4 Utilities With an Edge After Texas Power Outages

We look at which utility companies stand to benefit as the Lone Star state recovers from last month's blackouts.

Widespread power outages in Texas left millions without power during severe winter weather last month. This focused attention on utilities companies nationwide, and our Utilities equity research team believes they must address three key areas going forward.

1. Renewable Energy Growth We expect wind and solar energy to double their market share in the United States by 2030. That includes 50 gigawatts in wind and solar energy to go online in the next three years--with a significant portion going to Texas. Despite Texas being a large producer of wind and solar energy, there will be hurdles to expand renewable energy across the U.S. The biggest challenge is intermittency: producing solar and wind energy when it isn't sunny or windy. In addition, wind turbines can produce energy in cold temperatures, but investment is required for them to operate more efficiently during extreme cold.

2. Shifting Electricity Demand An already-stressed Texas electric grid will likely see further issues. Texas, Arizona, and Virginia are three states with increasing electricity demand due to a rebounding economy, data center expansion, and increasing interest in electric vehicles. States like Illinois, Wisconsin, and Massachusetts face falling electricity demand. We expect overall U.S. electricity demand to increase by 1.2% annually over the next 10 years.

3. The Folly of Electric Heating Opposition to carbon-emitting fossil fuels is driving a fringe movement to eliminate residential and commercial use of natural gas, particularly in California. New policies would prohibit natural gas in new buildings. This has led to a sell-off of gas utilities, but we think the market is overreacting to this long-term threat. Using gas to heat homes and water is cheaper than electricity. Our equity research team believes heating electrification will stretch an already-stressed electric grid, especially during cold winter months.

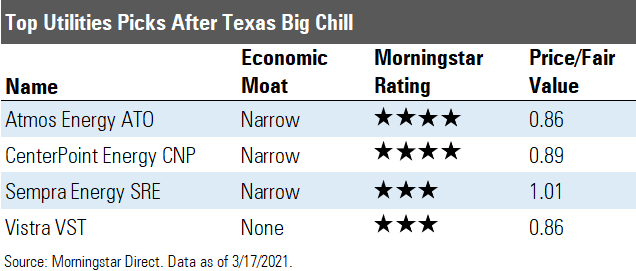

Atmos Energy ATO and CenterPoint Energy CNP are two of the most undervalued utilities with significant Texas exposure. Our equity research team expects these companies and a couple of others to win from energy policy changes in Texas.

The Utilities equity research team examined each of these four names in a report called "After Texas' Big Chill: Utilities Winners and Losers." Here's what they had to say.

Atmos Energy ATO

“Texas exposure: Regulated gas distribution system serves more than 2 million customers in Texas. Atmos also operates APT, a 5,700-mile intrastate pipeline in Texas spanning several key shale gas formations and interconnected with five storage facilities.

In the near term, Atmos management said it could face $2.5 billion-$3.5 billion of natural gas purchase costs payable next month due to the extreme gas price movements across its service territories. As a regulated gas distribution utility, Atmos is allowed to recover all supply costs from customers in the states it serves. Although there will be a cash timing lag, we don't expect a material impact on 2021 earnings or long-term value. Atmos maintains one of the strongest balance sheets in the sector and we expect it will be able to finance these payments through cash on hand and short-term debt without issuing additional equity beyond the $500 million we estimate will be needed to finance its 2021 infrastructure investments. Atmos had $3.0 billion of liquidity as of Feb. 18.

Atmos is one of our top utilities picks, based on its attractive valuation and long-term growth. Once one of the priciest utilities, Atmos is now one of the cheapest after a 24% drop in the stock price since January 2020. Yet Atmos' operations, earnings, and dividend remain a model of consistency. Favorable regulatory frameworks and large infrastructure investment opportunities have driven strong earnings growth and steady dividend increases averaging more than 8% annually in recent years. We expect over $12 billion of capital expenditures during the next five years, exceeding the top end of management's $11 billion-$12 billion target. Over 85% of the total investment is for safety and reliability, such as replacing bare steel, cast iron, and vintage plastic pipes. We expect this growth investment to receive regulatory support and continue well beyond this decade. This should continue to drive dividend growth near the top end of management's 6%-8% target over at least the next five years and possibly much longer.”

CenterPoint Energy CNP

“Texas exposure: CenterPoint's Houston Electric subsidiary owns the regulated transmission and distribution network serving 2.5 million customers in the Texas Gulf Coast area, including Houston. CenterPoint also owns the regulated natural gas distribution network in the Houston area serving 1.8 million residential and commercial-industrial customers.

CenterPoint's regulated utilities have significant investment opportunities due to growing energy demand and infrastructure needs in its vast service territories. We estimate CenterPoint's regulated earnings will grow over 7% annually and contribute more than 90% of consolidated operating earnings by 2023, based on its current portfolio of businesses. We don't expect that growth trajectory to change significantly if management follows through on its plan to sell its gas distribution utilities in Arkansas and Oklahoma.

CenterPoint's largest utilities in Texas, Minnesota, and Indiana remain the primary areas of growth. The recently announced merger of 54%-owned Enable Midstream Partners with Energy Transfer will provide a more liquid investment that we expect CenterPoint to eventually divest. Divestiture would eliminate CenterPoint’s nonutility exposure, and, we believe, provide a simpler story for investors. We think the dividend is secure after its 48% cut in the second quarter last year due to Enable's distribution cut and coronavirus-related issues. Eventually we expect dividend growth in line with the growth in the utilities' EPS contribution.”

Sempra Energy SRE

“Texas exposure: Owns an 80% stake in Oncor, one of the largest regulated transmission and distribution utilities in Texas. Its transmission business includes the assets of the former InfraREIT, which Sempra bought in 2019. Its Texas businesses represent 27% of Sempra's consolidated earnings.

Sempra's Texas subsidiaries should benefit from a renewed focus on transmission investment to make the grid more flexible and resilient, especially as renewable energy in the state continues to grow. We forecast Oncor's Texas rate base will grow nearly 7.5% annually over the next five years on nearly $12.2 billion in investments. While there will continue to be some concern regarding the regulatory environment, we continue to expect constructive regulatory support for Oncor's transmission and distribution investments. Texas regulation generally allows timely recovery of capital expenditures.

Sempra has de-risked its portfolio in recent years, focusing on regulated distribution and transmission utilities in Texas and California that offer healthy capital investment growth potential. Sempra's investment opportunities at its narrow moat regulated utilities in California and Texas will remain the primary growth driver, receiving over 80% of the company's planned capital investment. Sempra had long maintained a diversified portfolio composed of regulated utilities and unregulated energy operations, but it has recycled capital into its regulated operations with proceeds from its asset divestitures, notably gas storage, merchant renewable energy projects, and its Latin America subsidiaries. This portfolio pivot, lower payout ratio, and the long-term contracts at its Cameron LNG trains 1-3 support our dividend growth forecast.”

Vistra VST

“Texas exposure: Largest power generator in Texas with 19 gigawatts of generation, including 2.3 GW of nuclear, 4.5 GW of coal, and 11.4 GW of gas generation. It also owns one of the state's largest retail supply businesses, serving 2.3 million customers, or nearly one third of residential electricity customers in the state. Vistra's total portfolio remains long generation even after several recent retail acquisitions. Coming into 2021, Vistra estimated its retail supply commitments would be equivalent to two thirds of its expected generation.

Vistra stands to benefit more than any utility from policy developments that create economic incentives for the state's power plants to remain available for peak demand events. This could include a capacity market structure like those in other regions where Vistra owns power plants. We expect Vistra will collect $700 million, or nearly 40% of pretax income, from capacity or resource adequacy payments in the mid-Atlantic, Northeast, and California in 2021. If Texas were to implement a capacity market, we estimate Vistra could realize $680 million of additional annual EBITDA based on capacity prices in the other markets where it operates. That could lead to as much as a $10 per share increase in our fair value estimate, although we think some of that potential upside is already priced into the stock at $23 per share.”

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)