The Percentage of Female Fund Managers Is Almost Exactly Where It Was 20 Years Ago

Where the industry has and hasn’t made progress on gender representation.

Out of roughly 10,000 funds (among allocation, equity, and fixed-income funds) in the United States, less than 2% were led by exclusively female teams at the end of 2022. That’s not to say there isn’t any representation, as 26% of funds are led by a gender-diverse team (a team that includes at least one woman).

While the number of women included on portfolio management teams has certainly increased from 20 years ago, so has the overall number of people on these teams. Globally, the percentage of female fund managers has consistently hovered around 12% over the past two decades.

There remains ample room for growth. Here, we break down the representation of female fund managers across asset classes, countries, and more.

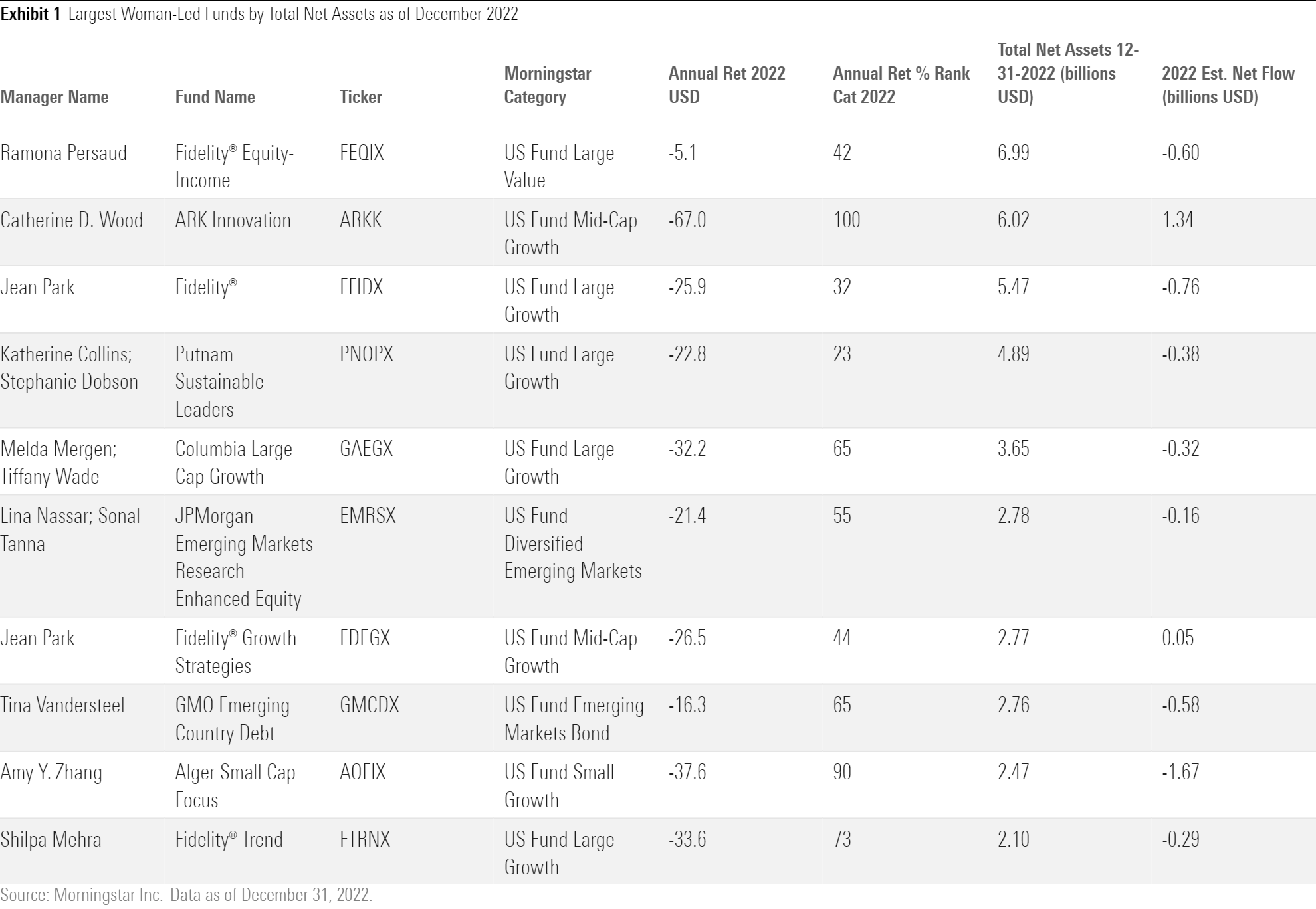

The 10 Biggest Funds Led by Women in the U.S.

The table below lists the 10 largest U.S. funds that were led by a female manager at the end of 2022. At the top of the list is Ramona Persaud, who has been leading Fidelity Equity-Income FEQIX since early 2018, though her involvement on the fund began much earlier. In spite of a tough year, the fund’s performance finished in the top 42% among peers in its large-value Morningstar Category. Morningstar senior analyst Megan Pacholok details Persaud’s accomplishments in “The Top Female Portfolio Managers to Invest With Now.”

Equity funds—particularly large-cap growth funds—were the most prevalent among the largest funds led by women.

Largest Woman-Led Funds by Total Net Assets as of December 2022

Every year, Morningstar conducts an analysis of global fund managers by gender. We use data provided by companies (including prospectus documents and public filings) as well as software to assign the probability that a portfolio manager is male or female based on name recognition. Our global coverage includes data on over 50,000 fund managers from equity, fixed-income, and allocation strategies (open-end and exchange-traded funds).

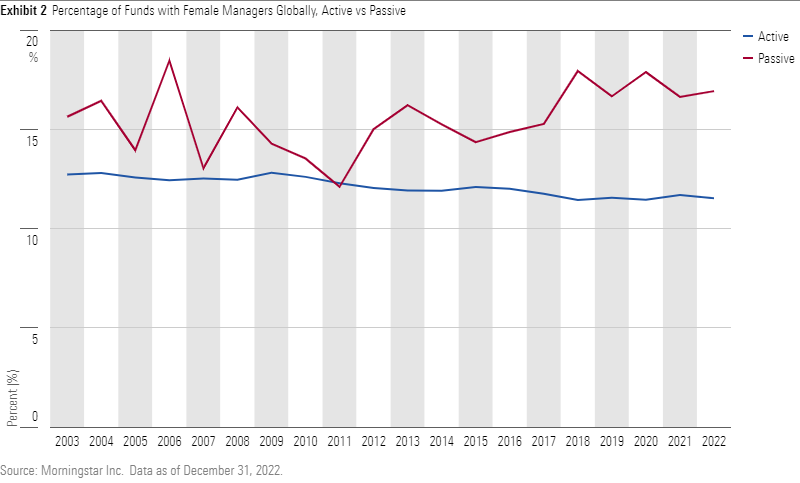

Women More Likely to Manage Passive Funds Than Active Funds

Despite the boom in the fund industry over the past 20 years, the percentage of female fund managers remains disproportionate. The exhibit below compares the percentage of women that manage active funds versus passive funds globally. The percentage of female managers of actively managed funds has remained constant, while there have been some fluctuations in passively managed funds.

Percentage of Funds With Female Managers Globally, Active vs. Passive

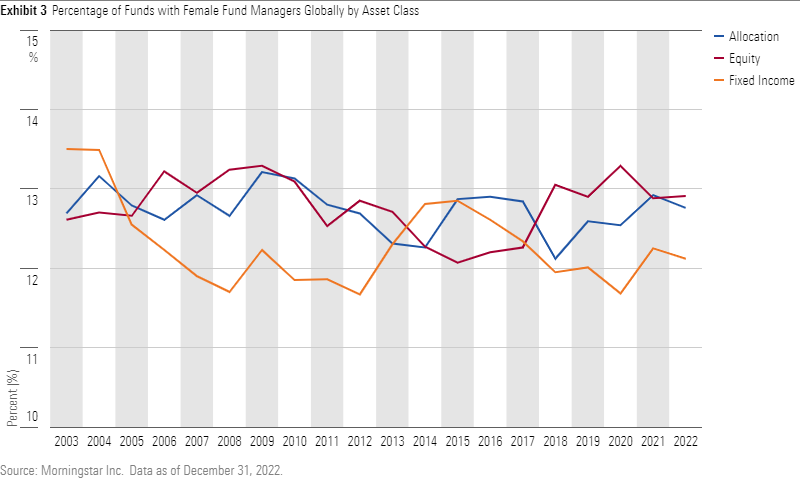

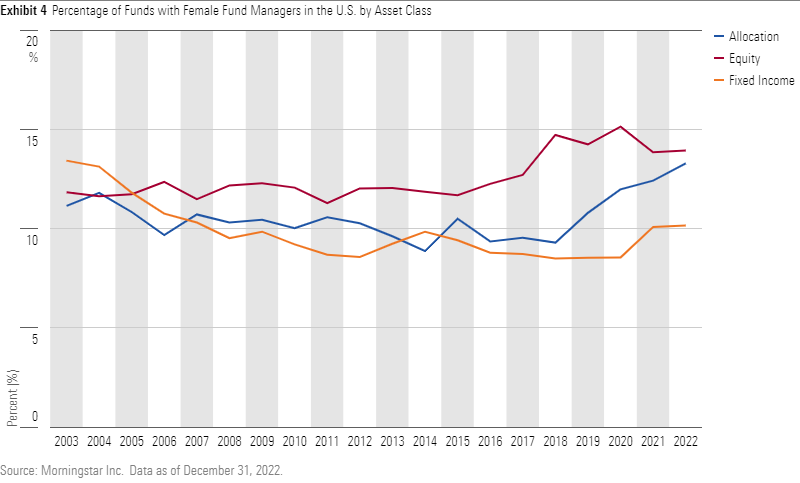

The Breakdown by Asset Class

We also explored the asset-class trends in funds managed by women globally and in the U.S. While female managers across the globe are represented relatively equally in allocation, equity, and fixed-income funds, in the U.S., there is a small skew toward allocation and equity funds at 13% and 14%, respectively, over fixed-income funds at 10%, which is a reversal from 20 years prior.

Percentage of Funds With Female Fund Managers Globally by Asset Class

Percentage of Funds with Female Fund Managers in the U.S. by Asset Class

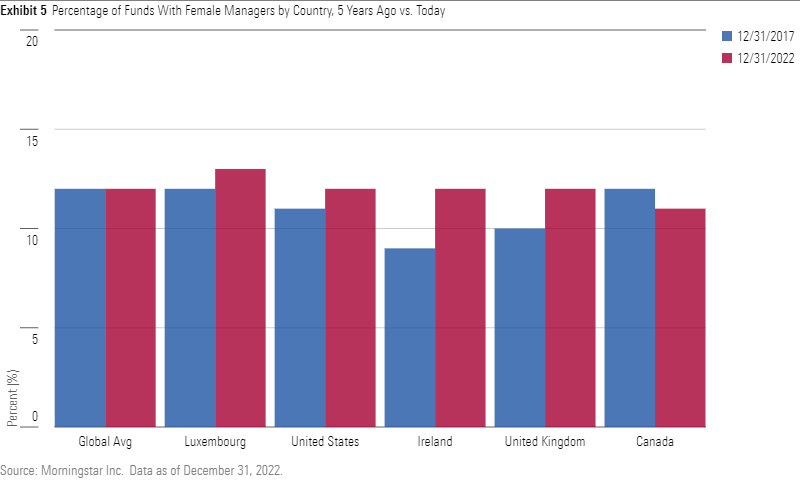

The Breakdown by Country

We also took a closer look at the female representation among funds in various countries. Highlighted in the chart below are five countries that had the most fund manager data available.

In 2022, the percentage of funds managed by women in Luxembourg slightly passed the global average. Meanwhile, the percentages of those in the U.S., Ireland, and the United Kingdom were on par with the global average of 12%.

Canada followed closely at 11%, though that percentage was slightly down from 2017, when 12% of the country’s funds were managed by women.

Percentage of Funds With Female Managers by Country, 5 Years Ago vs. Today

The Percentage of Female Fund Managers Remains Stubbornly Low

Overall, the biggest takeaway in the past few years has been the consistency in the percentage of female fund managers. Though we are encouraged by fund companies embracing diversity programs and encouraging female mentorship, it may be a while before we see the impact of those efforts at the portfolio manager level.

Note: We continue to revise our fund manager gender data and methodology in order to best represent changes in the industry. As such, historical figures presented in the charts and tables of this report may change over time as we refine the process. If you have any questions about the data or methodology, please contact the author.

A version of this article was published on March 16, 2021.

Correction (March 9, 2023): An earlier version of this article incorrectly stated the number of funds in the United States. It is roughly 10,000, not 7,200.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)