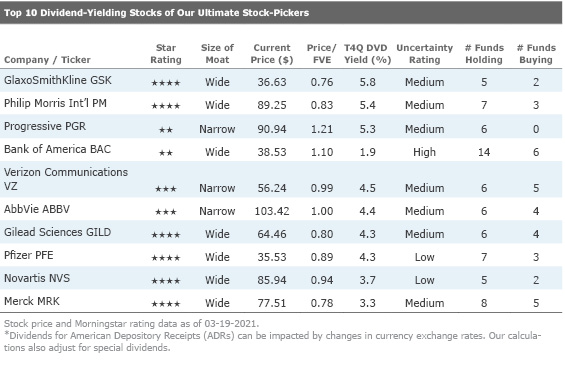

Our Ultimate Stock-Pickers' Top 10 Dividend-Yielding Stocks

A majority of the top 10 dividend-yielding names are undervalued.

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

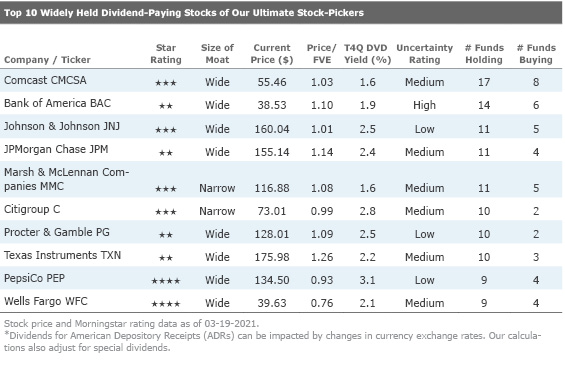

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.50% as of March 2021. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that half of the new list is composed of names that were also present on the previous list that we published in September 2020. These names include GlaxoSmithKline GSK, Pfizer PFE, Verizon VZ, Novartis NVS, and Gilead Sciences GILD. Similarly, the top 10 widely held dividend-paying stocks also changed moderately, but five of the 10 names—Comcast CMCSA, Johnson & Johnson JNJ, Pepsi PEP, Procter & Gamble PG, and Texas Instruments TXN—were present on the old list, as well.

In the last edition of the Ultimate Stock-Pickers article discussing dividend-yielding stocks, we highlighted the recovery of the global economy from the COVID-19-induced demand slowdowns. This recovery gained further momentum in the last quarter of 2020 as positive vaccine news, better-than-expected unemployment data, and a widespread lifting of lockdown buoyed the economy. Given the recent run-up in the stock market, based on our aggregate price to fair value estimates, we view the financial services, utilities, and energy sectors as the only undervalued sectors today, with investors still focused on "pandemic-proof" companies such as those in the technology space.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to sustainably maintain current dividends due to economic strain. To alleviate some of these risks, we eliminate high uncertainty rated stocks from our screening process. Although the market has recovered, many stocks on our dividend-yielding list remain undervalued. Wide-moat rated GlaxoSmithKline, Philip Morris PM, Gilead Sciences, and Merck MRK are all trading at or over a 17% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.93, indicating that we view these high-yielding stocks are attractively priced. The top 10 dividend-yielding stocks remain heavily overweight in the healthcare sector, which contributed six names to the top 10 list. The mix is different for our top 10 widely held dividend-paying stocks list, which includes just one healthcare stock, two consumer defensive stocks, and five financial services stocks. The most widely held stock that was also present on the top 10 dividend-yielding stocks list this period was wide-moat rated Comcast. Wide-moat rated Bank of America BAC, Johnson & Johnson, and JPMorgan Chase JPM were also on the list of top 10 widely held dividend-paying stocks.

Looking more closely at the two lists, there was only one company, wide-moat rated Bank of America, that appeared on both the top 10 dividend-yielding and top 10 widely held dividend-paying stocks.

Interestingly, all of the top 10 widely held securities were held by nine or more funds. This period's list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks. Three of the 10 stocks were materially undervalued, averaging a price to fair value of approximately 104% compared with an average of 93% for our top 10 highest dividend-yielding stocks.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat rated Philip Morris is trading at a significant discount to fair value, so we will focus on it in this piece, and we also highlight wide-moat rated Merck & Co and Gilead Sciences.

Philip Morris International Inc PM

Wide-moat rated Philip Morris International currently trades at a 17% discount to Morningstar analyst Phillip Gorham’s $108 fair value estimate. The firm finds itself at an intriguing crossroads. Its Unsmoke campaign envisions a medium term in which the company generates over half of its revenue from reduced risk alternatives to cigarettes. Gorham, while maintaining healthy skepticism about the firm achieving this stretch goal, does laud its attempt to switch away from cigarettes toward other products. Gorham also highlights this strategy’s soundness from an environmental, social, and governance, or ESG, perspective.

Moreover, it is worth noting that not only does Philip Morris’ strategy mitigate ESG risks, it could potentially accelerate profitable medium-term growth. The key assumption made in this positive outlook, however, is the maintenance of the current taxation regimes. Gorham asserts that under current market conditions, heatsticks, the cigarette-like sticks that are used in the iQOS device, are generally taxed at lower rates than cigarettes. The economics of the distribution of heatsticks, therefore, is highly favorable to the manufacturer. Net revenue per pack is 2.4 times that of a pack of cigarettes, and the gross margin is a whopping 10 percentage points higher than cigarettes, at about 75%. Selling and overhead expenses are likely to be higher than cigarettes at current volumes, but at scale, we think heatsticks can more than replicate premium cigarette EBIT margins.

With regard to taxation, Gorham believes that if heatsticks were to be taxed as cigarettes are in most markets, Philip Morris would have to absorb some of the tax incidence—negatively impacting its bottom line. However, the company has decided to take only very limited pricing on heatsticks in order to create a substantial price discount to cigarettes. The benefits of this are two-fold. First, smokers can see the lower prices and be convinced to try out reduced-risk alternatives that also provide better margins for the firm. Second, the current price difference between heatsticks and cigarettes can serve as a powerful disincentive for governments to increase taxation on heatsticks, as any subsequent price increase in heatsticks would lead to lesser people adopting the reduced-risk alternative.

It is also worth taking time to unpack Philip Morris’ wide economic moat. According to Gorham, Philip Morris International possesses a formidable franchise in the tobacco industry, formed by the aggregation of intangible assets and a cost advantage. Further, tight government regulations have essentially protected all major cigarette manufacturers from new entrants and have kept the industry’s market shares stable.

With regard to intangible assets, Gorham argues that Philip Morris’ customers’ brand loyalty essentially forms the firm’s intangible assets. Despite consumer segmentation in other consumer product categories amid eroding brand loyalty, brand equity remains relevant in tobacco. This is in no small part due to the absence of challenger brands because of high regulatory barriers to entry and because of the tight restrictions on marketing. Brand loyalty tends to be higher in premium price segments, which benefits the company disproportionately.

However, intangible assets are only one half of the firm’s economic moat. The second half is its cost advantage. Cigarette manufacturing is a scalable business model that results in an inverse correlation between volume and average operating cost per unit. Gorham sees Philip Morris’ lower operating costs per pack of cigarettes than its competitors, Altria and Imperial brands, as an indication of the cost advantage the firm enjoys.

Gorham expects Philip Morris to increase the dividend at a mid-single-digit rate, in line with earnings per share growth and a slowdown from its recent double-digit growth.

Merck & Co MRK

Wide-moat rated Merck currently trades at a 22% discount to Morningstar analyst Damien Conover’s $100 fair value estimate. The company is a manufacturer of pharmaceutical products that treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Conover believes that Merck's combination of a wide lineup of high-margin drugs and a pipeline of new drugs should ensure strong returns on invested capital over the long term—hence meriting a wide economic moat. Conover also believes that Merck is through the worst of its patent cliff, which should remove the heightened generic competition the company has experienced over the past years.

Merck’s economic moat is based on its patents, economies of scale, and a powerful intellectual base. The bedrock of the firm’s economic moat, however, is the patent protection that should keep its competitors at bay while allowing the firm to focus its energies on bringing the next generation of drugs to the fore. Further, the company's enormous cash flows support a powerful salesforce that not only sells currently marketed drugs but also serves as a deterrent for developing drug companies seeking to launch competing products. This strong cash flow generation also allows the company to invest heavily in R&D. Conover states that while not as strong as they were back in the 1990s, Merck's research laboratories still hold a vast database of knowledge that should help the company maintain its leadership positions in drug discovery and development.

Another key element in Merck’s competitive positioning is its strong pricing power in areas of unmet medical need. With patent protection essentially creating monopolies in the industry, firms such as Merck can ascertain significant pricing power as a result. Further, with the company’s large-scale production—Merck is also able to spread its costs, resulting in a lower cost base.

Conover’s analysis on the firm’s moat trend is also worth highlighting. As mentioned above, Merck has experienced heightened generic competition over the past years. However, Conover asserts that Merck’s competitive advantages are stabilizing. Patent protection still shields the majority of its drugs from competition, and the firm is now developing enough new drugs to offset eventual patent losses. On the pipeline side, Merck made a strategic shift in 2013 to accelerate its move to focus more on unmet medical needs in specialty care (areas of debilitating or lethal disease). The strategic shift should help increase R&D productivity and fight back against the negative trends.

Merck also remains on solid financial footing. The company boasts a strong balance sheet, with strong cash flows expected over the next several years. Conover believes that since Merck hasn't made any major acquisitions since the Schering-Plough deal in 2009, he expects the firm to make a large acquisition over the next two to three years. Beyond acquisitions, we expect steady future dividends supported by a payout ratio of close to 50% relative to adjusted earnings per share.

Gilead Sciences Inc. GILD

Wide-moat rated Gilead Sciences currently trades at approximately a 20% discount to Morningstar analyst Karen Andersen’s fair value estimate of $81. Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. According to Andersen, Gilead Sciences’ stellar profit margins with its HIV and HCV portfolio, which requires only a small salesforce and inexpensive manufacturing, along with its portfolio and pipeline support a wide moat.

Andersen believes that the firm’s patent protection on newer HIV regimens and its continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades. The company’s expertise in infectious diseases and single-pill formulations is part of its research and development strategy, which we see as one of the strongest intangible assets supporting its wide moat.

Historically, Gilead's moat was formed by its leadership position in the treatment of HIV, with patented products that form the backbone of today's treatment regimens. Despite numerous competitors, the company has established leading market share and spectacular profitability with its convenient, effective, and safe treatments. Gilead serves 80% of treated HIV patients in the United States.

Gilead’s $11 billion acquisition of Pharmasset in 2012 allowed it to have access to the most valuable hepatitis C drug in the industry. Although the deal was criticized initially, Gilead demonstrated its ability to recognize the potentially unique nature of Sovaldi's safety and efficacy profile compared with other, toxic nucleotide analogs. Andersen contends that this move has redefined Gilead as a powerhouse in the broader infectious disease market. Gilead is leading the way for all-oral treatments in the hepatitis C market, and it has a multi-billion-dollar product. Andersen believes that the low resistance potential and pan-genotypic efficacy of Gilead's regimens will allow the firm to retain close to 40% of the global HCV market in the long run, despite competition from AbbVie ABBV and Merck.

The firm also boasts a strong balance sheet that has allowed it to complete many an acquisition over the years. Its HIV and HCV businesses also generate stellar cash flows, and despite declining HCV sales, Andersen forecasts that Gilead will generate around $7 billion in free cash flow annually through 2024. With an eye on the dividend, Gilead has chosen to dial back its share repurchases to fund dividend growth alongside acquisitions.

Disclosure: Malik Ahmed Khan has no ownership interest in any of the securities mentioned here. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)