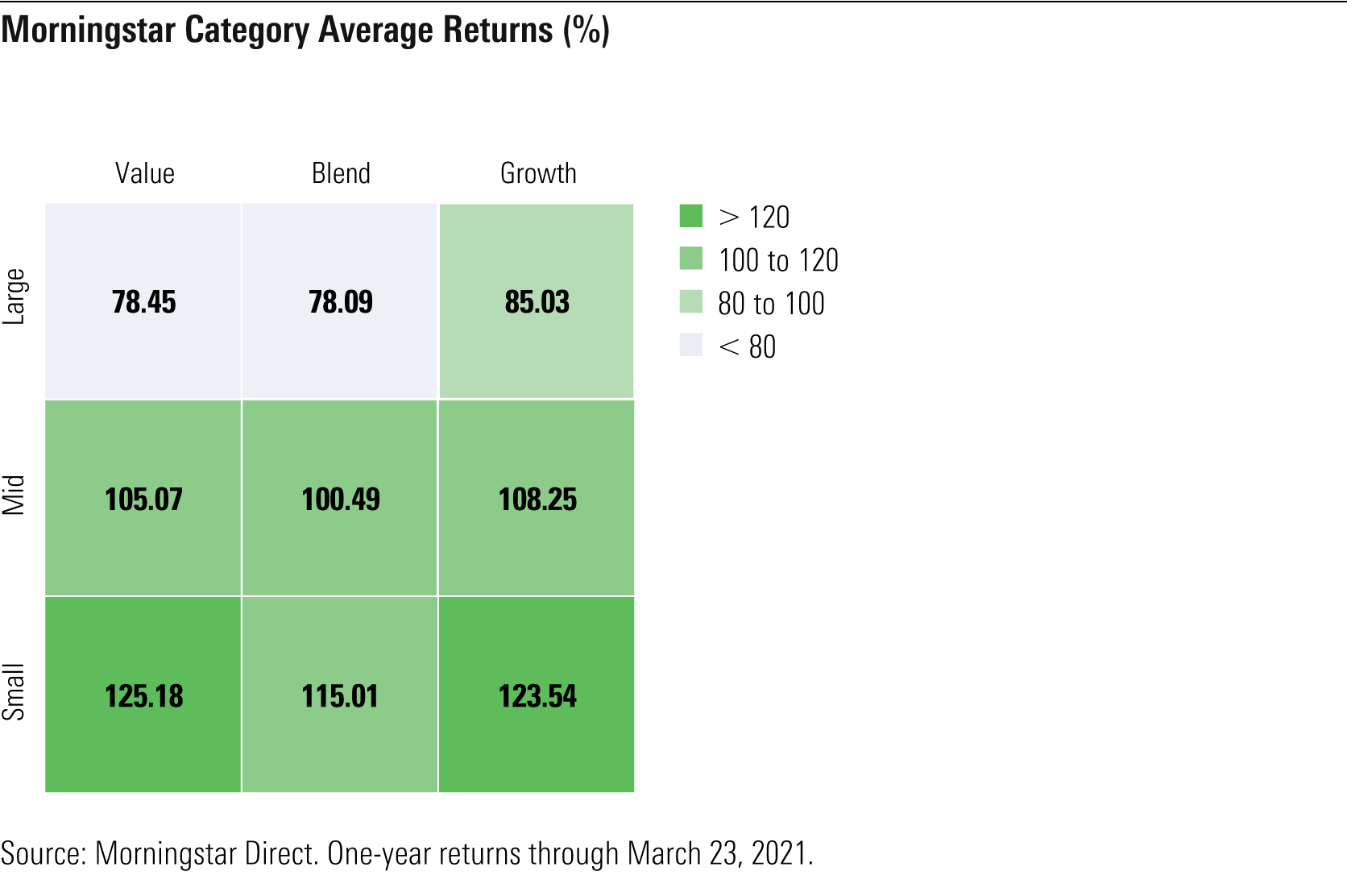

Small-cap active strategies of all styles gained the most on average over the past year, as Exhibit 2 shows. Investors who rebalanced their portfolios' size and style tilts away from early pandemic winners benefited. The typical small-value category fund's 125% cumulative gain beat the large-growth norm by 40 percentage points.

Leaders

Despite value's recent resurgence, some active managers who made big bets on growth stocks built such huge leads in 2020 that they were still in front over the trailing year through March 23, 2021. Baron Partners' BPTRX 284.5% gain was one of the highest out of all U.S. domestic open-end mutual funds thanks to letting its stake in Tesla TSLA, whose shares skyrocketed 662%, balloon to nearly half the portfolio's assets. The fund's outstanding performance notwithstanding, concerns about how it controls the risk of such big positions dropped its Process rating to Below Average and its Morningstar Analyst Rating of Bronze to Neutral in January.

Morgan Stanley Institutional Discovery's MPEGX 188% gain topped funds whose oldest share classes have Gold or Silver ratings and ranked in the mid-cap growth category's highest 4%. Lead manager Dennis Lynch, a former Morningstar Fund Manager of the Year, and his veteran 14-person Counterpoint Global team lean toward less-established names they think have long growth runways. Winning picks included top-20 positions in Carvana CVNA, Twilio TWLO, and Square SQ, which the team sold in 2020's third quarter.

Small value's overall advantage one year after the bottom showed in Silver-rated funds DFA US Targeted Value's DFFVX and DFA US Small Cap Value's DFSVX top-quartile returns of 139% and 137%, respectively. These strategies are reliable proxies for active small-value managers' opportunity set. The former focuses on cheaper and more-profitable U.S. stocks outside the largest 500 by market cap, while the latter looks for similar stocks within the smallest 10%.

Gold-rated Dodge & Cox Stock DODGX once again proved its worth. Its 99% gain placed in the large-value category's top decile. The team's research-intensive, contrarian process led it to hold fast on retailer Gap GPS, whose shares they had bought throughout 2019, and to add to select energy companies, including Occidental Petroleum OXY, and financials like Capital One COF. Each outperformed, with Gap soaring the most. They also took timely profits in FedEx FDX in 2020's third and fourth quarters.

Within large blend, Silver-rated Oakmark Select OAKLX and its slightly more diversified Gold-rated sibling Oakmark OAKMX beat nearly all category rivals, returning 113% and 112%, respectively. Longtime manager Bill Nygren and his comanagers focus on large companies defined by sales, net income, and shareholders' equity, rather than market capitalization, and try to buy those mispriced relative to what a rational buyer would pay to own the entire business. Consumer finance picks like Ally Financial ALLY helped both funds repeat the kind of rebound Oakmark Select had after the 2007-09 credit crisis.

Some lower-rated funds surged for clear reasons. Overweighting energy and financials spurred Bronze-rated Hotchkis & Wiley Mid-Cap Value's HWMIX 173% gain, which placed in the mid-cap value category's top percentile. Neutral-rated Emerald Banking and Finance's HSSAX 174% return topped the 25-fund financial category as bets on the digital currency businesses of Silvergate Capital SI and Voyager Digital VYGR paid off handsomely.

Laggards

Gold-rated Brown Capital Management Small Company BCSIX and Silver-rated Alger Small Cap Focus AOFAX, run by former Brown manager Amy Zhang since early 2015, gained about 78% and 88%, respectively, but those results placed in the small-growth category's bottom decile. Hefty stakes in healthcare, one of the worst-performing sectors, held both strategies back. They were resilient in the crash, though, and maintain excellent longer-term records.

Gold-rated American Funds American Mutual AMRMX and Silver-rated American Century Equity Income TWEIX both distinguished themselves in early 2020's downturn, as they often have in turbulent conditions, and then predictably lagged in the rebound. Their focus on steady dividend payers and sizable cash and bond allocations disadvantaged them. Returns of 54.5% and 52.8% trailed the large-value category norm.

Silver-rated Akre Focus' AKRIX 62% gain placed near the large-growth category's bottom. A double-digit cash stake in April and high-single-digit allocations the rest of 2020, though not out of character, held it back. The fund has rebounded from anemic performance in rallies before, but this time it will have to do so without namesake Chuck Akre, who retired at year-end. Comanagers John Neff and Chris Cerrone have had ample time to prepare for this transition.

Behemoths

The resurgence of smaller-cap stocks posed a headwind for actively managed large-growth behemoths, but some fared better than others. Silver-rated Fidelity Contrafund's FCNTX 75% gain placed just shy of the category's lowest quintile. While its $130 billion asset base hindered its ability to build meaningful positions at the lower-end of the market-cap spectrum, underweighting Apple AAPL didn't help.

Silver-rated American Funds Growth Fund of America AGTHX also suffered from a light Apple stake, but a sizable allocation to Tesla made up for it. The strategy's mix of turnaround plays and cyclical stocks alongside traditional growth names helped in recent months. Plus, splitting its $269 billion in assets between 13 named managers and three analyst teams let it take higher-conviction positions in a slew of smaller companies. The strategy's 86% gain placed near the category's top third.

Staying Invested

The equity market's historically swift rebound provides another reminder of the importance of staying invested, and even investing more, through harrowing downturns. Of the 157 U.S. open-end funds whose oldest share classes have Gold or Silver ratings, the worst performers after the downturn broke even by Jan. 6, 2021, in less than 10 months, and more than half (61.8%) were back to par within six months.

Endnote [1] The respective style and size Morningstar indexes used in Exhibit 1 are the Morningstar US Market Broad Growth Extended, Morningstar US Market Broad Value Extended, Morningstar US Large-Mid Cap, and Morningstar US Small Cap Extended.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)