Sustainalytics: 10 Investing Themes for 2021

Investing with global sustainability in mind.

The following article is a reprint from Morningstar's ESG research partner, Sustainalytics. The full Sustainalytics report can be found here.

, presents investors with 10 environmental, social, and governance investment themes for 2021 that can positively contribute to advancing the United Nation's Sustainable Development Goals. Here are the 10 themes highlighted in the report:

Agrochemical companies can expose investors to ESG risks through the production and application of pesticides and fertilizers, which can result in impacts ranging from toxic emissions, effluents, and waste incidents to large carbon footprints. Certain pesticides (for example, glyphosate) have also been linked to harmful effects on human health because of their hazardous properties and inappropriate uses. Novozymes NVZMF has recently expanded its activities into microorganisms, which can replace or complement traditional fertilizers and pesticide products.

The use of technology in agriculture can help ensure that optimal amounts of agricultural chemicals are used at the production stage and the application stage to help prevent the overuse of pesticides, fertilizers, and scarce resources such as water.

Precision agriculture is a farming management approach that uses digital techniques to monitor, measure, and analyze the needs of individual fields and crops, optimizing production processes. This approach enables farmers to account for soil variations and adapt their fertilizer and pesticide strategy, reducing costs and environmental impacts. Yara YRAIF and Nutrien NTR stand out for their lower levels of unmanaged risk and lack of involvement in significant events (which form part of the MEI assessment, along with ESG indicators on related policies and programs).

Both companies offer biological alternatives and precision farming solutions, which may help position them to mitigate environmental and social risks and to benefit from the increased demand for more sustainable alternatives to traditional agrochemical products.

Agrochemical products play a major role in assuring food production worldwide. As agricultural land is limited, pesticides and fertilizers are valuable inputs to increase land productivity. While such inputs can help meet increasing demand for food, limiting their negative impacts on the environment and human health remains a challenge. DSM is collaborating with Syngenta on the joint development of microbials for crop protection agents.

Organic farming and the use of biodynamics can help maintain good soil quality, while reducing the impact on biodiversity, and generate energy from renewable energy sources. These practices could also close several loops and prove more profitable than conventional farming.

While organic farming practices are atypical in the industry, some food companies support regenerative farming practices to improve soil health by limiting chemical inputs, rotating crops, reducing soil tillage, and using crop residues as compost. In this sense, agricultural companies are often laggards, as they display little effort in this field despite being highly exposed. However, some offer products that are certified organic or certified according to other sustainability standards. Archer-Daniels Midland ADM, a global processor and trader of agricultural commodities, offers organic food and animal feed options.

Of the 1.6 billion hectares of the world's productive land currently used to grow crops, a third has been degraded by erosion, nutrient depletion, acidification, pollution, and other unsustainable land management practices. Every continent is experiencing from 12% (Europe) to 37% (Australia and Oceania) stressed or declining productivity due to pressures on vegetated land.

As outlined in the Intergovernmental Panel on Climate Change’s special report on climate change, degraded land becomes less productive, restricting what can be grown, limiting the soil’s carbon absorption abilities, and reducing the amount of moisture that can be retained. This degradation exacerbates climate change, which further accelerates land degradation, putting food production and global markets at risk. Olam International OLMIY offers certified sustainable products, such as Rainforest Alliance and UTZ-certified coffee and cocoa products, and Bonsucro sugar.

The increasing efficiency and scaling of the fishing industry has led to a situation where, according to some estimates, global fishing capacity could catch the world’s fish 4 times over and cause significant marine damage. Overfishing has led to a situation where around 90% of fish stocks globally are classified as overexploited, fully exploited, depleted, or near a state of collapse. Consumption of this natural resource is outpacing natural regeneration.

Planet Tracker reports that the world’s biggest fishing nation, Japan, experienced a 66% decline in seafood production between 1985 and 2017, and warns that profits are at risk if overfishing and unsustainable fishing practices continue. Companies involved in fish farming are looking to reduce their dependency on wild fish stocks as raw materials for feed. Bakkafrost’s BKFKF vertically integrated model and control over its supply chain position the company as a front-runner in sustainable seafood production.

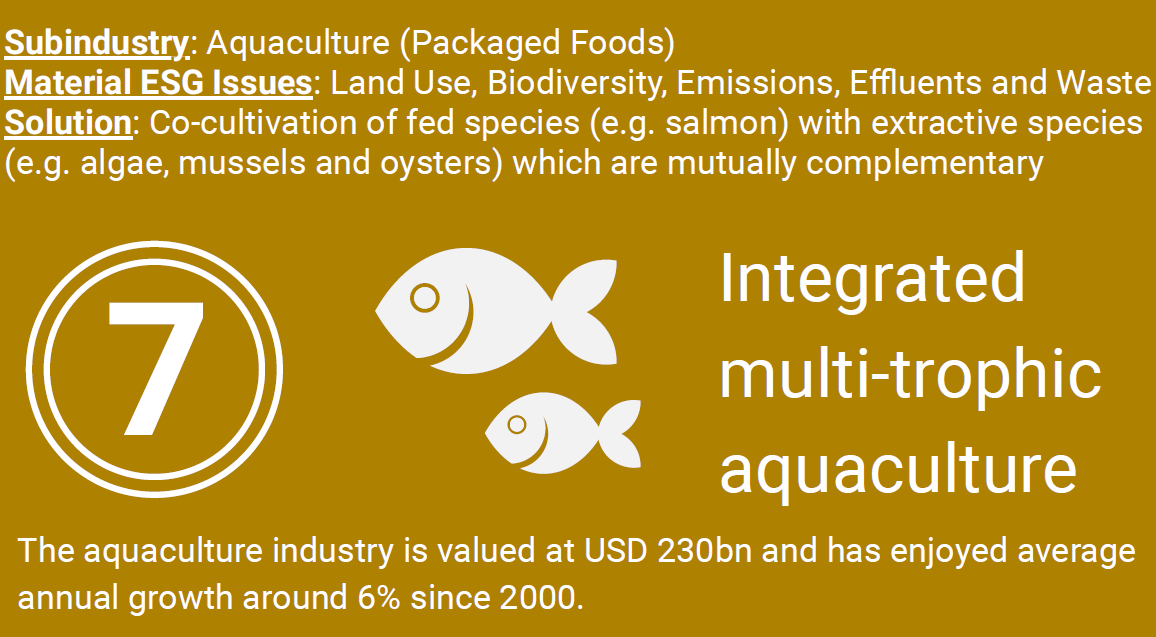

Advanced aquaculture systems include co-cultivation and natural solutions to close resource loops and reduce exposure to environmental risks. Some companies are moving to land-based and recirculation aquaculture processes, which can mitigate risks associated with physical climate change, warming sea temperatures, algal blooms, sea lice, and disease. Lerøy Seafood Group LYSFF and the Bellona Foundation have formed a company called Ocean Forest, which offers a regenerative approach to ocean farming.

Regulators are also increasingly requiring companies to use more sustainable packaging, higher percentage of recycled and recyclable materials, and less single-use plastic. Many countries and local governments have already enacted bans or put a price on thin, single-use plastic bags, with some encouraging results. Taking further steps, starting in 2021, the EU will ban single-use plastic products for which alternatives exist on the market. Similarly, the United Kingdom will levy a tax from 2022 on plastic packaging with less than 30% recycled materials.

Regulations have also come into effect to bridge gaps in the current consumption cycle, with the EU Landfill Directive prescribing reductions in the amount of biodegradable municipal waste, and mandatory garbage sorting introduced in a growing number of cities in China. Tesco TSCDF is taking a strong stance on reducing the use of plastic packaging from its stores by removing ready-meal trays, yogurt container lids, and straws.

Inefficiencies in the food value chain can affect a firm’s cost structure, translate into missed revenues, and potentially reduce margins and returns for shareholders. Food and packaging waste present environmental and social problems, ranging from world hunger and the overexploitation of natural resources to water stress, biodiversity impacts, and climate change. For investors, these issues can present portfolio risks because they can affect companies’ costs, revenues, and reputation.

By 2030, Starbucks SBUX aims to achieve a 50% reduction in waste sent to landfills from both its stores and its manufacturing facilities.

In the context of humanitarian concerns about poverty and hunger, addressing the issue of food waste can form the basis of an investment thesis for asset managers pursuing an impact investing agenda that is aligned with the UN Sustainable Development Goals. However, food security is also an important issue for mainstream, fiduciary investors to address because it can affect macroeconomic and geopolitical stability. Tesco was the first U.K. food retailer to report year-on-year food-waste data, including the amount of redistributed food surplus.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JUWC2VJUKBCG5P3KVQJCHL5QSQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JD5KSEJFLNFLJA5XRS6YK2O24Q.jpg)