Best TIPS for You

Advice for inflation protection.

A version of this article appeared in the October 2020 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Treasury Inflation-Protected Securities purchased directly from the United States Treasury and held until maturity provide a set real return, and so offer a simple method for inflation protection. Low-cost TIPS index funds are a less-than-perfect hedge against inflation, but they are worth considering for those concerned that inflation may exceed the market’s low expectations. The best way to get exposure to TIPS depends on the investor. Here’s a closer look at the key factors to keep in mind.

How TIPS Work

TIPS protect against inflation directly. Unlike nominal bonds, the principal amount due a TIPS holder adjusts to reflect changes in the Consumer Price Index. A rise in CPI will result in a corresponding rise in principal due, and a higher coupon payment received. As a result, an investor that buys and holds an individual TIPS to its maturity will receive a direct hedge against a rise in CPI. TIPS never return less than the original principal (as long as the government doesn’t default), even in the unlikely event of deflation over the life of the bond.

The difference in yield between a TIPS bond and a nominal Treasury bond (of the same maturity) is known as the breakeven inflation rate. But the breakeven inflation rate is only a proxy because TIPS are less liquid than Treasuries and because the market requires a premium for bearing inflation risk (the risk that actual inflation exceeds expected inflation). Consequently, expectations for inflation are priced into the yields of nominal Treasury bonds, along with a premium to compensate for the risk that inflation exceeds expectations.

According to the Federal Reserve Bank of Cleveland, the inflation risk premium has not changed much since TIPS were first issued in 1997.

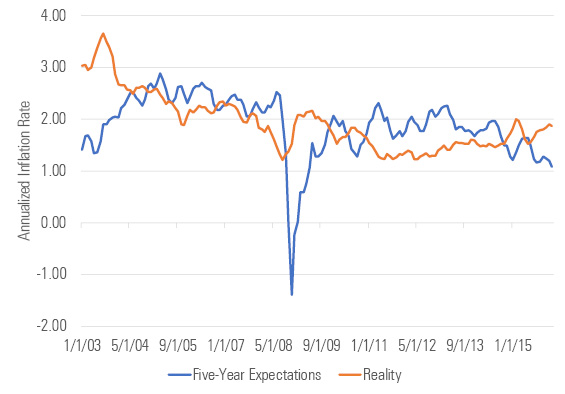

And though past performance does not predict the future, it is reasonable to anticipate that the market will continue to price traditional Treasuries with a similar inflation risk premium. This premium has remained stable despite the considerable decline in inflation, suggesting that it is partially independent of actual inflation. Given the presence of an inflation-risk premium, the breakeven inflation rate should tend to exceed subsequent realized inflation. However, realized inflation has tended to hew closely to the breakeven inflation rate most of the time, as Exhibit 1 shows. The market appears to do a decent job of predicting inflation, though it’s far from perfect.

Exhibit 1: Expectations and Reality Seldom Meet Five Years On

- source: Federal Reserve Bank of St. Louis.

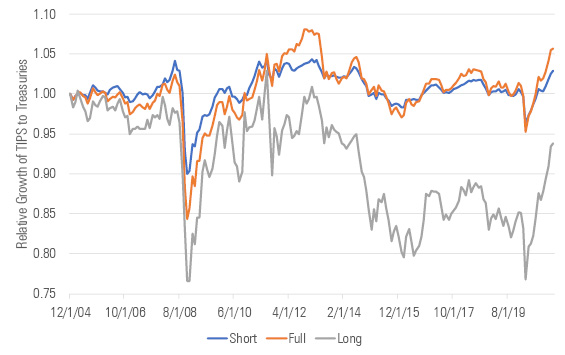

Treasury Inflation-Protected Securities deliver higher real returns than Treasuries when actual inflation exceeds expected inflation, which is a risk to traditional bond investors. But the insurance they provide against this risk is not free. They forfeit the inflation risk premium that traditional Treasuries and fixed-rate bonds offer, so they should have slightly lower expected real returns. That said, over the long term and short term, broad TIPS indexes have tended to offer competitive returns with traditional Treasury indexes, as Exhibit 2 shows. Conversely, the long end of the TIPS yield curve did not fare nearly as well against the long end of the Treasury yield curve. This most likely stems from the decline in long-term inflation expectations.

Exhibit 2: Short- and Full-Term TIPS Have Performed Well Relative to Treasuries

- source: Morningstar Direct, as of March 11, 2021.

Individual TIPS or TIPS Funds

The most direct way to protect against inflation is to buy and hold individual TIPS. If these are purchased directly from the Treasury when they are issued and held until maturity, they will provide a positive real return, as long as the U.S. government doesn’t default. These are offered in maturities of five, 10, and 30 years. Investors could construct a laddered portfolio of individual TIPS with maturities staggered for the dates when they need the cash.

An owner of individual TIPS forgoes a few benefits found with a professionally managed TIPS strategy, the most tangible of which is the management of cash flows when a TIPS reaches maturity. But the more compelling benefit is the potential for capital appreciation, which investors often enjoy when the yield curve is upward-sloping.

TIPS funds don’t necessarily move in lockstep with inflation because they don’t necessarily buy TIPS when they’re originally issued or hold them until maturity. TIPS’ market prices are influenced by interest rates, not just inflation. Investors in these funds aren’t guaranteed a positive real return.

Consider the choice between a 10-year TIPS issued in January 2005, and iShares TIPS Bond ETF TIP, an index-tracking fund that offers exposure to the entire TIPS yield curve. A $10,000 investment in TIP in January 2005 would have grown to $15,400 by December 2010, while the investment in the individual TIPS would have been worth$14,400.

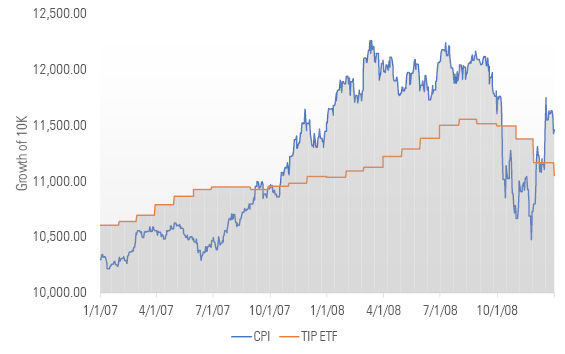

Nonetheless, the TIPS accomplished its goal in that it provided protection against inflation as measured by CPI. Exhibit 3 reinforces the need for caution, because although the choice between the ETF and the individual TIPS might seem obvious with the benefit of hindsight, during much of 2008 the ETF lost purchasing power. This illustrates that TIPS funds don’t always keep pace with inflation.

Exhibit 3: Tough Times During the 2008 Crisis

- source: Morningstar Direct

Yield Curve Positioning

The most important decision when evaluating TIPS funds concerns the segment of the TIPS yield curve to target. As of March 2021, seven passive strategies offer exposure to the entire TIPS yield curve, five passive strategies specifically target TIPS with less than five years remaining until maturity, and two passive strategies target TIPS with less than 10 years remaining until maturity. There is also one strategy with exposure to TIPS with at least 15 years remaining until maturity.

Strategies that offer exposure to the short end tend to be more highly correlated with inflation than longer-term TIPS portfolios. That’s because short-term interest rates are more directly affected by short-term changes in inflation than longer-term rates. Between January 2005 and February 2021, the performance of the Bloomberg Barclays U.S. TIPS 0-5 Year Index was 0.59 correlated with CPI, while the figures for the Bloomberg Barclays U.S. Treasury TIPS Index and the Bloomberg Barclays U.S. Treasury Note 10 Year + Index were just 0.35 and 0.14 correlated, respectively. That said, short-term TIPS strategies also tend to offer lower real returns than their longer-term counterparts.

Another factor to consider is how the TIPS strategy will fit into a portfolio. The performance of the short TIPS index is the most correlated to the equity market, partly because it has less exposure to interest-rate risk, which has a countercyclical payoff, and partly because of its higher correlation with the CPI, which is influenced by demand and economic strength. So, longer-term TIPS will likely better diversify stock risk in a portfolio.

Putting It All Together

TIPS offer a simple and direct method to protect against inflation. But given that expectations for inflation are priced into the yield of nominal Treasury bonds, TIPS should be considered based on one’s sensitivity to unexpected changes in inflation.

If any degree of unexpected inflation can cause serious harm, or if there is a specific date in which funds are earmarked ahead of time as needed specifically for liquidity, then buying and holding an individual TIPS (or a portfolio of TIPS) is probably the best choice.

However, low-cost TIPS index funds are probably suitable for most investors concerned about unexpected inflation over the long term. The trade-off for losing the fixed real yield is a potential uptick in total return. When the yield curve is upward-sloping, bond yields fall down the yield curve and their prices rise. TIPS exchange-traded funds can profit from this effect.

Because of their relatively muted interest-rate risk, funds targeting TIPS with less than five years remaining until maturity provide the most correlated performance with CPI. But these strategies are likely to offer lower real returns than those that own TIPS across the entire maturity spectrum and are more correlated to equity risk. Funds that provide exposure to the entire TIPS yield curve suffer from greater interest-rate risk and are less correlated to changes in CPI, but they also provide better diversification and greater return potential. The right fund depends on the investment horizon. Shorter-term funds are probably better for shorter holding periods.

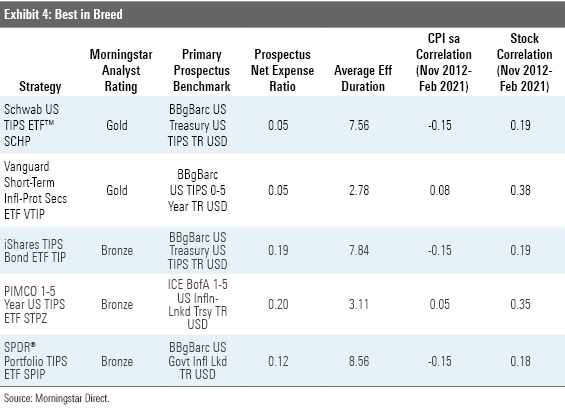

Exhibit 4 displays Morningstar Medalists worthy of consideration for exposure to TIPS.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)