Our New Quant Analysis Helps Fund-Seekers Explore Far and Wide

We've enhanced our Morningstar Quantitative Rating for Funds with a new feature--written reports that offer better insight and context.

Investors have come to rely on the Morningstar Analyst Rating to help them find suitable funds with great prospects. The analyst-written reports that accompany these Morningstar Medalist ratings provide an in-depth discussion of a fund's risks and potential rewards, strengths, and weaknesses to help investors size up the attractiveness and suitability of an investment.

In 2017, we greatly expanded the number of funds that receive medal ratings by launching the Morningstar Quantitative Rating for Funds. But something was missing. Unlike the ratings assigned by the analyst team, quantitatively rated funds lacked written analysis to help investors better understand the fund's potential risks and rewards, and why the fund receives the rating it does.

We have added written context to quantitatively rated funds to close this gap. We hope this analysis will be another tool investors can use to navigate the vast sea of fund products and find some great funds that will help them reach their investing goals.

Here are some frequently asked questions for investors who want to know more about the quantitative rating, its efficacy, and how the written analysis is generated.

What is the Morningstar Quantitative Rating?

The Morningstar Quantitative Rating is a machine learning model that's meant to mimic how Morningstar analysts would rate a fund. The system looks at the last five years of our analysts' ratings decisions alongside the data that was available to those analysts when they made those decisions.

The machine learning model tries to connect the data to the decisions and find the characteristics in the data that would predict an analyst's positive or negative rating. In that way, the system produces a rating that’s in most cases harmonious with the rating our analysts would have assigned the fund.

How can investors use the quantitative rating?

The quantitative analyst ratings can be used the same way investors use the Morningstar Analyst Rating. They're both forward-looking ratings that are meant to predict whether a fund will outperform or underperform over a market cycle, and both the quantitatively generated rating and the analyst-generated counterpart have shown to be predictive of future performance.

What kind of a track record does the Morningstar Quantitative Rating for Funds have? Can investors have confidence in the quantitative ratings and recommendations?

The short answer is yes. Before we initially launched the quantitative rating, we back-tested it over 15 years of data to make sure that it was going to produce the results we wanted. But real performance data--not just back-tests--are crucial in measuring effectiveness.

- source: Morningstar Analysts

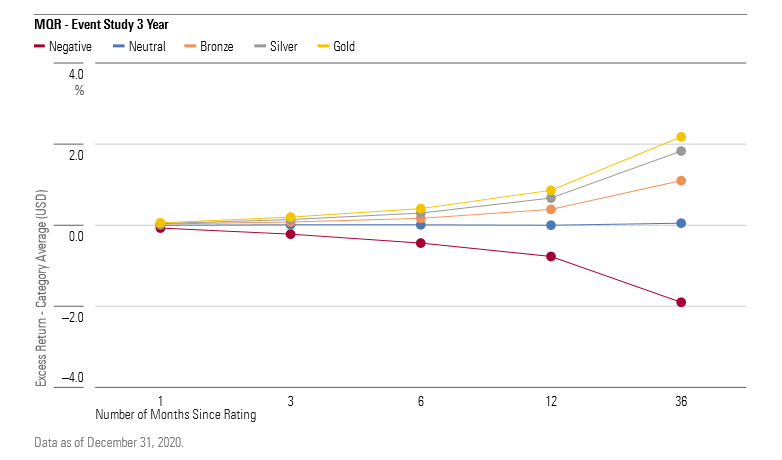

To determine the effectiveness of the rating, our research team performed an event study, which shows the average performance of funds that receive a rating over time. Because equity and fixed-income funds have very different return profiles, we compare all results versus a fund’s category average return. The above exhibit shows the degree of over- or underperformance of different ratings groups.

In this study, we looked at the margin of outperformance among different ratings buckets over various periods--one month, three months, six months, 12 months, and 36 months--to see whether, on average, a fund with a Morningstar Analyst Rating of Gold outperformed over a 36-month period and by how much. Over this three-year period, the average Gold-rated fund beat the Morningstar Category by a little over 2 percentage points, whereas a Negative-rated fund underperformed by 1.7 percentage points on average. The rating has done well for investors over the past three years, and we expect it to continue to perform well going forward.

Where can I find this written analysis, and how can investors use it?

The quantitative rating has been live in Morningstar products and on Morningstar quote pages as a Premium feature since June 2017.

Now when you look at a quote page for fund with a quantitative rating (a subscript Q) you will have an option to read written context that provides justification for the rating.

How is this quantitative analysis created?

The analysis is automatically generated, and it is designed to communicate the reasons for, and justifications behind, a fund's quantitative rating. The analysis is designed to replicate the style of the reports that Morningstar analysts publish.

How often is the written content refreshed?

The written quantitative analysis is refreshed monthly.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)