Munis in the Year of COVID

A recap of 2020’s roller-coaster ride in the muni markets and questions about what comes next.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

After a tumultuous start to 2020 in the municipal markets, investors have returned to the asset class in droves. The trend back into the sector started in earnest midyear as investors dipped their toes back into the muni pool and has since become an all-out pool party complete with cannonballs into the deep end. Individual retail investors and portfolio managers are now focused on what comes next in the municipal space, but it’s worth taking a look back at this turbulent year to understand how the sector has evolved.

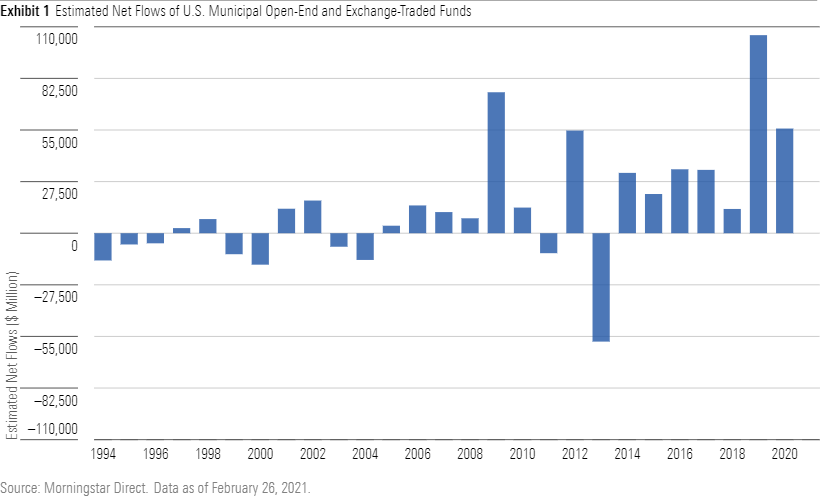

While it feels like a lifetime has passed, it was less than 18 months ago that we were watching historic demand for munis take flight. Munis soared through 2019 and into 2020, attracting record inflows into U.S. muni-bond funds and pushing extremely low yields even lower. Investors poured a massive net $105.5 billion into muni open-end mutual funds and exchange-traded funds from the start of 2019 and through the first two months of 2020. That amount towered over the annual gains the muni sector saw in each of the past 25 years, including the group’s previous boom year of 2009, which brought roughly $75 billion into muni strategies. The ardent demand for municipal fare was fueled by several factors including solid U.S. economic growth supporting strong credit fundamentals and low muni default rates.

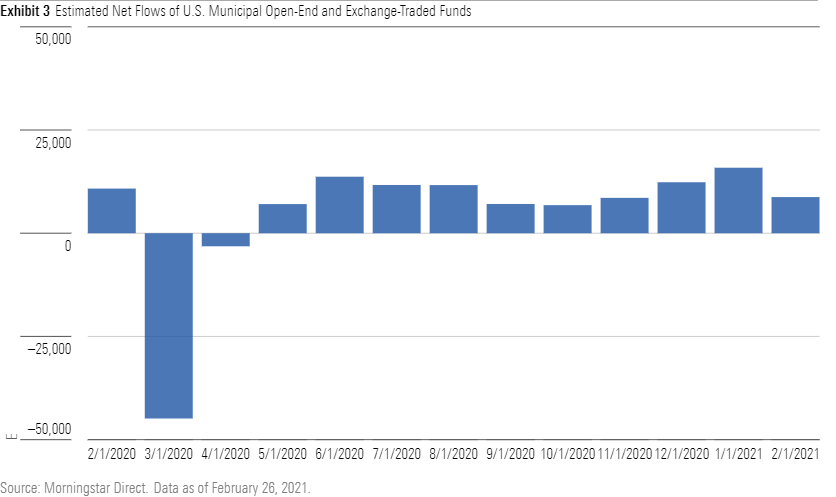

That insatiable appetite evaporated as the coronavirus pandemic market sell-off got underway in late February 2020 and quickly spread beyond equities to the fixed-income universe. A significant portion of the assets that had surged into municipal-bond funds took a little over two weeks to vanish and with them went a year’s worth of gains. Investors pulled a record $45 billion from muni funds in March 2020 (equivalent to four months of inflows from November 2019 through February 2020), resulting in the worst-ever organic growth rate of negative 4.9% for municipal-bond open-end funds and ETFs.

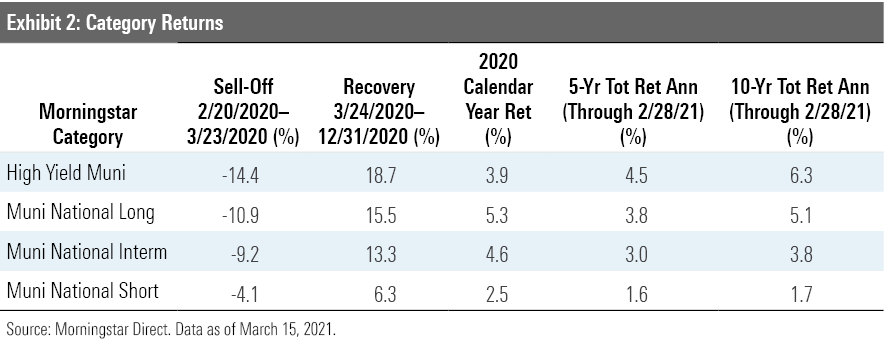

While few muni market segments remained unscathed through the volatility of early 2020, nearly a fourth of those outflows came from the high-yield muni-bond Morningstar Category. The riskier, low-quality fare that drove robust returns in 2019 got stung in early 2020, and funds that loaded up on some of the market’s riskier names and leveraged structures suffered deep losses. The median loss for a distinct group of funds in the high-yield muni cohort was 14.4% from Feb 20. 2020, through March 23, 2020, and losses reached closer to 20% for some of the most aggressive in the category. Funds that focused on higher-quality offerings and that generally take less interest-rate risk fared better: The median loss for a distinct group in the muni national intermediate Morningstar Category was 9.2% from Feb. 20, 2020, through March 23, 2020.

The turbulence was clear in the shifts of the muni-Treasury, or M/T, ratio, which compares muni-bond and U.S. Treasury yields to guide investors toward investment opportunities. The M/T ratio historically hovers near 80% to 90%, with anything over 100% suggesting that munis are a good deal, as they’re yielding more than a comparable U.S. Treasury. As muni investors fled in March 2020, the M/T ratio spiked across the muni yield curve, and according to Thomson Reuters TM3 Interactive Data, the five-year ratio ended the month at nearly 295% and the 10-year ratio at roughly 200% (both up from about 80% at the end of February).

In April 2020, some stability returned to the market. Unprecedented federal aid through the CARES Act and the creation of the Municipal Liquidity Facility helped lure weary investors back into munis and repair the market’s historic dislocation. The intensity of outflows from muni-bond funds waned as muni prices remained low and investors once again looked for value. Muni bonds were slower to recover than equities or corporate bonds as investors remained concerned for the longer-term fiscal health of all types of municipal issuers, but by midsummer investors had warmed up to the asset class once again. Reassured by federal support, the slow but steady restart of local economies, and bargain-rate pricing on even higher-quality muni names, investors again pushed muni credit spreads tighter and the M/T ratio closer to historic norms.

Portfolio managers continued their hunt for value from issuers with strong balance sheets going into the market volatility and often reported that their teams added to positions in sectors they felt were disproportionately impacted in the sell-off. For example, many bonds issued by hospitals were pricing a discount because of concerns over skyrocketing expenditures and the loss of revenues from the lack of elective procedures. Similarly, revenue bonds used to finance projects in the transportation sector such as airport and transit authority projects also dropped in price as the sharp decline in travel persisted through the summer. While the uncertainty was marked, in many cases the market’s initial punishment of these bonds was likely too harsh and therefore managers with strong research teams scooped up what they surmised as deals on some of their favorite names.

Spreads continued to tighten throughout the market, particularly in the second half of the year when investors’ reach for yield became more pronounced. Again, it was the riskier, lower-quality fare that provided a boost to many investment strategies through the end of year: The median return for a distinct group in the high-yield muni Morningstar Category from March 24, 2020, through December 2020 was 18.7% and for calendar-year 2020 was 3.9%, while a similar cohort in the muni national intermediate Morningstar Category gained 13.3% and 4.6% over the same time periods.

Much like 2020 started, munis remained in high demand through much of 2021’s first quarter, and the M/T ratios again reached significant lows in early February, indicating munis were expensive again when compared with U.S. Treasuries. Even as the fixed-income markets bowed in mid-February, spurred on by expectations of rising interest rates and inflation, and national muni indexes recorded losses for that month, investment into muni strategies remained steady. Indeed, muni strategies saw solid net inflows from mid-2020 through the first two months of 2021. In January 2021, muni open-end and ETF strategies recorded the highest total monthly estimated net inflows in at least the past decade. Even as yields rose on corporates and U.S. Treasuries, into early March yields on tax-exempt debt dropped again, providing investors with a positive return in most categories.

Looking forward, veteran muni managers note that there are still credit stories to watch, particularly in the high-yield muni space. Indeed, many budgets were saddled with the burden of providing much of the equipment and services needed to support their communities through the pandemic at the same time that revenues were drying up and projects were halted because of the severe economic slowdown. Yet many state and local budgets actually suffered less stress than initially forecast because of higher than expected tax revenues and economic growth, and the recently passed $1.9 trillion federal COVID-19 relief bill will do much to bolster those that did struggle. The package includes $350 billion of direct aid to state and local governments as well as funding for public health, schools, transportation, and airlines. That revenue boost will provide crucial stimulus to municipal issuers and could help prevent program cuts and shore up credit concerns through the medium term. This comes at the same time the vaccination program in the United States is picking up speed, and the U.S. economic forecast is stronger through the end of the year.

Yet questions remain as to what comes next for muni investors. Muni market participants are considering the impact of potential tax increases in the U.S., which will likely continue to fuel demand for munis, while the tax-exempt supply of bonds remains muted by comparison. Portfolio managers are also contemplating the impact of potential changes to the Tax Cut and Jobs Act of 2017, which eliminated the tax-exemption for advance-refunding muni bonds and introduced new limits on income and property tax deductions for some individuals, among other things. And of course, there’s always the question of whether this will be the year that a comprehensive federal infrastructure package is delivered. Portfolio managers are watching for signs of volatility spurred by investors' pulling money from muni funds as yields grind even lower, but overall, many report that their outlook for the asset class is cautiously optimistic.

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)