Where to Look for Income in a Low-Yield World

Don't try this at home.

The article was published in the February 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Where did the income go? A recession led high-quality yields lower in 2020, and fiscal and monetary support spurred a lower-quality rebound that kept yields pretty low across the board. But yield isn't everything. As Morningstar's director of personal finance Christine Benz and others have pointed out, you can also invest for total return and sell some of your appreciated mutual funds and stocks to pay some expenses in retirement. Certainly, it makes sense to be flexible rather than chase yield.

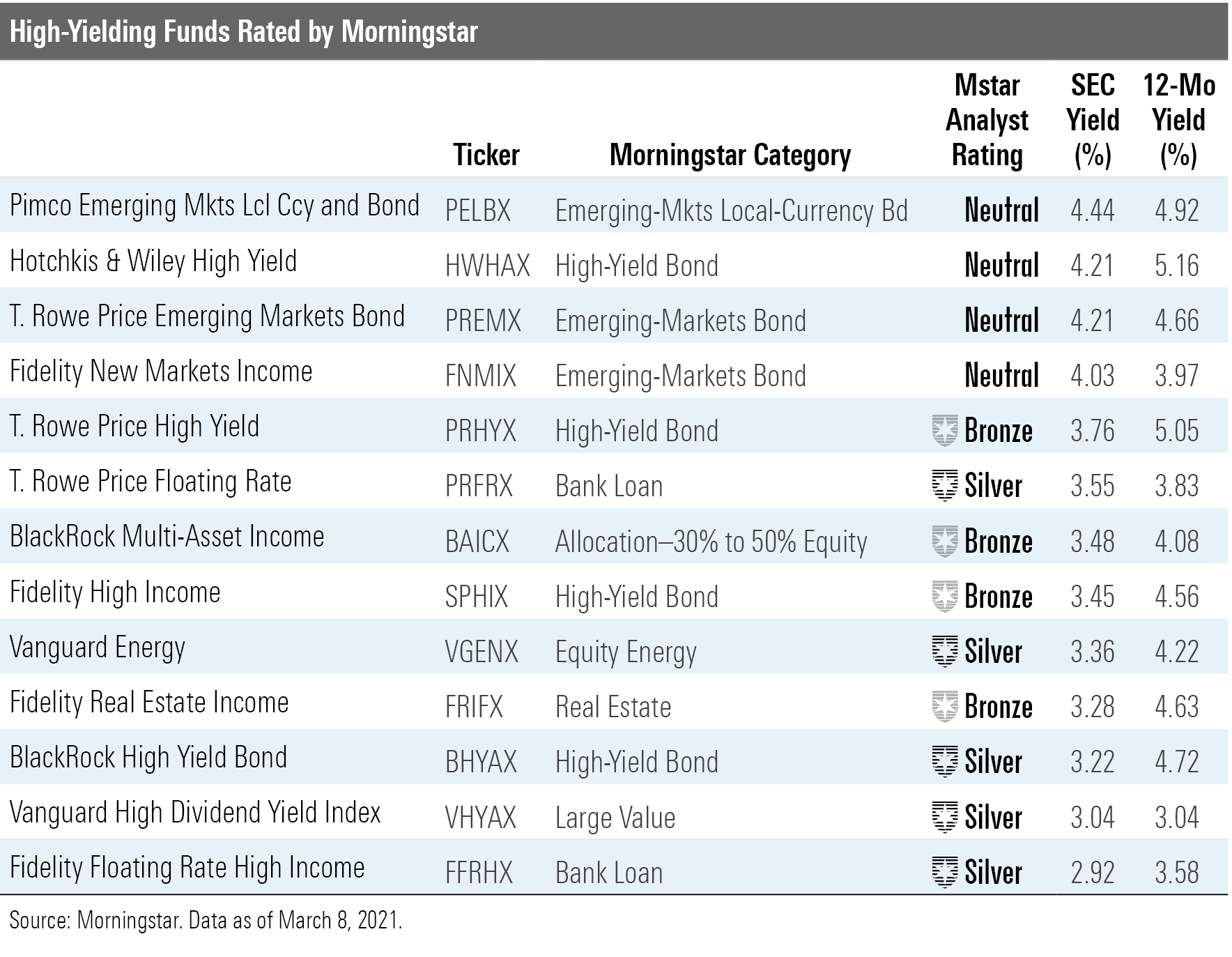

But to see how things shake out today, I looked at the 13 highest-yielding funds in the Morningstar 500 as of Jan. 25, 2021, though the table shows yields as of March 8. This is one of those "Don't try this at home" things. I select the M500 list mostly on Morningstar Analyst Ratings but also include prominent and up-and-coming funds that may be rated Neutral or not rated. So, it's a fairly safe place for this exercise. If you did this for the whole universe of funds or the whole universe of stocks, you'd come up with a list of risky investments likely to blow up on you.

SEC Yield vs. 12-Month Yield

Let's dive into the two most common measures of yield. The SEC yield is a monthly estimate of the portfolio's annualized 30-day yield with the expense ratio subtracted. The SEC yield's value is that it is timely and forward-looking. The 12-month yield represents the income actually paid out over the past 12 months, including short-term capital gains. Rather than an estimate, it is a real-world number. Also, for stock funds, it may better capture dividends, as they are paid out quarterly rather than monthly.

The downside of the 12-month yield is that some of it is in the distant past. If interest rates were meaningfully different, say, nine to 12 months ago, that 12-month yield can be much different from the portfolio's current yield. Also, the fund may have dialed up risk to boost yield over that period, or it may have dialed it down. The difference between the 12-month yield and the 30-day SEC yield can often give you an idea about where yields in the fund are headed. If the 12-month yield is higher, the yield is falling. If it is lower, then the yield is rising. The two are not perfect apples-to-apples measures, though, so this is not a perfect indicator.

For this article, I ranked by SEC yield.

High-Yield Bond

Naturally, there are some high-yield bond funds on the list. But I should note that yields are not far from all-time lows, so caution is warranted. The four high-yield bond funds here are led by Hotchkis & Wiley High Yield HWHAX, which boasts a a 4.2% SEC yield. The sudden downturn in February and March 2020 crushed high-yield funds; the four here lost between 21% and 23% in just a few weeks. Energy and other economically sensitive bonds fell particularly hard. But high yield rallied enough over the rest of the year to help nearly all high-yield funds finish with slight gains.

Former Pimco managers Mark Hudoff and Ray Kennedy run Hotchkis & Wiley High Yield with a mix of aggression and defensiveness. They lean a bit toward higher quality but favor smaller issuers that are more economically sensitive. As a result, they had a strong run until 2018 and now have had three years of underperformance. That's why the fund's yield is now so large. So, I'd say you definitely are taking some risks buying the fund today, but you do get veteran managers and a decent yield.

Bronze-rated T. Rowe Price High Yield PRHYX has a more modest 3.8% yield, but it has been pretty consistent. Rodney Rayburn took over for Mark Vaselkiv at the end of 2019, but he's an experienced investor backed by a strong team of 17 analysts.

Overall risk is fairly typical for its Morningstar Category, but the strategy does diversify to bank loans and foreign high-yield. Those sectors add some yield and diversification.

Bronze-rated Fidelity High Income SPHIX has a 3.5% yield and is meant to be Fidelity's tamer high-yield fund, but it had a rough 2020 because of some energy holdings. Managers Michael Weaver and Alexandre Karam benefit from the support of Fidelity's analyst staff.

BlackRock High Yield Bond BHYAX offers a 3.2% yield. The fund's A shares earn a Silver rating, and its People Pillar gets a High rating because manager Jimmy Keenan and BlackRock's deep analyst bench have been impressive. Keenan adds in some bank loans and investment-grade bonds for diversification because the strategy is a hefty $26 billion. What's really appealing here is that Keenan and team have outperformed peers in just about every type of market. Issue selection and top-down construction have made the fund a winner.

Emerging-Markets Bond

High risk doesn't always mean high return. Our three emerging-markets bond funds have appealing yields, as they often do, but their 10-year returns ranged from 1.3% to 4.9% annualized through the end of 2020. They do offer diversification, and there's potential for strong returns. However, macroeconomic events and currency movements often spoil the party.

Fund companies seem perplexed by these challenges, too. They struggle to find the right people and strategy. Consider the three emerging-markets bond funds on our list. They represent three of our favorite bond managers in Fidelity, Pimco, and T. Rowe Price, but we rate all three funds Neutral because these firms have struggled in emerging markets. I should note that Pimco Emerging Markets Local Currency and Bond PELBX is in the emerging-markets local-currency bond category, which provides greater currency diversification but has endured particularly weak returns and higher volatility.

With yields between 4.0% and 4.4%, they can boost your income, but they won't tamp down volatility. If you dip a toe in, think small.

Energy Equity

Yes, we know why this showed up. Energy stocks cratered in 2020 as the global economy slammed on the breaks in reaction to the coronavirus. Vanguard Energy VGENX lost 31% in 2020 and has a 3.3% annualized 10-year loss. Some energy companies have gone bankrupt, and more have cut dividends to preserve cash. Still, the fund has a nice 3.3% yield.

Yes, energy funds illustrate my point that yield comes with risk. In fact, Vanguard is remaking this fund as a half-energy, half-utilities fund. It has changed its benchmark to reflect its new outlook. I imagine the fund will continue to have a relatively high yield and high risk in its new guise.

Equity Income

This is one of the more promising areas to look for yield. Equity-income funds are mostly in the large-cap value category, and they typically try to provide yields greater than an index. Sometimes they are also required to hold income-producing securities exclusively. Well-run equity-income funds don't chase the biggest dividends because companies that are on shaky ground often pay them. Rather, they pursue a more total-return-oriented approach of seeking attractive stocks and dividends. The better ones also avoid betting too much on low growth sectors like utilities.

Vanguard High Dividend Yield Index VHYAX has a well-designed index and, of course, low costs. The Silver-rated fund tracks the FTSE High Dividend Yield Index, which emphasizes diversification over maximum yield. That has led it to more-stable, higher-quality names than the typical equity-income fund, and that seems like a sensible idea. It is also available as an exchange-traded fund with the ticker VYM.

Real Estate

After energy, real estate was one of the worst spots to be in 2020. The value of shopping malls and offices declined significantly as the world stayed at home to slow the spread of COVID-19. Did REITs decline enough to compensate for this sharp downturn? I don't know, but if they did, then this should be a decent place to invest.

Fidelity Real Estate Income FRIFX is one of the higher-yielding entrants in the category because it invests in a wide array of security types in order to increase income. Besides REITs, it owns corporate debt issued by real estate companies, REIT preferreds, and commercial mortgage-backed securities. The fund yields 3.3%.

We maintained our medalist ratings for this fund even though Mark Snyderman is handing the reins to Bill Maclay at the end of June. Maclay is experienced and has a good record in similar strategies.

Bank Loan

Most bond funds lose money when interest rates rise, but bank loans adjust to interest-rate changes, so your losses will likely be small or nonexistent. That makes bank-loan funds nice diversifiers for the bond side of your portfolio. However, they do come with credit risk. The bank-loan category's losses in the COVID-19 sell-off were just a hair below those of the high-yield bond category.

In addition, bank loans have liquidity risk that presents challenges for mutual fund managers responsible for daily liquidity. Typically, funds will hold some cash or short-term bonds to manage redemptions. They also have lines of credit, and occasionally bank-loan funds do tap them.

Two Silver-rated bank-loan funds made the list: Fidelity Floating Rate High Income FFRHX and T. Rowe Price Floating Rate PRFRX. The funds yield about 2.9% and 3.6%, respectively. I like both for their cautious liquidity management and ability to research individual issuers.

Allocation--30% to 50% Equity

This is a good category to go searching for income. Strategies here typically have widely diversified portfolios of equities, high-quality bonds, high-yield bonds, and maybe some other asset types, too. Some of the funds with "income" in their names, though, take on quite a bit of risk to drive yield.

Bronze-rated BlackRock Multi-Asset Income BAICX doesn't push it too far, though. Michael Fredericks takes a wide-ranging approach with holdings in dividend-paying stocks, high-quality bonds, high-yield bonds, bank loans, emerging-markets debt, and even covered-call strategies. The fund has performed well under Fredericks, though it did lose as much as its typical peer in the sell-off. The fund yields 3.5%.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)