Why Sustainable Investors Should Keep an Eye on the SEC

The government plays a key role in ESG proxy voting.

As investors have pushed to hold public companies to higher standards across issues such as environmental impacts, racial and gender pay equity, and human rights, in recent years they’ve run into a growing number of roadblocks from government regulators at the Securities and Exchange Commission.

But there are signs that regulatory pushback may now be turning into a tailwind in favor of investors backing these sustainable investing goals.

Last week marked the unofficial "kick-off" of the 2021 proxy season. More than 330 companies announced their annual shareholders’ meetings. In coming weeks, thousands more will do the same. They’ll ask shareholders to cast votes on board of director nominees, pay practices, and usually mundane items such as auditor appointments. At many of the larger companies, shareholders themselves submit items for vote. And many of these ballot items address shareholders’ sustainable investing concerns.

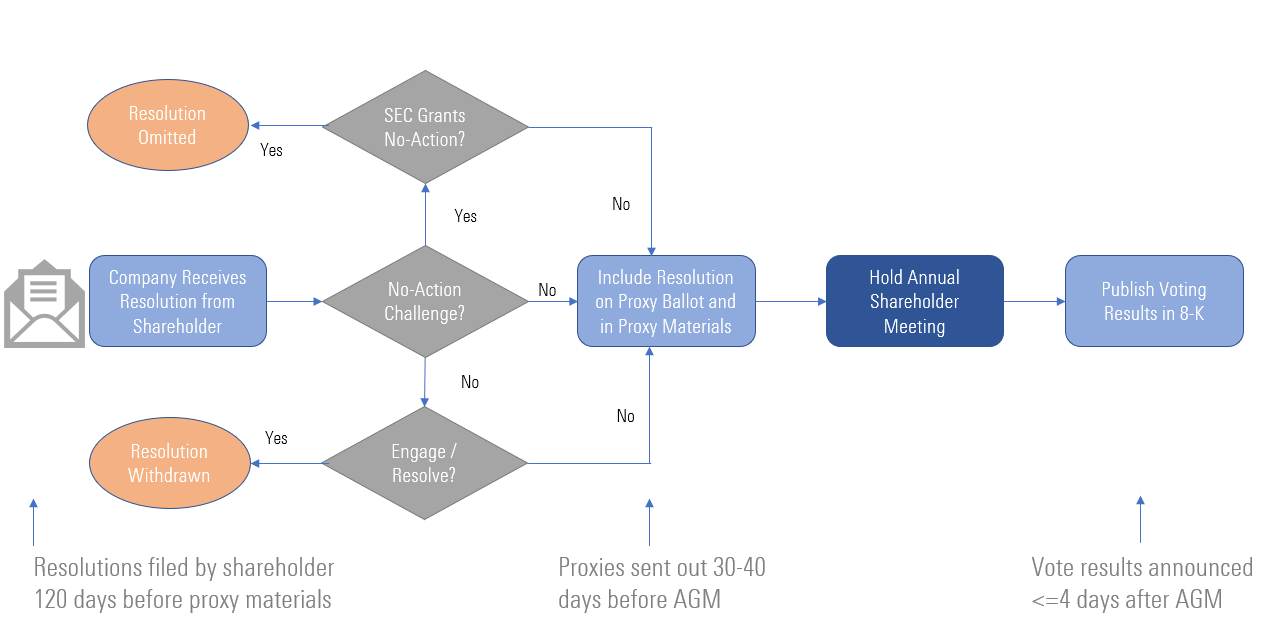

But filing a shareholder resolution is no simple matter, and for investors who care about the role and influence of companies in society, there is a key gatekeeper to keep an eye on: the SEC. If a company doesn't want shareholders to be able to vote on an issue, its executives can, under certain circumstances, get clearance from the SEC's Division of Corporate Finance via a "no action" letter. This process is explained below in Exhibit 1.

How the SEC Tightened Proxy Access

Increasingly over the past three years, the SEC’s Division of Corporate Finance has sided with companies that wanted to block resolutions, particularly climate resolutions. For instance, in 2018 the SEC allowed EOG Resources EOG to omit a resolution asking it to set and disclose companywide greenhouse gas emission targets--a request that had previously passed muster with the SEC. In 2020, Chevron CVX, Devon Energy DVN, Exxon Mobil XOM, and Hess HES were granted no-action relief for resolutions asking each company to describe its plans to reduce its contribution to climate change and align with the Paris Agreement’s climate goals.

These outcomes followed SEC Staff Legal Bulletins issued between 2017 and 2019 that reinterpreted key qualifying conditions for shareholder resolutions--making it more likely that resolutions would be considered excludable under the micromanagement condition or as having already been substantially implemented.

In 2019, the SEC issued guidance that makes it more difficult for investment advisors with voting authority--who are legally bound to cast votes in their clients' best interest --to rely on research from outside proxy-voting companies to vote on environmental, social, and governance issues, the logical effect of which is to make it less likely that they'd vote in support of an ESG resolution.

Then in 2020, against overwhelming opposition from investors and despite a multiyear trend of strengthening support for ESG resolutions, the SEC changed the rule governing shareholder resolutions, making resubmission and shareholding thresholds tougher to meet.

As we wrote last year after the rule change was announced, the likely impact when the change comes into force in 2022 will be to block issues of emerging significance to investors--such as racial and gender pay-equity transparency--from coming to a vote. Resolutions filed at companies where corporate insiders, such as founding family members, are the majority shareholders could effectively be blocked, stifling the voice of minority shareholders.

For example, were the new rules in place for 2021, Tyson Foods TSN, Pilgrim’s Pride PPC, Santander Consumer USA SC, Facebook FB, and Alphabet GOOGL could likely have escaped the attention brought by resolutions in recent years thanks to votes controlled by family holdings, parent companies, and insider founders. These resolutions asked for transparency on human rights, racial bias in vehicle lending, and racial and gender pay equity.

A Likely New, Friendlier Climate for ESG Advocacy

Notwithstanding the challenges, in 2020, 186 ESG shareholder resolutions were voted at 134 companies, including many of the largest listed companies in the United States. Concerns raised ranged from human rights to deforestation and climate governance. They were filed by state and local government pension funds, asset managers, foundations, individuals, faith-based investors, trade union pension funds, and organizations that represent these investor groupings. A record number of ESG resolutions (21) passed with majority support. And, although they were filed well before the onset of the pandemic, many anticipated issues that would emerge as central to how companies weathered lockdown, protected employees, and supported community efforts.

With a new administration in place in Washington, D.C., and a clear mandate across government agencies to address the climate crisis, the tea leaves suggest a shift at the SEC when it comes to ESG shareholder resolutions and proxy voting.

On March 15, 2021, the SEC announced a consultation on climate change reporting, inviting inputs on a range of questions aimed at improving the usefulness of companies’ climate disclosures to investors. At the same time, the SEC has started looking at how the proxy process can deliver stronger accountability to shareholders. ESG shareholder resolutions feature prominently.

This week, acting chair Allison Herren Lee announced that she’s directed her staff to consider overhauling the disclosure format, known as Form N-PX, originally intended to strengthen mutual fund accountability for proxy voting. She attributes this decision to two important trends: the growth of index investing and the “soaring demand for opportunities to invest in vehicles with ESG strategies.”

Since 2004, mutual funds and exchange-traded funds have been required to annually report their full proxy record, vote by vote, via the SEC. However, for the retail investor, these disclosures are effectively impenetrable--consisting of unstructured text in thousands of files often large enough to crash a browser.

Herren Lee wants to revisit plans initially drawn up in 2010 to require these filings to be tagged and submitted more regularly. We see this as a key measure in advancing shareholder democracy by connecting fund investors to the votes cast on their behalf.

As assets accumulate in passive investing strategies, so, too, does voting power. Morningstar's research shows that the largest passive index fund providers have been among the least likely to support ESG shareholder proposals in the past (see here for asset manager votes on climate change in 2020 and here for votes on DEI and social justice). Even ESG funds offered by asset managers that focus predominantly on passive investing strategies voted against key climate change, diversity, and other ESG resolutions that a significant proportion of other shareholders supported in 2020 (See Exhibit 7 of this report).

Fund investors can get a fuller picture of the ESG impact of their investments by understanding how their funds vote on ESG shareholder resolutions. Greater visibility into fund-level voting will focus attention on how index fund providers channel their voting power--particularly, on ESG shareholder resolutions.

Over the coming weeks and months, we will be tracking the issues coming up for vote and summarizing our findings in regular updates.

For more insights on the evolution of the U.S. sustainable funds landscape and regulation of these products, sign up for our webinar.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)