Small-Cap Multifactor Funds Pick Up Speed

There's a case to be made for these funds.

A version of this article appeared in the November 2020 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

While most multifactor funds focus on large- and mid-cap stocks, the payoff to factor investing has tended to be larger among smaller stocks. Small-cap stocks may not always be in favor, but those who believe in factors should consider small-cap multifactor strategies, which have greater potential to beat their relevant benchmark than large-cap multifactor funds.

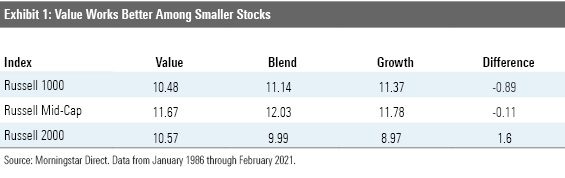

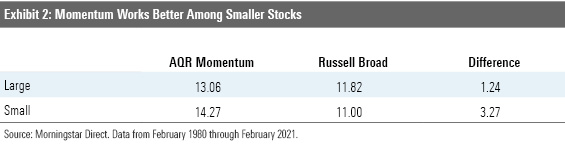

Explaining the Edge The value, momentum, low-volatility, size, and quality factors have historically been linked with superior risk-adjusted performance. The payoffs to value, momentum, and low volatility have tended to be greater among small-cap stocks, as shown in Exhibits 1, 2, and 3. Quality and size, however, appear to work similarly well across the entire market-cap spectrum.

Inefficiencies in the small-cap market offer the best explanation for these factors’ greater payoffs among smaller stocks. Stock mispricing is more likely further down the market-cap scale. Smaller firms don’t receive the same degree of attention as their large-cap brethren. Because mispricing likely contributes to the success of each factor, it makes sense that greater mispricing would contribute to greater factor efficacy among smaller stocks.

The small-cap market’s proclivity to mispricing makes it fertile ground for the value effect to take hold. Value stocks’ historical outperformance is believed to stem from one of two reasons: 1) investors are compensated for holding riskier stocks, or 2) stocks are not priced accurately. However, the risk compensation explanation doesn’t hold up well for small-cap stocks. In the small-cap universe, the cheapest stocks have historically been less volatile than the priciest. This supports the explanation that value’s increased efficacy among small-caps is partially due to greater mispricing in that market segment.

Conventional wisdom holds that, in an efficient market, low-volatility (low-risk) companies come with lower expected returns than their riskier counterparts. Yet, Exhibit 3 shows that the least-volatile quintile of stocks in each size segment posted better risk-adjusted performance than the most-volatile quintile. And similar to the value effect, this advantage was more pronounced among smaller stocks. This suggests that large-cap stock prices reflect risk more accurately than small caps.

The small-cap market is not quite as information-rich as the large-cap universe, which aligns with the economic intuition of why the momentum factor works. Momentum likely arises because markets are slow to react to new information. It’s reasonable to conclude that the small-cap market--which is comparatively sparse in information--would react to news even more slowly than the larger markets. That said, channeling the momentum effect in small-cap strategies is difficult in practice. It requires frequently trading relatively illiquid stocks, which brings transaction costs that may offset momentum’s added returns.

Not all factors work better among smaller stocks. For example, quality bucks the trend. This is likely because larger firms tend to be more profitable, so this factor tends to favor larger stocks to begin with. However, researchers from AQR have shown that after controlling for differences in quality, smaller firms tend to do better (1).

The small-size effect also appears to work equally well across the market-cap ladder. This is likely because mispricing probably doesn’t contribute to the success of the small-size factor. Rather, it’s likely compensation for greater market risk, as smaller firms tend to carry higher market betas.

Turning Data into Dollars Although quality and small size may not offer a bigger advantage when applied to small-cap stocks than they might among a universe of larger stocks, diversified factor investors have greater room to outperform in the small-cap arena. A few exchange-traded funds are well positioned to help investors channel the small-cap factor advantage.

IShares MSCI USA Small-Cap Multifactor ETF SMLF offers diversified factor exposure and levies a 0.30% fee, which is one of its category's lowest. It targets stocks with a strong combination of value, momentum, quality, and size characteristics. This holistic approach produces solid factor exposure and differentiates it from the Russell 2000 Index to the tune of a 76% active share, giving it ample room to recoup its fee. This fund kept risk in check despite its tilts; it has posted lower volatility than the index since its 2015 inception.

SMLF successfully leaps the practical hurdles of implementing a small-cap multifactor strategy. Combining momentum with the other factors has kept turnover in check, which a small-cap fund chasing momentum alone would struggle to do. Pursuing factor exposure can introduce pronounced sector biases, but this fund mechanically holds each sector allocation to within 5% of its parent index, the MSCI USA Small Cap Index. This constraint prevents the fund from making any sector bets that may go unrewarded by the market. It effectively diversifies risk at the holding- and factor-level, too.

This strategy has trailed the Russell 2000 Index by 1.19% annually since its inception. Much of its underperformance has come in the past 12 months, as its defensive posture made it hard to keep up during the market’s emergence from the depths of the COVID-19-induced drawdown. However, the fund’s risk-adjusted performance measures paint a brighter picture, and it should fare well if value sustains its recent momentum.

Another way to capture multifactor exposure is to piece together different single factor funds. Vanguard Small-Cap ETF VBR--the only index fund in its category with a Morningstar Analyst Rating of Gold--is an excellent option to harness the small-cap value effect. This fund features the cheaper half of the small-cap market and weights stocks by market capitalization, which channels the collective wisdom of the market to size its positions. Market-cap weighting and well-crafted index buffers help mitigate turnover and the accompanying transaction costs, which complements this fund's 0.07% expense ratio in limiting costs.

This fund is mindful of risk. Market-cap weighting mechanically trims exposure to firms on the decline, and the inclusion of blend stocks improves diversification. Over the past decade, this fund landed in its Morningstar Category’s least-volatile quintile. However, the pursuit of value introduces sector biases that may not be rewarded by the market over the long-term. Investors would be wise to partner VBR with other factor strategies to spread their exposure.

IShares MSCI USA Small-Cap Min Vol Factor ETF SMMV makes for a solid partner, which comes with a 0.20% expense ratio and pronounced low-volatility tilt. This fund selects stocks from the same universe as SMLF but focuses on low-volatility rather than their return-enhancing factor traits. It uses an optimizer to consider both firm-level volatility and the way potential holdings interrelate. It leverages the low-volatility factor and builds on it through efficient portfolio construction to produce a well-diversified fund that mitigates exposure to concentrated sources of risk that past volatility alone may not detect.

Like SMLF, SMMV ensures each sector allocation remains within 5% of its parent index. Other constraints cap individual holding weights and mitigate turnover to improve diversification and limit transaction costs. Its defensive stance has overshadowed these efforts over the past year, when it captured only two thirds of the Russell 2000’s upside. However, this fund’s holistic approach to portfolio construction should enable it to deliver better risk-adjusted performance than the broad small-cap market over the long term.

Late Registration Small-cap multifactor funds' relative advantage has taken a while to register with U.S. investors. At the end of February 2021, multifactor ETFs listed in the large growth, large blend, or large value Morningstar Categories tallied nearly $28 billion in assets, while their small-cap counterparts counted just $5 billion. This makes sense, as large-cap strategies tend to absorb more assets, but it shows that U.S. investors are not capitalizing on the greater factor payoffs among smaller stocks.

There are currently 17 small-cap multifactor ETFs on the market, nine of which were launched within the past five years. The recent wave of these products indicates that ETF providers expect more assets to start flowing into the small-cap multifactor space, but investors have been slow to comply.

That said, the imbalance between the developed product lineup and their relatively modest investment is beginning to level out. Over the trailing 12 months through February 2021, U.S. small-cap multifactor ETFs have raked in over $1 billion in flows. Large-cap multifactor ETFs have seen outflows of about the same magnitude over the same span. Market-cap weighted index trackers have performed better in the large-cap space until recently, so it's difficult to say if the small-cap multifactor uptick is driven by frustration with traditional small-cap funds or wider recognition of the small-cap factor advantage. But for those with conviction in factor investing, there is a strong case for small-cap factor funds.

Reference 1) Asness, Cliff, Andrea Frazzini, Ronen Israel, Tobias Maskowitz and Lasse Pedersen. "Size Matters, If You Control Your Junk": AQR. Jan. 2015.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)