Robinhood: What to Know Before It Goes Public

A look at how the trading app makes money, its competition, and its growth potential.

Robinhood has been no stranger to the spotlight since the launch of its trading platform in 2015. The company has been a disruptor in the fintech space: The discount brokerage’s mission to democratize investing, its streamlined platform, and zero minimums have made it popular among younger investors. Its no-commission model has forced competitors to follow suit.

Robinhood's growth has been impressive, and the company has found no shortage of funding. One of Robinhood's co-founders told members of Congress in February that the brokerage has more than 13 million users. JMP Securities estimated that Robinhood's total accounts may actually be closer to 23 million. Through January 2021, the company has raised nearly $5.6 billion. After its last deal, Robinhood's post valuation was $11.87 billion, according to PitchBook, a Morningstar company.

While Robinhood has an impressive funding history in the private market, going public can give the company access to even more capital to fuel future innovation and growth. On Tuesday, Robinhood confirmed that it had confidentially filed for IPO. Despite recent hubbub, a spike in demand for pre-IPO shares suggests that the company's valuation could approach a whopping $40 billion, though that estimate is likely overly optimistic.

Robinhood in the News

While the commotion around GameStop GME and trading restrictions may be fresh in our minds, the events of early 2021 weren’t Robinhood’s first taste of negative publicity.

In March of 2020, Robinhood’s trading platform crashed during a period of extreme market volatility, leaving users unable to make trades without a customer service line to call. The outage was particularly painful given how fast the average Robinhood user trades; Robinhood users trade riskier securities--at a faster pace--than those of any other retail brokerage.

In addition to congressional questioning, Robinhood has also come under regulatory scrutiny. In findings published in December 2020, the U.S. Securities and Exchange Commission stated that Robinhood had previously failed to disclose its largest source of revenue: payment for order flows. The SEC also found that Robinhood had sacrificed price improvements for its customers (a potential benefit of outsourcing customer orders to principal trading firms) in the name of higher revenue. The SEC fined Robinhood $65 million.

How Does Robinhood Make Money?

Here are Robinhood’s main sources of revenue.

- Interest.--Robinhood collects interest earned on users' uninvested cash and lending securities.

- Robinhood Gold.--For $5 a month, users of this premium service can get margin investing and additional data and research.

- Payment for order flows.--Robinhood outsources its users' orders to principal trading firms to execute the trades. These trading firms then pay Robinhood in return for the opportunity.

Payment for order flows makes up the majority of the company’s revenue. These payments mean that Robinhood benefits from more trades. The platform itself seems to encourage high-frequency trading. Among the different securities that users can purchase, Robinhood benefits the most from options, which are generally riskier than traditional stocks.

As more users joined Robinhood and trading volume increased in 2020, Robinhood's revenue from order flows jumped from $91 million in the first quarter to $180 million in the second quarter. Order-flows payments brought in $682 million in revenue for the year.

Who Does Robinhood Compete With?

Robinhood competes with a bevy of discount brokerage platforms offered by both public and private firms. Many of these companies also offer more-traditional brokerage options in addition to online platforms for do-it-yourself investors. Many also have an array of revenue streams from business segments that are separate from their retail brokerages altogether.

Charles Schwab SCHW, TD Ameritrade (acquired by Charles Schwab), E*Trade (acquired by Morgan Stanley MS), Fidelity Investments, and Interactive Brokers IBKR stand out as some of the most widely used discount brokerages in the United States. Pressured by Robinhood’s growing popularity, these firms eliminated stock-trading fees for online trades in 2019.

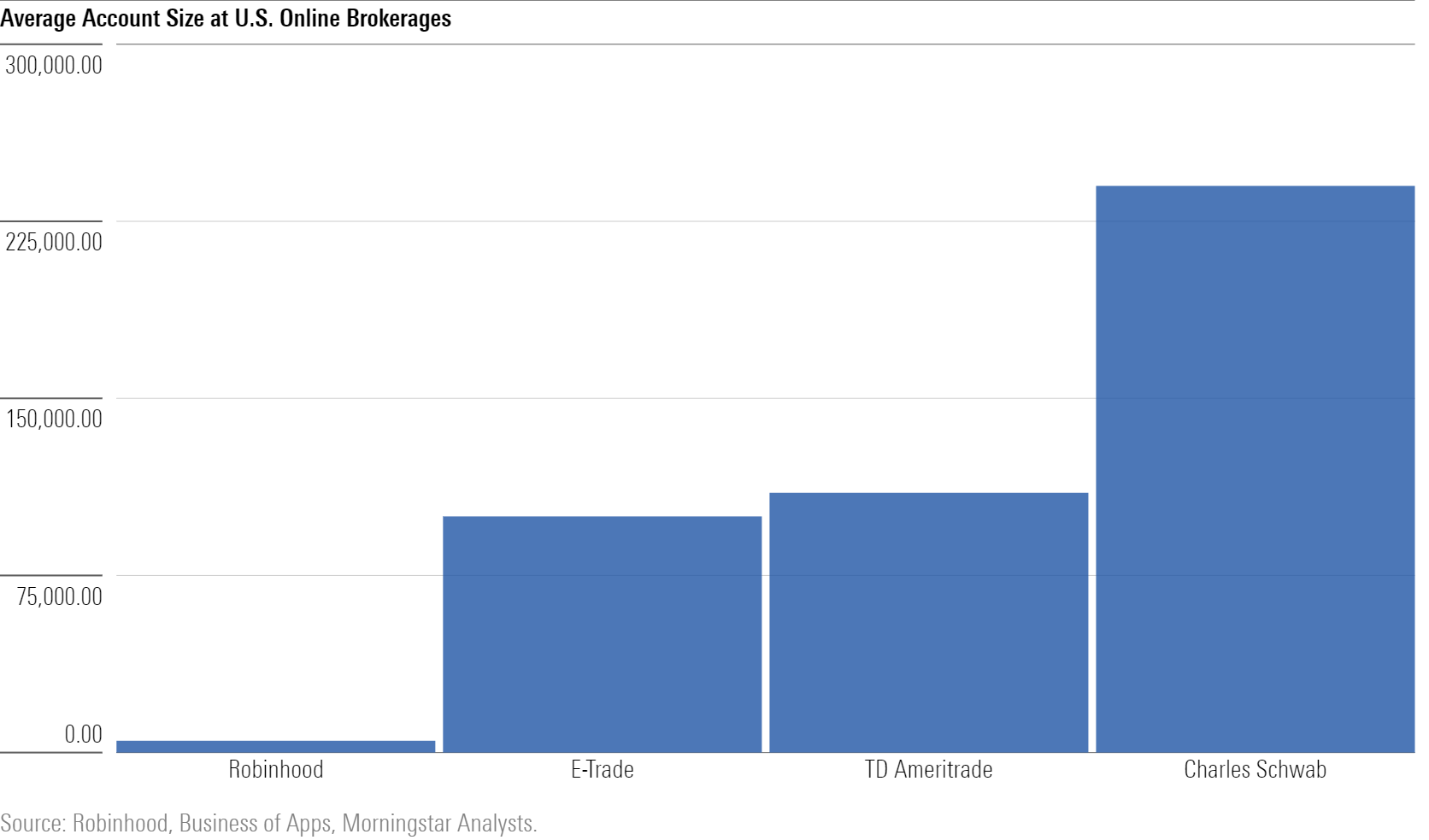

Though both Charles Schwab and TD Ameritrade took a hit when they slashed their commissions, Morningstar equity analyst Michael Wong views Charles Schwab-TD Ameritrade as a financials-sector powerhouse. The combined firm has more than $5 trillion of client assets. While Robinhood has managed to attract more users to its platform than Schwab, the average Robinhood account holds $5,000, compared with roughly $240,000 at Charles Schwab and $110,000 at TD Ameritrade.

In addition to its scale and cost efficiency, Wong sees an advantage in Schwab’s investment offerings: “We estimate that around 25% of client assets are in either a Charles Schwab proprietary or a controlled product, which allows the company to extract more profits on client assets than other brokerages where their clients use primarily third-party products.”

Opportunities for Future Growth

According to PitchBook, Robinhood is part of the “wealthtech” segment, which consists of companies that provide alternatives to traditional wealth-management services. PitchBook analyst Robert Le believes companies in this space have opportunities “to attract new assets from customers who expect digital, usercentric, and multichannel solutions to manage their assets.”

Pitchbook analysts have identified three primary drivers of the wealthtech industry that stand to benefit Robinhood.

- Demographic shift.--The U.S. is undergoing the largest intergenerational wealth transfer in history. As a younger generation takes over their inheritance, they will likely place more importance on investing rather than saving than their predecessors.

- Preferences for passive investments.--As more consumers turn to passively managed products, there is an opportunity for automated products and technology to replace traditional relationship-based services.

- Large traditional market.--Alternative wealth-management products represent a small share of global assets under management, leaving them plenty of room to grow in the space and disrupt traditional wealth-management providers.

Robinhood may prove that all publicity is good publicity--after all, there’s no denying that the discount brokerage has become a household name. Despite media backlash, Robinhood has continued to grow its user base at an impressive rate.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)