Why Vanguard Dividend Growth Remains One of the Best

This strategy can outperform again.

Vanguard Dividend Growth's VDIGX slump since mid-2019 is a reminder that even outstanding funds go through prolonged periods when they're out of step with the market. A recent review of the fund's management team, process, and portfolio reaffirmed its Morningstar Analyst Rating of Gold, as detailed in the Analyst Report from Feb. 26, 2021. Here, though, we dive even deeper to illustrate how and why we decided to maintain a rating on a strategy that has struggled but whose best days aren't necessarily past.

A Capable Manager's Team Grows

Manager Donald Kilbride's three-person team may seem too small for the fund's $45 billion asset base, but it's not. He and longtime collaborator Peter Fisher interact regularly with their former "quality value" teammates and Wellington Management's deep bench of global industry analysts, and they've made a promising hire. That's more than enough for the compact portfolio of big, well-researched, and liquid stocks that the strategy favors.

Plus, Kilbride can carry a heavy workload. The former Boston Company research director and Greenberg-Summit Partners energy and materials analyst joined Wellington in 2002 as the sole analyst covering a wide variety of sectors for Edward Bousa, then the new stock sleeve manager of Vanguard Wellington VWELX. The balanced fund finished in the top quartile of its Morningstar Category in four of Kilbride's first five calendar years on the job and Vanguard tapped him to lead this fund in February 2006.

Since then, Kilbride has taken time building his own team. Six years passed before he added Fisher, and he remained part of the quality value team for more than a decade. After forming an independent "dividend growth" squad, Kilbride and Fisher spent two years looking for the right analyst. In 2020, they hired Ashley Carew, who has impressive academic credentials and more than five years of forensic accounting experience. She's already contributed research that led to the strategy's sale of 3M MMM in 2020's third quarter.

A Clear Investment Philosophy

Kilbride's investment philosophy remains distinctive for its clarity. He thinks dividend growth is the best sign of a company's ability to create lasting value and its willingness to share it. Targeting firms that can grow their dividends at the rate of inflation plus 3%, Kilbride often finds large- and mega-cap stocks with five-year dividend-growth rates of at least 10%, thanks to their embedded competitive advantages. As investors appreciate such companies during market panics, Kilbride tends to build more-resilient portfolios than broad equity benchmarks like the S&P 500.

Kilbride has a worthy competitor in Vanguard Dividend Appreciation ETF VIG. It tracks the fund's primary prospectus benchmark, the Nasdaq US Dividend Achievers Select Index, which holds U.S. stocks (excluding REITs and limited partnerships) that have increased their regular dividend payment for at least 10 consecutive years and passed profitability screens. But Kilbride often finds dividend-growth opportunities that those screens exclude.

In 2019's second half, for example, he looked past a then-recent lull in Deere's DE otherwise consistent record of payout increases and built a 1.5-percentage-point stake in the agricultural equipment maker. He and Fisher, who led the team's work on Deere, thought its efforts to boost recurring revenue by licensing tractor software would help fuel future dividend growth. Deere has since announced an 18.4% dividend increase, and its share price more than doubled between the start of 2020 and February 2021, returning 7.5 times what the benchmark did over the same period.

A Benchmark-Agnostic Portfolio

Diverging from the index doesn't always work out in the short term. The fund's top-five, out-of-benchmark stake in Coca-Cola KO, for example, hurt throughout 2020 as the stock gained only 2% for the year. Underweighting strong performer Microsoft MSFT also hindered results.

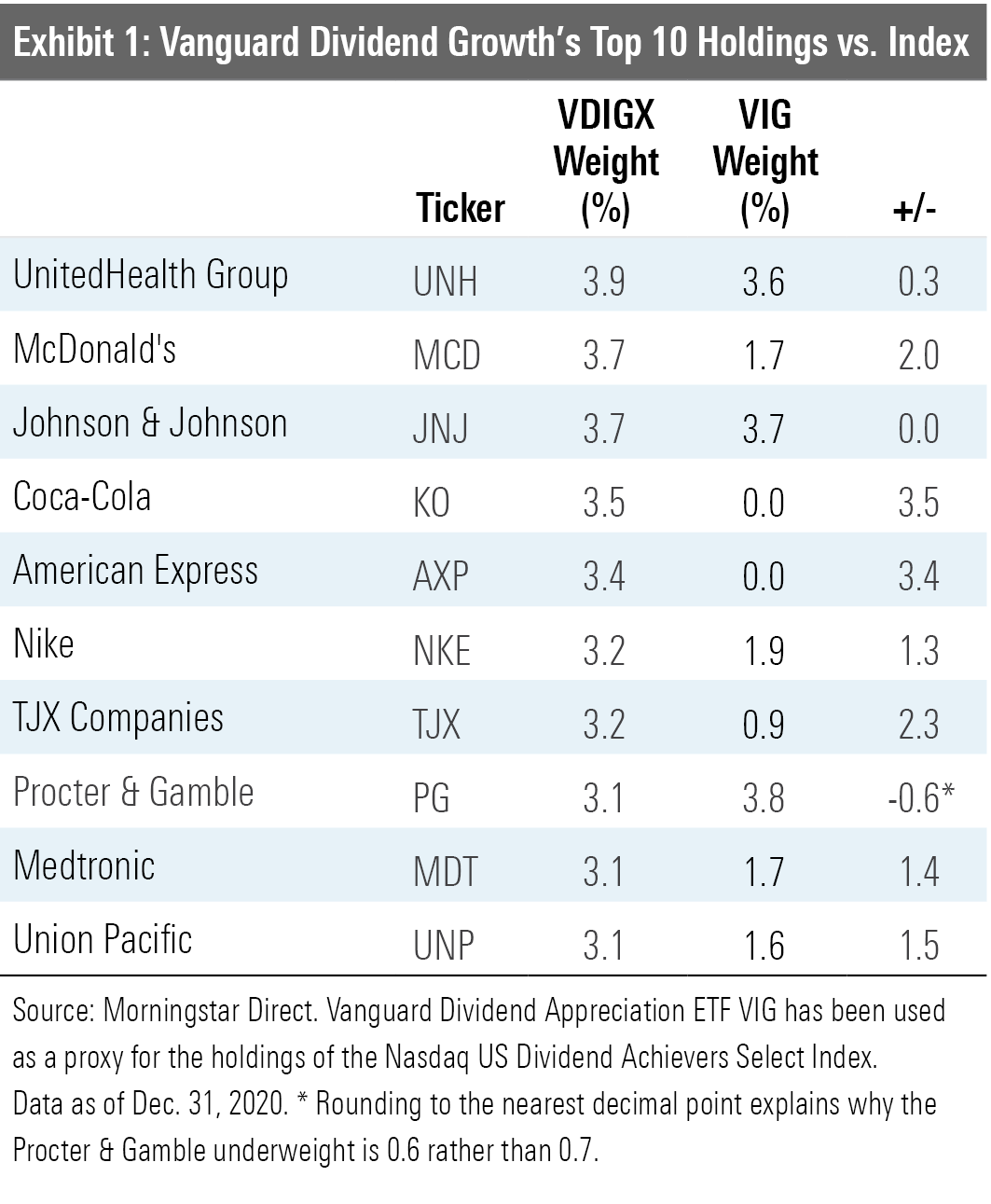

These and other examples highlight a key feature of Kilbride's approach. Unlike many active managers, he is not tied to any index's holdings or allocations, including the Nasdaq bogy he's paid to beat. Exhibit 1's comparison of Vanguard Dividend Growth's top 10 holdings with their index weightings provides a snapshot of the fund's broader benchmark agnosticism. There are two out-of-index positions (Coca-Cola and American Express AXP), one index-matching position (Johnson & Johnson JNJ), six overweights of shared stocks varying in degree, and one underweight (Procter & Gamble PG).

Overall, 16 of the portfolio's 40 stocks, 35.7% of the fund's assets, were not in Vanguard Dividend Appreciation ETF (a benchmark proxy) at year-end 2020. Of the fund's remaining 24 stocks, its 11 overweight positions and 13 underweights lacked a consistent pattern, suggesting that Kilbride makes decisions for fundamental reasons rather than benchmark-tracking purposes.[1]

Performance That Reassures

Kilbride's disregard of the benchmark can cause short-term stumbles, as in early 2020. Not owning major benchmark constituents like Walmart WMT hurt Vanguard Dividend Growth when the coronavirus pandemic ravaged equity markets. The fund didn't fall as far as the S&P 500 and the large-blend category norm, but its 33% peak-to-trough loss was 1.3 percentage points worse than the Nasdaq index.

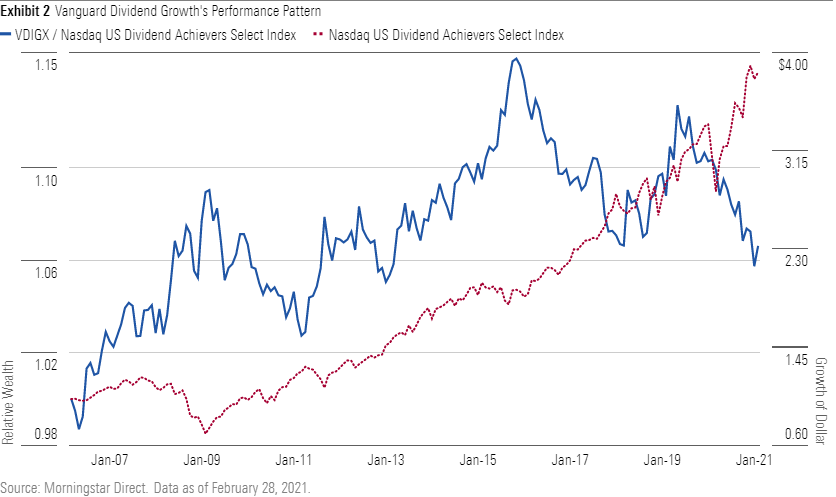

Yet, that's the first time that the fund has lost more than the Nasdaq bogy in a major downturn. Kilbride's approach has otherwise distinguished itself in down markets, which has made the fund easier to hold and kept it ahead, even after its recent struggles. Indeed, from the benchmark's April 2006 inception through February 2021, the fund's 9.9% annualized gain beat the index by 47 basis points, turning a $10,000 investment at the beginning of that nearly 15-year period into $40,811, versus $38,275 for the benchmark.

Exhibit 2 shows the timing and magnitude of the fund's relative wealth advantage and the market conditions in which it gained that advantage. For every dollar the benchmark returned over the period, the fund made nearly $1.07, often outperforming sharply (the solid blue line's upward surges) when the index lost money (the dotted red line's downward plunges).

While there's no guarantee the fund will emerge from its current slump, it has done so in the past. It lagged the Nasdaq index from April 2009 to March 2011 and from late 2015 to early 2018 before outperforming again.

Sticking With Kilbride

Those who stick with the strategy invest alongside Kilbride himself. He has more than $1 million in Vanguard Dividend Growth--the SEC's highest disclosure band in regulatory filings--and he also volunteers that most of his personal net worth is in the strategy. It won't impress in every environment, as has been evident lately, but it remains an excellent long-term holding.

Endnote [1] Vanguard Dividend Growth's active share (a measure of differentiation) versus Vanguard Dividend Appreciation ETF at year-end 2020 was 59.93. It is misleading, however, to compare that figure to the active share of similarly concentrated portfolios versus broad benchmarks like the S&P 500, which can be in the 90s. Although a higher active share signifies greater differentiation, other factors come into play. In this case, the dividend-growth equity universe is more limited (there are only about 210 stocks in the Nasdaq US Dividend Achievers Select Index). Vanguard Dividend Growth's active share was then in line with actively managed competitors' like Franklin Rising Dividends FRDPX (61.92) and Silver-rated T. Rowe Price Dividend Growth PRDGX (62.32). Although its active share was a bit lower, Vanguard Dividend Growth has the best record of the three since the benchmark's April 2006 inception.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)